The major apartment markets in the West region of the U.S. are recovering nicely from recent demand lows – if you don’t count some of the big coastal markets.

Overall, the West region of the U.S. logged apartment demand for roughly 69,000 units in the year-ending 1st quarter, according to data from RealPage Market Analytics. By comparison, that was less than half of what the South region logged for demand in that time frame.

But when you break down Western demand, a pattern emerges. The large, pricey coastal markets have struggled to maintain apartment demand in recent years, hindered by population losses and stagnant job growth. Meanwhile, the West region markets further from the coast – namely, the ones with more affordable monthly rents – have enjoyed the return of solid apartment demand volumes since the pandemic downturn, fueled by population increases and solid employment markers.

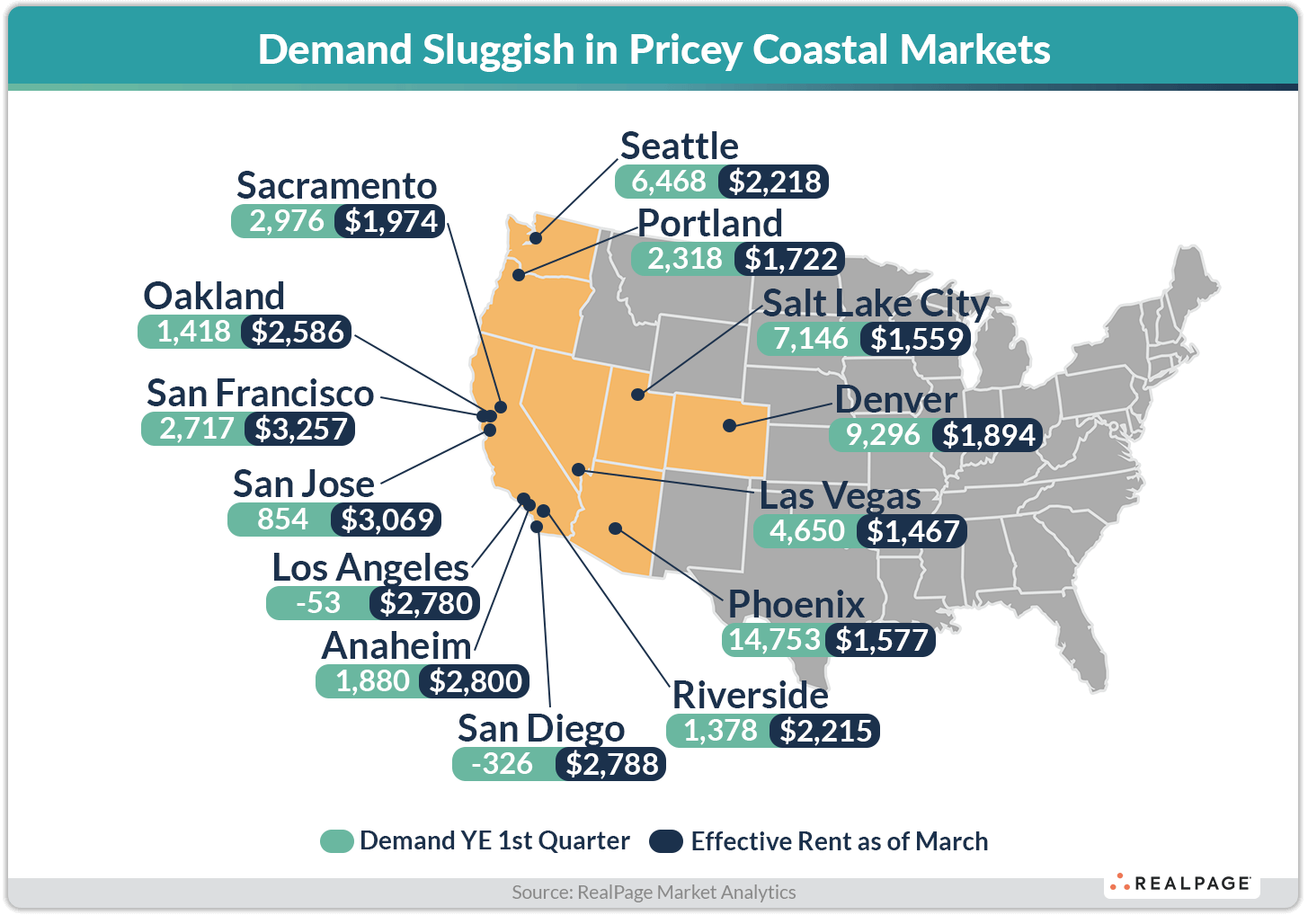

Phoenix captured some of the nation’s strongest apartment demand in the past year, with about 14,800 units absorbed in the year-ending 1st quarter. Only Houston and Dallas logged more demand across the U.S. in the same time. Phoenix is also one of the most affordable West region markets, with effective rents of $1,577 as of March. Only Las Vegas and Salt Lake City command more affordable monthly prices in the West region.

Two other inland West region markets – Denver and Salt Lake City – logged solid demand volumes of more than 7,000 units in the past year. Effective rents in those markets are also more moderate at about $1,550 (Salt Lake) to $1,900 (Denver). By comparison, the national norm for monthly rent clocked in around $1,800 as of 1st quarter.

Seattle was the only other West region market to log demand of more than 6,000 units in the past year. Monthly rents there are right in line with the West region average at about $2,200.

On the other hand, apartment demand has been sluggish across the pricey West Coast markets. Out of the largest 50 apartment markets nationwide, San Diego and Los Angeles were two of only four major markets to record net move-outs in the year-ending 1st quarter. Though mild, San Diego and Los Angeles recorded net move-outs from 330 and 50 units, respectively, both numbers softened considerably by weak 1st quarter demand. Across the U.S., only Memphis and Cleveland suffered worse fates of net move-outs in the past year. San Diego and Los Angeles are also some of the nation’s most expensive apartment markets, with average monthly rents of $2,800.

