Comparing 1st Quarter Rent Growth to Normal Seasonal Behavior

With U.S. apartment rent growth below typical seasonal trends in 1st quarter, only a handful of markets across the nation logged price increases ahead of seasonal norms during the first three months of 2024.

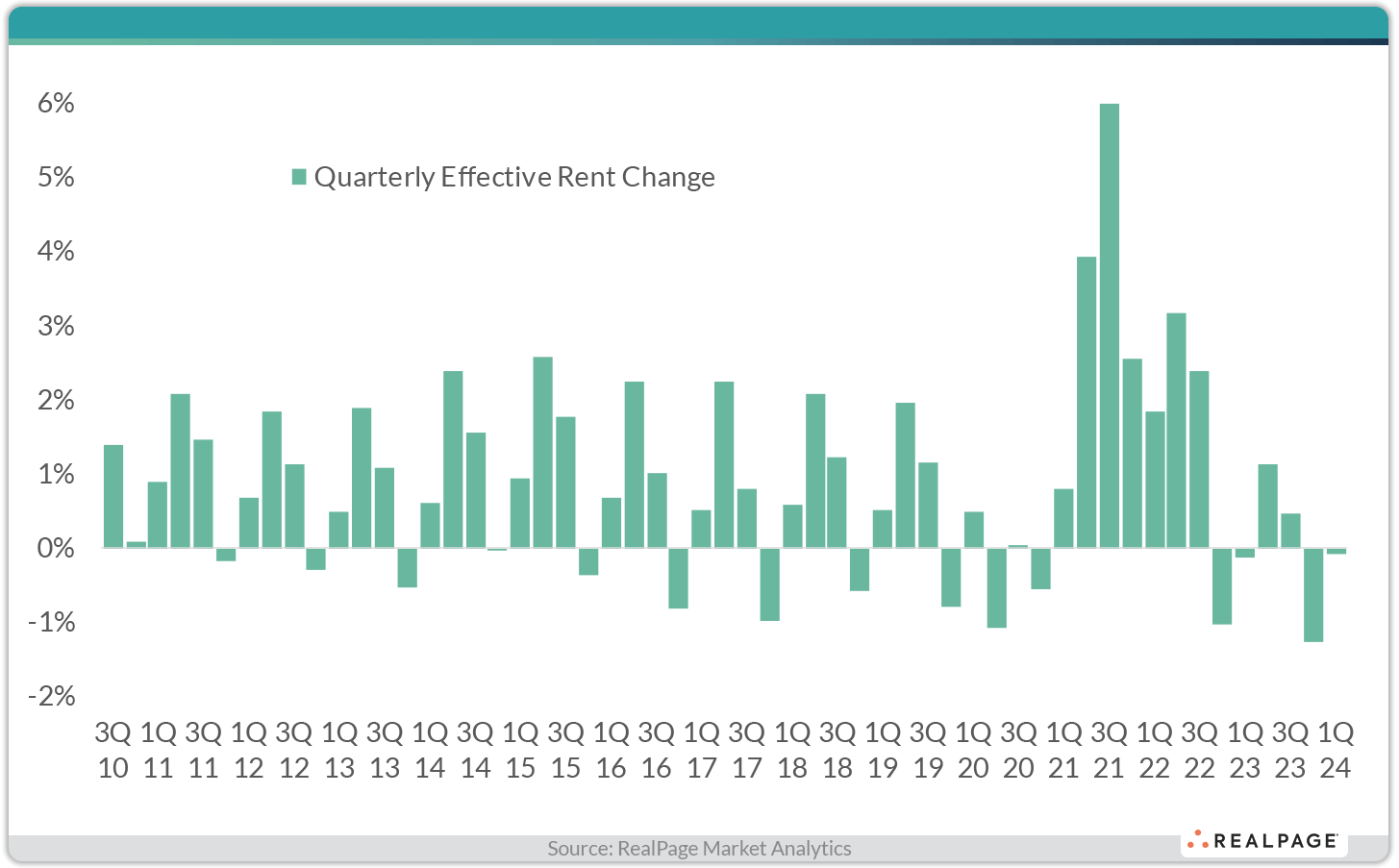

Effective asking rents in the U.S. overall fell by 0.1% in the January to March time period. That was a notable difference from the pre-COVID norm, which was growth of 0.6% during 1st quarter, according to data from RealPage Market Analytics. That was measured during the 2010 to 2019 time frame, when there was a distinct pattern of growth during 1st quarter. The pandemic triggered a time when seasonal trends disappeared, as rents surged. More recently, however, we’ve seen a return to a more normal cadence.

