South Florida Rents Rise Dramatically Since COVID, While Bay Area Stagnates

In the four years since the global pandemic began and caused massive swings in the U.S. apartment industry, average effective rents have climbed approximately one quarter nationwide. Two regions of the country, however, demonstrate the two extremes of that rent change.

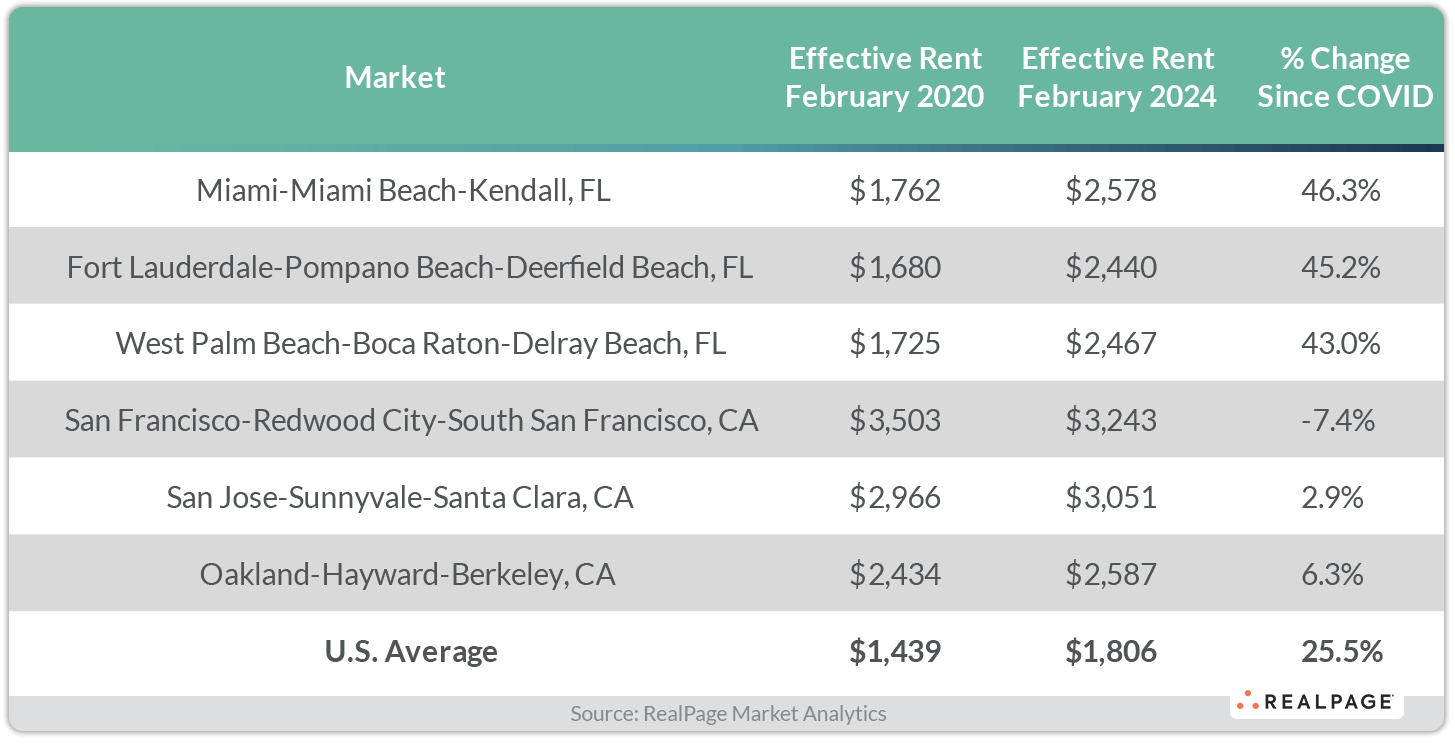

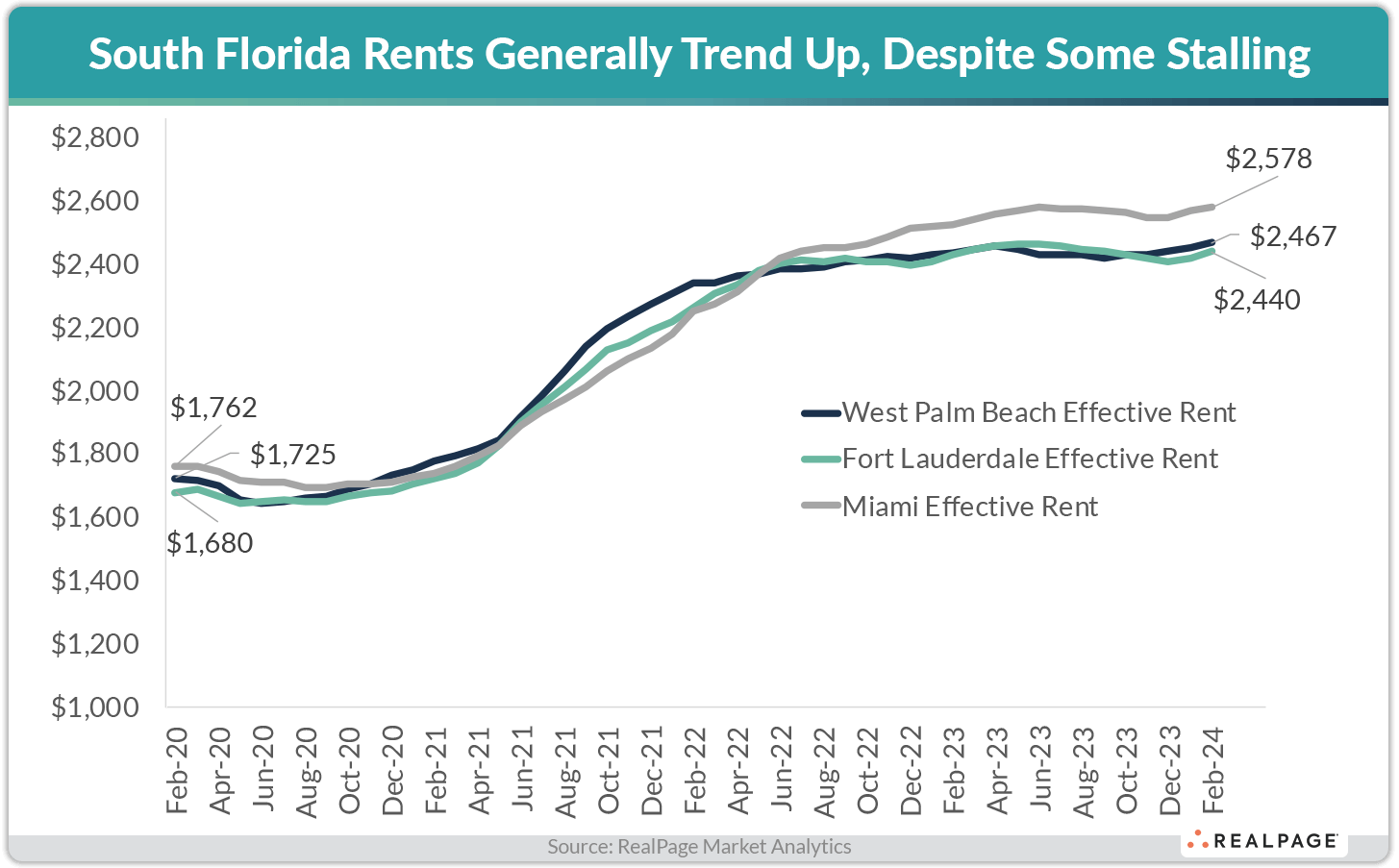

In South Florida, which is comprised of three markets including Miami, Fort Lauderdale and West Palm Beach, effective rents have climbed by the highest dollar differential in the nation since February 2020, equating to a more than 43% jump in four years.

