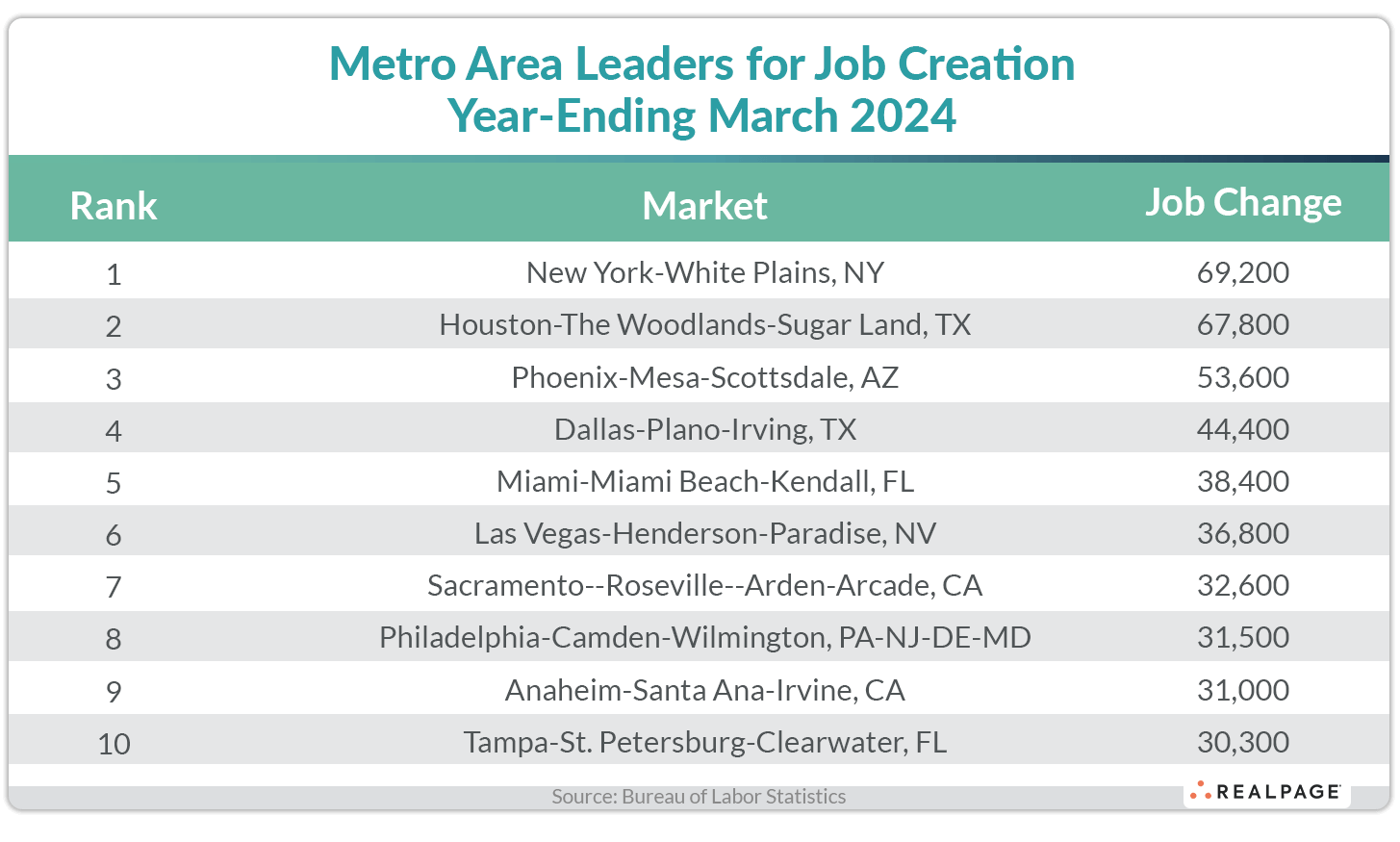

After falling out of the #1 spot last October, the New York-White Plains metro division is back to ranking at the top for employment gains nationwide in March. According to data released by the Bureau of Labor Statistics (BLS), New York gained 69,200 jobs in the year-ending March, up from a revised 55,000 jobs in February (initially reported as 47,900 jobs gained).