While the 1st quarter 2024 rent performance fell below pre-pandemic trends, that’s easily explained. With new supply levels hitting a record high recently, and even more significant development underway, apartment operators have been cautious, especially in markets most impacted by elevated construction activity.

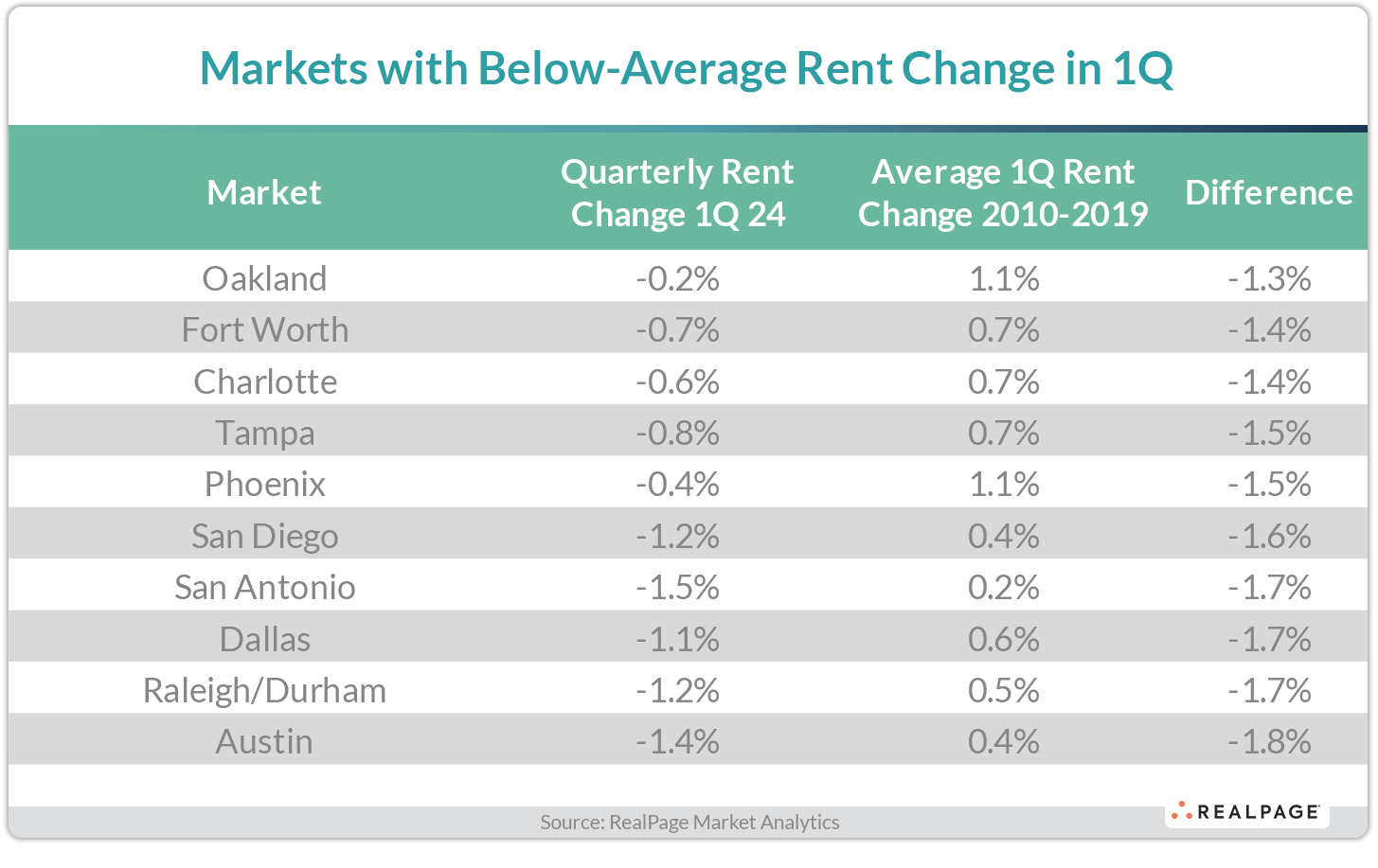

Among major markets with 1st quarter rent positioning trailing pre-COVID trends most severely, four are Texas markets that have seen record supply volumes soar past solid apartment demand. Austin and Dallas in particular have both recorded nation-leading apartment demand in recent months, but the amount of new supply that has hit these markets has been astounding, far outpacing those numbers.

