The near-term outlook for the student housing industry may be at an all-time high. This was the general sentiment captured from the April 2023 Interface Student Housing Conference in Austin, where more than 1,000 industry professionals gathered to discuss the state of the student housing industry.

Dozens of sessions and hundreds of side conversations held throughout the three day affair elicited plenty of interesting takeaways. Here are the seven that most caught my attention.

Expect Eventual Moderation from Today’s Double Digit Revenue Growth

Due to the strength of demand, rent growth and pre-lease occupancy have excelled to all-time highs. But sage wisdom reverberated throughout many sessions: The unprecedented run of revenue growth will eventually return to more normal levels.

Though the consensus among attendees was that performance will inevitably moderate below today’s record levels, there was some slight difference in suggested timelines. Some feel that next year will begin to show early signs of normalization while others feel Fall 2025 will be the turning point.

A New Supply Baseline is Being Reestablished

Few (if any) attendees anticipate that supply will return back to its peak 2010s level where north of 60,000 new beds were delivering. Though Fall 2021 and Fall 2022 may be the low point due to pandemic interruptions, a consortium of factors suggest that a new baseline for expected annual deliveries is now being established.

It's certainly not impossible to find viable development sites, but it’s more difficult to do so today than 10 years prior. Another headwind for new construction? Financing. Not only has the broader economic tide shifted with rising construction costs and challenging cost of debt structures, but ongoing distress within regional banks – entities that fund a larger-than-typical share of student construction relative to the conventional sector – further solidifies the expectation that a new normal annual delivery total probably more closely mirrors Fall 2023 than the previous 10 years.

Market (Really) Matters in Student Housing

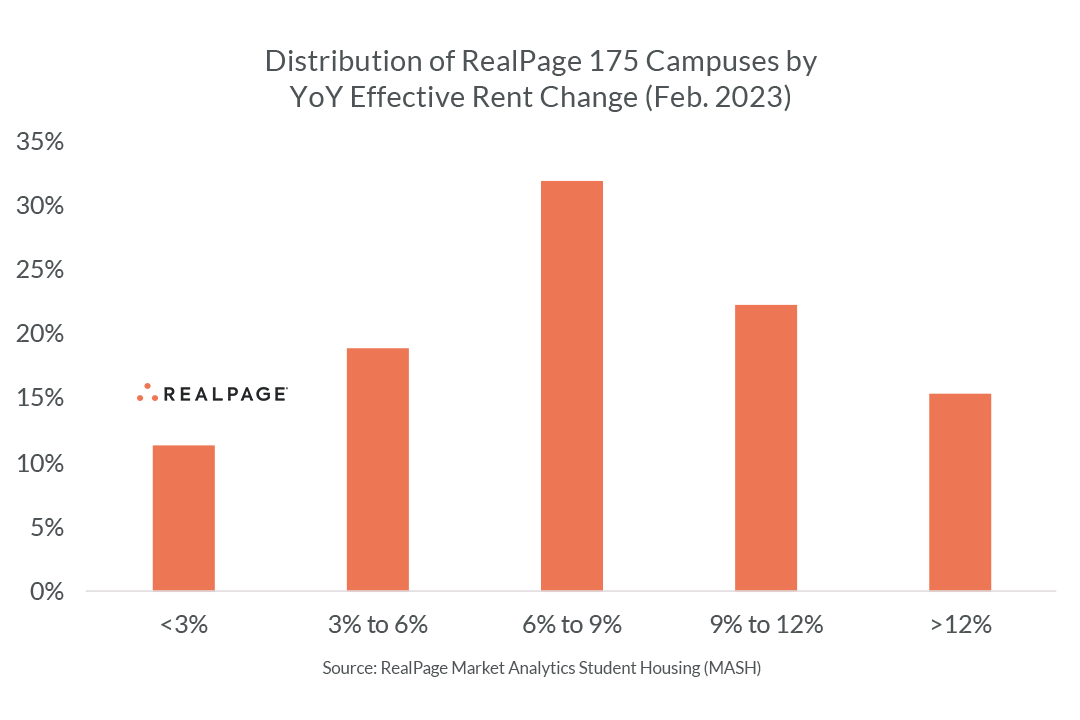

As the saying goes, a rising tide boosts all ships. Indeed, that’s true for the student housing industry. Just one in 10 RealPage 175 campuses is failing to match 3% annual rent growth today, an impressive feat considering that threshold was considered outperformance not too long ago.

Still, today’s strength shouldn’t hide how important university (and site) selection is. Though only a handful of campuses are truly underperforming, the gap between the highest and lowest performing campuses is massive. Further, as enrollment trends continue to consolidate (i.e. established state flagship campuses garner an ever-increasing share of enrollment while off-the-beaten-path campuses get left behind), the importance of selecting the right campus and approaching with an appropriately tailored operational strategy will become more important.

