U.S. Apartment Occupancy Demonstrates Resilience Amid Historic Supply

The U.S. apartment market again appeared in solid shape in May as both occupancy and rent change fundamentals essentially held steady in recent readings.

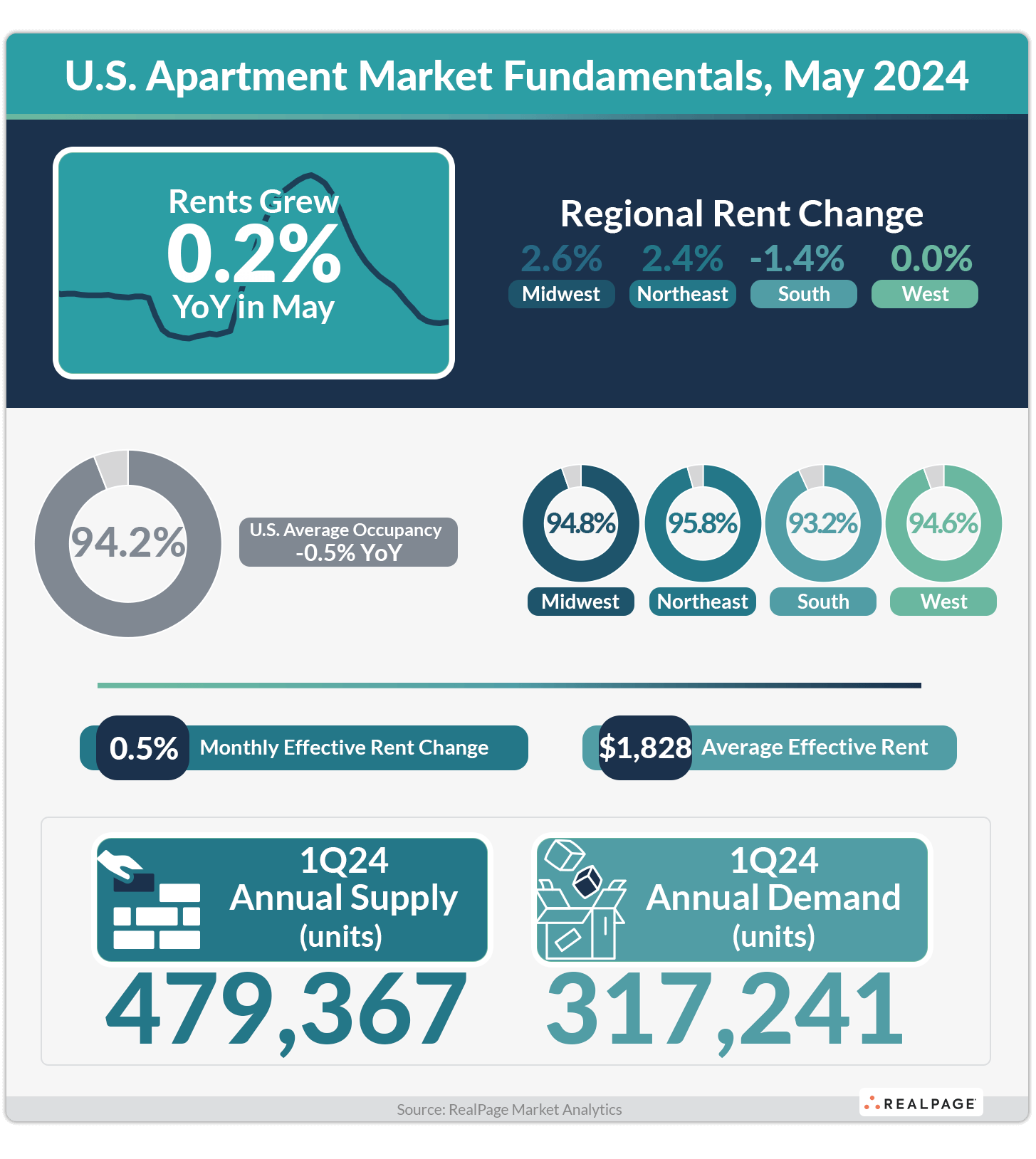

After softening throughout most of 2022 and 2023, occupancy for U.S. apartments held essentially in-line with readings seen throughout 2024 to stand at 94.2% in May, according to data from RealPage Market Analytics.