Outside of Texas, other big markets that have logged significant apartment deliveries recently include Charlotte, Raleigh/Durham and Phoenix, where completions swelled each market by at least 17% in the past five years.

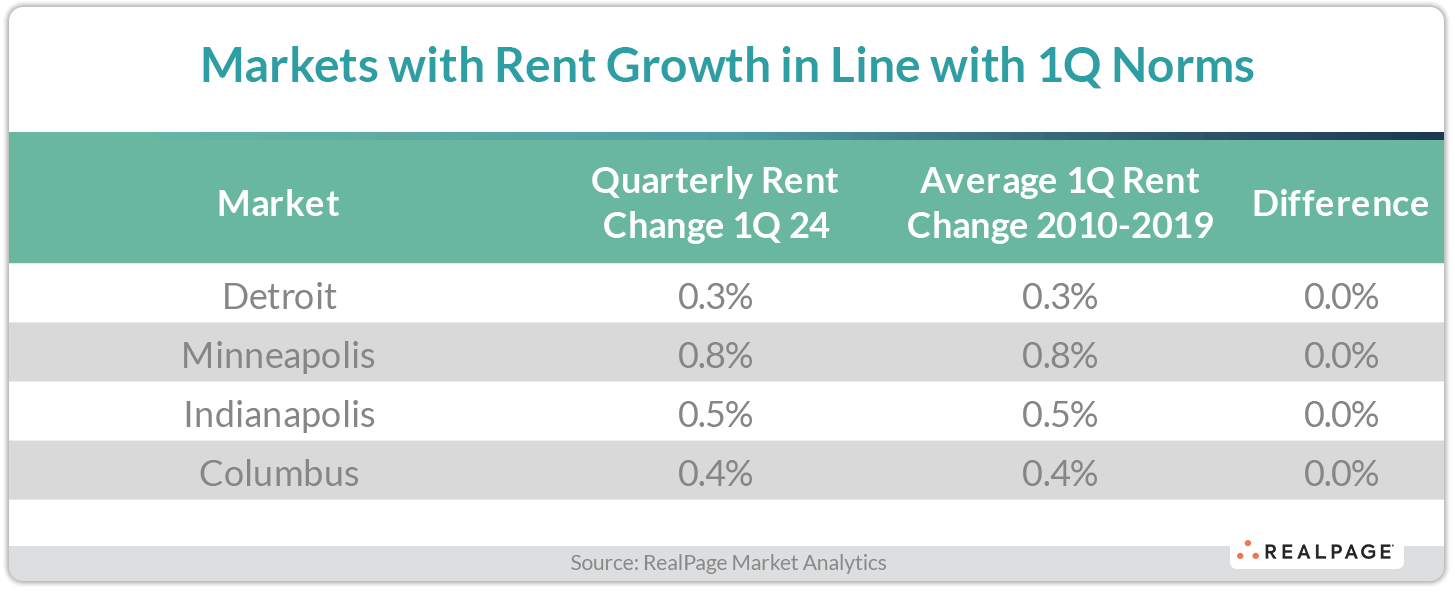

Markets with 1st quarter rent growth in-line with pre-pandemic seasonal trends were – not surprisingly – stable Midwest markets. These metros typically see mild to moderate rent growth – and that continued in the early months of 2024. Price increases between 0.3% and 0.8% in 1st quarter were right in line with pre-COVID norms in Detroit, Minneapolis, Indianapolis and Columbus.

