Census is Likely Overstating Multifamily Starts in 2023

Newly released data from the U.S. Census Bureau shows multifamily construction starts are down only 12% year-to-date in 2023 compared to the same period in 2022. That is highly unlikely, and I’ll share a few reasons why the evidence points to a far more severe drop of 40%+.

1. Other Data Sources Show Deeper Drops

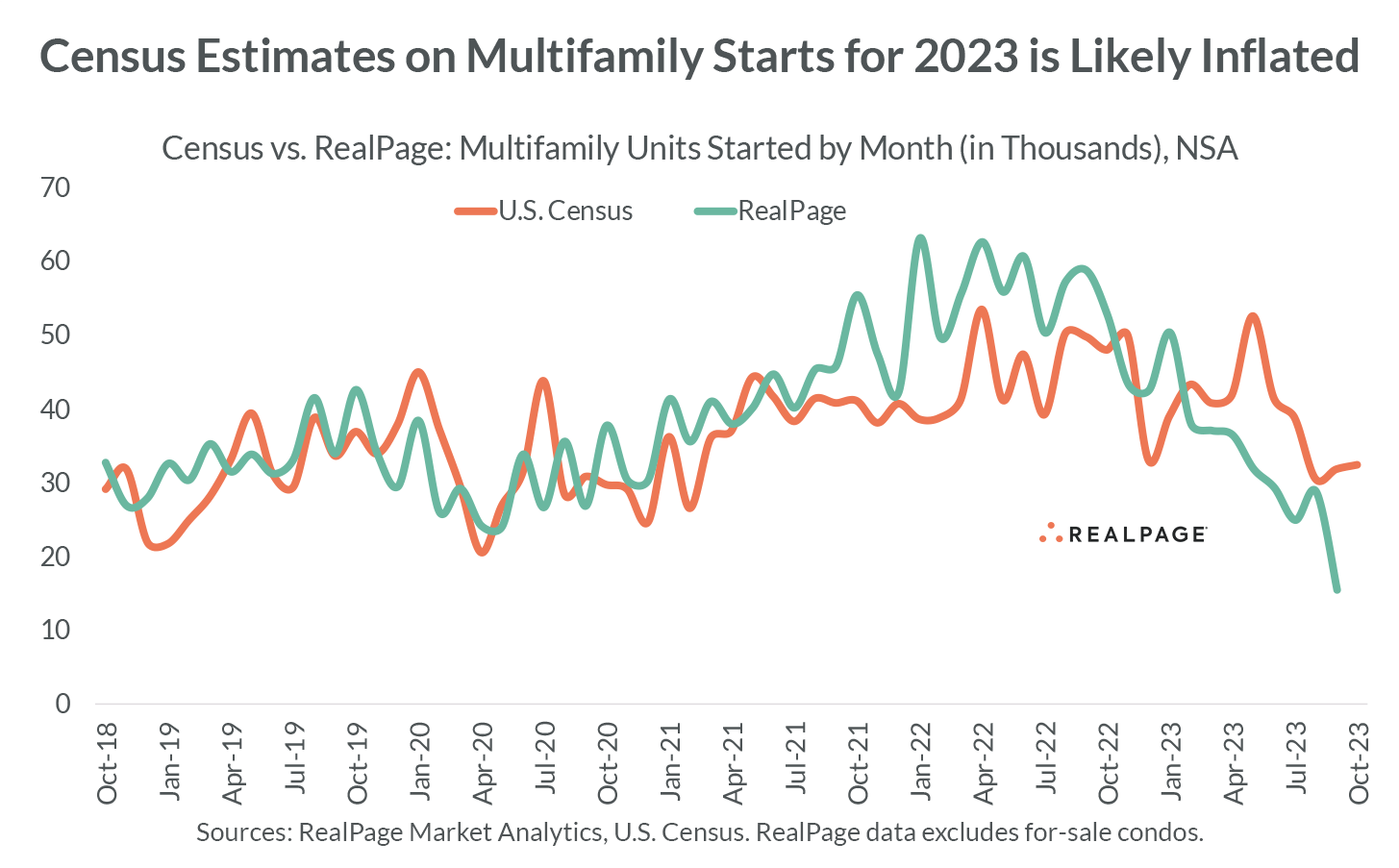

Private sector data providers including RealPage and others have reported sharp drops. These sources track individual products from planned to completion, whereas the Census surveys only a small sample of permit-holders to ask if they’ve started.

Small sample surveys can smooth out inflection points, and that appears to be what happened. Comparing Census data to RealPage data, it appears the Census understated multifamily starts in 2022 and overstated them in 2023.

2. Architects Report “Extremely Weak” Demand for New Work

The American Institute of Architects has reported 15 consecutive months of declined billings for multifamily – meaning they’re designing far fewer apartment projects since rates started climbing. Their most recent report noted that “business conditions remained extremely weak at firms with a multifamily residential specialization.”

3. Developers Struggling to Find Construction Financing

The National Multifamily Housing Council does its own survey of apartment developers and builders. The surveys this year consistently show around 90% reporting delayed projects in 2023. The most common reason cited for delays are tied to availability of construction financing. Unlike other factors for delays (i.e. supply chain or labor shortage), financing delays can be indefinite delays.

Lots of projects just don’t pencil out when rents are falling, costs are elevated, debt is high (assuming your bank is willing to lend), and loan-to-cost ratios have dropped from around 65% to 50-55%. Banks are also often only lending when they can recycle capital with preferred sponsors who maintain broader relationships with the bank.

4. Banks are Tightening Loan Standards

In line with the NMHC surveys, the Federal Reserve’s Senior Loan Officer Survey shows that the vast majority of lenders have consistently tightened lending standards for new construction.

Unlike for stabilized deals, banks are the primary provider for multifamily construction debt, and they are getting pressured by regulators to preserve cash and limit commercial real estate lending – even though delinquency rates remain low.

5. Equity Investors are Looking Elsewhere

Lower loan-to-cost ratios mean developers need more equity, but developers will tell you that’s no longer readily available. Falling asset values mean investors can potentially buy new-ish assets for cheaper than they can build them. Groups with dry powder are waiting out lease-up distress rather than investing in ground-up development. Only certain types of deals are finding willing partners.

What Does it All Mean for the Multifamily Outlook?

Construction today is still elevated but only because of 2021-2022 starts. Construction volumes from this period could very likely go down as a generational high akin to the 1970s, resulting from a perfect storm of ultra-high demand and rent growth plus an environment of cheap debt and low cap rates that incentivized ground-up development.

But today, more projects are completing than starting. Peak deliveries hit now through 2024.

After 2024, we should see a massive plot shift, as the multifamily market goes from supply>demand in 2023-2024 to (assuming a decent economy) demand>supply in 2025-2026 and possibly into 2027. In turn, that could lead to falling vacancy and rebounding rents.

It’s difficult to see a scenario where starts can meaningfully re-accelerate prior to 2026, which means we should see a few years of lower supply. Developers need to see some combination of lowering rates, steadying/rising rents, falling construction costs, stabilizing asset values, and reinvigorating banks.

To that point, an October survey from John Burns Research & Consulting showed apartment developers are expecting the number of multifamily starts to continue dropping over the next 12 months.

And for policymakers, declining starts should be a worrisome signal. We’re being reminded here in 2023 that high supply is the one and only proven remedy for rental affordability concerns, yet the pendulum could be swinging back a couple years from now.