U.S. Apartment Supply Falls as Demand Ramps Up

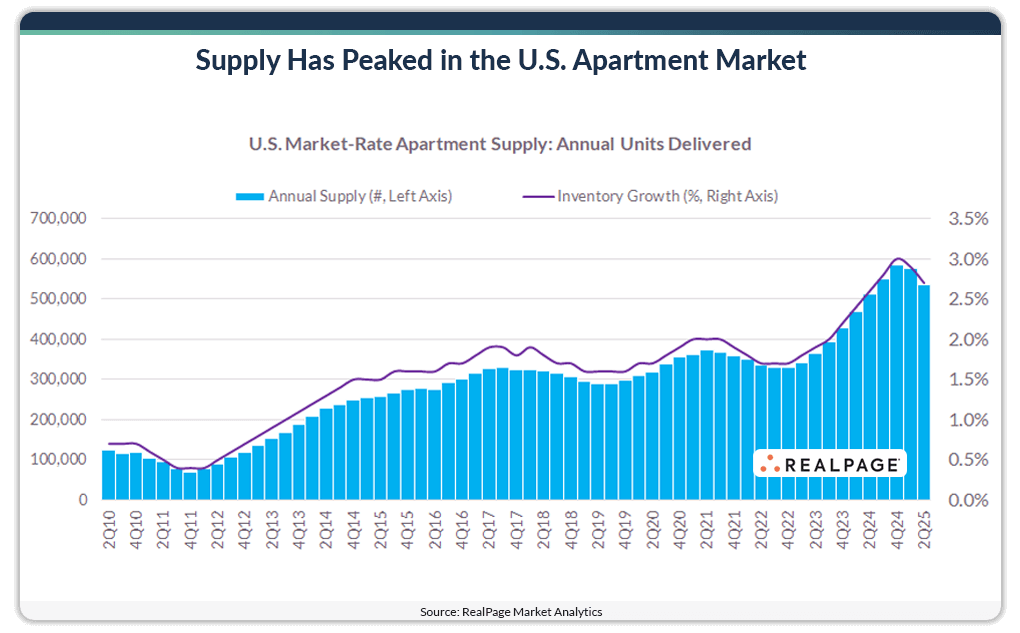

Apartment supply numbers have peaked in the U.S. apartment market, and the volume of new deliveries is steadily falling at the same time that demand is mounting.

Developers wrapped up construction on nearly 536,000 units across the U.S. in the year-ending 2nd quarter. While that annual completion volume easily stands above the nation’s long-term average, it comes in below the all-time high recorded two quarters ago. In fact, 2nd quarter 2025 marks the first time annual inventory growth has fallen quarter-over-quarter by more than 20 basis points in at least 15 years. Most of the apartment market’s big annual supply number is due to huge quarterly volumes in the back half of 2024.

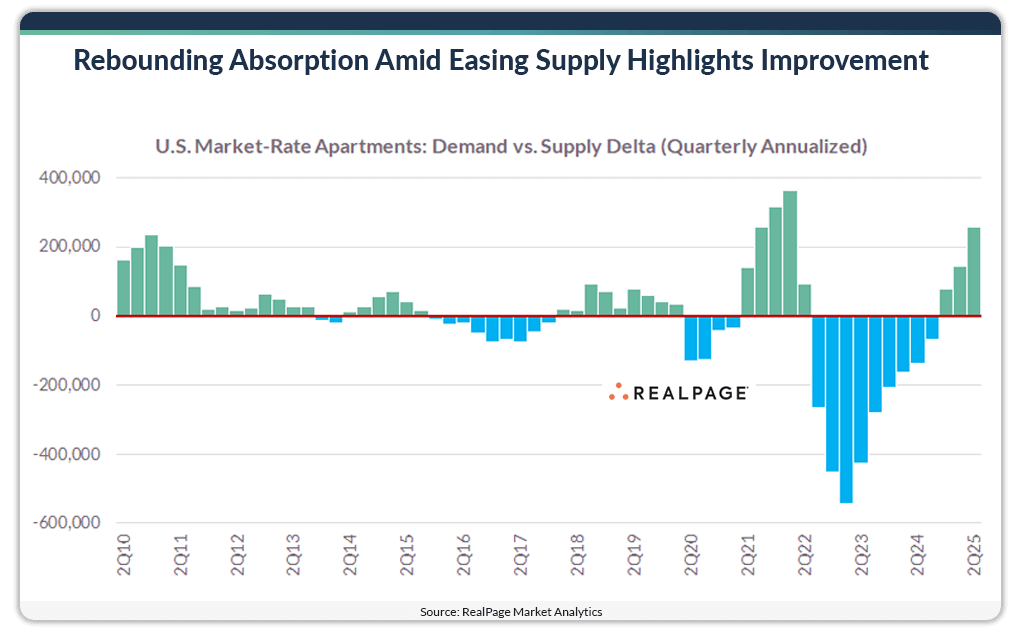

At the same time that supply is on the decline, apartment demand is gaining steam. The U.S. absorbed over 794,000 units in the year-ending 2nd quarter. That was a record for the nation and well above the average of about 358,000 units absorbed annually over the past five years.

This marks a third consecutive quarter of excess annual demand in the U.S., meaning total annual absorption outpaced concurrent deliveries, resulting in a demand surplus.

Looking back, the apartment market was logging a supply surplus throughout much of 2022 through 2024.

The nation’s largest apartment markets with the most demand surplus in the year-ending 2nd quarter include Houston, Chicago, Los Angeles and Atlanta. In the case of Atlanta, that surplus came at a time when the market logged one of the nation’s biggest supply volumes concurrently.

For more information on the state of apartment markets across the U.S., including forecasts, watch the webcast Market Intelligence: Q3 U.S. Multifamily Update.