Benchmark revisions to employment data by the Bureau of Labor Statistics resulted in lower totals for job gains at the metro level than were previously reported. February saw those totals shrink further.

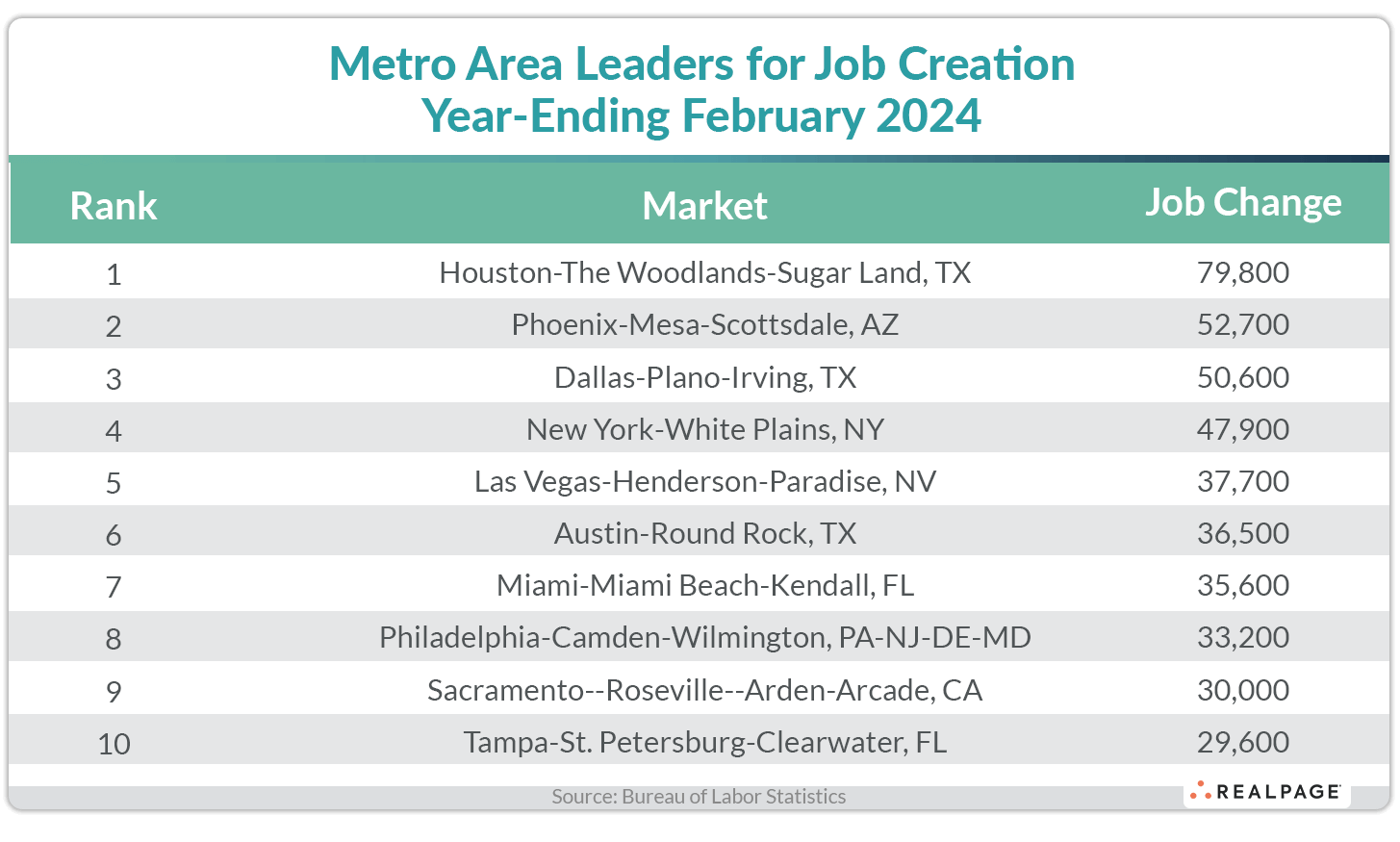

Nine of January’s top 10 job creation markets returned in February but most of these metros saw annual totals continue to decline. The total number of new jobs for February’s top 10 was 134,200 jobs fewer than last month’s combined total.