Population and Job Growth Drive Demand

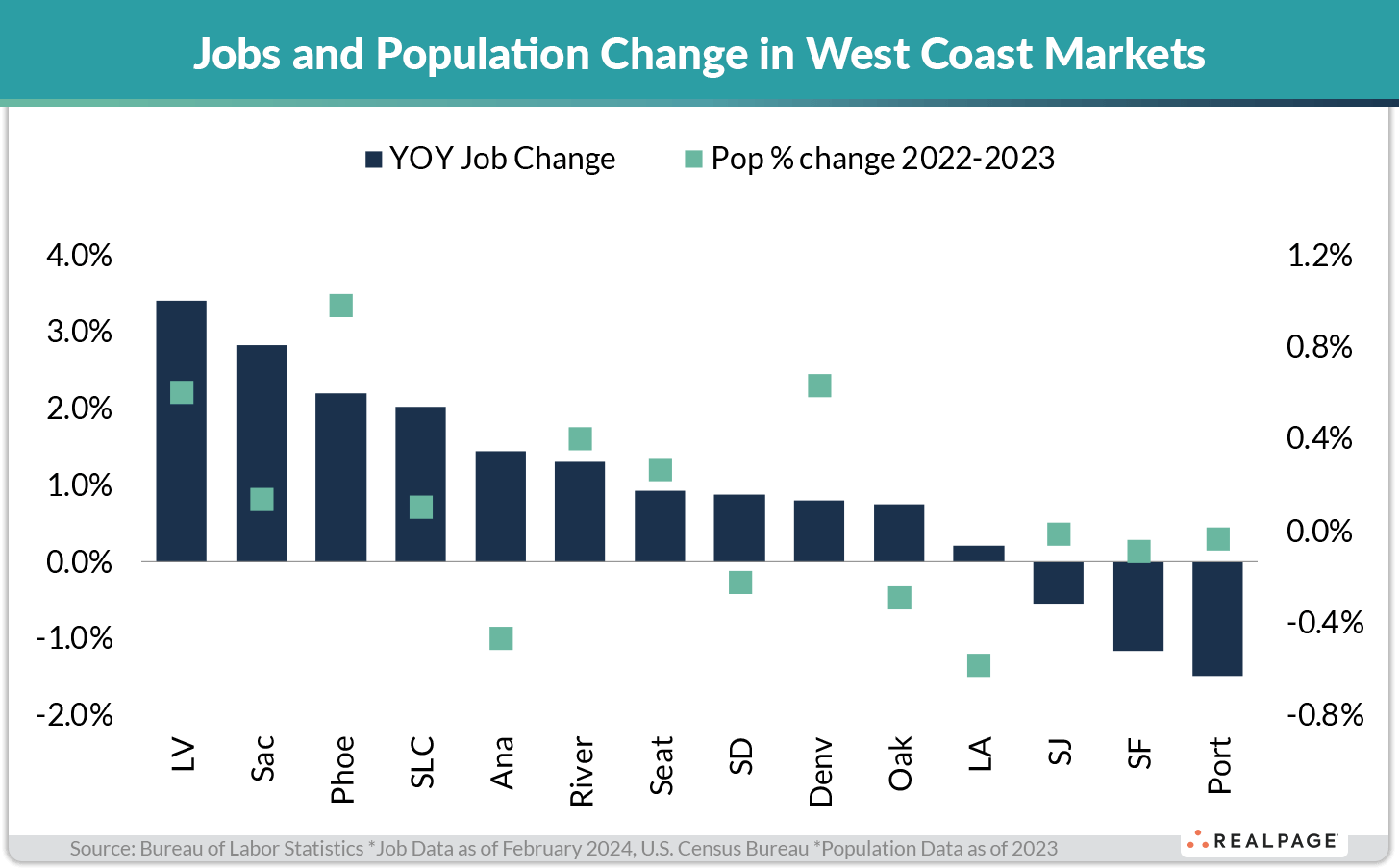

It’s typical for markets with solid job growth and population gains to see elevated apartment demand, as those two factors heavily influence household formation. For markets without those drivers, absorption comes at a slower pace. Across the West region, a clear pattern emerges: More affordable, inland markets with elevated job growth and in-migration achieved strong apartment demand. Pricier West region markets with less favorable demographic and job tailwinds experienced poor-to-mild apartment demand.

Las Vegas was the nation’s job growth winner in the past year, according to the latest market-level data from the Bureau of Labor Statistics. (Nevada was, too, at the state level.) The Las Vegas employment base grew by 3.4% in the year-ending February. Sacramento, Phoenix and Salt Lake City also logged top performances nationwide, with annual job growth of 2% or more.

And it’s not just jobs. Phoenix saw the West region’s biggest population increase between 2022 and 2023, according to the latest estimates from the U.S. Census Bureau. The market’s population increased by 1% in that timeframe. If we extend that out further, the Pheonix population swelled by a sizable 4% between 2020 and 2023.

Other West region markets to log notable population increases were Denver, Las Vegas and Riverside, where the markets were up by 0.4% to 0.6% in 2022-2023. Although Riverside is technically coastal, average monthly rents there run more than $500 below that of neighboring Los Angeles, Anaheim and San Diego.

On the other hand, the big, pricey coastal markets saw much milder job growth – if any at all. And the population counts in these markets have been either declining or stagnant of late.

Among the nation’s 50 largest apartment markets, only five suffered job cuts in the year-ending February. Three of those markets were in the West region: Portland, San Francisco and San Jose. Portland saw the worst employment base decline at 1.5%. Portland is also the only affordable inland West region market to see job cuts and stagnant population change in the latest data. Portland – along with a couple West Coast neighbors like Los Angeles, San Francisco, San Jose and Oakland are the only markets nationwide that have yet to recover all the jobs lost during the pandemic downturn. These same markets that have seen the worst West region performances for employment in the past year.

Jobs growth and population growth typically go hand-in-hand. As such, Los Angeles saw the region’s worst population decline between 2022 and 2023, with the market losing 0.6% of its resident base. Anaheim, Oakland and San Diego also logged notable loss between 0.2% and 0.5%.