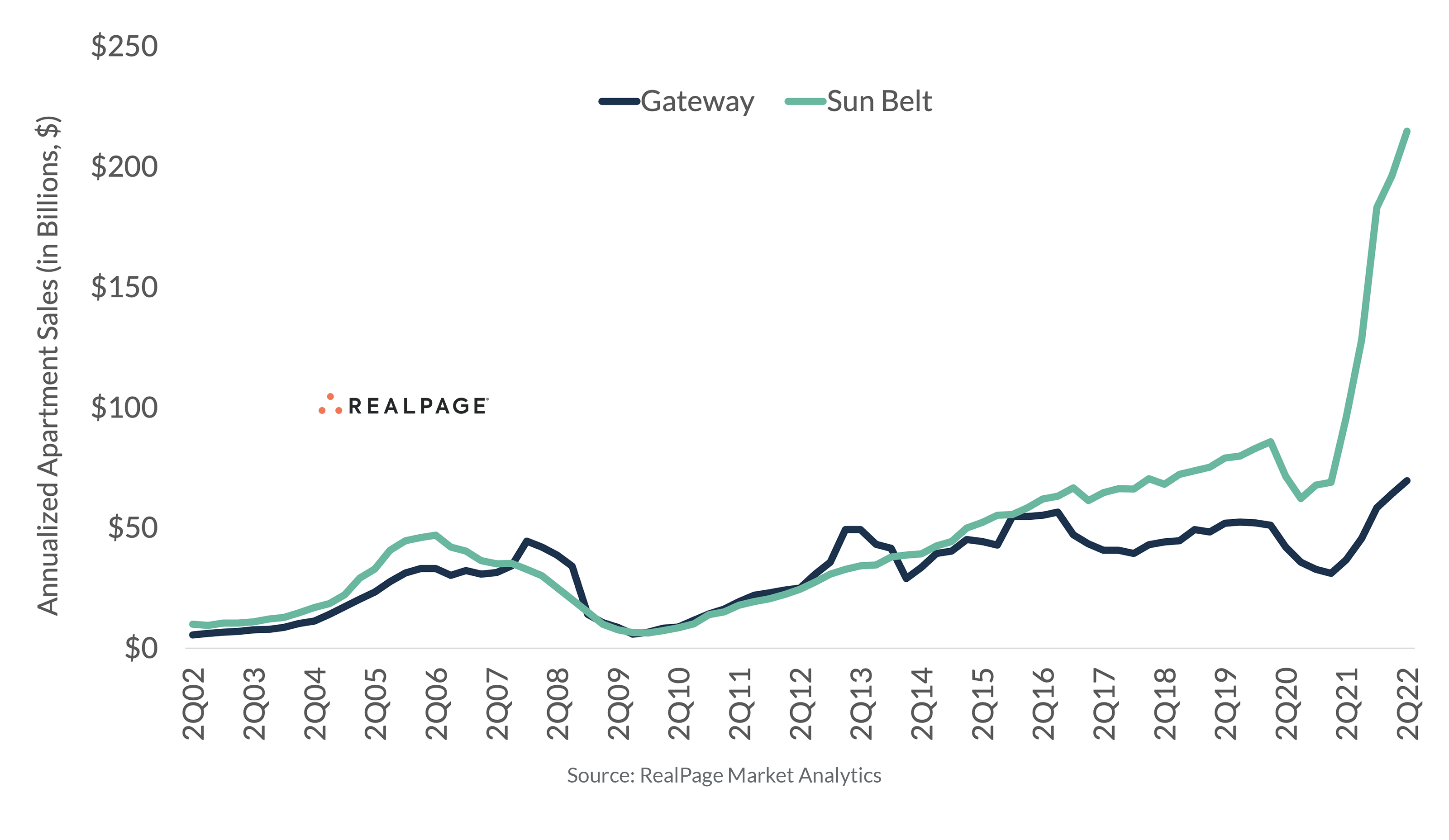

Investment in Sun Belt Markets Growing Much Faster than in Gateway Metros

The wave of capital flowing into the Sun Belt region continues to overshadow capital flow into the nation’s Gateway metros. Although the total volume of Sun Belt apartment sales had begun rising sharply around 2017, it wasn’t until the onset of the COVID-19 pandemic that the Sun Belt group of metros saw their total sales volume skyrocket, according to data from RealPage Market Analytics. After the Sun Belt garnered a consistent share of roughly 55% of capital flow in the preceding 20-year period, the past eight or so quarters have seen that share jump to about 70%. The data shows that every major Sun Belt market has seen an increase in the past 12 months versus their local pre-pandemic peak (or 2019 volumes) as well. There are a number of reasons why Sun Belt markets have become viewed in a more favorable light in the past real estate cycle in particular. One key driving force influencing this influx of capital is the purported relative savings of Sun Belt markets versus their Gateway counterparts. Investment in the Sun Belt equates to a savings of about 70% compared to Gateway markets.

Stay tuned for a more in-depth look at this phenomenon.