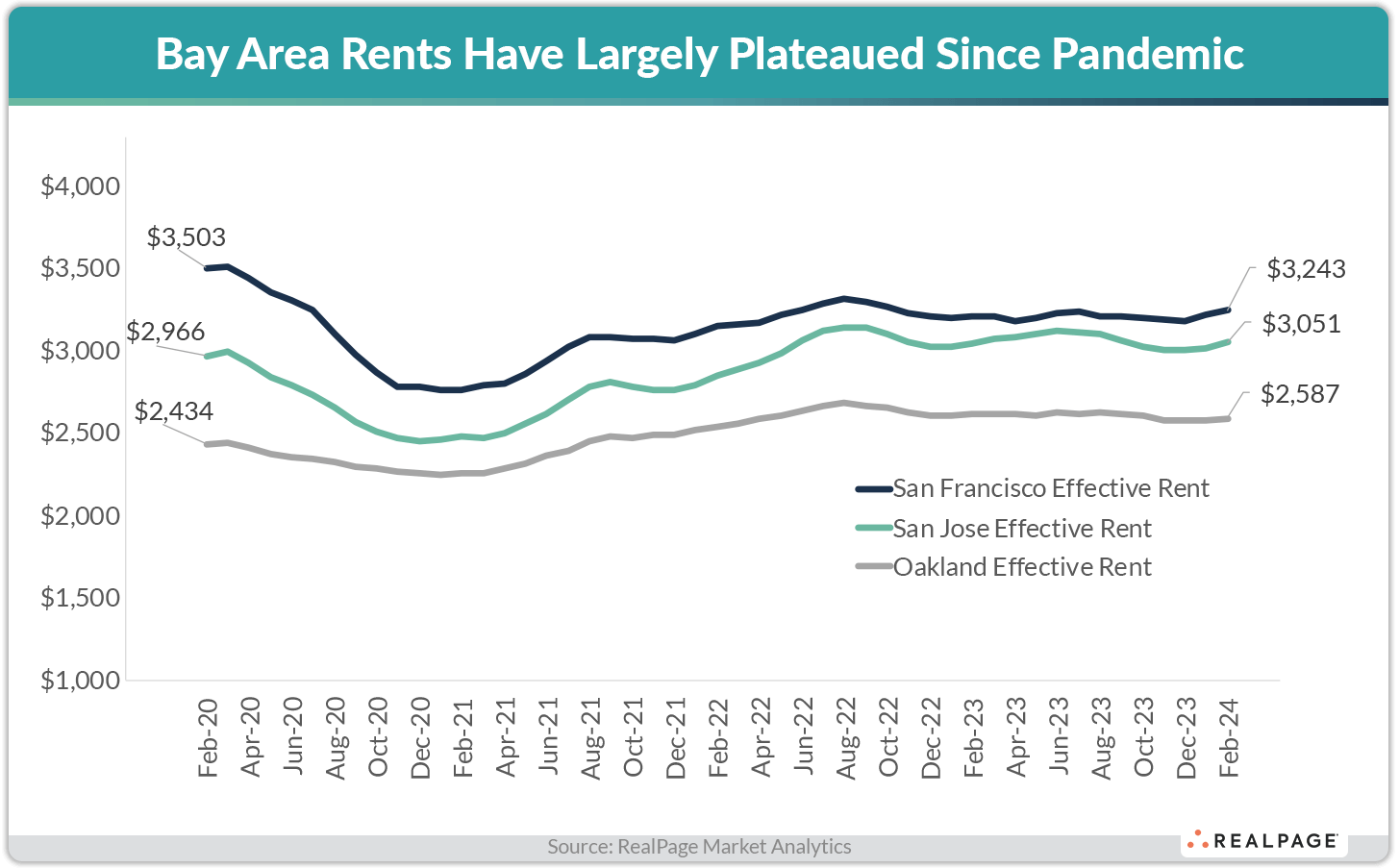

In contrast, on the other side of the country, the Bay Area saw effective rents stagnate in that time frame. Within the three Bay Area markets of San Francisco, San Jose and Oakland, the price of rent has all but flatlined – and even declined in the case of San Francisco – since February 2020.