Houston topped the list for job creation in the 12-months-ending in February with 79,800 new jobs, less than half their total one year ago. Phoenix moved up to the #2 spot with 52,700 jobs created, although that was about 10,000 less than in January.

Dallas came in at #3, gaining 50,600 jobs for the year, about even with last month but down more than 85,000 from last year. Perennial job leader New York slipped to the #4 spot with 47,900 jobs gained through February, far fewer than the pre-revision six-figure gains of the past. Las Vegas moved up to #5 this month, gaining 37,700 jobs and Austin was close behind at #6 with a gain of 36,500 jobs, both close to their respective January’s total.

Miami slipped to the #7 spot with 35,600 jobs gained, slowing by more than 10,000 jobs from last month. Philadelphia dropped two spots to #8 with 33,200 new jobs, about 5,000 fewer than last month and 50,800 less than one year ago.

Sacramento jumped on to the top 10 list at #9 with 30,000 jobs gained, 11,9000 more than last February’s annual total, while Tampa rounded out the top 10 with a gain of 29,600 jobs for the year, close to 5,000 fewer than in January.

As mentioned, the total number of jobs gained for the year-ending February for the top 10 markets was down about 134,000 jobs from their collective total last month. The next 10 markets (#11-#20) saw their combined annual jobs gains decrease by only 7,100 jobs.

For the first time since the pandemic recovery began, none of the top 10 markets exceeded 100,000 jobs gained for the year while only two gained between 50,000 and 99,999 jobs, equal to last month. This is also the first month that the #10 market fell below 30,000 jobs gained. Thirteen markets reported annual job losses for the year, one less than last month.

