Apartment Occupancy Ticks Up for the First Time Since Early 2022

While apartment occupancy has been falling nationwide since early 2022, new data from RealPage indicates the industry might be at an inflection point in which occupancy could be stabilizing.

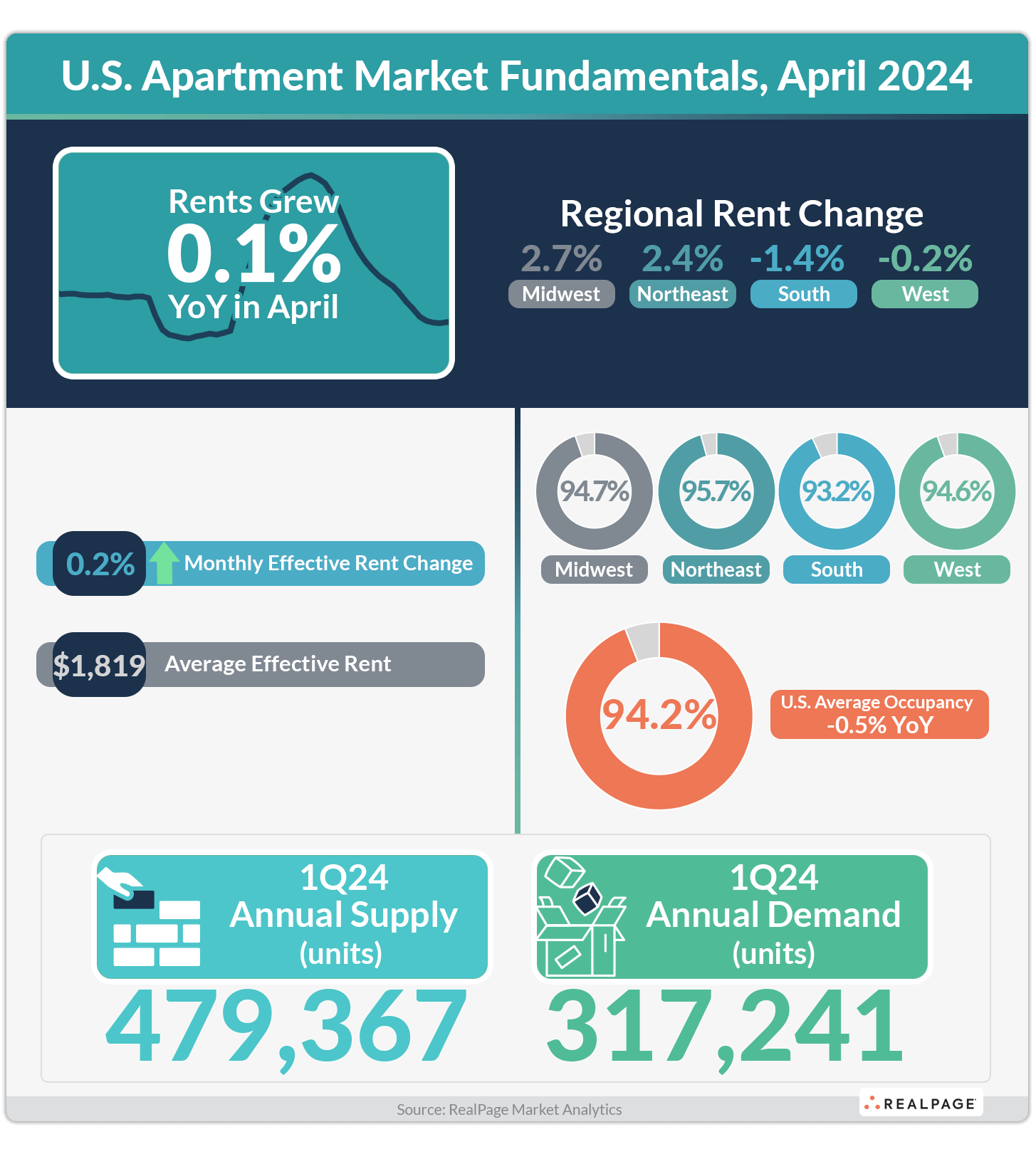

For the first time since February 2022, the national average for apartment occupancy ticked up month-over-month to stand at 94.2% in April 2024, according to data from RealPage Market Analytics. That rate is a mild 10 basis points (bps) above March’s reading. That trend was seen nationwide as all four apartment regions – Northeast, Midwest, South and West – recorded occupancy strengthening by 10 bps from March to April.

April’s positive occupancy increase highlights strengthening apartment demand is carrying forward from the highest-ever 1st quarter tally – which saw more than 100,000 units absorbed on net. It also suggests demand trends are returning to more normal seasonal patterns whereby the late spring/early summer months see the strongest demand.

Apartment Rent Change Remains Tepid

Apartment rent change, meanwhile, remained restrained under the pressure of new supply. Effective asking rents for professionally managed apartments ticked up just 0.2% month-over-month, keeping the year-over-year figure subdued to just 0.1% growth, with change measured on a same-store basis.

