What We Got Right – and Wrong – About the U.S. Economy So Far in 2025

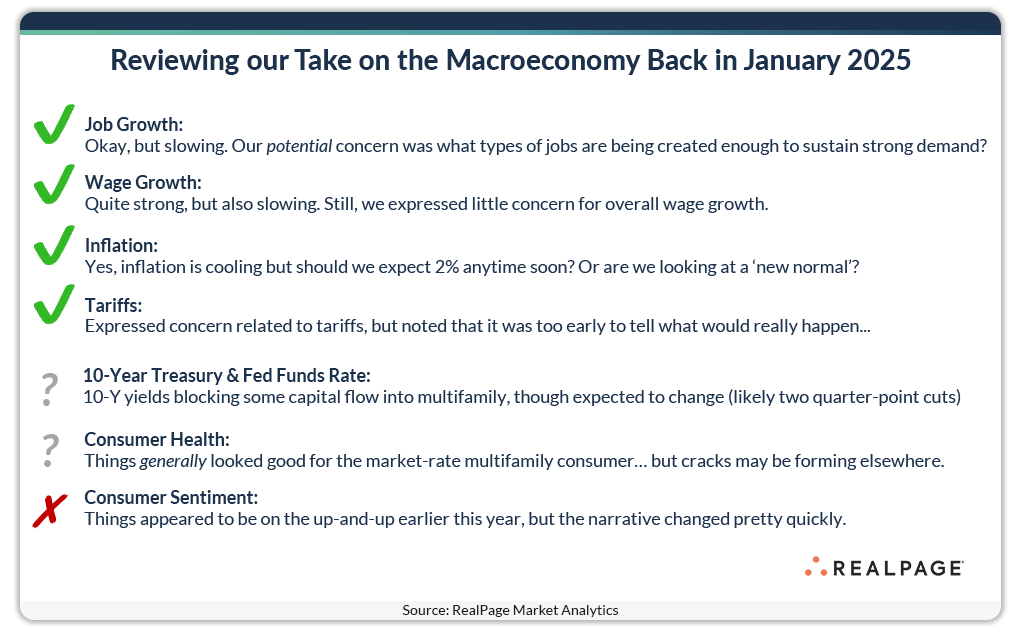

Back in January, RealPage economists made predictions about the economic landscape of 2025 and its effects on the apartment market. Let’s take a look at how those forecasts have panned out so far in 2025.

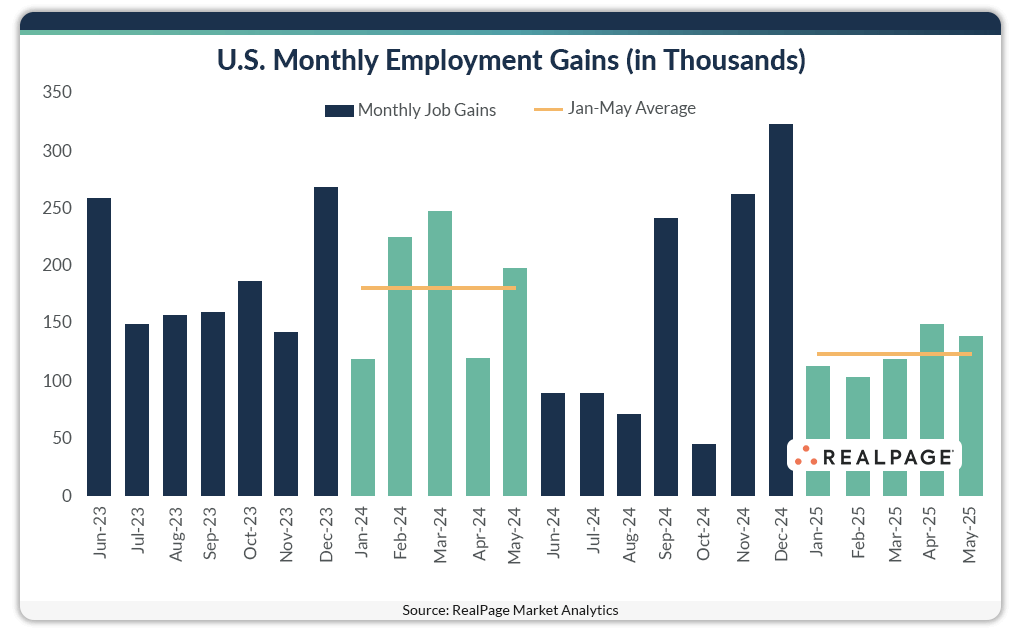

Job Growth

As a driver of apartment demand, moderating job growth was a concern going into 2025. In the first five months of the year, job growth definitely slowed, though jobs are still being added at a relatively steady pace. Sectors losing the most jobs as of May were Manufacturing and Other Services, while Education/Health Services added the most employees to the workforce.

