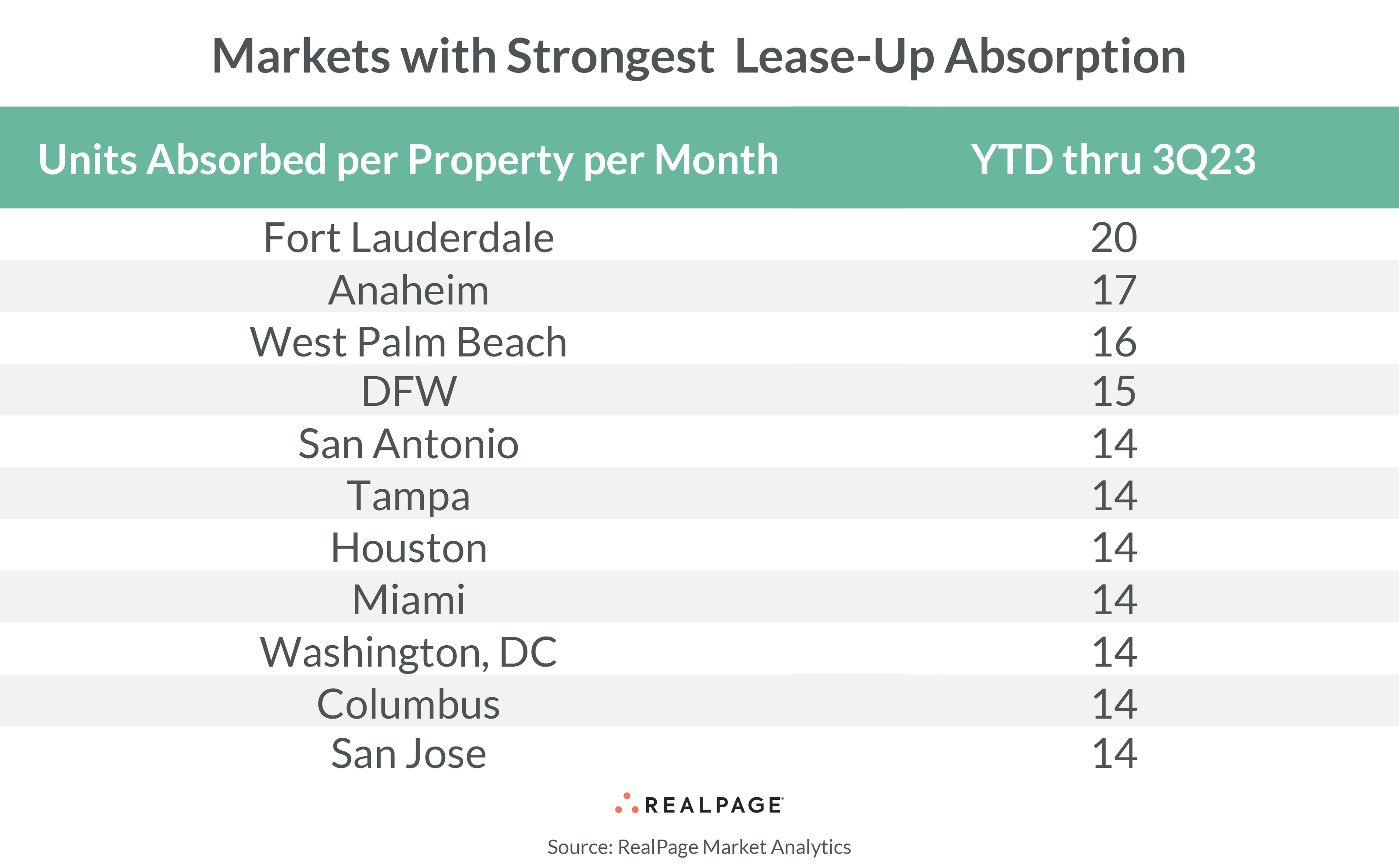

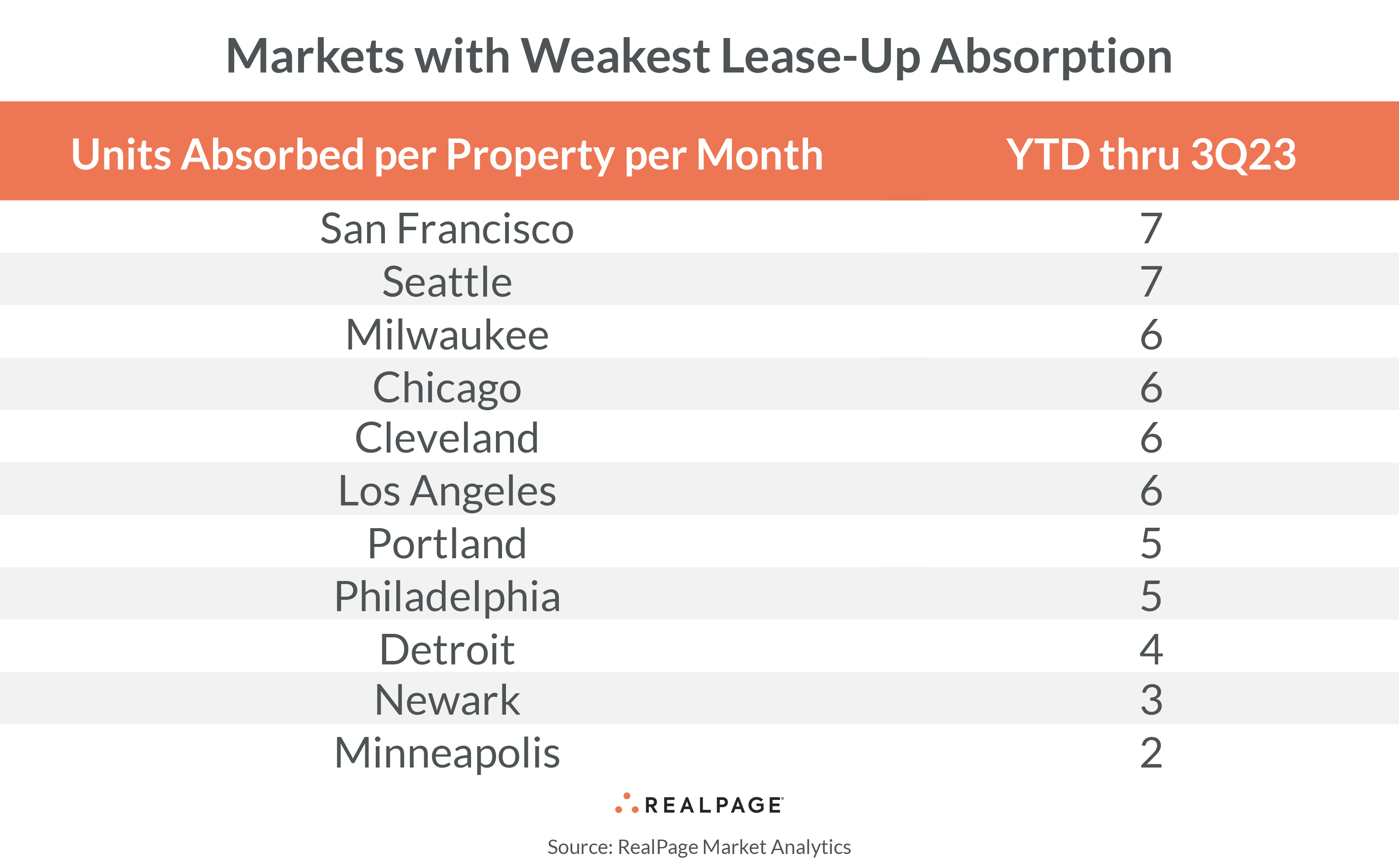

Comparing Markets by Strength of Apartment Lease-Up Absorption

As new apartment deliveries continue to mount to 50-year highs, properties working their way through lease-up can shed light on local market performance. If lease-ups take longer than expected to build up their initial base of renters, then concessions among these assets could increase.

By controlling for average property-level absorption on a per month basis (units absorbed per property per month), it’s easier to derive a baseline of lease-up demand in a market, making it simpler to compare markets. For instance, the absolute number of apartments working through lease-up in a market like Columbus will never match that of a larger metro such as Los Angeles. The per property per month measure helps provide a better market-adjusted demand snapshot.

Regionally, demand in the South Florida trio of markets – Fort Lauderdale, West Palm Beach and Miami – continues to impress, clenching some of the top spots on this demand leaderboard, according to data from RealPage Market Analytics. Dallas/Fort Worth, San Antonio and Houston meanwhile highlight that luxury product demand is strong in nearly all of the major Texas markets – with the exception of Austin (where the average units absorbed per property appears to be watered down due to sheer volume of assets delivering).

Of note, Baltimore, Greensboro, New York, and San Jose have seen the pace of lease-up absorption increase in 2023 relative to 2022. Whereas, Austin, Miami, Minneapolis, Newark and Orlando have seen the pace of lease-up absorption slow down the sharpest, declining more than 50% year-over-year.

Orange County and San Jose are two West region markets where lease-up property demand has been far stronger than regional peers. Generally speaking, the West coast markets make more of a showing on the weak absorption list.

By comparison, San Francisco, Seattle, Los Angeles and Portland are show some regional underlying demand weakness. Sun Belt counterparts, meanwhile, appear to be absorbing new supply fairly well – although the amount of supply delivering is outpacing absorption.

Already, there appears to be a considerable impact to existing assets – especially on Class B assets – in high supply markets and neighborhoods. As more and more units work through lease up, this is going to increase the available stock of apartments leading to even more competition among both existing and lease-up assets.