The Nation’s Strongest Student Housing Regions

The prevailing student housing development and investment thesis in recent years has been that of targeting large, state flagship or land-grant universities in the Sun Belt region. The driving force behind that thesis is simple. That is, states with the fastest growing populations will see stronger enrollment growth.

Extending that assumption further, if enrollment growth is strong, then demand for purpose-built off campus student housing will be more robust among these universities. The same line of thinking applies to those larger, land-grand universities (often referred to as Tier 1 or Power 5 institutions) versus peer campus types (such as Tier 2 or Group of 5 institutions).

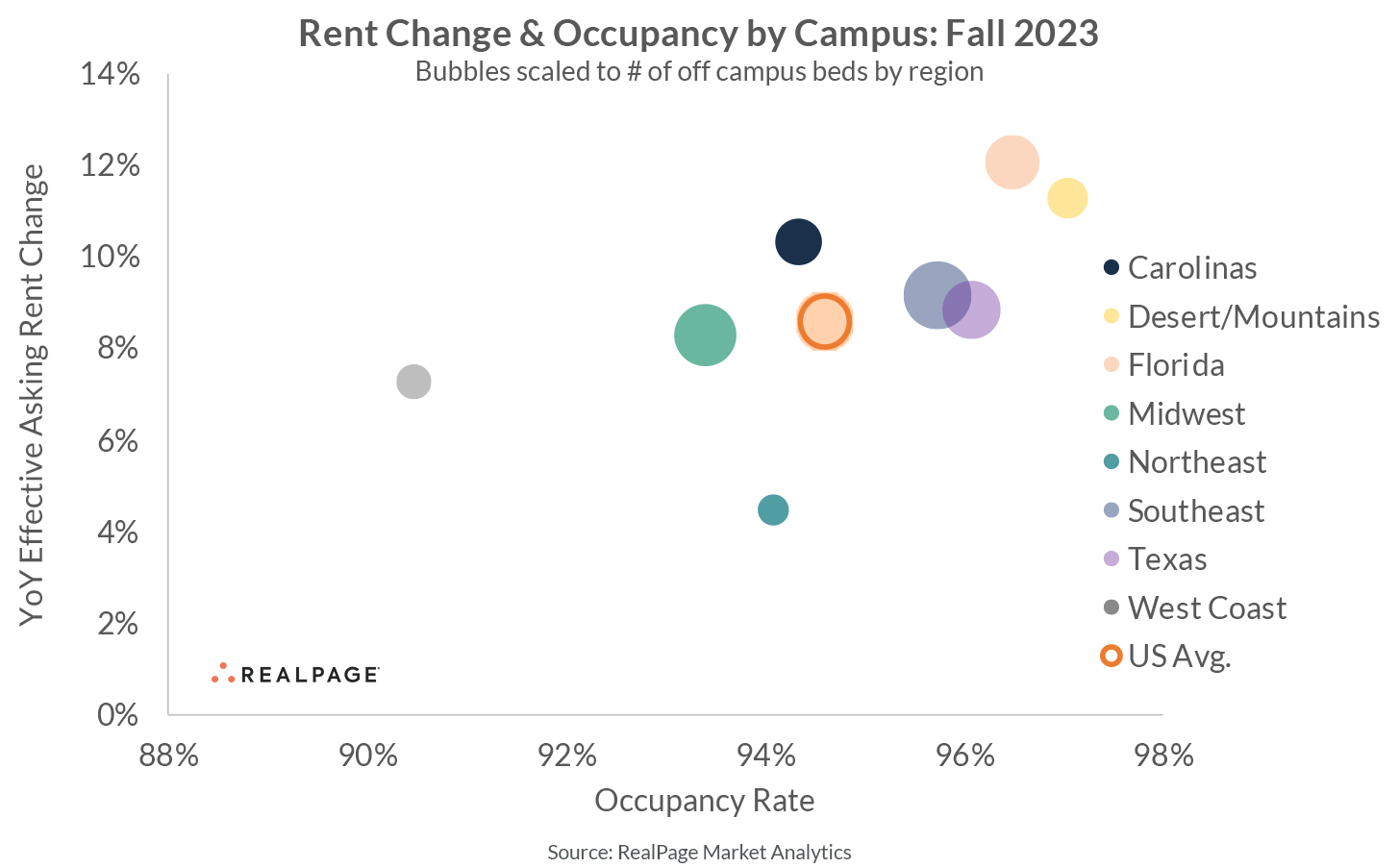

As the nation’s student housing performance remained red-hot in the Fall 2023 leasing season, many schools saw performance trend well ahead of previous decade norms. As the saying goes, a rising tide lifts all boats. Still, even a regional snapshot shows some support for the idea of getting investment and development dollars out in front faster-growing parts of the country.