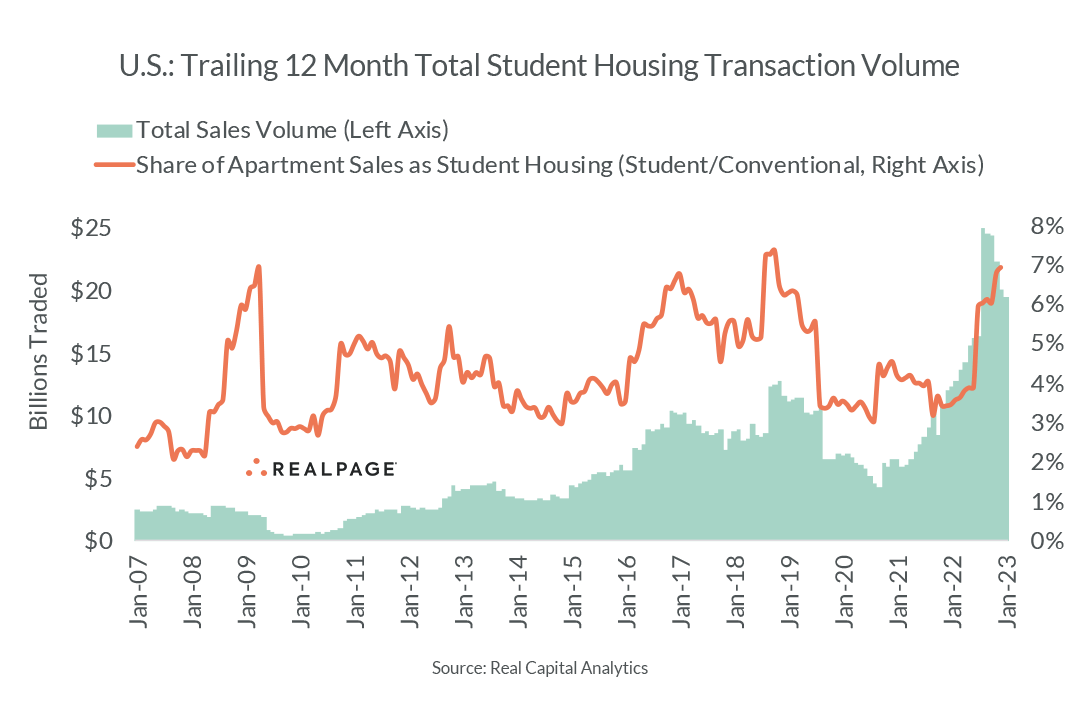

Industry Consolidation is Likely to Continue

Though newfangled interest in the space shows more eyes from other sectors are peering on the student housing industry, the industry’s continued consolidation doesn’t appear to be slowing down either. Student housing has always been a fairly consolidated sector. But rapid consolidation marked much of the late 2010s cycle and that has only continued into the start of the 2020s decade.

As shared by Cardinal Companies CEO Alex O’Brien on the always-popular Power Panel, things like centralization and broader technology adoption among operators is only going to further delineate the top performing companies from the the ones that need to reassess their operational approach (and, if not, likely exit the space which, in turn, will drive additional consolidation).

Recent NOI Growth – Driven by Revenue – is Helping Offset Adjustments to Property Valuations & Expense Growth

Recent adjustments to property valuations have been no secret. This has been true among conventional and student multifamily properties alike. The difference in performance between student and conventional lately, however, has been drastically different. Though the state of the conventional market shows performance is effectively rebalancing with long-term norms, the slowdown from peak 2021/early 2022 levels has been drastic.

Meanwhile, student housing revenue acceleration over the past 12 months has helped drive stronger NOI growth. In turn, the adjustments to property values are being offset to some degree within the student space. That’s less true in conventional multifamily for the time being, as revenue growth tapers off its record highs. Student revenue growth is also helping stave off the toughest of expense growth challenges.

The Transactions Market is Likely to Remain Frozen for (At Least) Another Few Months

The headwinds facing property trades are well documented. More specific to the student space, however, is a qualitative consideration. In short, with record revenue growth – not to mention the expectation for another solid few years of revenue growth waiting in the wings – many groups are finding little incentive to sell assets. Though specific circumstance may change that scenario, the general takeaway among most groups today is: “Why sell?” The economic backdrop and stubbornly disparate bid/ask spread have only compounded that sentiment.

Will the transactions market freeze eventually thaw? Most likely, yes. Much like conventional multifamily housing, the general sentiment among attendees was that the appetite for acquisitions is certainly there. And with a potential influx of capital coming in from outside of the industry (namely private equity and sovereign wealth funds), there could be even more interest in the coming few years.

Look to Conventional Multifamily as a Bellwether for the Mid-Term Student Housing Outlook

As mentioned earlier, the student space continues to accelerate while the conventional space moderates. But real estate has always been cyclical, and conventional housing’s trajectory over the past six to 12 months could serve as a future signal for student housing performance.

But it’s not just performance. Things like centralization and more data-driven, fine-tuned technological solutions are being widely adopted among conventional operators. The trend for student housing adoption is likely to increase in the coming years as well.

And – much like we are seeing within conventional housing – the focus for the coming few months is to focus inwards, not outwards. In other words, shoring up operational strategy and assessing things like expense management is the focus today. Growing portfolios through acquisitions and reassessing growth strategy will come at a later time when the broader health of the economy comes into better focus.