Nine of February’s top 10 job creation markets returned in March with most markets remaining close to their previous positions.

Last month’s top three – Houston, Phoenix and Dallas – were each bumped down one spot in March after New York. Houston’s 67,800 jobs gained was still pretty strong but down more than 10,000 jobs from February’s total. At #3, Phoenix gained 53,600 jobs for the year, close to their level last month.

Dallas came in at #4, gaining 44,400 jobs for the year, about 6,000 fewer than last month and one of the lowest gains for Big D in a long time. Miami ranked #5, moving up two spots from last month with 38,400 jobs gained, while Las Vegas slipped one spot to #6 with 36,800 jobs gained in the past year.

Sacramento also moved up two spots to #7 with 32,600 jobs gained, 2,600 more than in February. Philadelphia retained the #8 spot with a gain of 31,500 jobs, close to last month’s level and Anaheim jumped onto the top 10 list (replacing Austin) at #9 with 31,000 jobs gained. Tampa was the only other top 10 market to remain in place at #10 with 30,300 jobs gained in the past 12 months.

The total number of jobs gained for the year-ending March for the top 10 markets was down only about 13,000 jobs from their collective total last month. The next 10 markets (#11-#20) saw their combined annual jobs gains increase by about 5,000 jobs.

For the first fifth time since last October, none of the top 10 markets exceeded 100,000 jobs gained for the year while only three gained between 50,000 and 99,999 jobs, equal to last month. Nine markets reported annual job losses for the year, four less than last month.