May 2024 marked the seventh straight month in which occupancy has held at or above 94.1%, further solidifying the idea that the nation has reached a point of stabilization. Though May 2024’s occupancy (94.2%) was static month-over-month and therefore underperformed typical expectations, the broader idea that occupancy has found its level amid a 40-plus year high supply wave remains a testament to the depth of the nation’s demand for apartments.

An unchanged occupancy reading at a time when the nation is delivering near-unprecedented volumes of new apartment supply indicates that renters continue to absorb new units at healthy rates nationwide.

In fact, for 17 consecutive months now, the needle on occupancy hasn't moved more than 10 basis points (bps) in either direction. Occupancy was easing downward for much of 2023, but now the rate has remained essentially stable for the first five months of 2024.

Across all four apartment regions, occupancy either ticked up marginally or remained unchanged in May. In the Midwest and Northeast, occupancy increased 10 bps month-over-month. In the South and West, occupancy did not change month-over-month.

A growing share of major markets saw occupancy rates increase on a year-over-year basis. May 2024 saw eight of the nation’s 50 largest markets manage an increase in their local occupancy reading year-over-year. By comparison, just two markets (Minneapolis and San Francisco) recorded occupancy increases year-over-year at the start of 2024.

The eight major markets that recorded annual occupancy increases in May 2024 included Richmond, West Palm Beach, San Francisco, Las Vegas, Detroit, Greensboro/Winston-Salem, Sacramento and San Jose.

Alternatively, several apartment markets across the Sun Belt are still suffering lower occupancy readings among record supply rates. All five of the major Texas apartment markets (Dallas, Fort Worth, Houston, Austin and San Antonio) were less than 93% occupied as of May.

Meanwhile, though annualized rent change remained muted by historical standards, monthly rent change for apartments looked more seasonal. Effective asking rents for professionally managed apartments ticked up just 0.2% year-over-year in May 2024, with change measured on a same-store basis.

In the May readings, national rent growth ultimately weathered the supply siege as well. But similar to occupancy, this marked the eighth-straight month in which annual effective asking rent change held between 0.1% and 0.3%.

On a monthly basis, rents grew 0.5% in May, indicating a more normal seasonal performance.

May’s monthly rent growth marked the highest month-over-month rate of change since June 2023, and just 10 bps off the average May dating back to 2010. The monthly rate of change outpacing that of annual change is largely a result of deeper-than-usual rent cuts in the back half of 2023.

