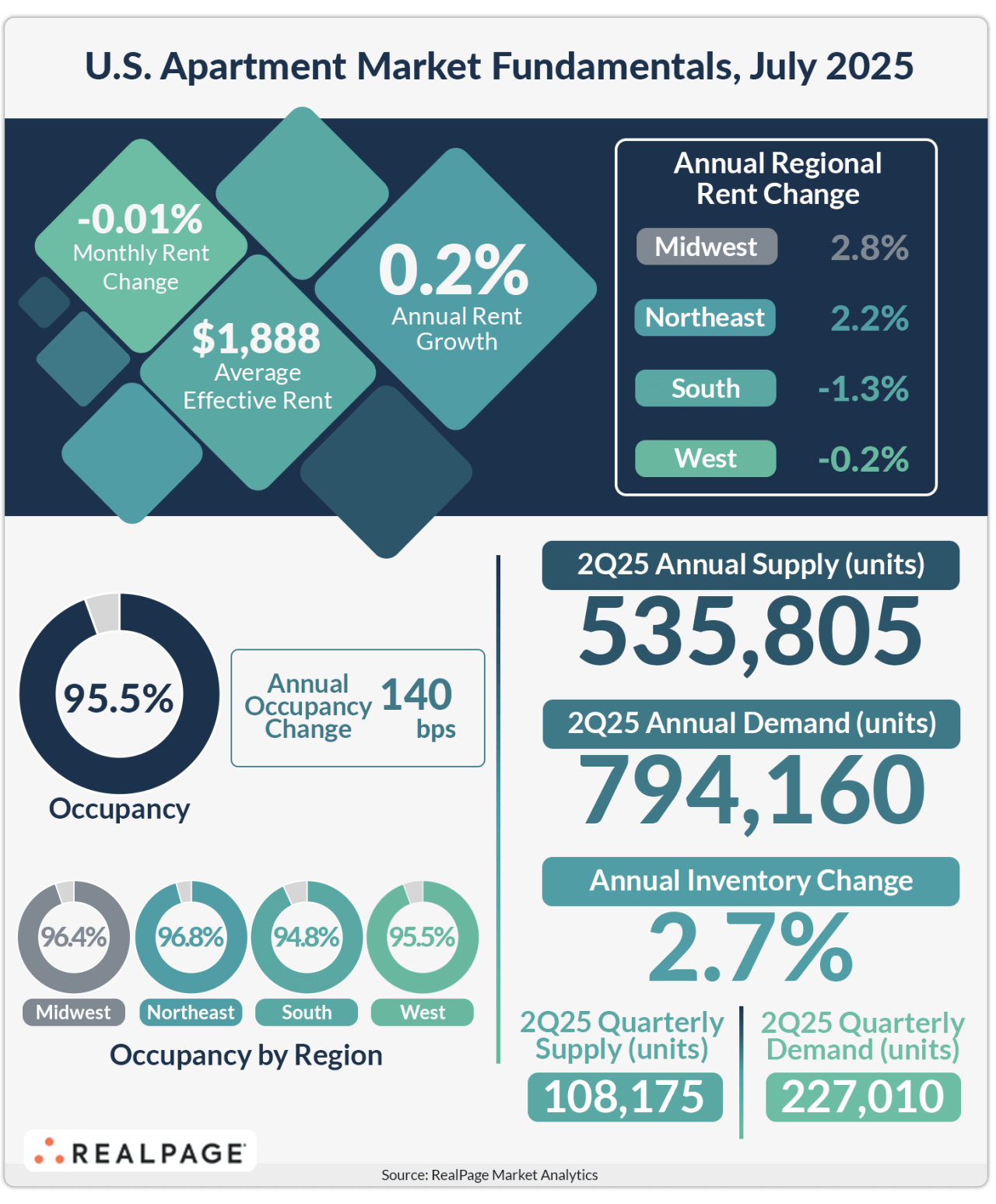

The U.S. apartment market saw occupancy and rent growth continue to hold steady in July, motivated by falling supply and mounting demand.

For the second consecutive month, U.S. apartment occupancy registered at 95.5%, according to July data from RealPage Market Analytics. That was down just a shade from the peak of 95.6% from April and May, and just a shade above the market’s five-year average of 95.4%. Year-over-year, occupancy was up 140 basis points (bps).

