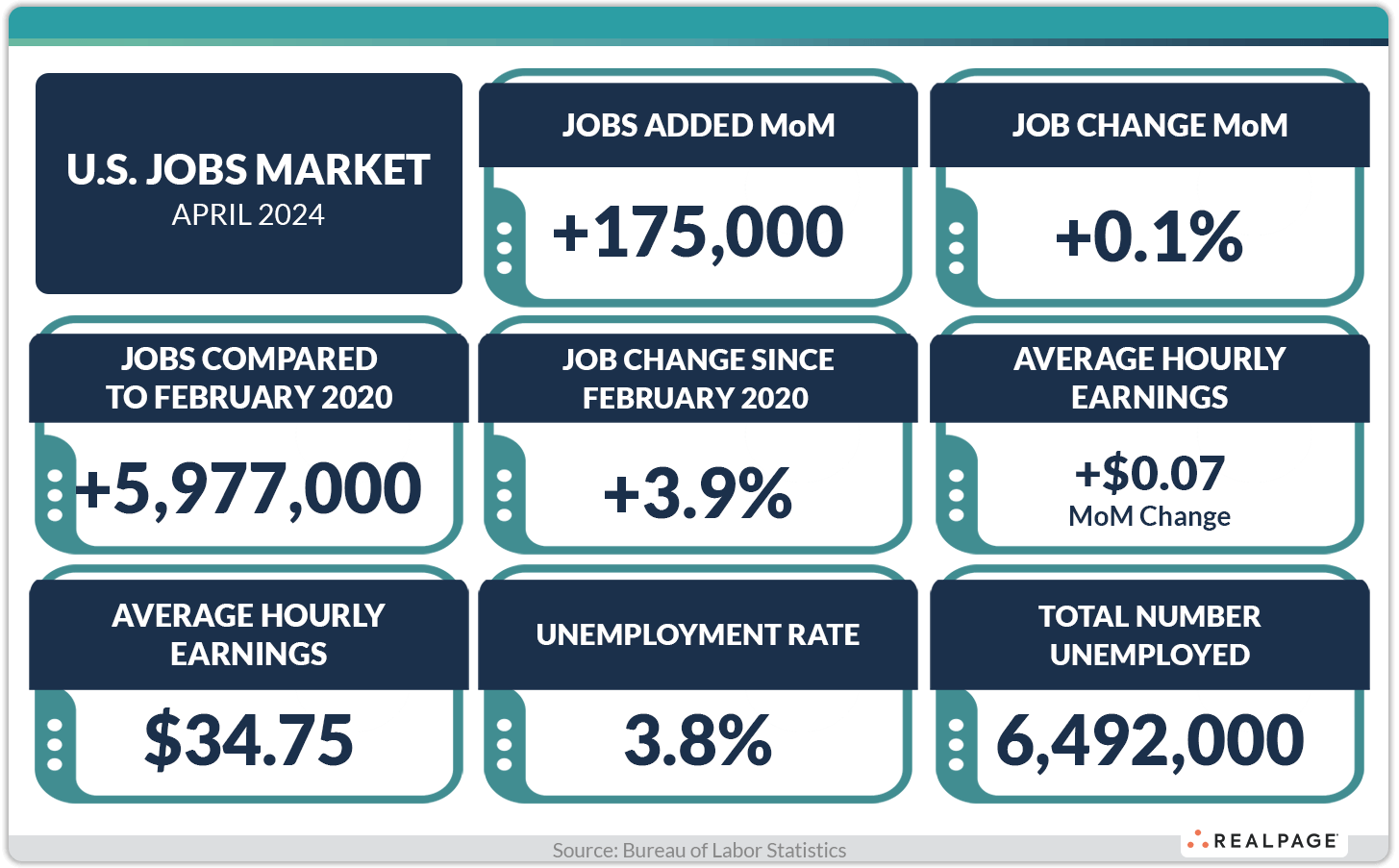

The U.S. labor market has remained historically tight over the past year, defying economists’ expectations. But in April, the U.S. economy added fewer jobs than expected while the unemployment rate rose unexpectedly, a sign that high interest rates and elevated inflation may be starting to impact the labor market. The cooling labor market may prompt the Federal Reserve to cut interest rates in the coming months which have remained at 20-year highs.