When considering the weighted average of Fall 2023 rent growth charted by occupancy, high population growth states and regions recorded the strongest student housing performance, according to data from RealPage Market Analytics.

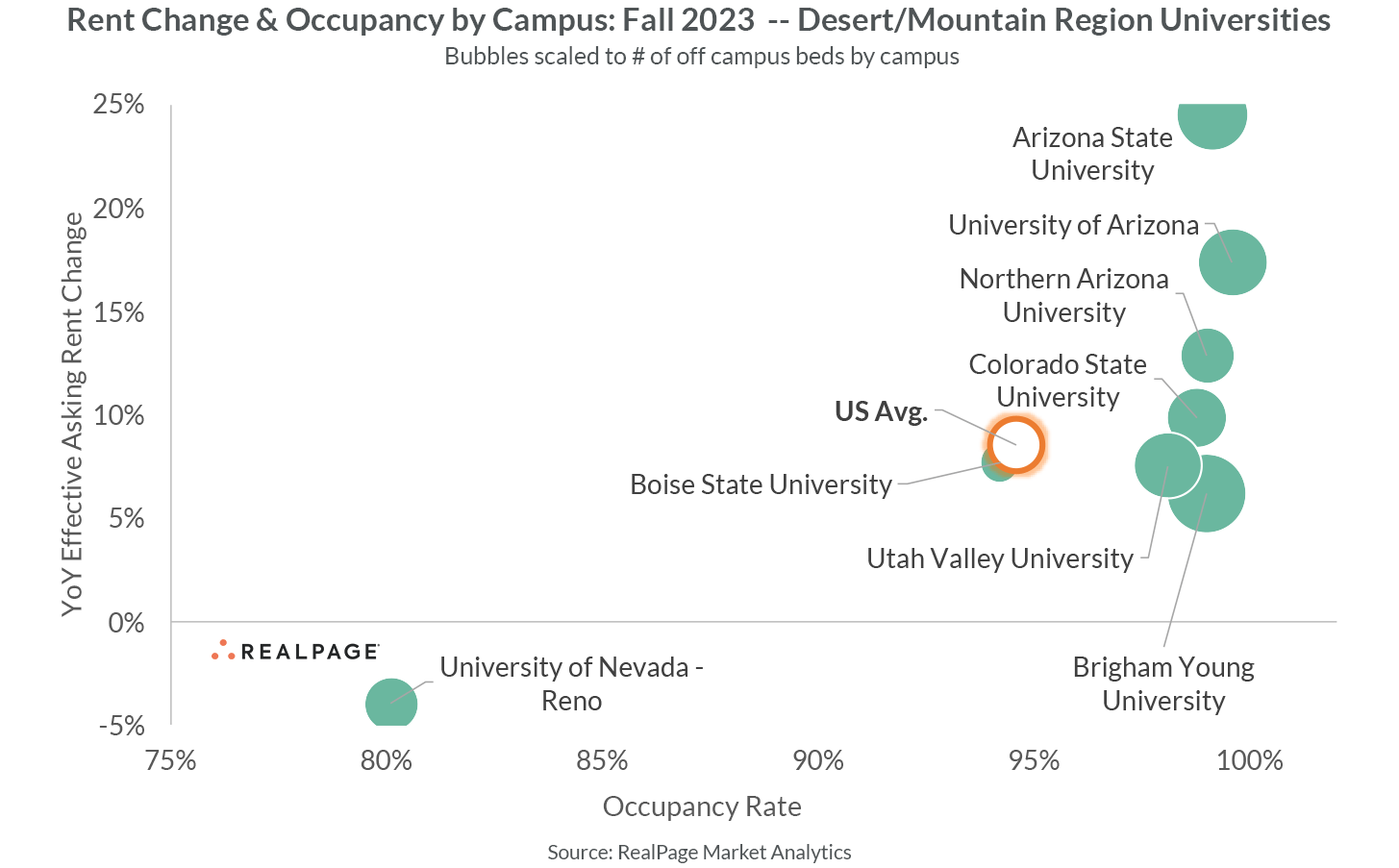

Desert/Mountains Region

The Desert/Mountains region – home to fast-growth states such as Arizona, Utah and even Idaho – led the country with occupancy approaching 99% while rent growth averaged nearly 13%.