Effective asking rents were up 0.2% year-over-year across the U.S. While any rent growth at all after the historic supply wave the country just came through is impressive, this was the market’s lowest annual price increase in 10 months. Thus, operators continue to preserve occupancy at the expense of pushing prices.

Aiding in the ability to preserve occupancy, apartment demand keeps hitting new highs. The nation recorded record absorption of over 794,000 units in the year-ending 2nd quarter, topping the peaks from 2021 and 2022.

While supply volumes remain robust in historic terms, they are declining rapidly. Over 535,000 units were completed across the U.S. in the year-ending 2nd quarter. While that volume easily stands above the nation’s long-term average, it came in below the all-time high recorded just two quarters ago.

Ongoing construction volumes have come down every quarter since peaking in early 2023 and, as of 2nd quarter, hit a decade low. At the same time, multifamily permitting has waned. Moving forward, this could help firm up occupancy and inspire the return of rent growth.

The Northeast and Midwest remain the nation’s occupancy leaders, with rates of 96.8% and 96.4%, respectively. The West region is holding tight at 95.5% alongside the nation overall, while the South – where supply volumes have been the most extreme – has the most vacancies, with occupancy at 94.8%.

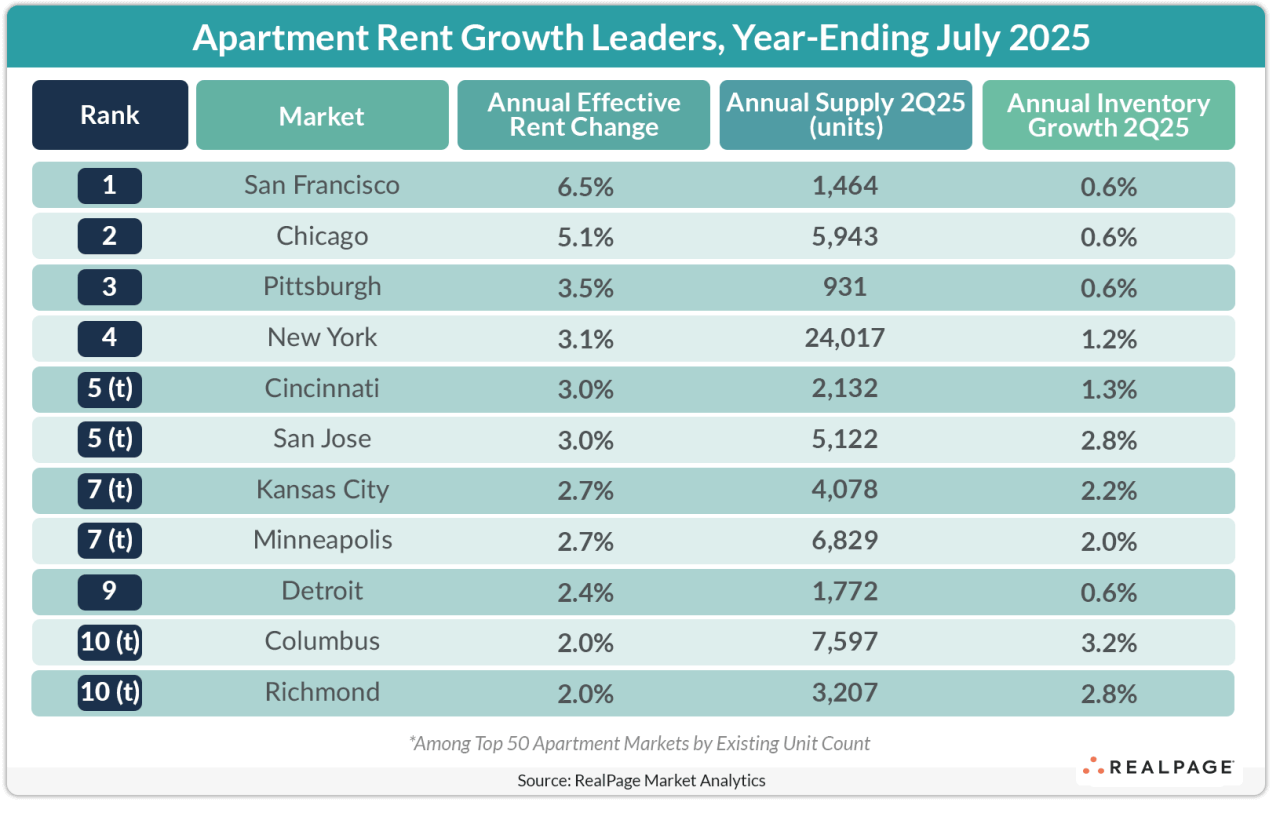

Markets with the Most Rent Growth

Tech-heavy coastal markets like San Francisco, New York and San Jose were among the largest 50 apartment markets with the most rent growth, with prices climbing 3% to 7% in the year-ending July.

