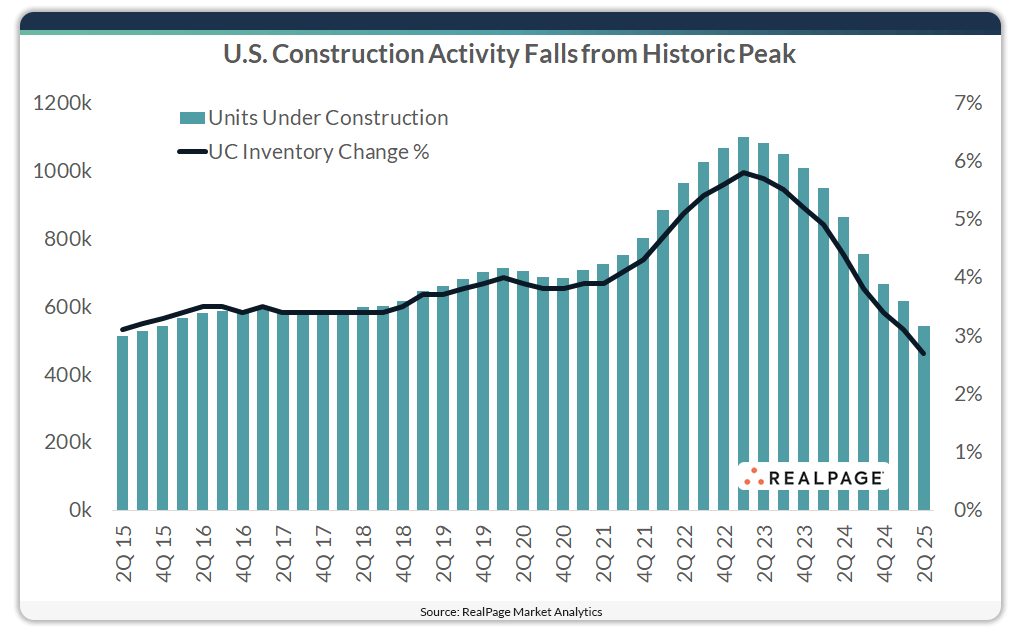

U.S. apartment construction activity is at its lowest point in nearly a decade.

Just over two years ago, apartment construction volumes were at a record high, peaking at over 1.1 million units underway at the end of 1st quarter 2023.

Following that apex, building volumes have come down every quarter, as properties wrapped up construction and permitting waned. At the end of 2nd quarter 2025, just over 542,800 units were under construction across the U.S., according to data from RealPage Market Analytics. That was the smallest apartment construction figure the nation has seen since 3rd quarter 2015.

Just in the past year, nationwide apartment construction activity fell by nearly 320,000 units. That was a 37% decrease from 2nd quarter 2024’s volume. Of the stock underway at the end of 2nd quarter 2025, roughly 354,000 units are scheduled to complete in the coming year.

