U.S. Home Prices Tick Up After Falling for Seven Consecutive Months

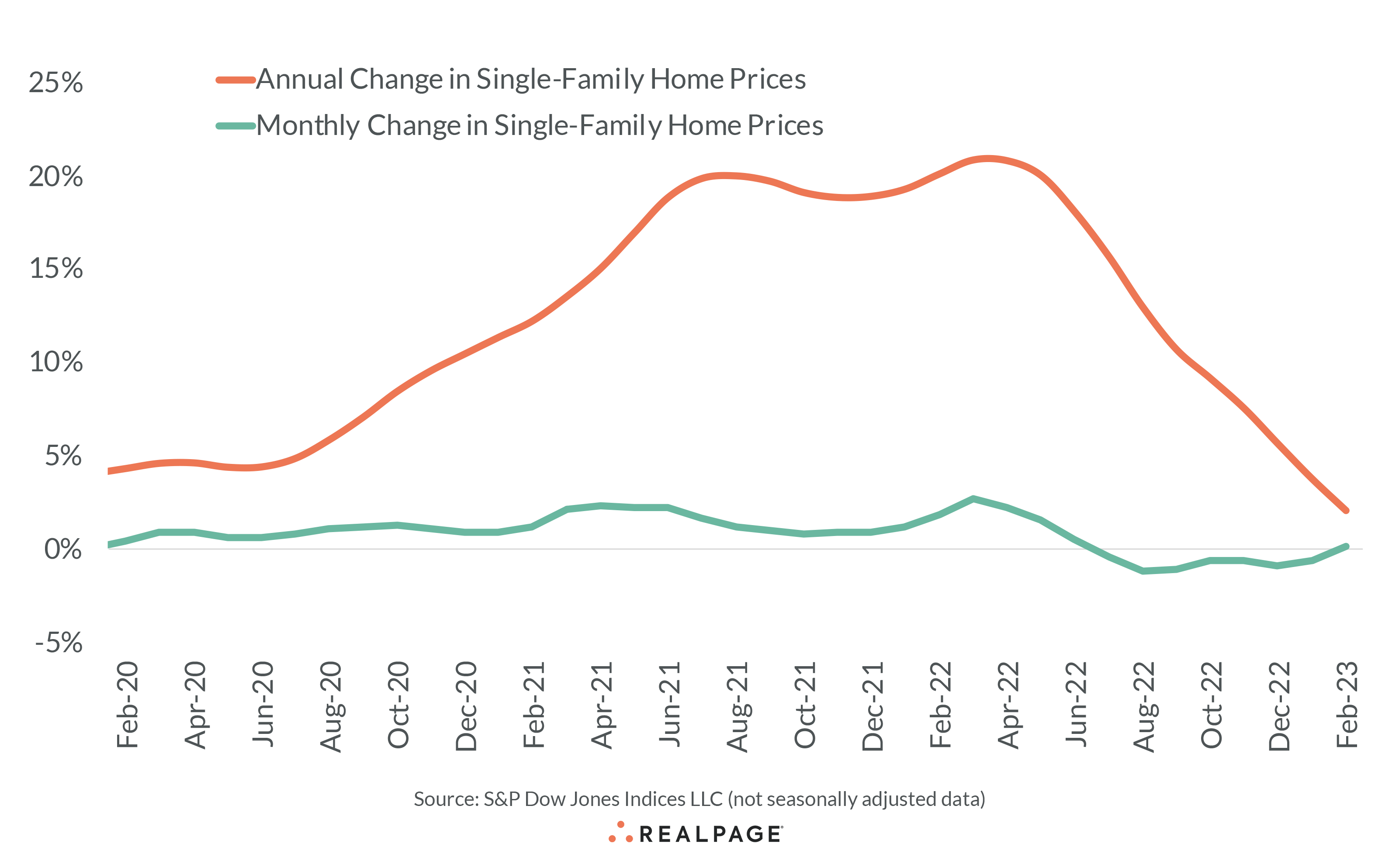

U.S. home prices unexpectedly rose month-over-month in February, ending seven consecutive months of price declines. Home prices ticked up a modest 0.2% from January to February, according to the S&P CoreLogic Case-Shiller U.S. National Home Price Index, which measures average home prices across the nation. Although that was the first month-over-month upturn in eight months, the annual rate of acceleration has slowed over the past 10 months and is now at the lowest level since July 2012. Home prices were up 2% year-over-year in February 2023, down from the 3.7% annual jump in January 2023 and now stand 4.9% below the June 2022 peak. Looking at more granular results, the S&P CoreLogic Case-Shiller 20-City Composite Index, which tracks prices in the 20 largest metros, posted a slight 0.2% month-over-month gain, while the annual gain fell from 2.6% in January to 0.4% in February. In February, nine of the 20 cities in the index reported month-over-month price increases, while four posted no change. The largest monthly increase was in San Diego (1.5%), followed by Los Angeles and San Francisco (both up 1%). The biggest month-to-month decline was in Las Vegas (-0.9%). On an annual basis, eight metro areas recorded year-over-year price drops, with the largest pull backs in San Francisco (-10%) and Seattle (-9.3%). The nation’s biggest annual hikes were led by Miami (10.8%), Tampa (7.7%), Atlanta (6.6%) and Charlotte (6.0%).