Other markets with big rent growth in the past year include Chicago, Pittsburgh and Cincinnati.

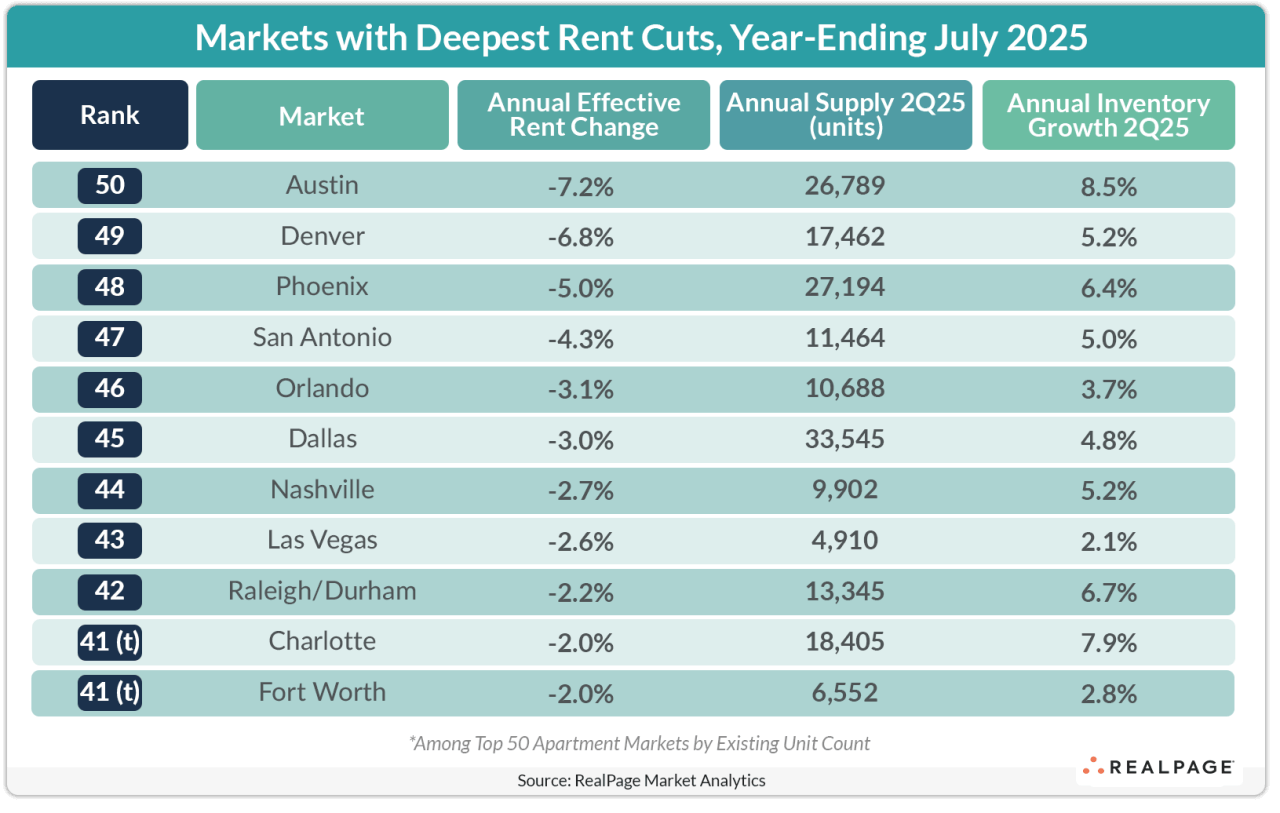

Tourism Markets See Weakness

Meanwhile, markets that saw the deepest rent cuts in the past year were those that depend on tourism, such as Orlando, Nashville and Las Vegas. Softness in tourism-dependent markets can be an early sign of economic weakness as consumers tighten discretionary spending on travel.

Other markets that continue to see deep rent cuts are supply-heavy areas like Austin, Denver, Phoenix and San Antonio.