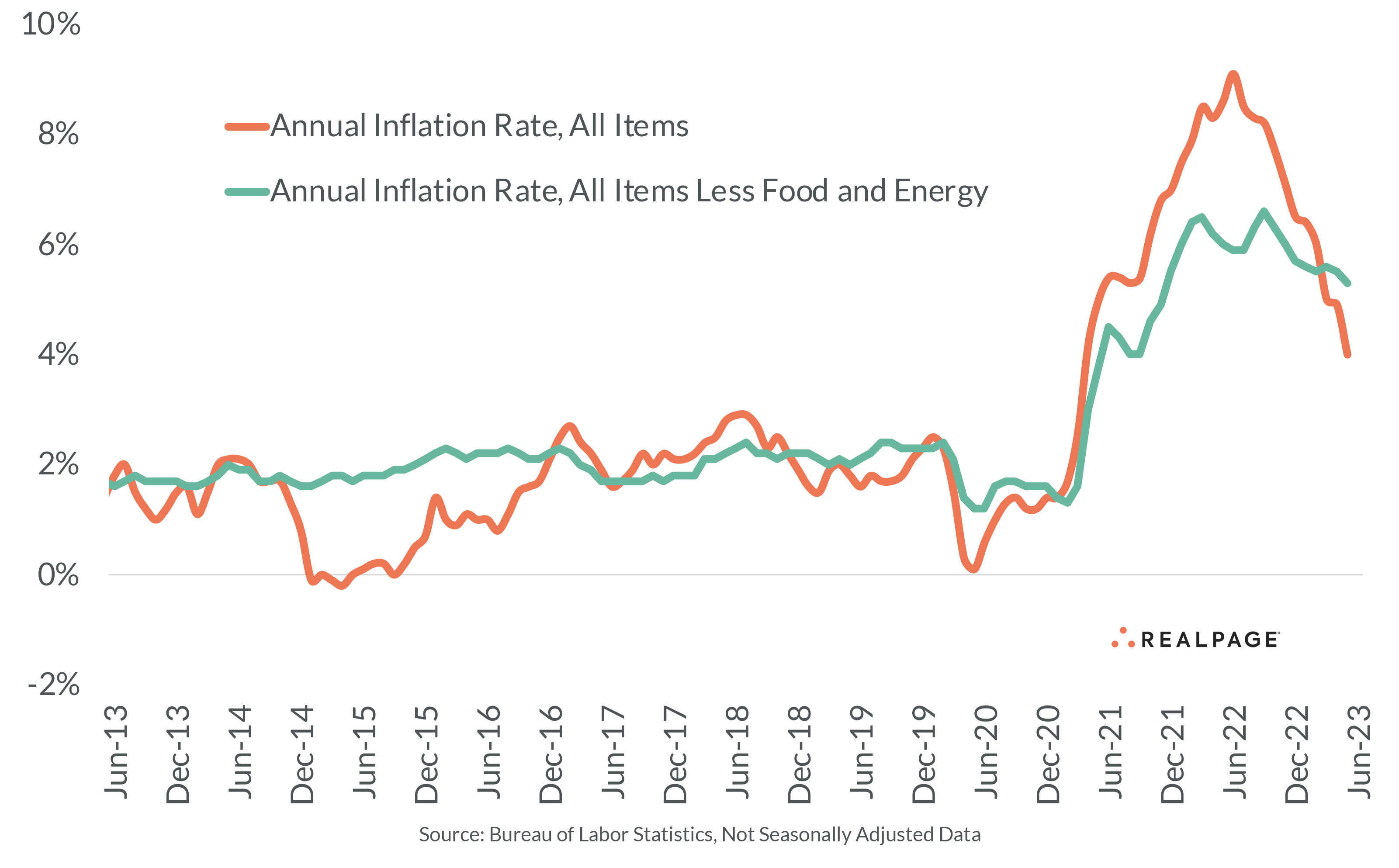

Consumer price increases are retreating from decade highs, with the cost of goods and services for U.S. consumers easing for the 12th consecutive month. The Consumer Price Index (CPI) for All Urban Consumers, a measure of price changes commonly referred to as the inflation rate, registered at 3% in the year-ending June 2023, the lowest level since March 2021, according to the Bureau of Labor Statistics. The annual inflation rate in June was in line with economists’ expectations of 3.1% and well below May’s 4% annual gain. In addition, inflation has cooled considerably since reaching a 40-year high of 9.1% in June 2022. Still, inflation has been well above the Fed’s target rate of 2% annually – the pre-pandemic norm. Excluding volatile food and energy prices, the core CPI increased 4.8% during the year-ending June, down from the 5.3% annual increase in May and the lowest level since October 2021. Looking at other indexes, shelter, which accounts for about one-third of the total CPI index, saw a 7.8% year-over-year price surge in June, still registering as one of the biggest annual gains in the past 40 years. Meanwhile, the cost of food was up 5.7% over the past year. And new vehicles posted an annual price increase of 4.1%. Contributing to the lower inflation rate, the cost of energy dropped 16.7% year-over-year in June, with the cost of gasoline (-26.5%) having a deep impact on that decline. The price of used cars and trucks (-5.2%) was also down on an annual basis. Airline fares, which saw huge price jumps in 2022 through early 2023, fell 18.9% in the year-ending June.