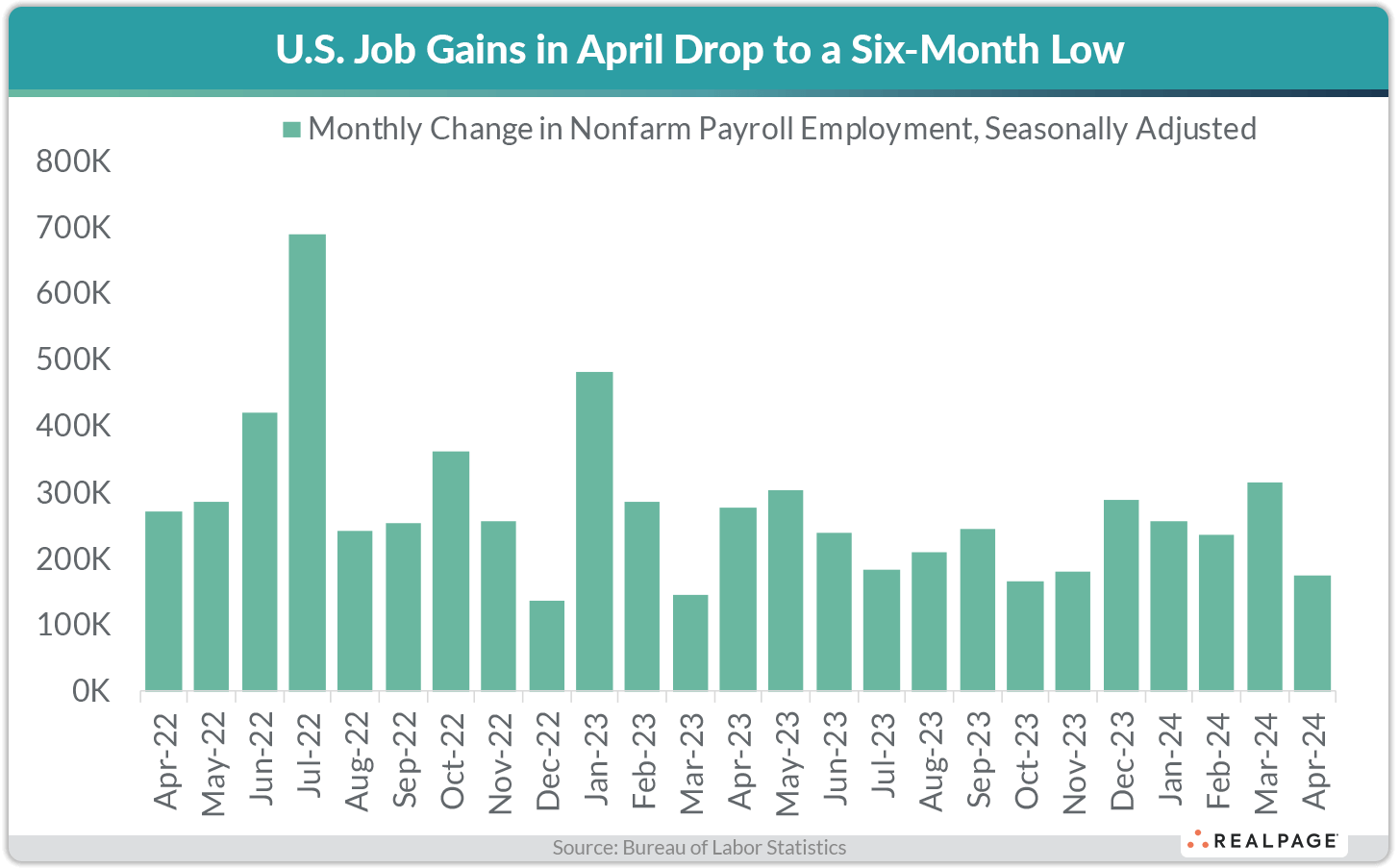

Employers added roughly 175,000 workers to payrolls in April 2024, according to a survey of businesses by the Bureau of Labor Statistics. While that was a solid gain, it came in well below the 315,000 jobs gained in March (which was revised up) and was the smallest one-month gain since October 2023. In addition, recent job gains came in well below what economists were forecasting (+235,000 to +240,000 jobs). Still, the U.S. economy has now added jobs for 40 consecutive months, the fifth-longest period of job base expansion on record dating back to 1939.