Though Arizona State’s incredible Fall 2023 boosts the regional norm (ASU achieved 24.5% rent growth while occupancy clocked in at 99.1% across its 11,100-plus existing beds), there weren’t any discernable pockets of weakness in the region either. Boise State University and its base of roughly 3,300 existing off-campus beds ever so slightly trailed the national norm. Only the University of Nevada, Reno saw performance significantly trail the national average in Fall 2023.

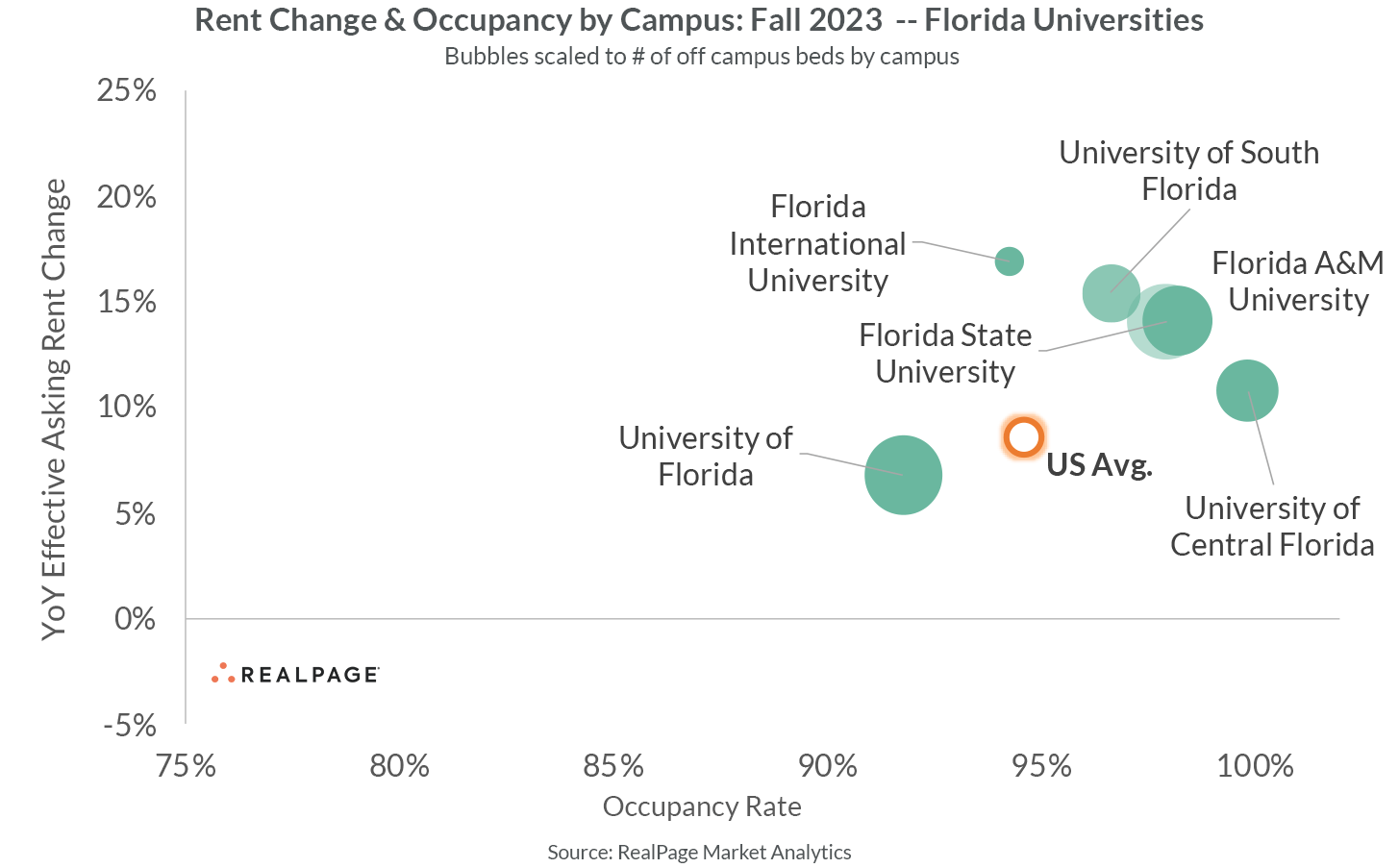

Florida Region

The second-strongest weighted region – Florida – saw performance outpace the national average, despite its largest university (based on existing beds) fail to match the national average.

The University of Florida and its incredible 29,500-plus existing beds failed to reach 92% occupancy, while rent growth of approximately 7% also trailed the nation. Insatiable construction volumes have seemingly watered down performance there, despite strong demand.