Before the pandemic started, these two coastal areas ranked very differently for monthly rents. Prices in South Florida averaged at around $1,720 per month back in February 2020, before the lockdowns started. Meanwhile, average prices were much more expensive in the Bay Aare at nearly $3,000. As of February 2024, after such significant differences in price setting, the two regions are much closer together in price, with rents averaging around $2,500 in South Florida and about $2,960 in the Bay Area.

Since the onset of the pandemic, effective rents for professionally managed apartments have climbed more in Miami than in any other major market nationwide, according to data from RealPage Market Analytics. Fort Lauderdale and West Palm Beach take the no. 2 and no. 3 spots, respectively, for percent change in effective rents since February 2020, among the 50 largest apartment markets nationwide.

A few other Florida markets rank high for total change in effective rents since the pandemic. Tampa (42.5%), Jacksonville (32.3%) and Orlando (31.9%) all reported cumulative price hikes above the national norm over the last four years.

Conversely, only one major market nationwide reported effective rents in February 2024 below prices seen in February 2020. In San Francisco, effective asking rents were about $260 lower in February 2024 than they were in the final month before the onset of the pandemic in February 2020. The two other Bay Area markets of San Jose and Oakland have grown effective rents at the most muted rates in the nation in the last four years. In San Jose, effective rents were only about $85 more expensive per month in February 2024 compared to four years earlier, accounting for a less than 3% increase. In Oakland, effective rents climbed only $150 over the last four years to stand about 6% higher than the February 2020 rate.

Bay Area Population Shrinks, While South Florida Grows

The two coastal regions have experienced very different demographic shifts over the last four years, which heavily influences renter demand.

On the West Coast, the Bay Area has recorded population loss since 2020. (Note: U.S. Census Bureau definitions of metro divisions differ slightly from RealPage definitions but align well enough to see broader trends.) All Bay Area metro divisions recorded population loss between 2.5% and 6% from mid-2020 to mid-2023, per the latest Census estimates. While international migration to the Bay Area continues, domestic out migration of residents has been prolific. The combined metro areas of San Francisco-Oakland-Fremont and San Jose-Sunnyvale-Santa Clara recorded net out migration of nearly 406,000 residents from April 1, 2020, to July 1, 2023, according to the latest Census data.

However, over on the East Coast, South Florida continues to gain residents. In the same Census estimates from mid-2020 to mid-2023, South Florida metro divisions all recorded population growth. In the cases of Miami and Fort Lauderdale, growth was approximately in line with the national norm of 1% during that time. In the case of West Palm Beach, population growth was even stronger as that metro grew its population by about 2.6% in the three-year period ending in mid-2023, per the Census. Interestingly, domestic out migration also plagued South Florida in the latest readings. The combined metro of Miami-Fort Lauderdale-West Palm Beach recorded domestic out migration of nearly 154,000 residents – but that was easily overtaken by the international migration of nearly 187,000 residents during the same period from mid-2020 to mid-2023.