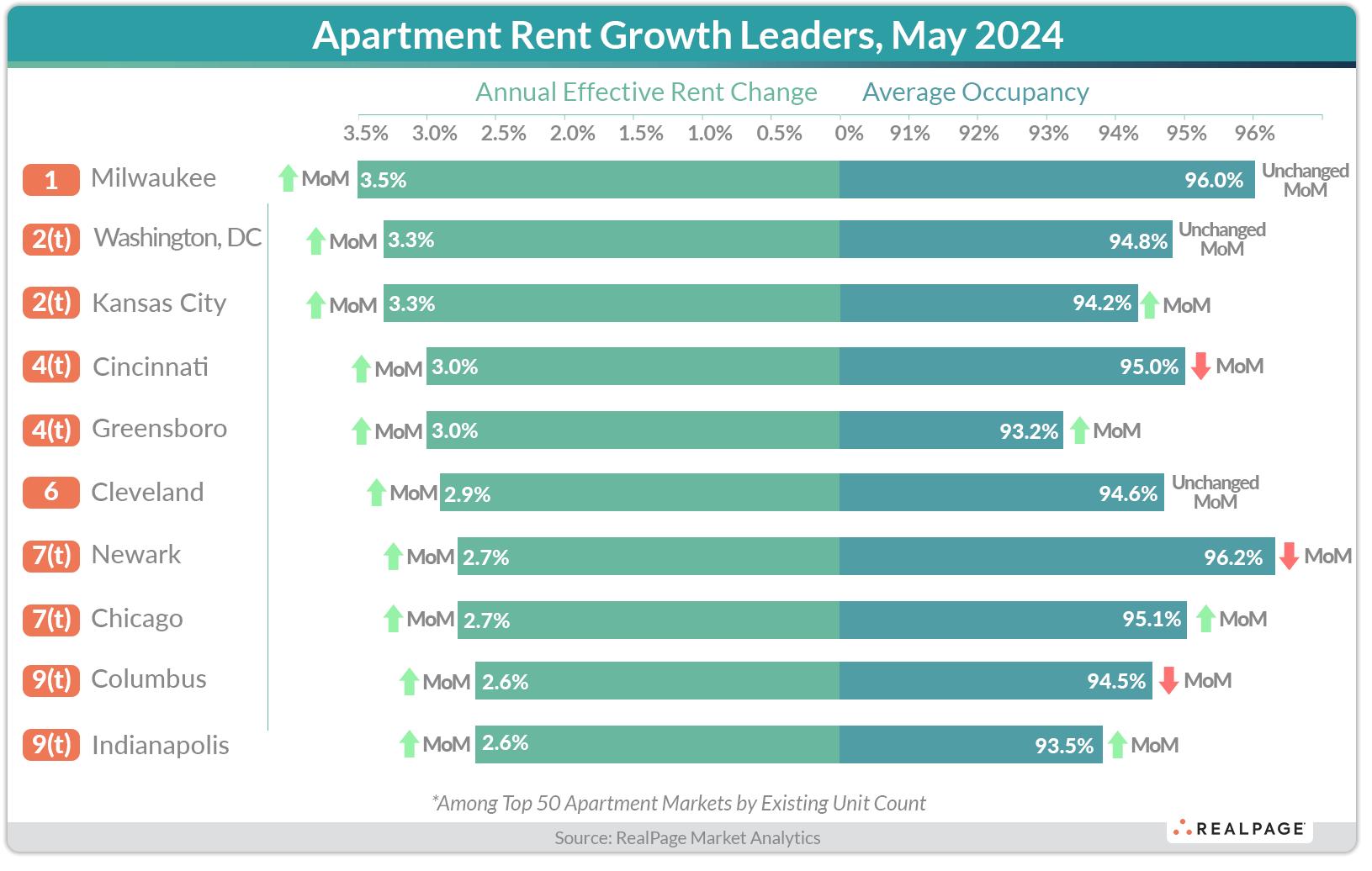

Among major markets, even the top performers for rent growth managed to grow rents less than 4% year-over-year – a far cry from the double-digit rent growth seen in most major markets throughout most of 2022.

The national leaders for apartment rent growth as of May were Milwaukee, Washington, DC, Kansas City, Cincinnati and Greensboro/Winston-Salem.

The national rent growth story does, however, miss some important market-level nuance. Five of the nation’s 50 largest markets saw rents grow by 3.0% or greater in the year-ending May 2024. That was the fewest number of markets to record more than 3.0% rent growth since July 2020.