Still, strong performance across the state of Florida is a good reflection of robust population growth in recent years.

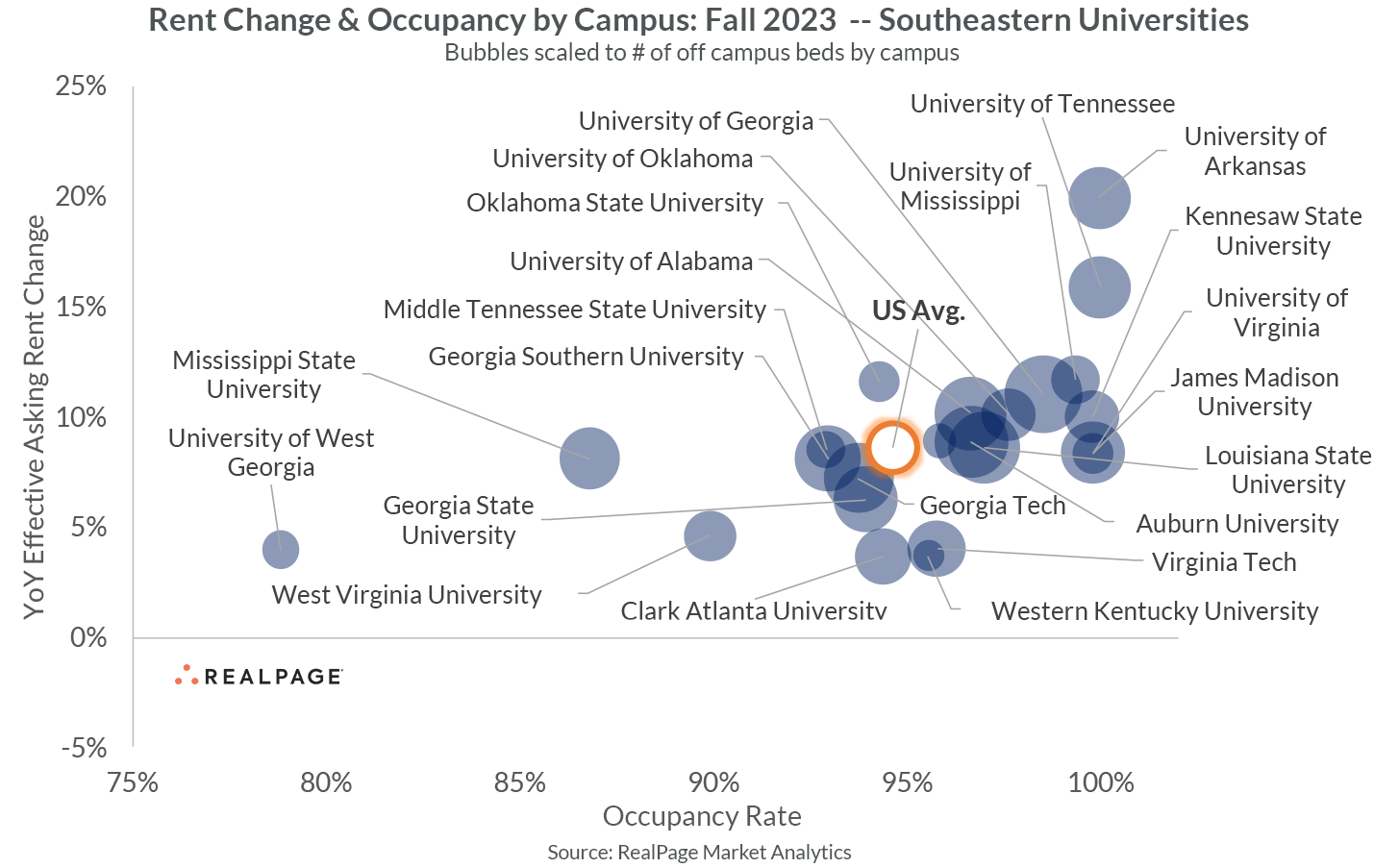

Southeast Region

Though the southeast region could arguably include Florida, the Sunshine State was excluded from the southeastern region set of campuses. Nevertheless, strong demand supported regional occupancy of about 96% while rents grew approximately 9% during the Fall 2023 leasing season.

Unlike the Desert/Mountains and Florida regions, a noticeable spread in campus-level performance skews regional readings here. Places like the University of Arkansas and the University of Tennessee saw some of the nation’s strongest revenue growth. Conversely, the University of West Georgia, Mississippi State University and West Virginia University all recorded relatively weak readings below the national norm.