Jobs Growth Favors Sunshine State Over Bay Area

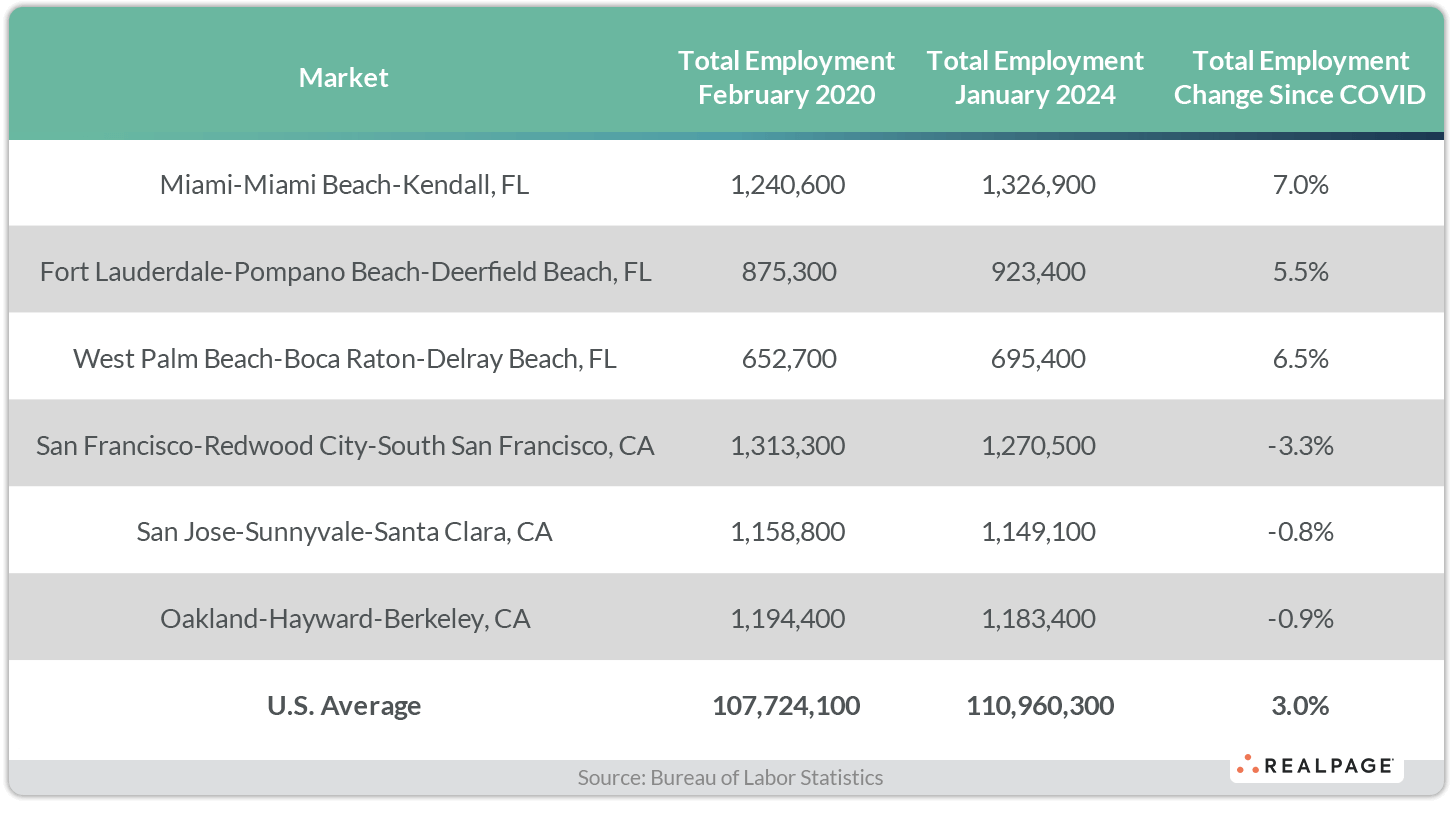

Employment growth – which tends to run hand-and-glove with population growth – has also been stronger in South Florida since the pandemic began. All three South Florida markets have grown total employment at a rate faster than the national norm – more like double – since early 2020. Miami leads the trio of South Florida markets with total employment growth of 7% from February 2020 to January 2024, which is the latest available data from the Bureau of Labor Statistics. West Palm Beach and Fort Lauderdale recorded employment gains of 6.5% and 5.5%, respectively, during that time.

Not to mention, given that all South Florida markets are retirement destinations, this region is generally less reliant on a strong jobs market with such a high concentration of its population not engaging in the workforce.

In the Bay Area, on the other hand, total employment gains have been tepid over the last four years. According to the latest BLS data, San Francisco, San Jose and Oakland all currently sit below their total employment bases from February 2020. In other words, the Bay Area has yet to recover all the jobs lost from the pandemic.

Meanwhile, total U.S. employment has grown by about 3% since the pandemic began.

In the case of South Florida, population growth and employment gains have combined to create some pretty strong renter demand, allowing operators to realize some of the strongest pricing power in the nation since the pandemic began. The opposite seems to be true across the Bay Area. Population loss and a still-recovering jobs market has caused apartment rents to stagnate across the Bay since early 2020.