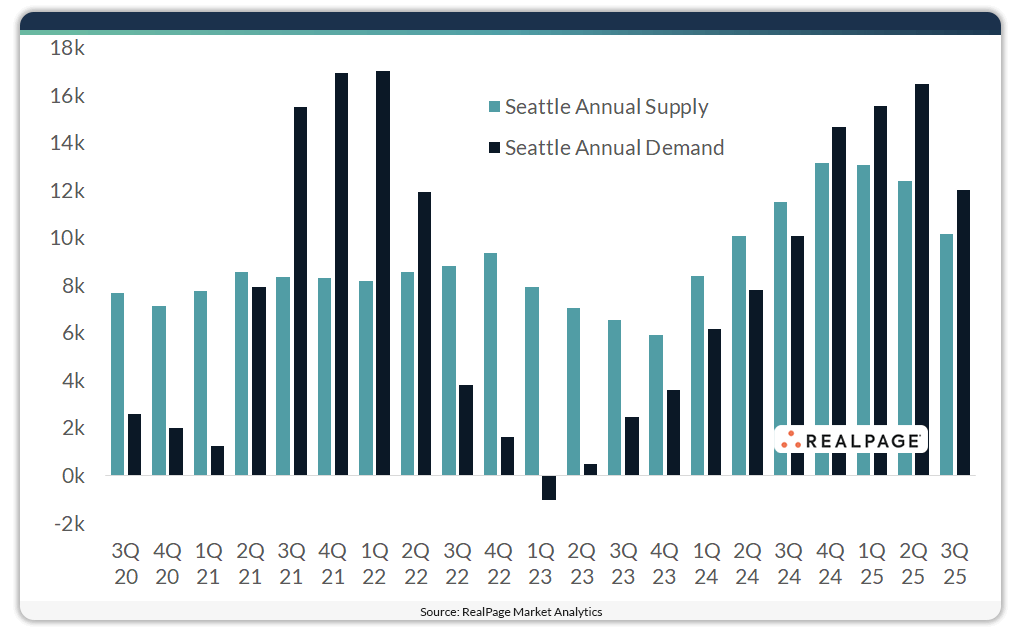

Annual demand surpassed completions in the Seattle apartment market for the fourth consecutive quarter, marking a reversal in trend from a year ago. Roughly 12,030 units were absorbed in the year-ending 3rd quarter 2025, while 10,177 units completed in the market, according to data from RealPage Market Analytics. Annual supply was down from roughly 11,500 units just a year ago as the supply wave in Seattle, like much of the country, crests. With demand overtaking supply, occupancy tightened 70 basis points (bps) year-over-year to 95.5%, about 30 bps above the five-year norm. With limited vacancies, rent performance moderated despite demand topping supply. Effective asking rents in Seattle ticked up a modest 1% year-over-year in 2025’s 3rd quarter, with performance impacted by cuts in the last three months of 2024. That small annual increase topped the U.S. norm but fell below the 2.9% average in Seattle over the last five years. Growth across Class A product where rents rose 3.7% over the last year, spurred performance. As supply slows and demand accelerates, rent growth is expected to trend above the national average in the near-term outlook. Meanwhile, job growth in Seattle continues to slow from the pre-pandemic era when employers added roughly 44,000 jobs per year from 2015 to 2019. RealPage forecasts employers will add just under 9,500 jobs over the next 12 months, expanding the job base less than 1%, a potential headwind that could impact housing demand.