The general takeaway here once more matches the broader idea of fast-growth areas versus slower-growth areas. Places Tennessee and Arkansas (at least its northwestern portion which is home to the state’s largest university) have seen considerable population growth in recent years. Meanwhile West Virgnia, Mississippi and Kentucky have recorded less noteworthy population growth, if not altogether uninspiring.

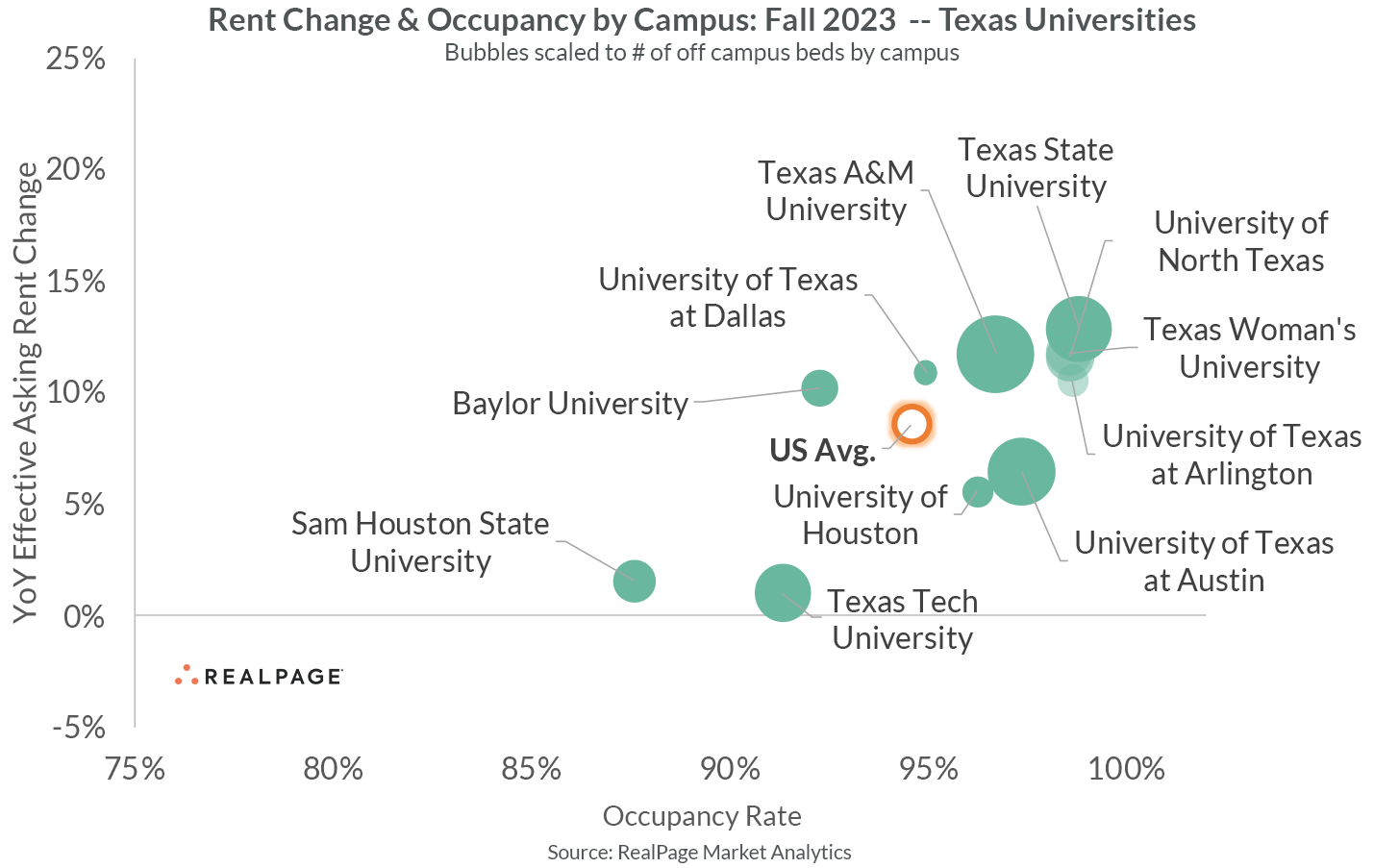

Texas Region

With the Lone Star state’s immense population growth, it’s unsurprising to see it outperform the national average as well. Still, some more outliers remain, such as Texas Tech University in Lubbock and Sam Houston State University in Huntsville where local populations haven’t swelled as notably.

