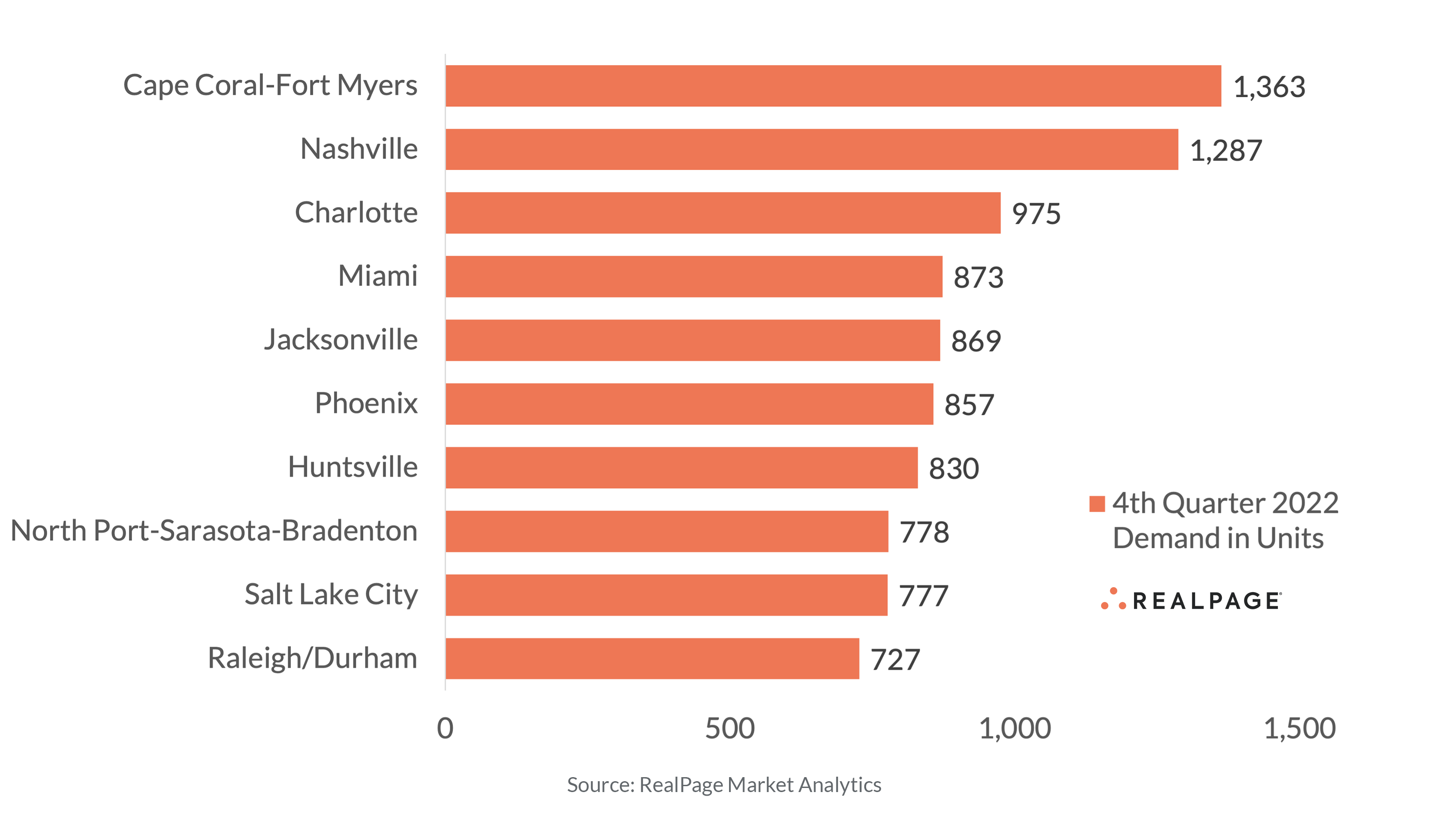

This Small Florida Market Led the Nation in 4th Quarter Apartment Demand

While apartment demand remained weak throughout much of the country during the last three months of 2022, Cape Coral-Fort Myers saw a rebound. This small market absorbed 1,363 units in 4th quarter, according to data from RealPage Market Analytics. That quarterly demand tally led the nation, surpassing top-performing major markets Nashville, Charlotte, Miami, Jacksonville and Phoenix. Cape Coral-Fort Myers’ 4th quarter demand cancelled out much of the net move-outs in the previous two quarters, keeping annual absorption in positive territory at 446 units. Of the nation’s 150 largest markets, only 49 logged positive absorption in calendar 2022. Cape Coral-Fort Myers’ strong demand in 4th quarter came amid a supply wave. In 2022, the market’s inventory expanded 3.8% with the addition of 1,915 units, of which 863 units came online in the last quarter of the year. Occupancy was up 100 basis points (bps) quarter-over-quarter (the second-best performance behind College Station-Bryan, TX) but down 270 bps year-over-year to 95.2% (in line with the national average). Still, effective asking rents grew 2.5% during the quarter (fourth-best performance nationally), taking annual rent growth to 15.8% (second-best performance behind Midland/Odessa, TX). Much of Cape Coral-Fort Myers’ resiliency comes from strong demand drivers. The population here grew 10.5% from 2016 to 2021, to nearly 752,300 people, according to the latest data from the U.S. Census Bureau. That was the 10th fastest growth pace among the nation’s top 150 markets. While the 55+ age cohort contributed the most to that population growth, the number of young adults ages 20 to 34, a key renter demographic, grew 8.8% during that five-year period, more than six times faster than the national average.