Strong demand drivers and ever-flowing job additions send a constant flow of renters to Dallas and, as a result, developers have been building more apartments in this market than any other nationwide over the last decade. And with a record amount of construction still underway, Dallas isn’t quite done with the rapid transformation of its apartment market.

Dallas is the nation’s fifth largest apartment market with over 696,000 existing units as of 1st quarter, according to data from RealPage Market Analytics. The only U.S. markets with more stock are New York, Los Angeles, Houston and Chicago.

No Market Has Added More Units Than Dallas Since 2014

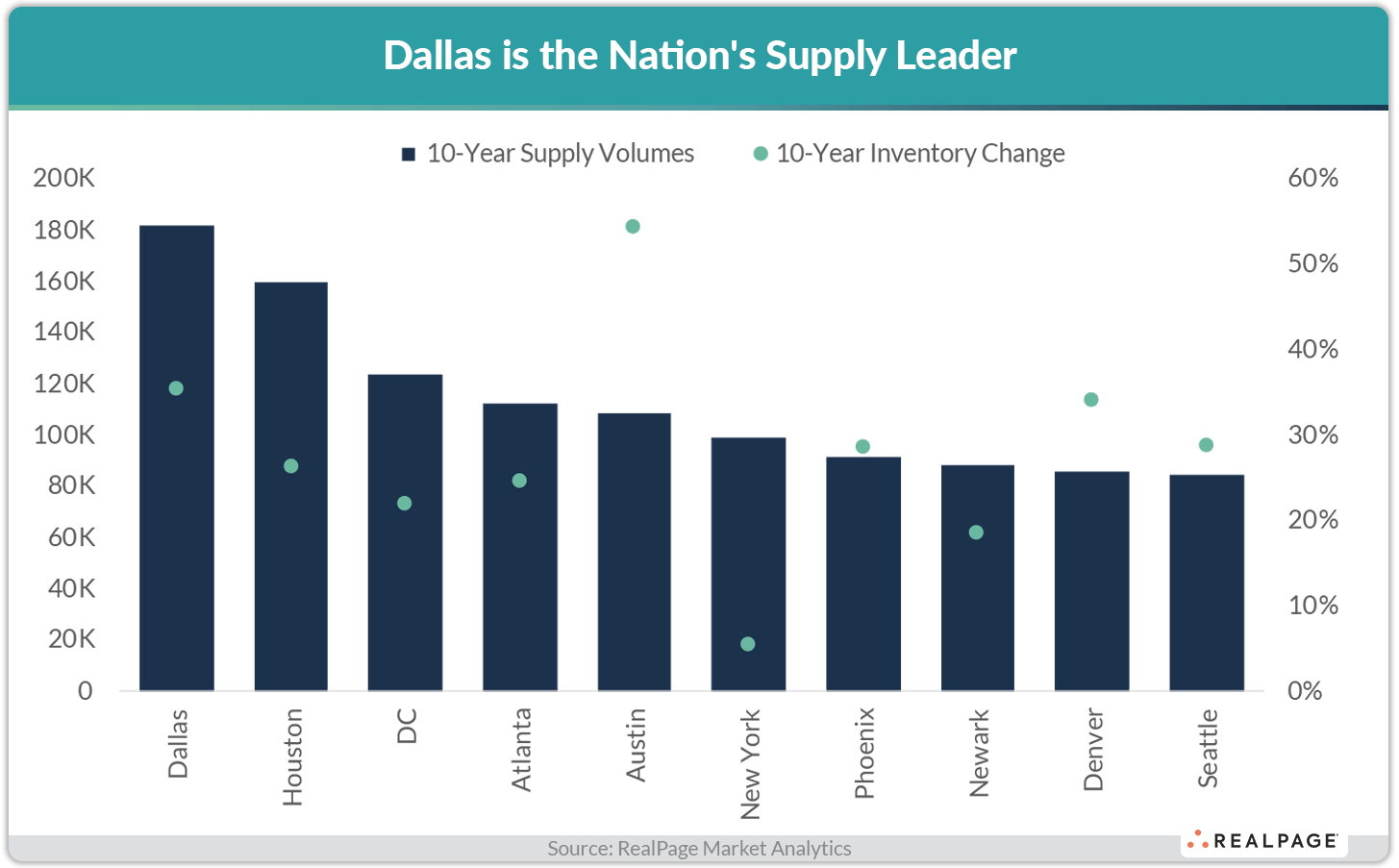

Over the past 10 years, Dallas has added more apartments to its existing base than any other market nationwide. Over 181,000 units have come online since 2014, increasing the apartment base by a stunning 35.3%. While there were several other markets nationwide that saw more growth on a percentage basis, all those apartment markets were less than half the size of Dallas. In fact, the only market that comes close on a relative growth basis is fellow Texas metro Austin, where the existing apartment base is less than half the size of Dallas at more like 300,000 existing units.