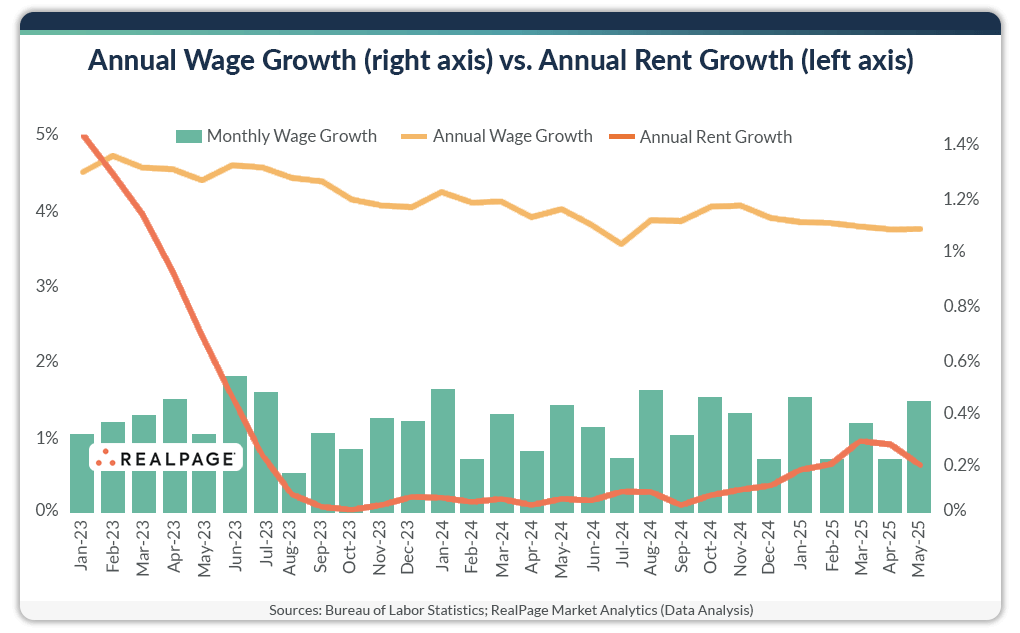

Wage Growth

Job growth tends to translate into wage growth. In the year-ending May, average hourly earnings were up about 3.9%, according to the Bureau of Labor Statistics. Most of those gains were seen in January and May, when paychecks bumped up around 42 basis points (bps) each. That performance tracks with what our economists predicted in January, as there was no real reason to think wages wouldn’t keep rising this year.

Inflation

Inflation was on the rise back in January, climbing for four straight months. At the same time, the Federal Reserve had just cut the funds rate by 25 bps, which added to the uncertainty about where things were headed. Still, our economists predicted lower inflation ahead, and that’s exactly what happened. Consumer prices were up 2.4% in the year-ending May, holding pretty steadily from April figures.

But inflation could go back up soon, and one wild card that could push that number is tariffs. Tariffs were a big topic of discussion back in January, and exactly how those tariffs will impact the multifamily industry remains to be seen.

Rate Cuts

We suggested the Fed could cut rates twice in 2025, which was the consensus from most economists at the time. While we haven’t seen much movement in the first five months of the year, we could potentially see some cuts before the end of 2025.

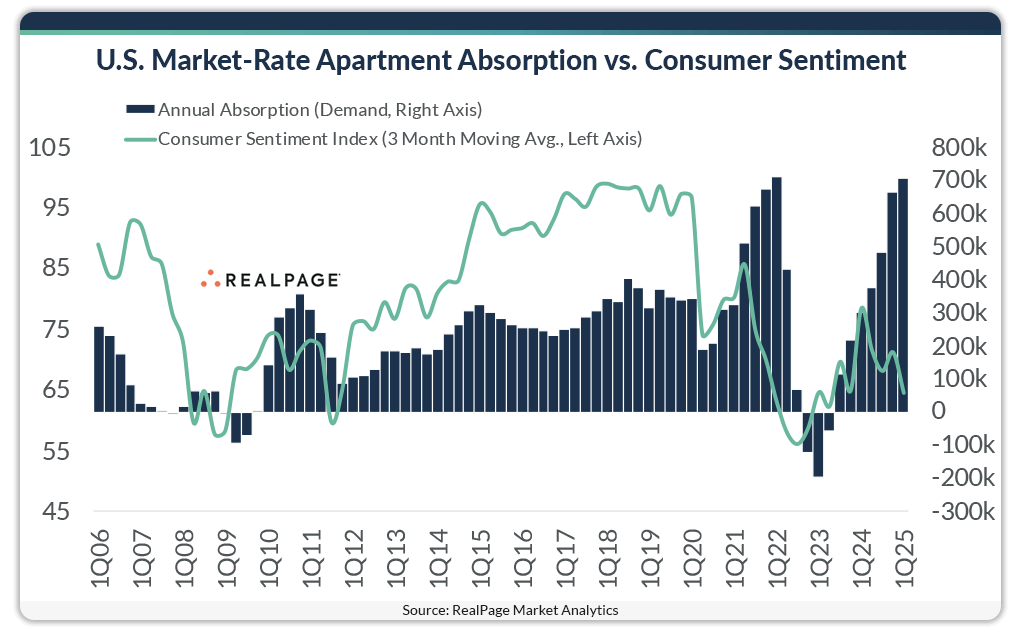

Consumer Sentiment

The consumer health for the market-rate multifamily renter was in good shape back in January. That’s still true, as evidenced by rent-to-income ratios. However, there has been a recent tick up in debt delinquency, most notably from the return of student loan repayments. This could be a key factor to watch through the end of the year.

The one place our aim really missed was in consumer sentiment. The year started with strong and improving consumer sentiment in January. But the tariff-related volatility in the stock market weakened consumer expectations by the end of 2025’s 1st quarter. In good news, apartment demand has not yet felt the impact of declining sentiment, but this could be a warning that some softening is coming later this year.

For more information on the state of the U.S. economy, including more forecasts, watch the webcast Market Intelligence: Q2 Macroeconomic Update.