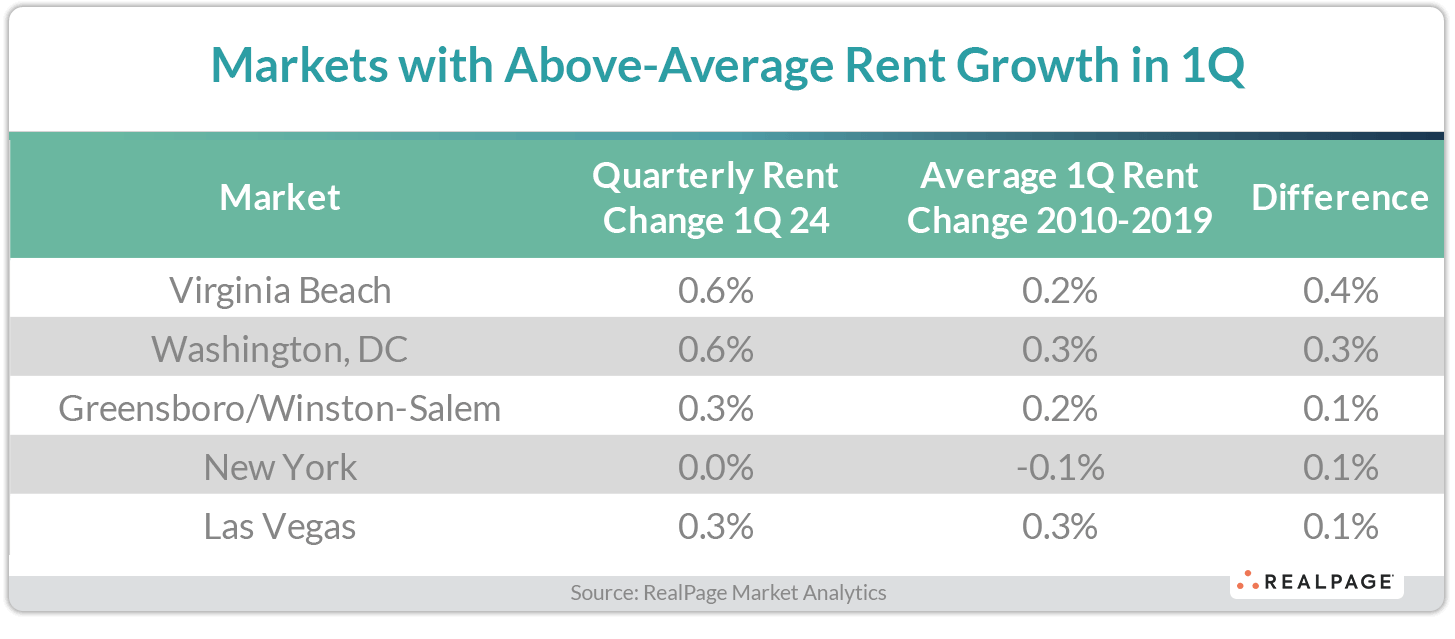

In only a handful of markets – mostly located in the Eastern U.S. – rent increases in 1st quarter went beyond the typical boost seen in the decade before the start of the pandemic.

Virginia Beach was the national leader, with rent growth in the first three months of 2024 coming in 0.4% ahead of the market’s pre-COVID 1st quarter average. Washington, DC rent growth in the January to March time frame was 0.3% ahead of pre-pandemic seasonal trends. Both of these markets logged nation-leading price increases of 0.6% in the first three months of 2024.

New York was the nation’s occupancy leader in 1st quarter, with a rate of 96.8%. Virginia Beach was also ahead of national norms with a rate of 95%. Another commonality these two markets share is limited increases to existing stock in the past five years. The existing unit base inched up by 4.1% in Virginia Beach in that time frame, while New York – already the nation’s largest apartment market – saw an increase of 2.3%.