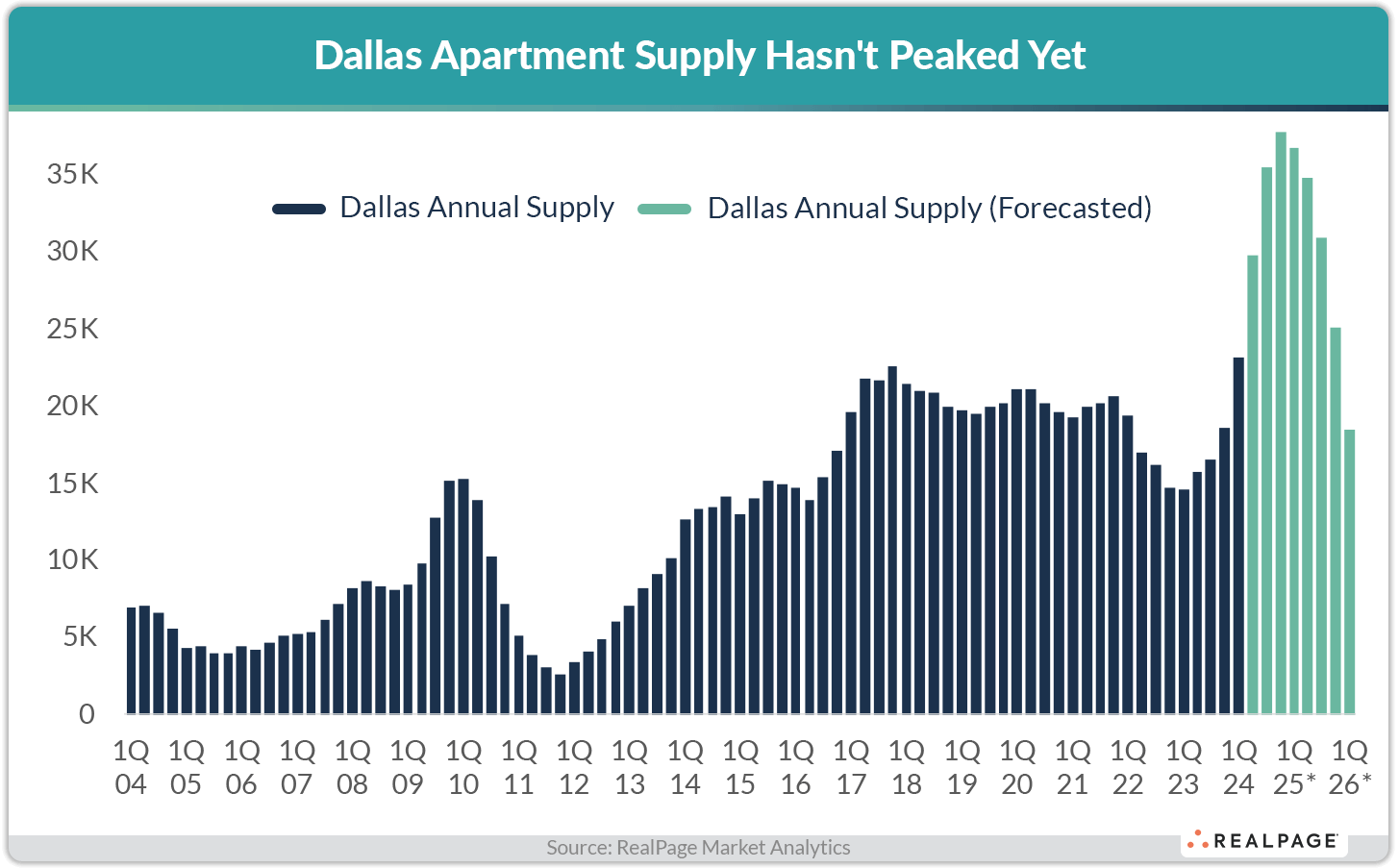

And apartment developers are not done with Dallas yet. In fact, Dallas just experienced an all-time high in annual deliveries in the RealPage data set dating back to 1992. Over 23,100 units were completed in Dallas in the year-ending 1st quarter, the second highest showing nationwide after Houston. In Dallas, that marked the first time on record annual completions busted the 20,000-unit mark.

It took over 30 years of data for Dallas to bust the 20,000-unit mark for annual supply – but it could take only another year for it to nearly surpass the 40,000-unit mark. Over 52,000 units were under construction in Dallas at the end of 1st quarter 2024, with nearly 37,000 of those units forecasted to deliver over the next four quarters. Though, construction delays could alter these figures somewhat. Annual supply is forecasted to peak in Dallas in 2024’s 4th quarter at roughly 38,000 units before tapering back down. Recent U.S. Census numbers show that Dallas also recorded a significant drop off in multifamily permitting, falling nearly 40% year-over-year to stand at about 15,000 units permitted in March 2024.