One clear exception to this thesis is the University of Texas at Austin. Though UT Austin is a prime example of a Tier 1, state flagship university in the heart of one of the nation’s fastest growing markets, UT Austin is also in the throes of a multi-year supply siege. As such, even strong demand has struggled to keep local performance in line with the national average.

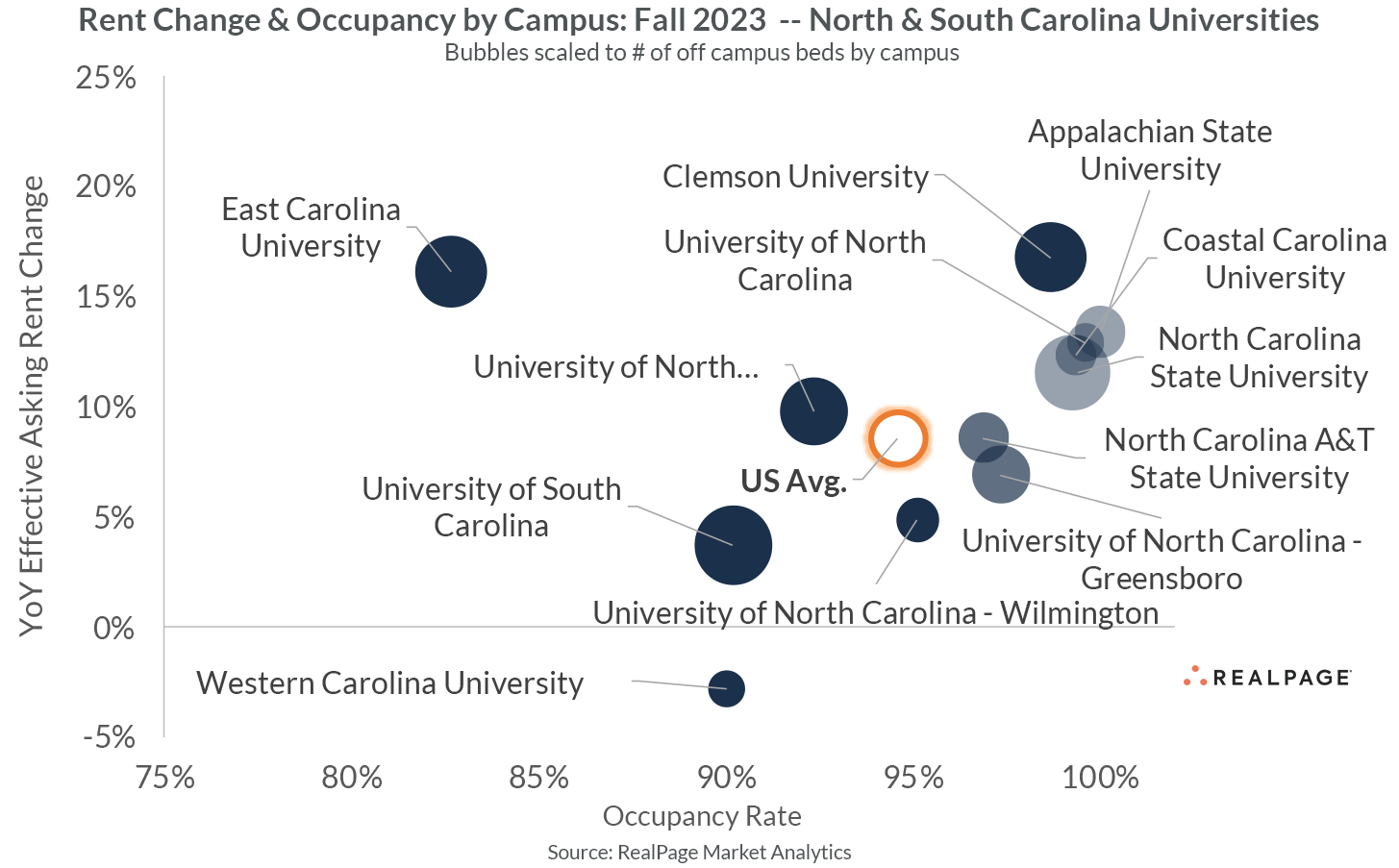

Carolinas Region

The Carolinas region has seen a trio of schools – Clemson University, Appalachian State and UNC Chapel Hill – consistently outperform the U.S. overall in rent growth and occupancy. Though construction is a bit more constrained at those latter two than Clemson University, all three have seen strong demand in the past few years.

