Apartment Occupancy Returns to Historically Normal Levels at End of 2024

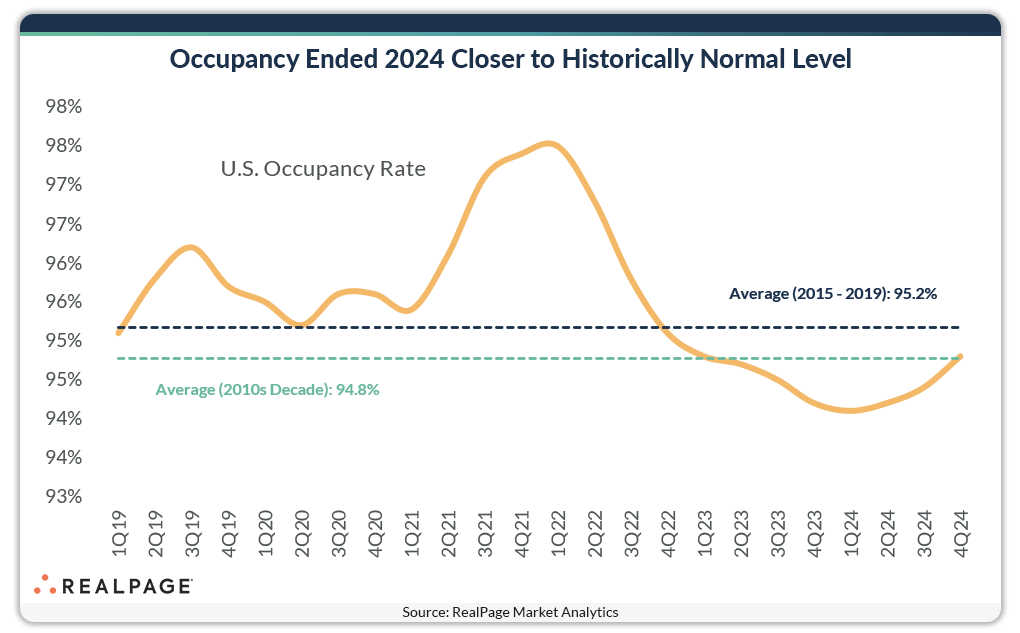

Despite suffering a dip recently, apartment occupancy ended 2024 closer to historically normal levels.

The U.S. apartment market delivered a record volume of apartment supply in 2024. This influx of deliveries pushed occupancy down to a recent low of 94.1% in early 2024. However, demand also rebounded significantly during the year, and caught up to record supply by the end of 2024, helping occupancy bounce back up to end the year at 94.8%. This rate was in line with the U.S. apartment market’s long-term norm from the 2010’s decade (94.8%) and the more recent average from 2015 through 2019 (95.2%), according to data from RealPage Market Analytics.

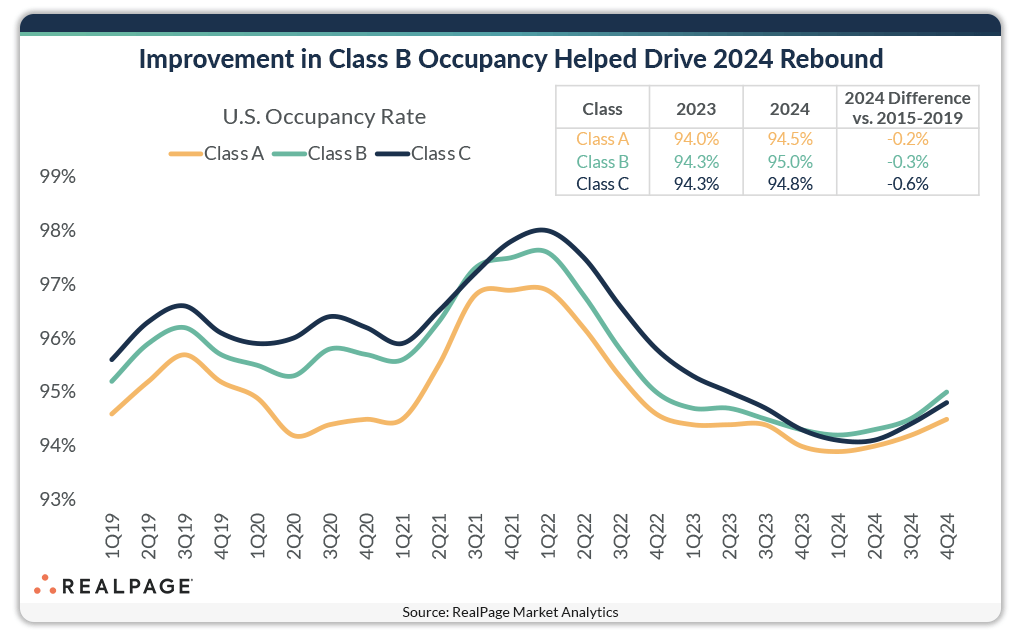

Driving much of the occupancy rebound in conventional apartment stock in 2024 was the performance in Class B stock.

As of the end of 2024, Class B stock – the largest product class – overtook Class C units to become the tightest asset class. Historically, in the 2010s and through the early pandemic period, it was normal for Class C units to be the most occupied product class. But occupancy in Class C stock ended 2024 at 95%, ahead of Class C (94.8%) and Class A (94.5%) units.

While all three asset classes are registered occupancy behind their averages from the five years leading up to the pandemic, improvement in the past year specifically was notable across the board. Again, Class B units led the charge with a meaningful occupancy increase of 80 basis points (bps) in calendar 2024, while Class A and C units logged growth of 50 bps each in the year.

Roughly half the existing apartment base nationwide is comprised of Class B units, compared to roughly a quarter each in Class A and Class C stock. So, it’s clear why improvement in Class B stock would boost overall occupancy.

For more information on the state of the U.S. apartment market, including forecasts, watch the webcast Market Intelligence: 2025 U.S. Apartment Market Outlook.