While apartment demand has been strong across the major Texas metros, Texas-focused operators are feeling the pressure of supply.

Austin, Dallas/Fort Worth and Houston all rank in the top five markets in the country for annual absorption. But strong demand at a market level unfortunately doesn't scale on a 1:1 basis down to the property level.

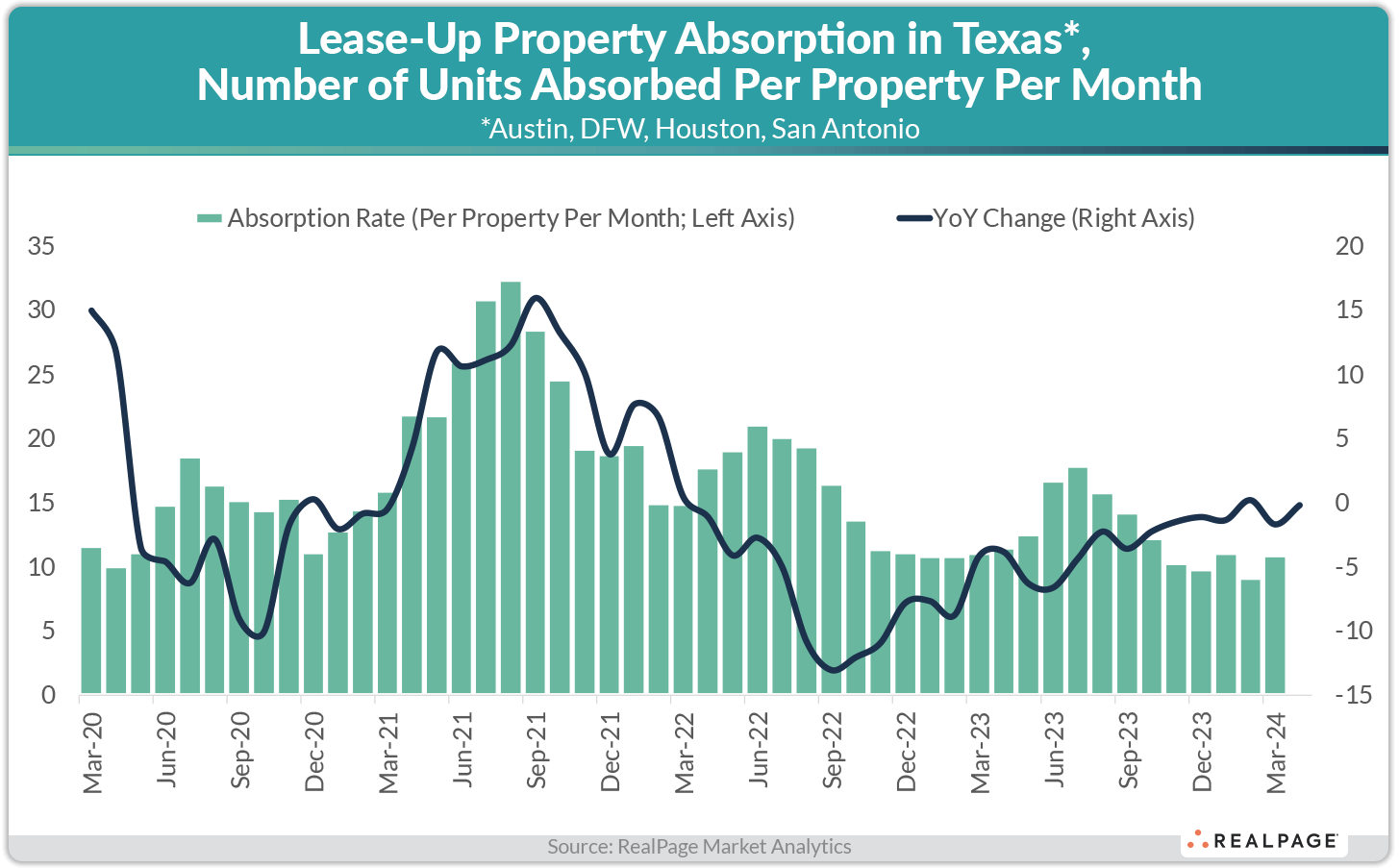

As of March, a typical lease-up property saw move-ins into roughly a dozen units. In Dallas, it was actually 15 units per property per month, as 1,500+ lease-up units were absorbed in March alone. That was a vast improvement from the 700 units that were typical a year ago in March 2023.