The Carolinas region has seen a trio of schools – Clemson University, Appalachian State and UNC Chapel Hill – consistently outperform the U.S. overall in rent growth and occupancy. Though construction is a bit more constrained at those latter two than Clemson University, all three have seen strong demand in the past few years.

On the inverse, either demand (Western Carolina University in Cullowhee) or supply headwinds (University of South Carolina in Columbia) have resulted in choppy performance at select campuses. Still, the long-term growth prospects of the Carolinas is among the nation’s most favorable.

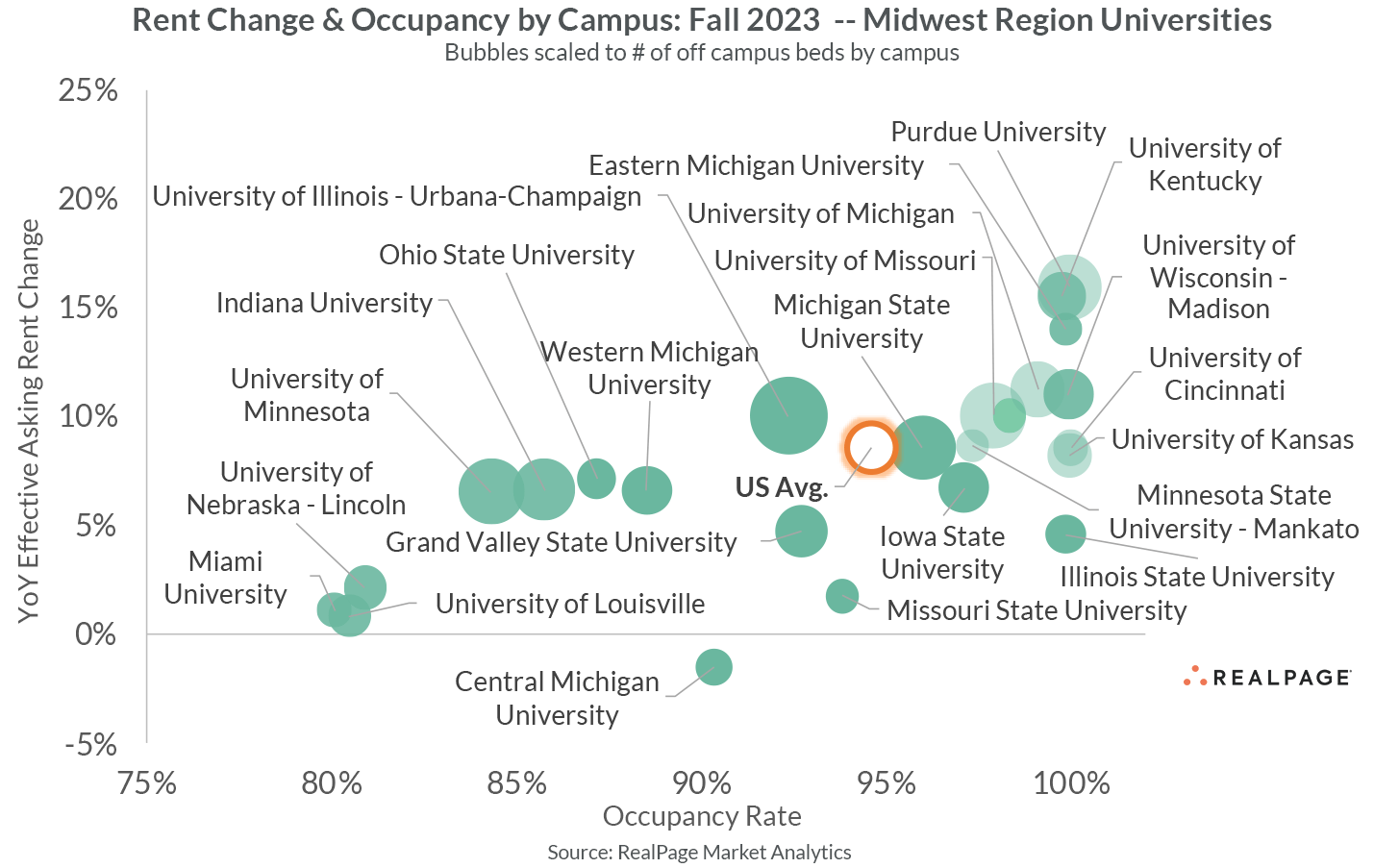

Midwest Region

The Midwest region is perhaps the most wide-ranging for individual campus performance. Rent growth failed to reach 2.5% in 11 campuses nationwide included in this analysis, including five in the Midwest. Most of these campuses are in slower population growth markets or challenged enrollment campuses.