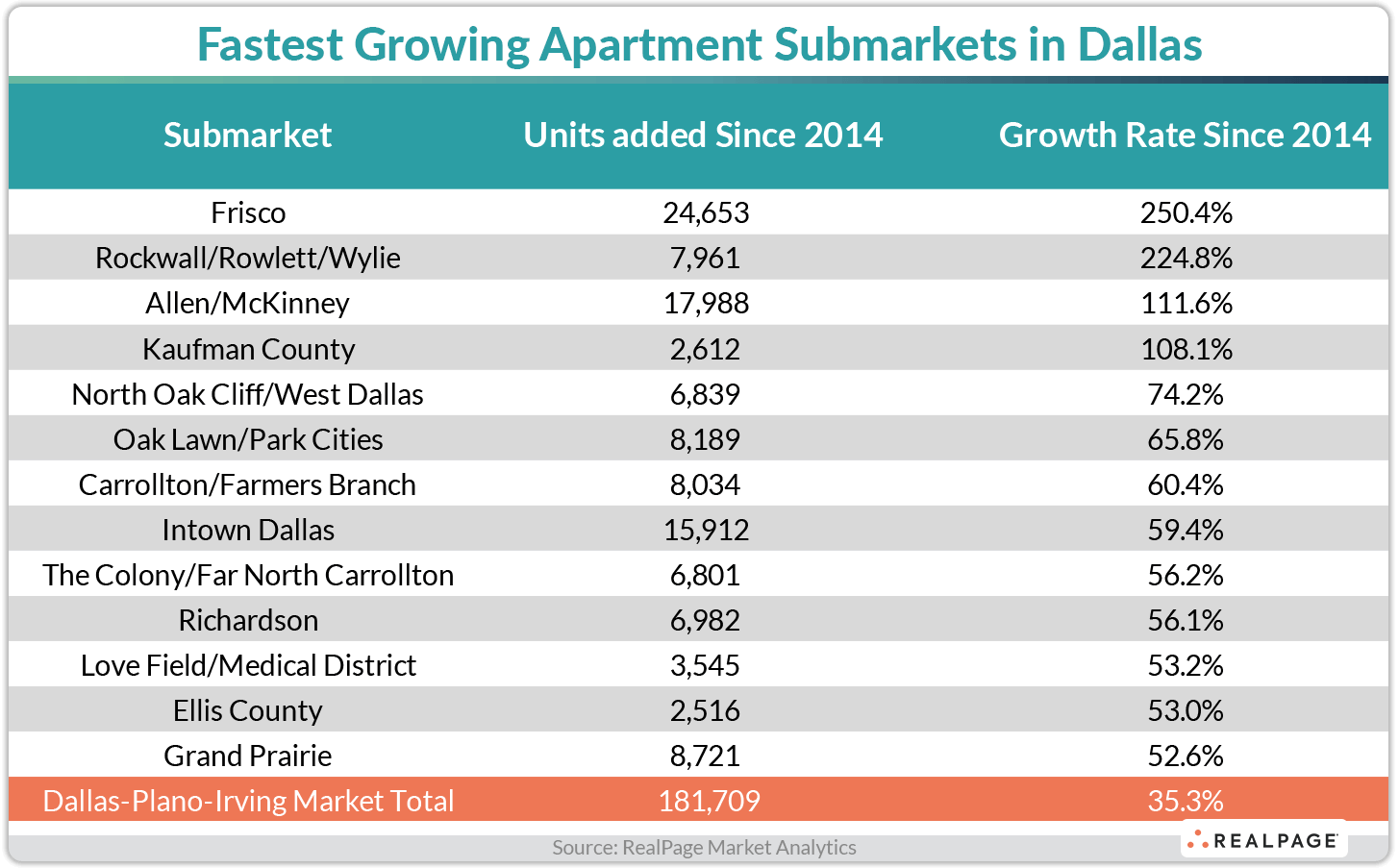

Across Dallas, apartment supply has not been uniform. Some submarkets have grown total inventory by truly astronomical volumes over the last decade, while others have seen virtually no change to existing unit count. Three northern suburban submarkets – Frisco, Rockwall/Rowlett/Wylie and Allen/McKinney – have all more than doubled their respective apartment inventories since 2014, as well as southeastern submarket Kaufman County. Conversely, the submarkets of North Irving, Mesquite, Far East Dallas and Far North Dallas have added essentially no new units in the last decade.

Although apartment demand was solid in Dallas in the past year, it wasn’t enough to keep up with concurrent supply volumes. The market absorbed over 15,000 units in the past year, which was the second-best performance nationwide after only Houston. Like the nation at large, Dallas demand has seen notable fluctuation over the past few years, peaking at a high of 40,000 units in 2022 and then dropping to an all-time low of net move-outs from over 11,000 units in 2023. More recent performance has looked less volatile. The past year’s performance is more reminiscent of the decade before the COVID-19 pandemic, when annual demand averaged around the 14,600-unit mark.

At least in the near term, don’t look for Dallas to start suffering just yet. Job gains continue to impress in Dallas – albeit at more normalized levels in recent data. And residents keep moving to North Texas at nation-leading rates, per the latest Census data. As long as people continue to flock to the market, and employers keep creating jobs for them, Dallas will have ample demand to hold occupancy steady for the next few years. And if the market’s proven anything in recent years, it’s that it can handle extreme volumes of new apartment supply.