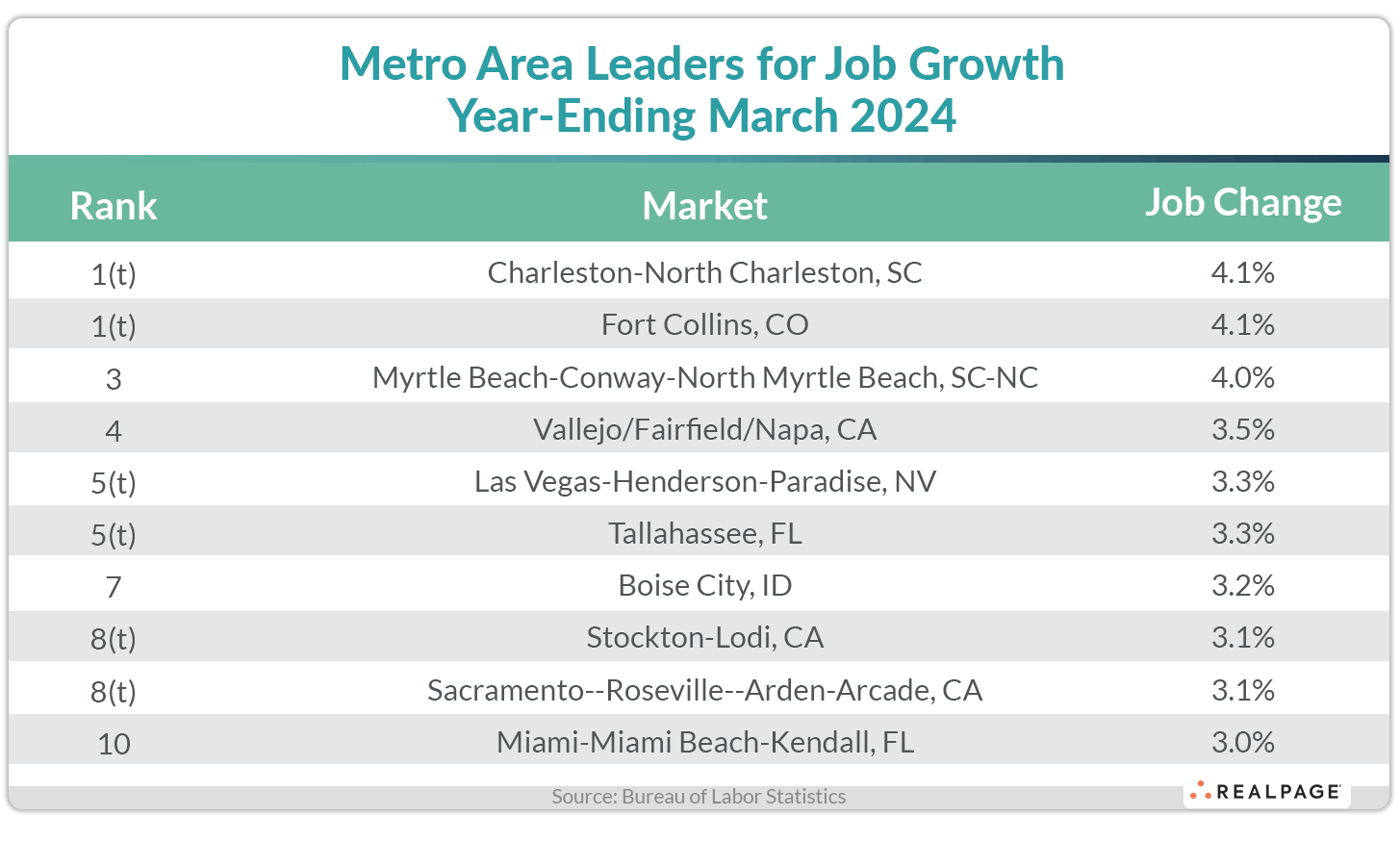

Like annual job gains, the annual percentage change in employment saw a leveling off as well with some continuing slowing (last month’s #1 had 4.8% growth compared to 4.1% in March). Only five of last month’s top employment growth markets returned in March and several changed places.

Charleston and Fort Collins each moved up one spot from February to tie for #1 with 4.1% employment growth. Myrtle Beach, SC slipped to #3 with 4% growth. Vallejo/Fairfield/Napa, CA joined the top 10 list at #4 with 3.5% growth, up 70 basis points (bps) from last month.

Las Vegas and Tallahassee tied for #5 with 3.3% job growth but Tallahassee improved 40 bps while Las Vegas slowed by 10 bps. Boise, ID was close behind at #7 with 3.2% growth, up 70 bps from February.

Stockton-Lodi, CA and nearby Sacramento tied for #8 with 3.1% employment growth and both were up 30 bps for the month. Miami rounded out the top 10 with 3% growth, up 20 bps from February’s rate.

Six of this month’s top 10 growth markets improved from last month, with three declining and one unchanged. Compared to last year, five markets had lower job growth rates and five had higher rates. They ranged from an improvement of 340 bps in Stockton-Lodi (which had been negative) to a decline of 220 bps in Myrtle Beach (to a still-strong 4%).

Outside of the top growth markets, New Haven, CT, Santa Rosa, CA, Oxnard, Reno and Ann Arbor, MI saw their job growth rates increase by 150 bps or more from last year. Meanwhile, Midland/Odessa, Portland, OR, Chattanooga, Austin, New Orleans, Port St. Lucie/Sebastian/Vero Beach, FL, Shreveport, LA, Orlando, Akron and Dallas fell by at least 310 bps from last year’s job growth.

Major markets with employment declines are Portland, OR, Memphis, New Orleans, San Francisco and Milwaukee. Sub-0.5% growth markets include Chicago, Cincinnati, San Jose, Boston, Denver and Los Angeles. Sub-1% growth major markets include Washington, DC, Nashville, Pittsburgh, Columbus and San Diego. Fifty-five markets had annual job growth rates above the not seasonally adjusted national average of 1.8%, 13 fewer than in February.