By comparison, demand has been good-to-great at campuses such as Purdue University, the University of Kentucky, the University of Wisconsin-Madison and the University of Michigan. Individual campuses such as the University of Missouri, the University of Kansas and the University of Cincinnati have had volatile performance in recent years as well.

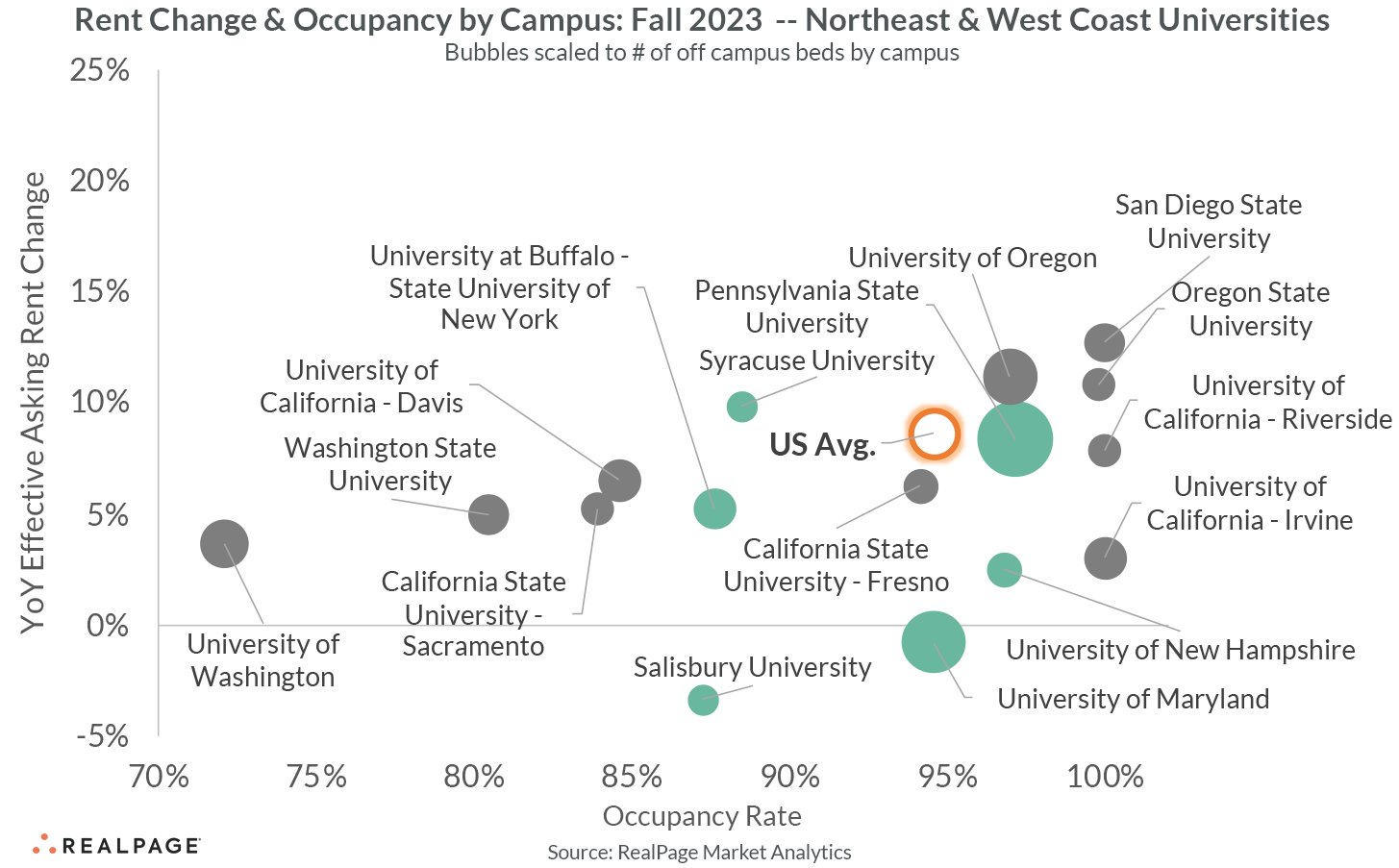

Northeast & West Coast Region

The final regional snapshot spans across the nation’s west coast and the northern port of the east coast into the Northeast. Though examples of outperformance can be found (San Diego State University, University of Oregon and Oregon State University), the general trend here is weaker demand.