The difference today is supply. And lots of it. Lease-up properties total some 33,700 units in Dallas alone as of March. That goes up to 47,000 units if you add in Fort Worth. And that means a lot of competition for lease-ups to fill up as quick as possible. In Austin, for example, the average lease-up concession is approaching 40 days free. But there are instances of nine to 11 weeks discounted right now. That's a lot of downward pressure on existing Class A units.

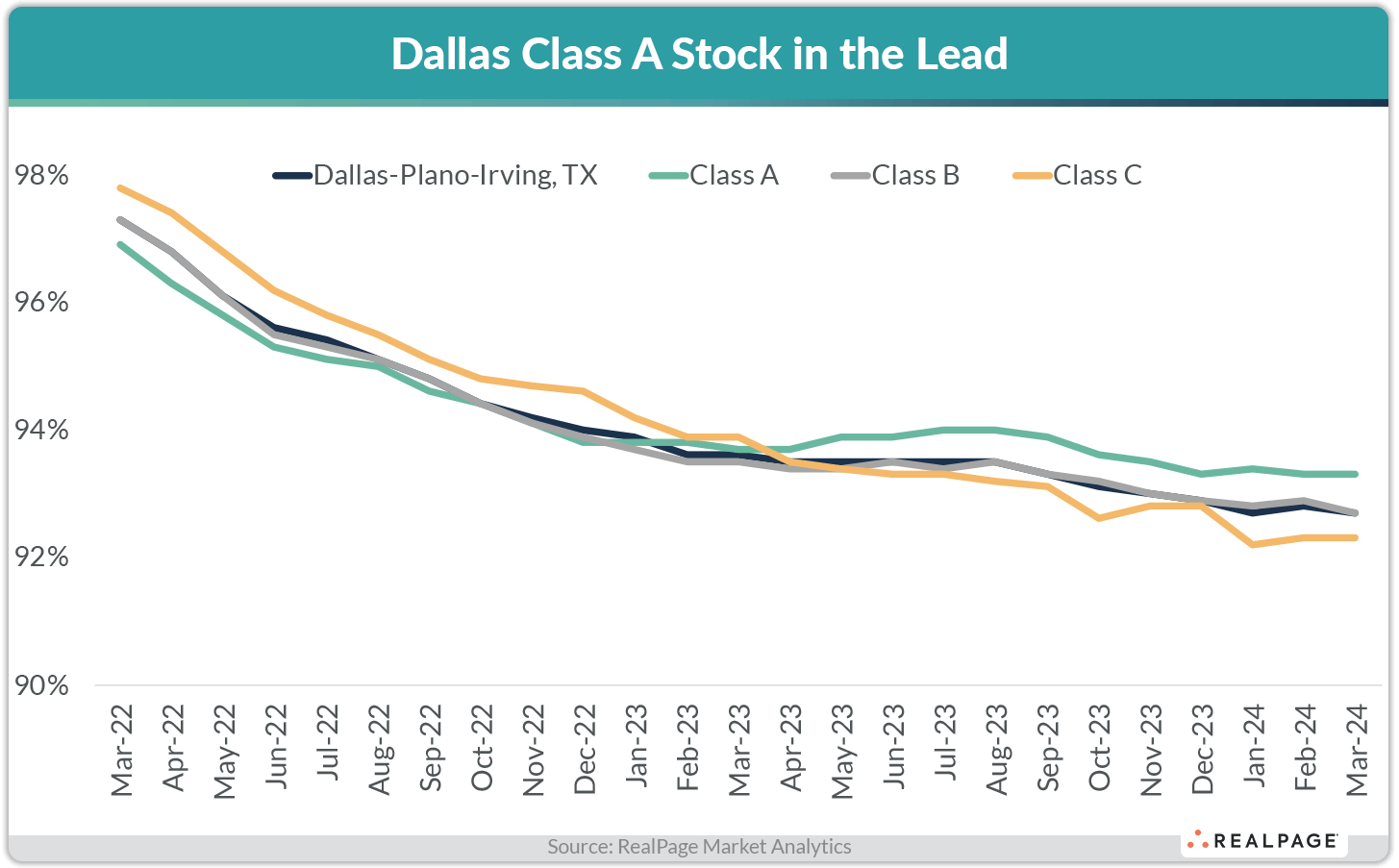

Dallas' challenge for now seems to be an erosion of the Class B renter base into Class A properties. It’s not typical for Class A occupancy to lead the local market. But Class A occupancy in Dallas has been roughly 50 to 100 basis points higher than both Class B and Class C stock for the past six months.