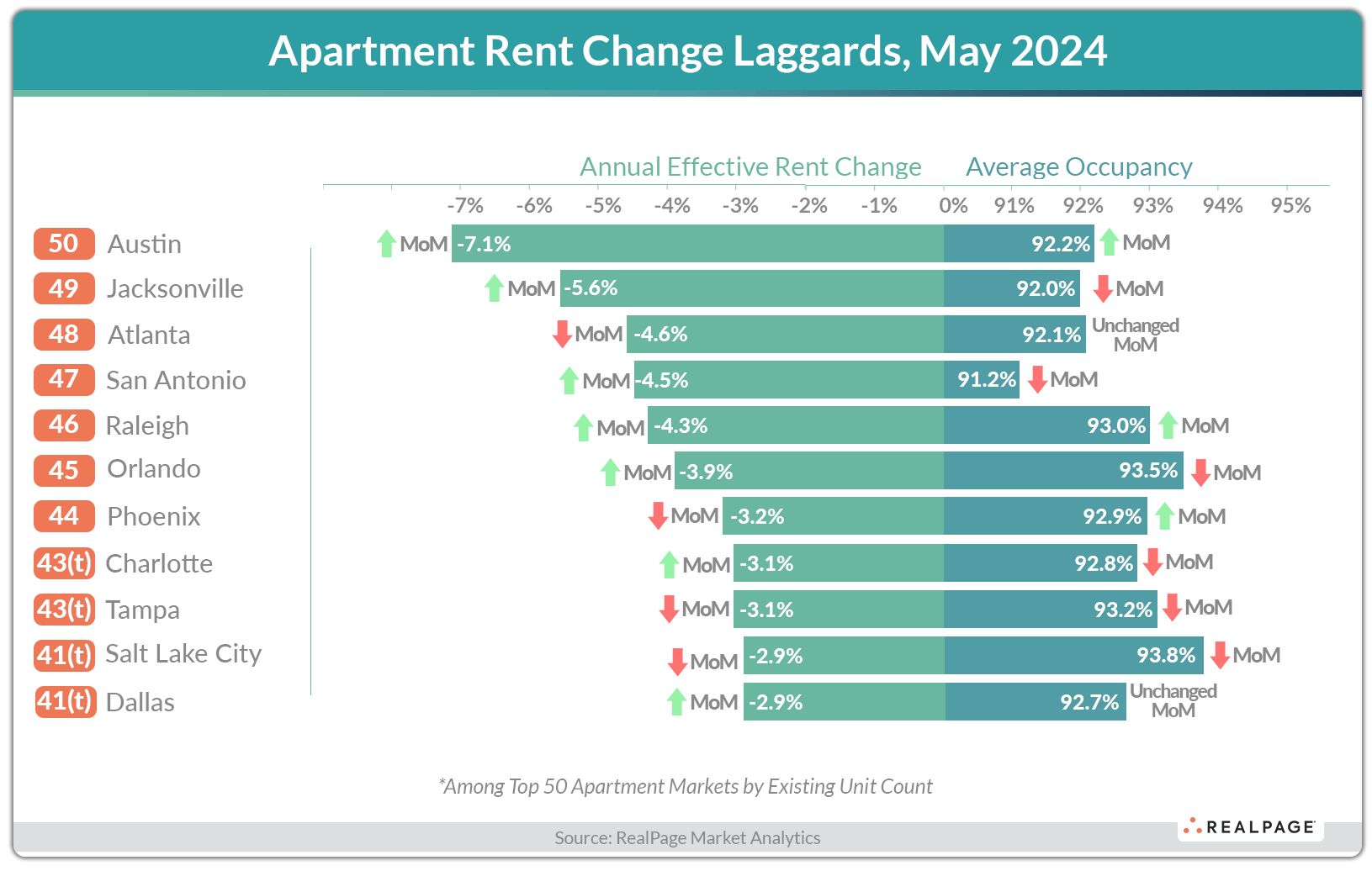

Just under half of the nation’s 50 largest apartment markets (23 or 46%) recorded rent cuts on an annual basis in May. Austin, again, recorded the deepest rent cuts in the nation, among major markets, at a cut of 7.1% in May. Jacksonville, Atlanta, San Antonio and Raleigh/Durham all posted rent cuts deeper than 4% in the year-ending May.

Still, on a monthly basis, nearly all (45 out of 50) markets posted some level of rent growth, further indicating that the deepest rent cuts are likely in the rearview for most locales. The only five major markets to post rent cuts on a monthly basis in May were Tampa, Atlanta, Phoenix, Salt Lake City and Miami.