Annualized starts for single-family and multifamily units were both up for the month and year but are trending differently.

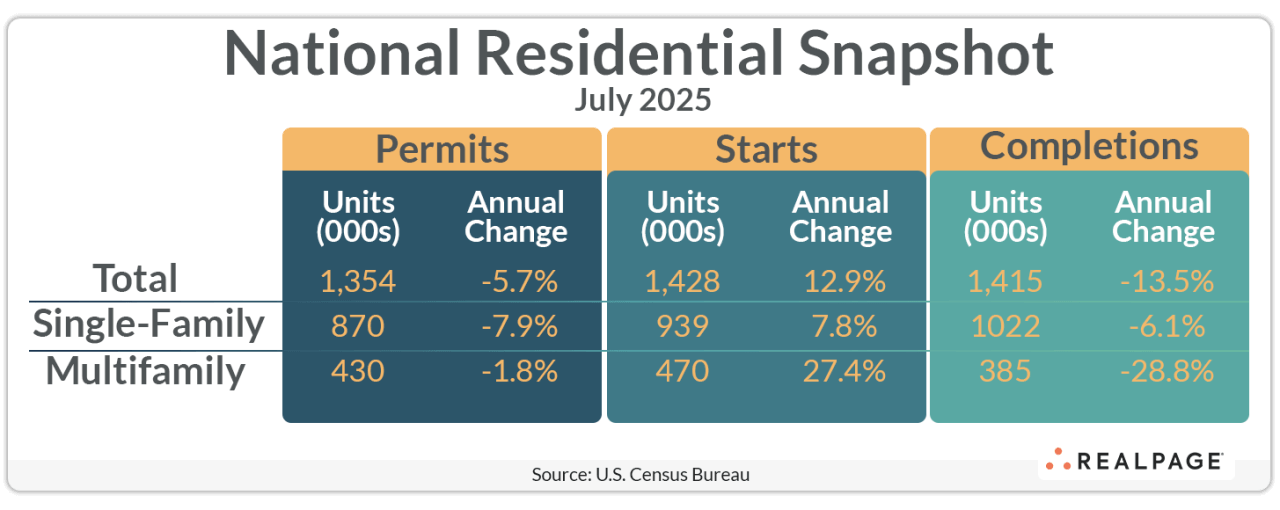

The seasonally adjusted annual rate (SAAR) for multifamily starts increased 11.6% between June and July to 470,000 units, up 27.4% from last July’s unusually low SAAR. Meanwhile, the annual rate for single-family starts increased 2.8% for the month and 7.8% for the year to 939,000 units.

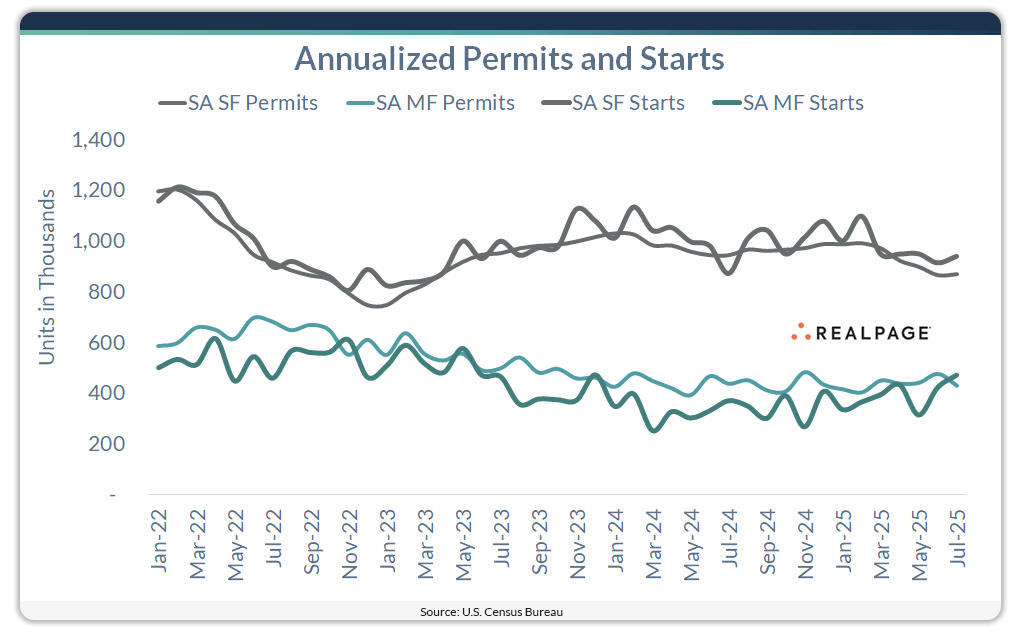

However, the annual rate for single-family starts has averaged about 940,000 units for the past five months compared to an average of about one million homes from January 2024 to February 2025. During those same 14 months, annualized multifamily starts averaged 338,000 units versus an average of more than 400,000 units for the past five months. July’s SAAR of 470,000 units is the highest since December 2023.

While multifamily starts appear to be trending up, the forward looking building permit data shows a flatter trend with July’s SAAR down 9.9% from June to 430,000 units, and a mild decrease of 1.8% from last year. July’s jump in multifamily starts reflects June’s permitting rate of 477,000 units.

Single-family permitting has trended downward since the beginning of the year when the annual rate nearly reached one million units but has since fallen to 870,000 units, virtually unchanged from last month and down almost 8% from last July. Mortgage rates have not changed significantly since 2022, but economic uncertainty and tariff-related pricing concerns have hampered the industry.

Together with the small two-to-four-unit plex product, total residential permitting was down 5.7% for the year and 2.8% from June to 1.354 million units. The annual rate for total residential starts jumped 12.9% from last July to 1.428 million units, and with this month’s increase in multifamily starts, July’s SAAR was up 5.2% for the month.

The SAAR for multifamily units under construction decreased 19.4% from last July to 716,000 units, up only 0.8% for the month. Single-family units under construction were down 3.7% for the year and 1% from June to 621,000 units.

Multifamily completions were down almost 29% from last July and 2.8% for the month at 385,000 units. Meanwhile, single-family completions fell 6.1% from last July to 1.022 million units but were up 11.6% from last month.

Compared to one year ago, the annual rate for multifamily permitting increased in only the Midwest region (up 33.1% to 84,000 units). Annual permitting fell 17.3% in the West region to 83,000 units, by 14.9% in the small Northeast region to 59,000 units, and by just 0.6% in the South region to 206,000 units. Compared to the previous month, permitting was also down in the South and West, up in the Northeast and unchanged in the Midwest.

Annualized multifamily starts almost tripled in the Midwest region (up 173.2% to 122,000 units) and were up 54% in the South region to 252,000 units. The Northeast region experienced a decrease of 52.4% to 51,000 units, while the West region saw starts decrease 16.1% to 44,000 units. Compared to June’s SAAR, starts were down in the Northeast and Midwest regions and up in the Midwest and South regions.

This post is part of a series by RealPage Senior Real Estate Economist Chuck Ehmann analyzing residential permits and starts data from the U.S. Census Bureau. For more on this data, read previous posts in the Permits series.