Which Markets Could be Most – and Least – Impacted by Apartment Construction?

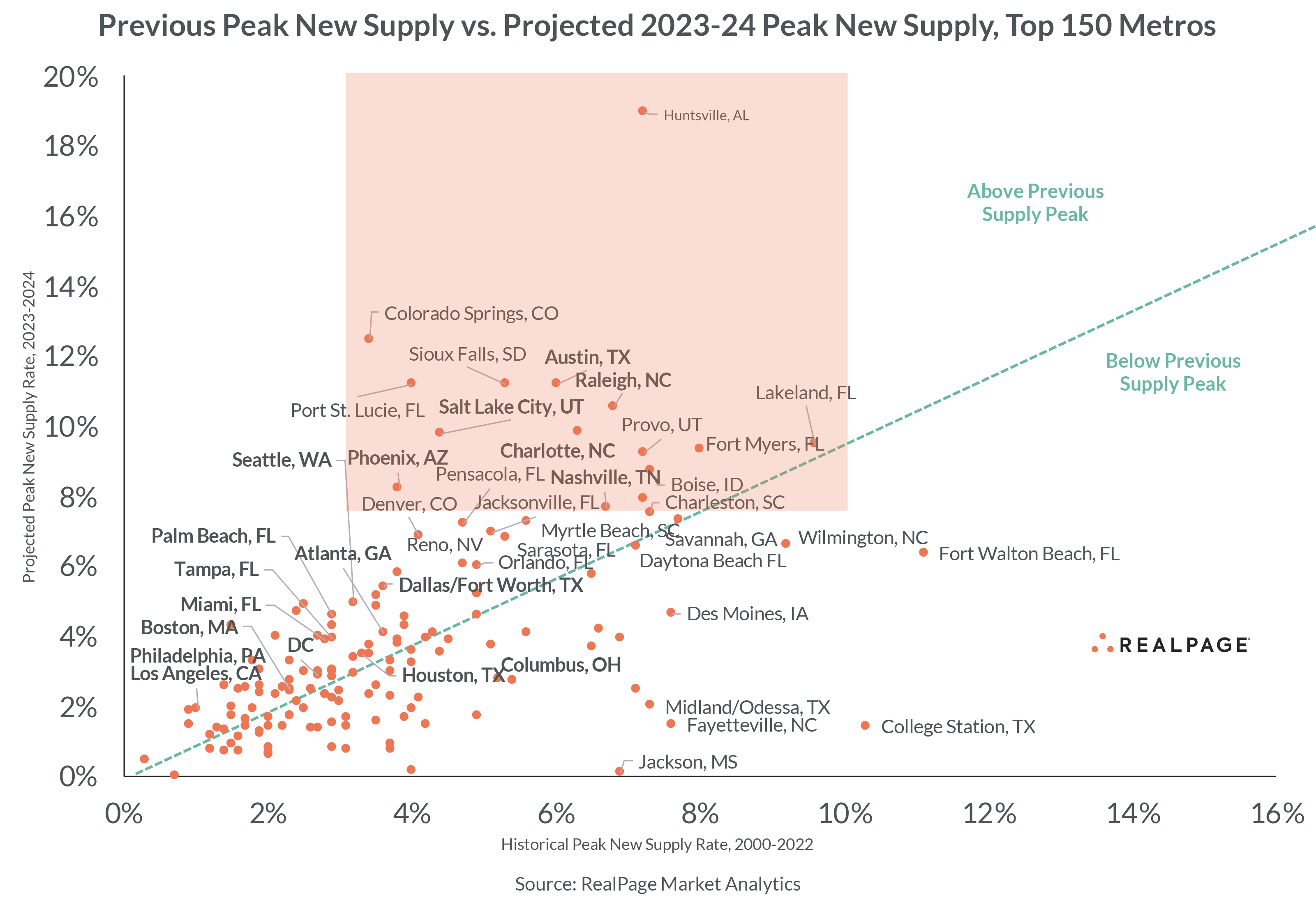

Here's another way to look at the big wave of apartment construction: How does each market's supply peak in this cycle compare to its previous peaks over the last 20+ years? Any market on the left of the green dotted line of this chart below will set a new peak for new supply.

The previous peak is a useful benchmark because it provides context to a market’s past absorption capacity. Comparing markets based only on current supply levels doesn’t account for each market’s historical ability to absorb supply. This approach isn’t flawless, but it’s a helpful framework.

Let’s group the markets into five categories, with some commentary on what impact supply might have in each one.

Tier 1: Big Supply

These are markets adding a ton of supply and mostly places blistering past their previous peaks: Austin, Raleigh, Salt Lake City, Nashville, Charlotte, Phoenix – and Denver and Jacksonville are pretty close too. These are markets that historically have had little trouble absorbing big supply and will likely continue to see massive demand yet will likely get challenged in the short term. They'll lease up, but slower than most developers want to see.

Among smaller markets? Look at Huntsville. Wow. We had to adjust the Y axis just to fit it into the chart. Other boomtowns include Colorado Springs, Sioux Falls, Port St. Lucie, Lakeland, Fort Myers, Provo, Boise, Asheville, Charleston, Savannah, Myrtle Beach and Pensacola. These are all great spots long term, but short term could get tough for operators and developers.

Deal-seeking, middle- and upper-income renters will have a lot of options in this group of markets. As we’ve previously shared, there’s a direct relationship between supply levels and rent movements. Rents are already falling across all asset classes in the highest-supplied areas, and probably will continue to decline in 2024.

Tier 2: Lots of Supply, But Not Crazy

They're new peaks, but a big notch below the first tier – and mostly very large metro areas with growing, well-diversified economies. Supply will have an impact, but these markets probably won't be the bottom-tier performers. This includes Dallas/Fort Worth, Seattle, Atlanta, Tampa, Miami and Orlando.

This is a good reminder that not every Sun Belt market is building like Austin or Phoenix.

Tier 3: More Than Advertised

We hear about some of these markets as high barrier to entry, and it’s implied these places aren't building many apartments. BUT it's actually a pretty significant volume – especially by local historical standards, even if not among the national leaders, so developers are testing the depth of short-term pent-up demand.

This includes Philadelphia, San Jose, Washington, DC, Northern New Jersey (Newark), Long Island, Boston, Sacramento, San Diego, Los Angeles, Oakland and Minneapolis. In these spots, there are a handful of high-supply submarkets that will be tested.

Tier 4: Less Than Advertised

This is where developers aren't building as many apartments as you might think. The biggest surprise might be Houston. Supply expansion there in this cycle will peak at 3.5%, just a slight tick above its previous peak and below D/FW (5.4%), San Antonio (5.8%) and Austin (11.2%). Yet demand there has been great of late.

Also deserving of this group are Chicago, Indianapolis, Columbus, Las Vegas, Kansas City, Portland, Riverside, Anaheim and Greensboro. In most of these spots, supply peaks are fairly manageable and below (or around) previous peaks. These markets are not totally immune to supply impact (and indeed, they're feeling it already) but could emerge as outperformers in an otherwise down year.

Tier 5: The Minimal Supply Markets

Supply is pretty much everywhere, but there are a small number of exceptions. Some of them are also low-demand markets, so that minimizes the upside. That includes New Orleans, San Francisco and Cleveland.

What about New York City? Well, as usual, the nation's biggest market deserves its own category. Its 1.4% peak expansion rate is among the nation's lowest, but it's a slight tick (10 bps) above its post-2000 peak.