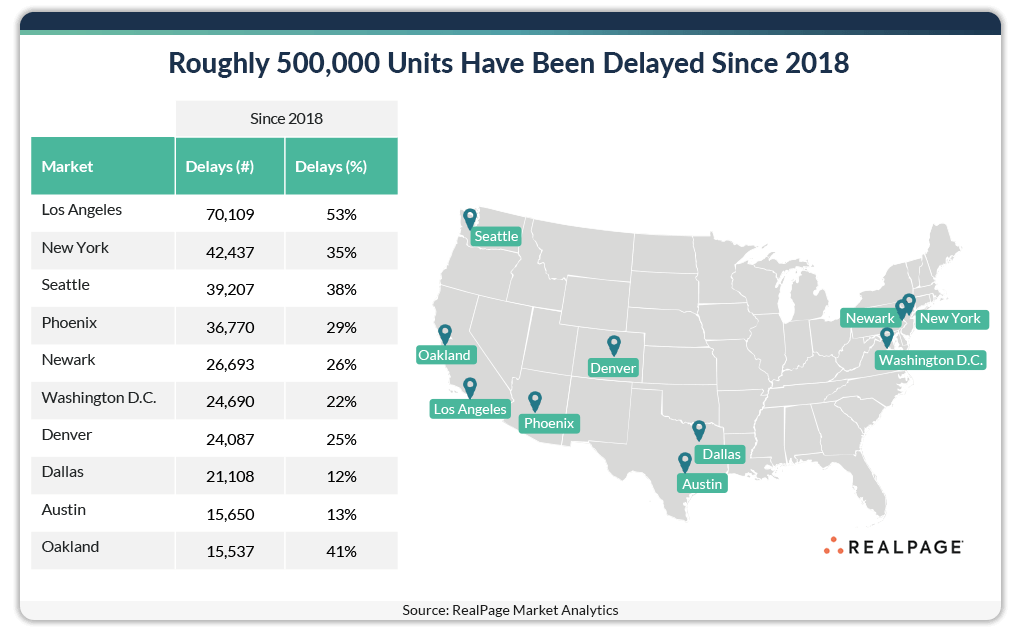

More than 500,000 U.S. Apartments Have Been Delayed Since 2018

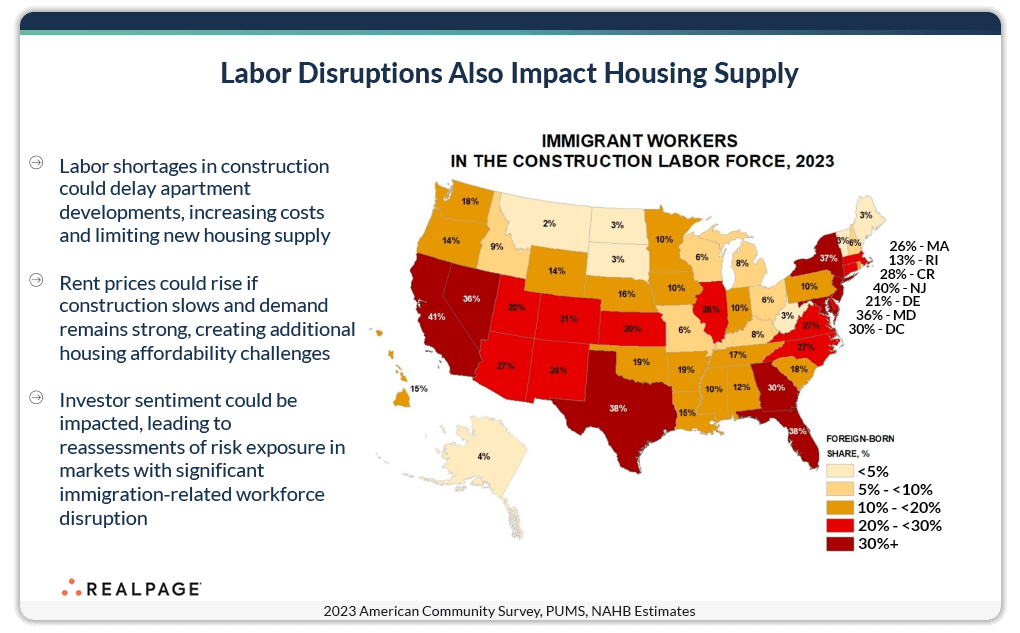

Labor disruptions have recently emerged as a significant concern among apartment developers. That new threat adds to the concerns of tariff implementation, surging insurance premiums and rising construction costs.

Roughly 500,000 units have been delayed across major apartment markets since 2018, according to data from RealPage Market Analytics. Los Angeles saw the most delays, with over 70,000 units disrupted during construction. That amounts to more than half of the market’s expected deliveries. Delays were also significant – at over 30,000 units – in the high-supply markets of New York, Seattle and Phoenix.

While the impact of tariffs can be seen on construction activity across the U.S., contributing to the increase in the cost of building materials, there are also more nuanced concerns contributing to these delays. Among developers, concerns also include operating expenses and, more recently, labor disruptions.

Apartment construction heavily relies on immigrant workers, with dramatic regional variations that could lead to workforce vulnerabilities in some areas, according to the American Community Survey and estimates from the National Association of Home Builders.

In Texas, Florida and New York, immigrants make up 37% to 38% of the construction workforce. In California, just under half (41%) the construction workforce is reported to be immigrant workers.

With construction activity already slowing, this disruption in the labor market threatens to further delay the apartment development pipeline, which could drive up costs and limit new housing supply.

For more information on the state of apartment market expenses across the U.S., watch the webcast Market Intelligence: Beyond Tariffs: Navigating Operational Expense.