That annual rent growth figure has hovered near zero since August 2023 and RealPage forecasts much of the same throughout the remainder of 2024.

Improved demand and stabilizing occupancy – yet tepid-at-best rent growth – highlights the current imbalance of supply and demand across the nation. That is, demand has been stronger than usual but it’s being met with the highest new supply total since 1986. As such, both rents and occupancy showed increases due to seasonality – but their rate of increase remains below historically normal levels for this time of year.

Notably, a couple of the nation’s weakest markets for apartment occupancy posted improvement in April. San Antonio – the nation’s weakest occupancy performer among top 50 markets – posted a 30-bps improvement in occupancy from March to April to stand at 91.3%. Memphis and Fort Worth, which also ranked among the bottom markets nationwide for apartment occupancy, posted 20-bps increases from March to April to stand at 91.9% and 92.1%, respectively. All three of those markets still posted weakening occupancy year-over-year, however, as did most markets nationally.

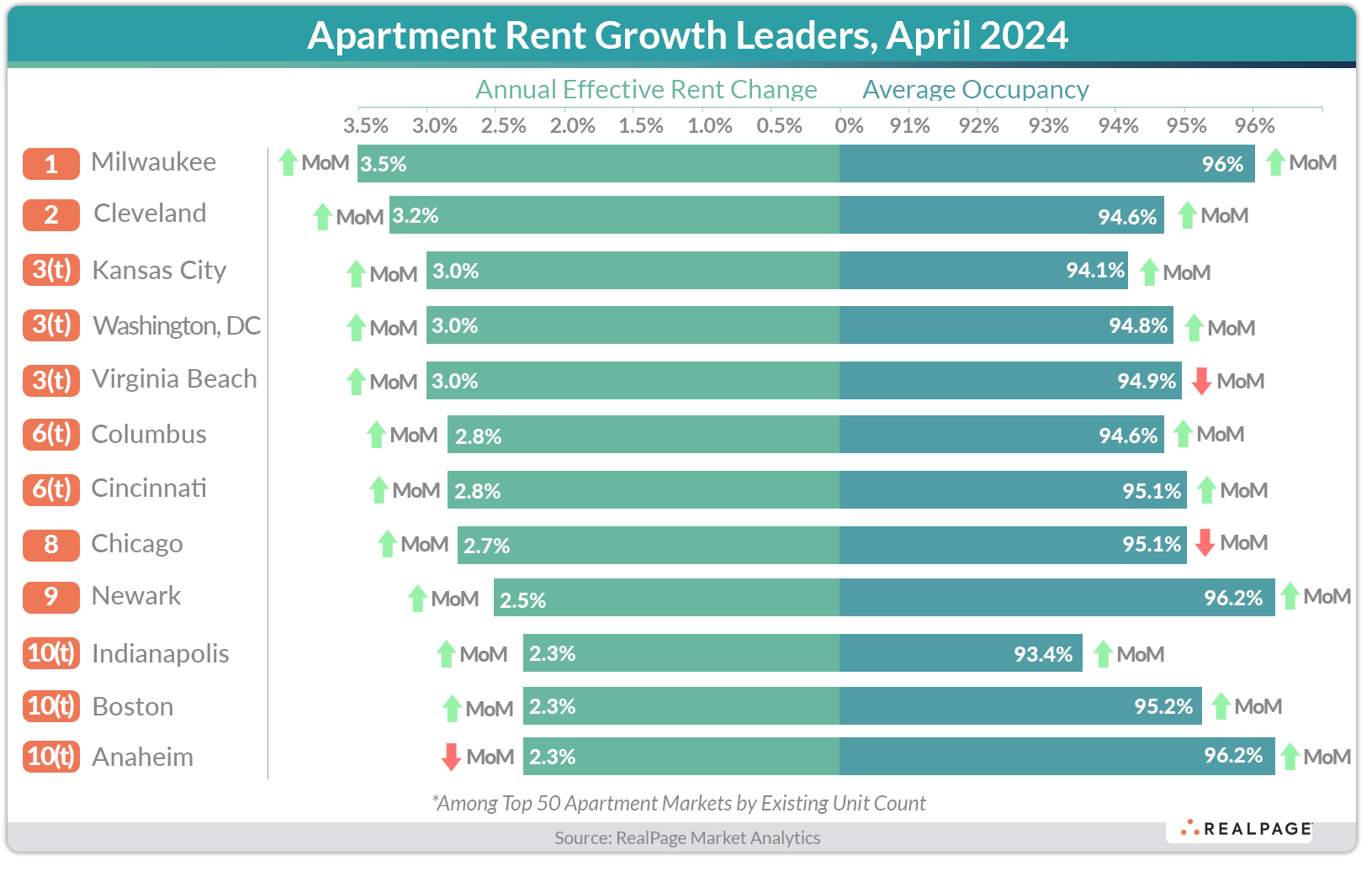

Of the 14 major markets that recorded rent growth of 2% or more in the year-ending April 2024, eight of those are in the Midwest, led by Milwaukee’s 3.5% rent expansion. Another cluster of top-performing markets for rent growth are along the eastern seaboard, including Washington, DC, Virginia Beach, Newark and Boston.