Of note: The job count for February was revised down while the March job number was revised up. Downward revisions to February 2024 data showed 34,000 fewer jobs were added than previously reported, down from 270,000 to 236,000 positions. The March 2024 job growth number was revised up, increasing by 12,000 jobs to a total of 315,000 positions. With these revisions, employment gains in February and March combined were 22,000 jobs lower than previously reported.

Job gains in April were below the monthly average of around 242,000 jobs added over the previous 12 months and fell below pre-pandemic norms. From 2015 to 2019, the U.S. economy added an average of roughly 190,000 jobs each month.

On an annual basis, the nation gained more than 2.8 million jobs as of April 2024. While that was one of the weakest annual gains over the past three years, it still registered above the pre-pandemic average of around 2.4 million jobs added annually from 2015 to 2019.

The U.S. economy has recovered all the net jobs lost during the COVID-19 pandemic. As of April, the nation had nearly 6 million more jobs (+3.9%) compared to the pre-pandemic employment level from February 2020.

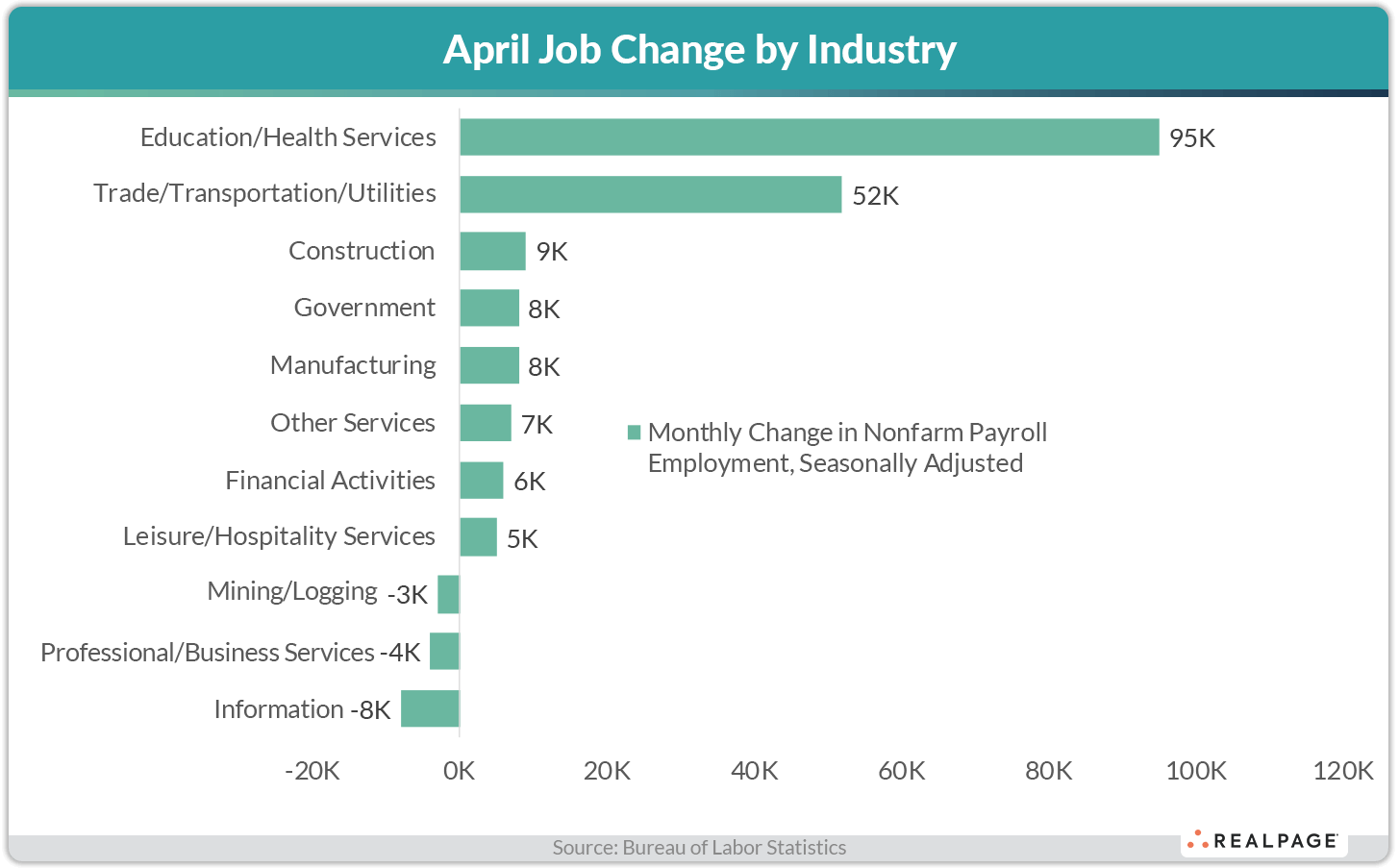

Jobs by Industry

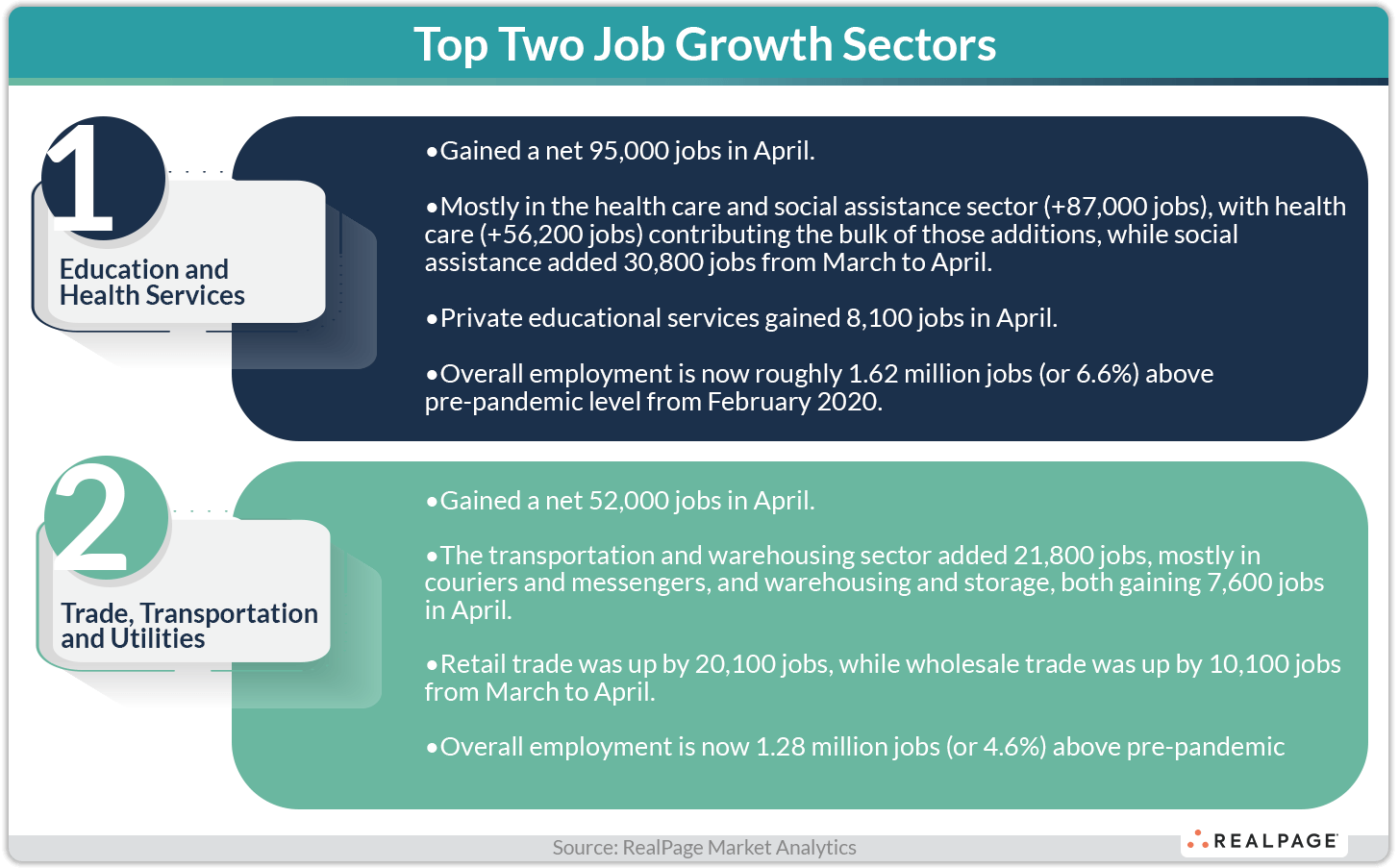

Most of the 11 major industry sectors gained jobs in April. The most notable job base expansions were in Education and Health Services (+95,000 jobs) and Trade, Transportation and Utilities (+52,000 jobs). Much smaller gains were recorded in Construction (+9,000 jobs), Government (+8,000 jobs), Manufacturing (+8,000 jobs), Other Services (+7,000 jobs), Financial Activities (+6,000 jobs) and Leisure and Hospitality Services (+5,000 jobs). Job losses were recorded in Information (-8,000 jobs), Professional and Business Services (-4,000 jobs) and Mining and Logging (-3,000 jobs).