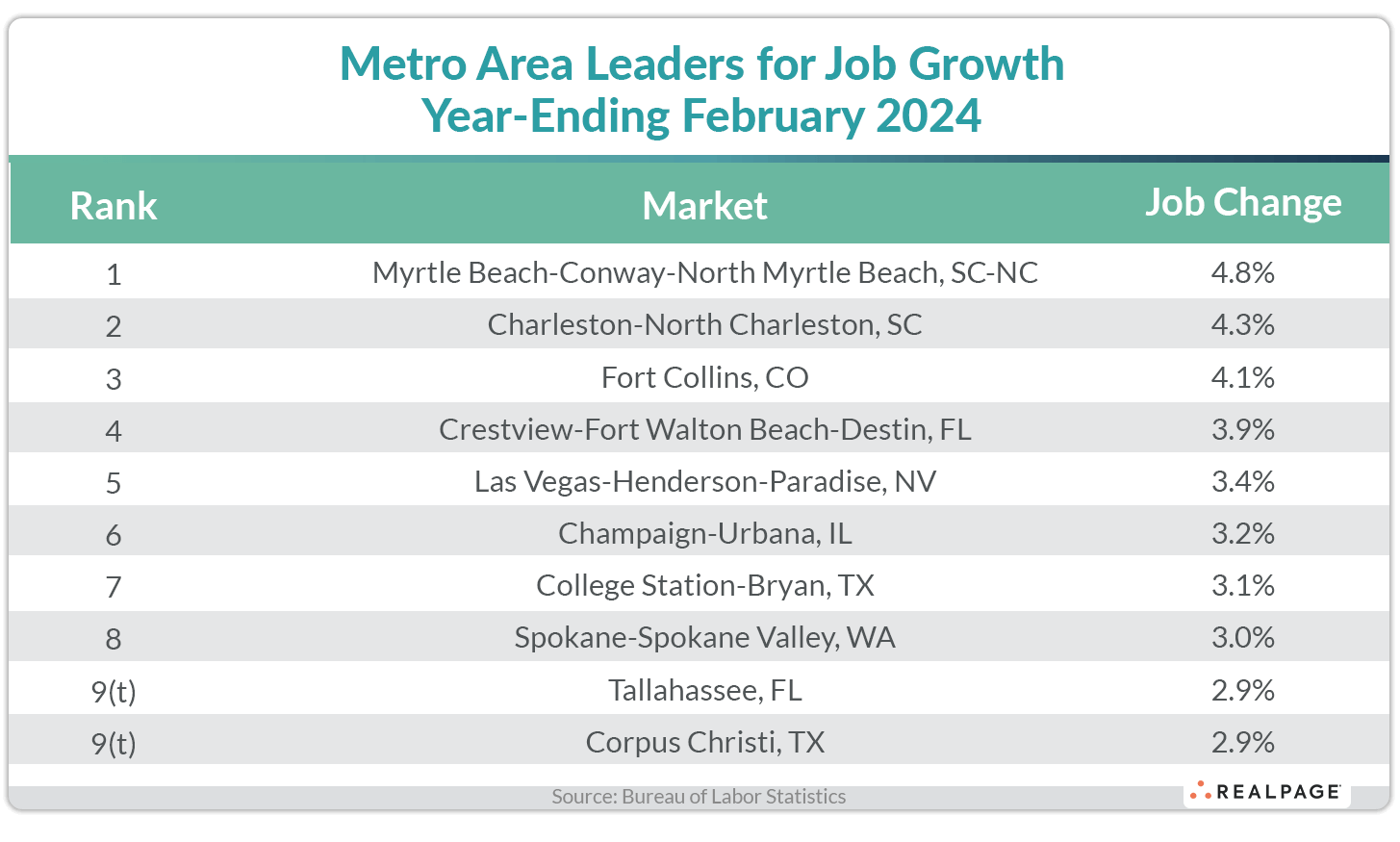

Like annual job gains, the annual percentage change in employment saw continuing slowing as well. Only six of last month’s top employment growth markets returned in February and several changed places.

Myrtle Beach, SC returned at #1 with 4.8% employment growth, 10 basis points (bps) below last month’s rate. Charleston moved up to #2 with 4.3% growth, an improvement of 20 bps from January. Fort Collins, CO slipped one spot to #3 with 4.1% growth, a decline of 70 bps from last month. Crestview-Fort Walton Beach-Destin, FL came in at #4 with 3.9% employment change, 50 bps lower than in January.

Las Vegas enjoyed 3.4% employment growth for the year, placing at #5 on this month’s list, down only 10 bps for the month. Champaign-Urbana, IL improved their economy by 3.2% and landed at #6 this month, a whopping 110 bps increase for the month. The college town of College Station-Bryan, TX dropped to #7 this month with a solid 3.1% growth rate but that was down 150 bps from January.

Spokane-Spokane Valley, WA joined the list at #8 with 3% job growth. Still, that was 30 bps lower than the previous month. Tallahassee, FL and Corpus Christi, TX tied at #9 with 2.9% growth and both were down a few bps from last month. In fact, eight of the top 10 job growth markets saw declines in their growth rates from last month.

While eight of 10 markets were down for the month, only six of 10 had lower employment growth than one year ago with the most improvements in Fort Collins (+180 bps), Spokane (+150 bps) and Crestview-Fort Walton (+130 bps). Among the top 10, steep declines from last February occurred in College Station (-190 bps), Las Vegas (-150 bps) and Tallahassee (-120 bps).

Outside of the top growth markets, Stockton, CA, Sacramento, Rochester, NY and Omaha saw job growth rates increase by 100 bps or more from last year. Meanwhile, Midland/Odessa, Chattanooga, Akron, OH, Portland, OR, Shreveport, LA, Orlando, Knoxville, TN and New Orleans fell by at least 360 bps from last year’s job growth.

Major markets with employment declines are Portland, OR, Memphis, New Orleans, San Francisco, Milwaukee, Knoxville and San Jose. Sub-0.5% growth markets include Detroit, Cincinnati, Los Angeles, Chicago, Boston and Columbus, OH. Sub-1% growth major markets include Nashville, Washington, DC, New York, Pittsburgh, Oakland, Cleveland, Denver, Atlanta, Kansas City, San Diego and Seattle. Fifty-six markets had annual job growth rates above the not seasonally adjusted national average of 1.8%, 13 fewer than in January.