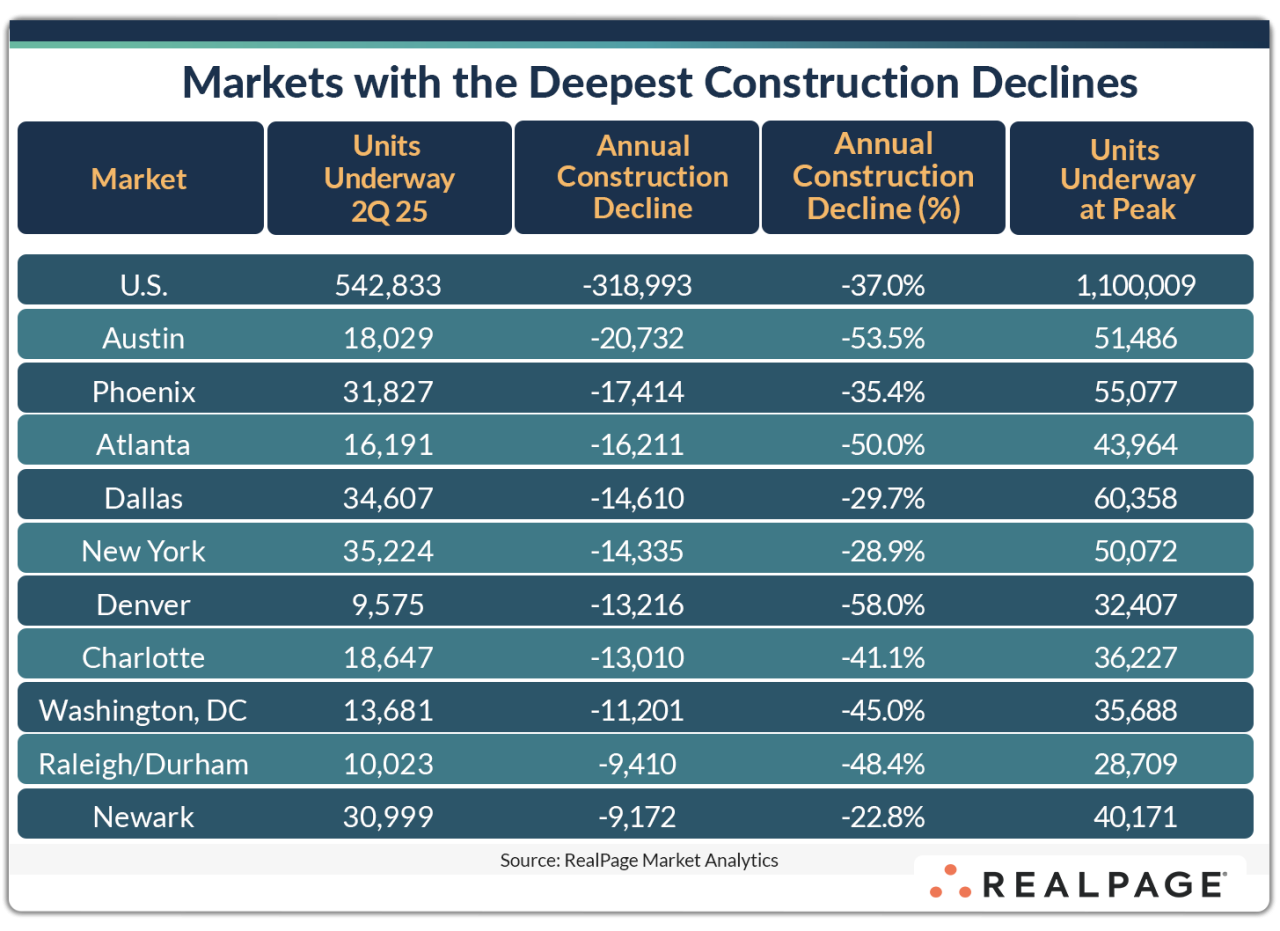

Not surprisingly, Austin is the apartment market that has seen the deepest drop off in construction activity in the past year. Roughly 18,000 units were under construction in Austin at the end of 2nd quarter, which was less than half the volume of units underway just one year ago.

Other markets to see volumes come down notably in the past year include Phoenix, Atlanta, Dallas and New York. In those markets, construction activity came down by about 14,000 to 17,000 units year-over-year.

On a relative basis, there were a handful of markets that have seen construction drop by more than 60% over the past year. Those were mostly West Coast markets like San Jose, Oakland and Portland, but Midwest market Indianapolis was also included in that list. Denver came close to that cutoff, with construction falling 58% year-over-year.

At the end of 2nd quarter 2025, the markets with the biggest volumes of apartments underway included New York, Dallas, Phoenix, Newark and Los Angeles. All of those markets have seen construction activity fade, but the deepest decline was in Phoenix, where developers are building 35.4% fewer units than they were just one year ago.

On the other hand, a small group of markets – Cincinnati, Richmond and West Palm Beach – are seeing construction activity increase. These markets all had construction numbers that have bumped up slightly from last year’s pace.