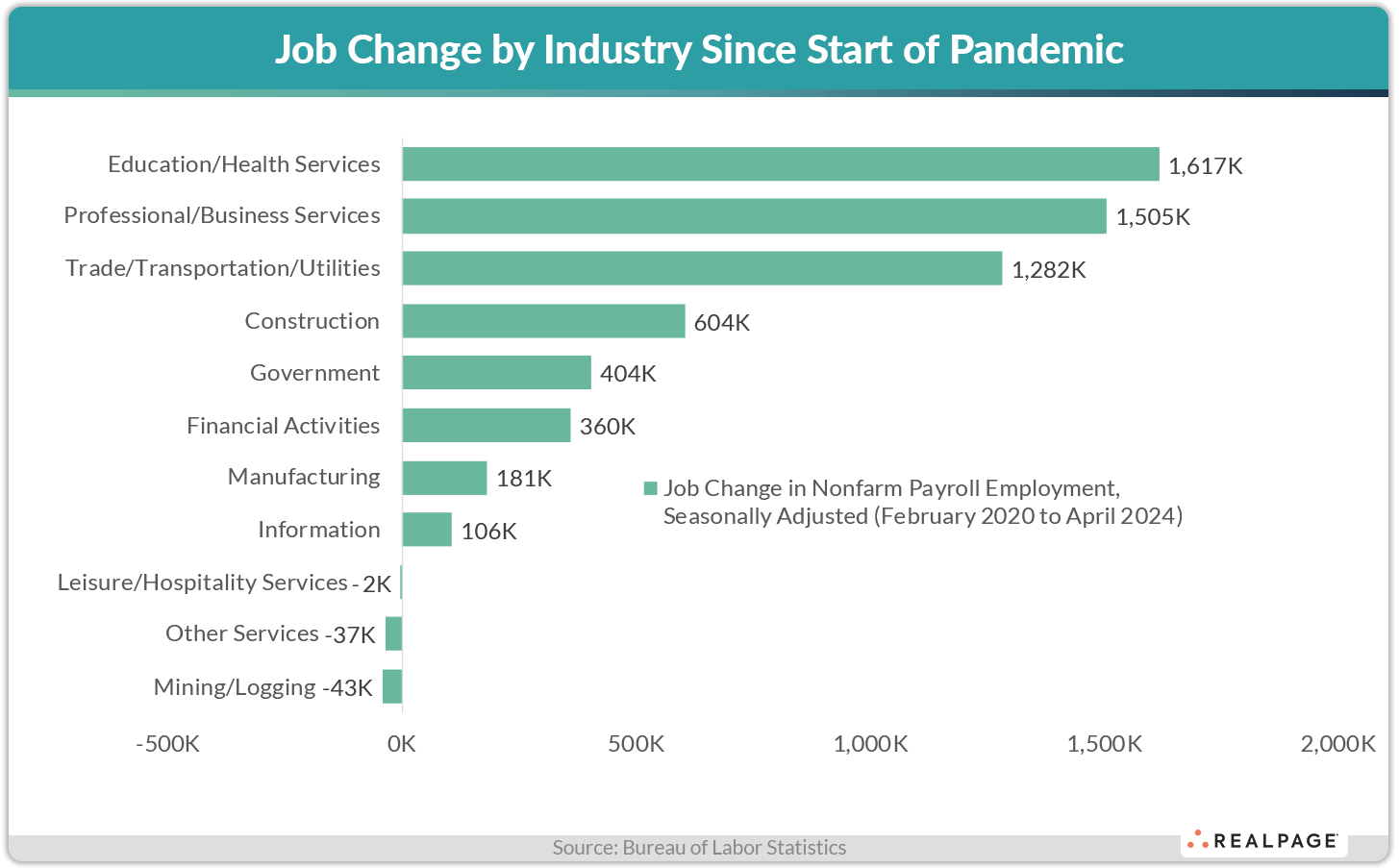

Most major industries have recovered all the jobs lost during the COVID-19 pandemic downturn. Education and Health Services has seen the best recovery, with the recent job count coming in roughly 1.617 million positions ahead of February 2020 numbers, closely followed by Professional and Business Services (+1.505 million jobs). Also well ahead of pre-pandemic norms was Trade, Transportation and Utilities (+1.282 million jobs).

Despite recent gains, employment in the Leisure and Hospitality Services sector (the hardest-hit sector during the pandemic) remained below pre-pandemic employment counts. As of April, that sector had 2,000 fewer jobs than in February 2020, but that was just a 0.01% decline in the job base.

Employment in Other Services and the Mining and Logging industry have yet to recover all the jobs lost during the COVID-19 downturn, with both those segments about 40,000 jobs below their February 2020 levels. That put the April 2024 employment count in Other Services 0.6% below the pre-pandemic level, while the job base in Mining and Logging was 6.3% below the February 2020 level.