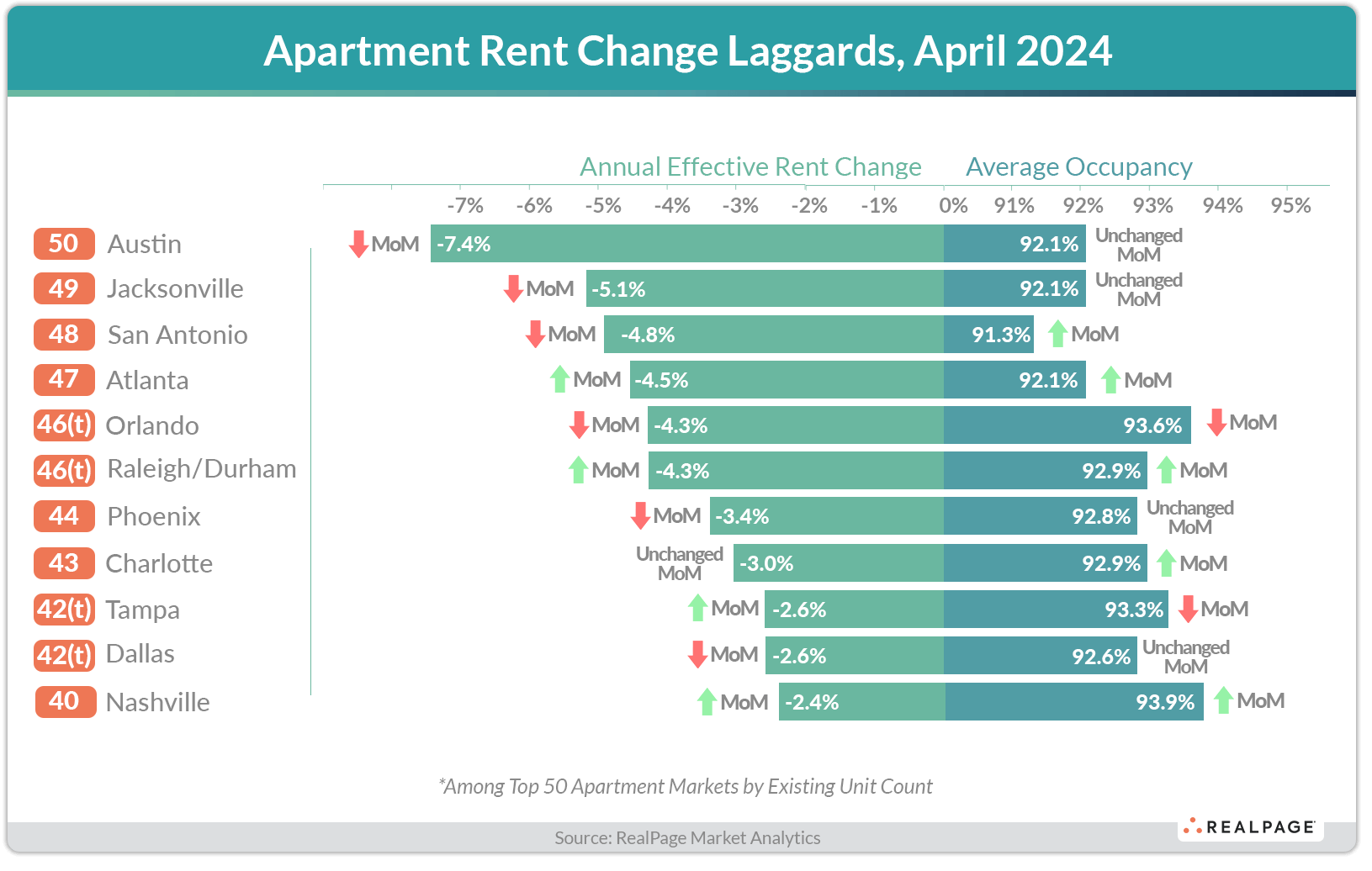

Again, Austin was the nation’s rent growth laggard among major markets, posting rent cuts of 7.4% in the year-ending April. Austin was joined by many other high-supply markets where operators continue to struggle realizing pricing power with such fierce competition to fill units.

The list of rent growth laggards again showed a clear correlation that high-supply markets (generally in the Sun Belt) tended to post the deepest rent cuts as of April. A few of these markets – Atlanta, Orlando and Tampa – posted mild rent improvement in April, just not enough to counter deeper rent cuts on an annual basis.

Regionally, signals of equilibrium again emerged as all four major regions posted rent growth on a monthly basis. In the South, rents were cut 1.4% on an annual basis, but that was strengthened slightly by rent growth of 0.2% on a monthly basis. The West was the only other region nationwide to record rent cuts on an annual basis, at a mild 0.2% contraction. The Midwest continued to be the regional rent growth winner with an annual hike of 2.7%, followed by a 2.4% hike in the Northeast.