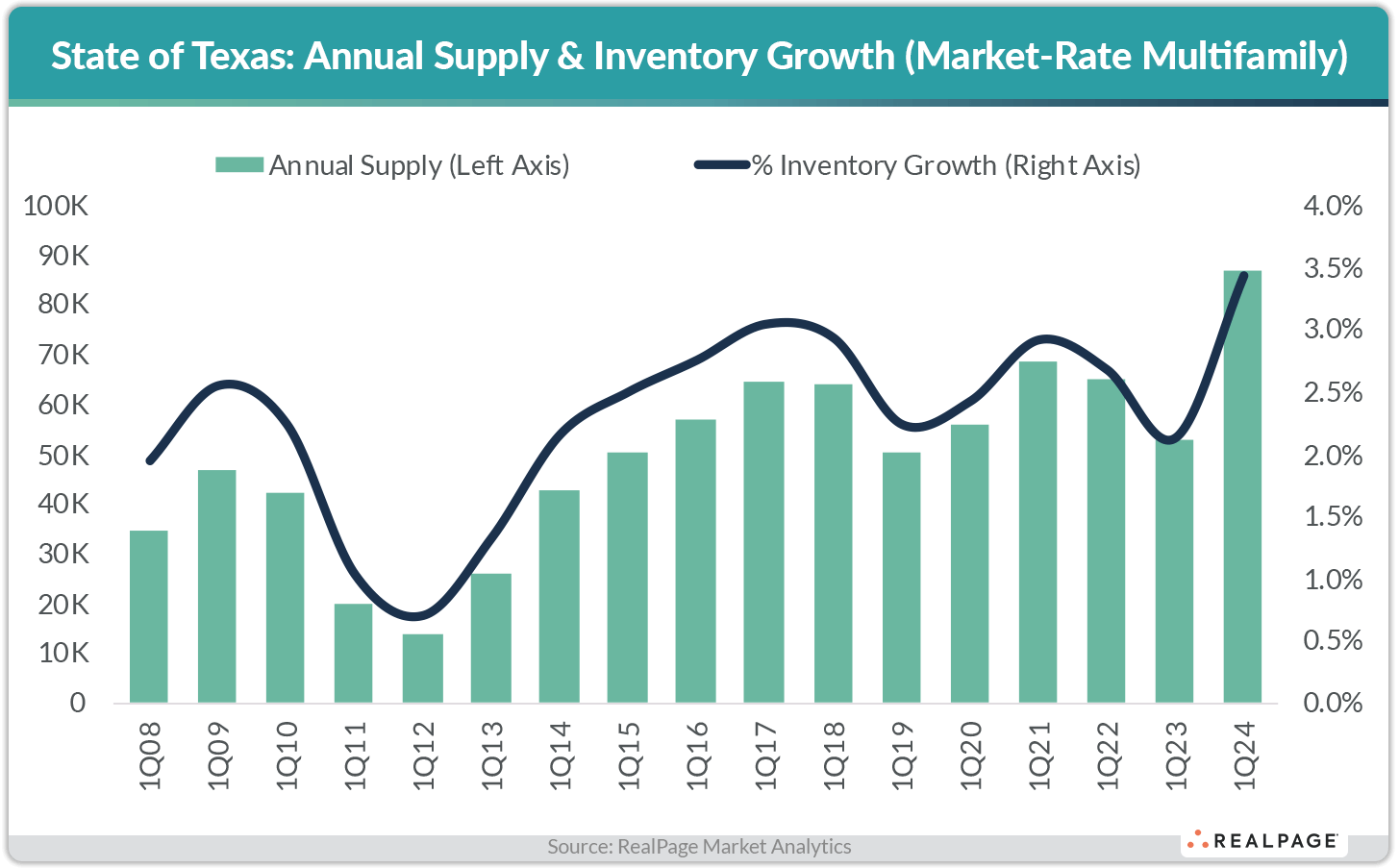

In Texas overall, while demand has been strong, so has supply. The difference is demand builds like a tidal wave – it's the byproduct of economic growth and population growth. Supply, however, crests and troughs in shorter cycles.

Right now, supply is cresting in Texas. Nearly 90,000 new units completed in the year-ending 1st quarter 2024 in the Texas markets. That’s an all-time high for a supply-heavy state. Those units increased the existing base in Texas by 3.4%.