Unemployment

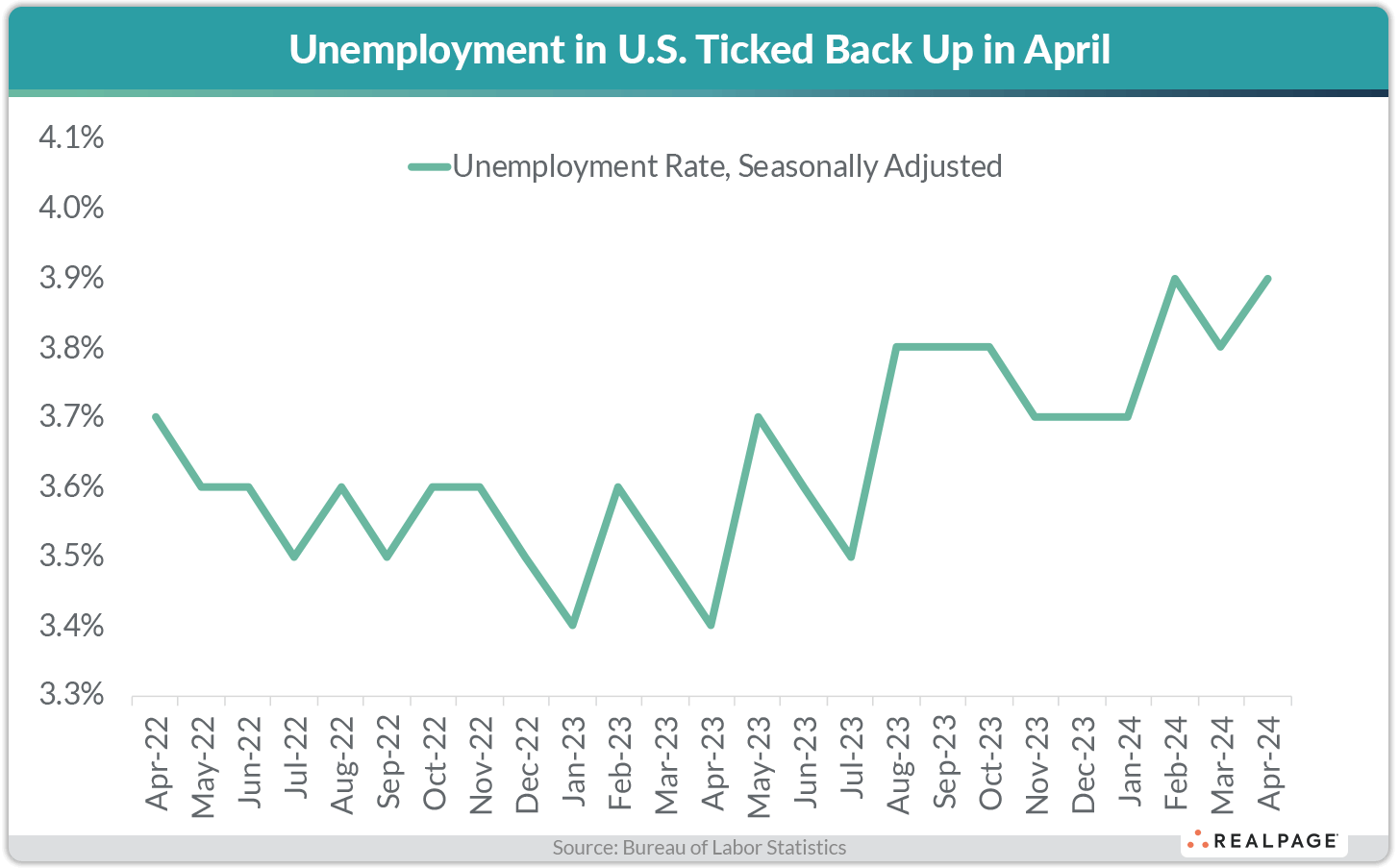

The unemployment rate (the U3 or headline unemployment rate, which is seasonally adjusted, is a survey of households) increased 10 bps from March to April registering at 3.9%, above economists’ expectations that the rate would hold steady at 3.8%. Still, that marked the 27th consecutive month that the jobless rate has remained below 4%, the longest such streak since the 1960s. The rise in the unemployment rate came amid the labor force participation rate remaining unchanged from March to April, at 62.7%.

Since February 2022, the unemployment rate has been in a narrow range of 3.4% to 3.9%, averaging 3.6% during that period. At the onset of the pandemic, the unemployment rate climbed to 14.8% in April 2020. Prior to the pandemic, the unemployment rate clocked in at 3.5% to 5.7% from 2015 to 2019, averaging 4.4% during that five-year period. Prior to 2023, the unemployment rate hadn’t registered below 3.5% since 1969.

The total number of unemployed persons in the U.S. registered at just over 6.49 million in April, up from about 6.43 million in March.

The unemployment rate for adult men (20 years and over) increased 30 bps from March to April, to 3.6%. The unemployment rate for adult women (20 years and older) decreased 10 bps to 3.5%. Meanwhile, the unemployment rate for teenagers (16 to 19-year-olds) fell 90 bps from 12.6% in March to 11.7% in April.

Average Hourly Earnings

Average hourly earnings among employees on private nonfarm payrolls rose $0.07 (+0.2%) from March to April. That monthly increase took average hourly earnings to $34.75 in April. On an annual basis, average hourly earnings were up $1.31, a 3.9% increase year-over-year. That was the smallest annual gain since June 2021. Still, overall wage growth continues to surpass rising prices, as the Consumer Price Index rose 3.5% annually in March. The Fed’s target for inflation is currently at 2%.

Wage growth over the past year was strong across most major industries. The largest increases in earnings from April 2023 to April 2024 were recorded among workers in Financial Activities (6%), Mining and Logging (5.4%), Construction (5.2%), Manufacturing (4.8%), Leisure and Hospitality Services (4%) and Professional and Business Services (4%). The smallest increases were among employees in Education and Health Services (2.8%), Information (3.4%), Trade, Transportation and Utilities (3.4%) and Other Services (3.6%).