The build-to-rent (BTR) space continues to grow. There were some 341 BTR communities with 57,435 units under construction across the U.S. as of March 2023. Those numbers show that the BTR sector continues to hold developer interest as mortgage rates hover above 6% on 30-year fixed-rate loans and the Federal Reserve continues to raise interest rates. The consumer pool remains ripe in the face of economic uncertainty and elevated interest rates, as individuals choose to remain in place or remain renters rather than pursue the American Dream of homeownership.

Looking at the BTR pipeline, more than 14,100 units have been permitted as of March. Additionally, RealPage is monitoring over 500 pre-planned properties with nearly 74,000 units in the construction pipeline. To add a little context, there were 1,026,941 conventional units under construction as of March, according to data from RealPage Market Analytics.

The size of BTR properties varies widely. Out of the 341 BTR communities currently under construction, the number of units per community that RealPage is tracking ranges widely swinging from as few as 12 units up to 643 units. RealPage defines single-family BTR housing as those properties that are fully detached, semi-detached, row houses, duplexes, quadruplexes, and townhouses with no units located above or below.

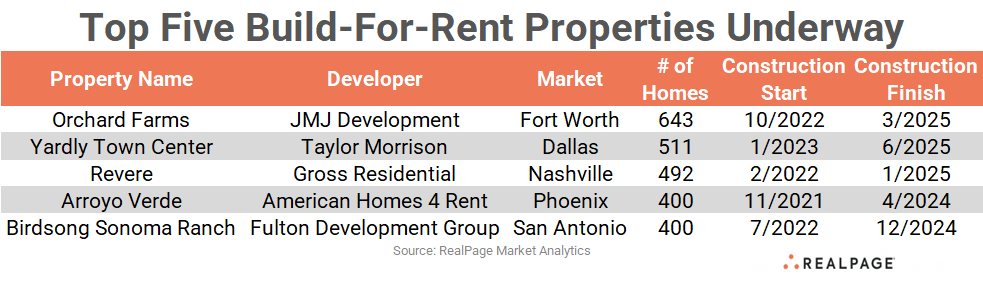

Here are the top five largest under construction BTR properties among the nation’s top 150 markets as of March 2023. Note that four of the largest projects are going up in some of the most actives markets for BTR. Additionally, three of the top five are rising in Texas.

Orchard Farms

Florida-based DLP Capital in partnership with Dallas-based JMJ Development broke ground on this South Fort Worth community in October. Located at Shelby Road and Rendon Road, Orchard Farms will offer 643 single-family rental units with three- and four-bedroom units. Construction on the property is expected to complete by March 2025. Monthly rents are projected to cost between $1,850 and $2,100 per month, significantly above average effective prices in conventional apartments for the South Fort Worth submarket ($1,196 per month, or $1.445 per square foot as of February). Occupancy for conventional apartments hovered around 93% in South Fort Worth. There were nearly 11,200 existing conventional units in South Fort Worth at the end of February.

Yardly Town Center

In January, Scottsdale, AZ-based Taylor Morrison broke ground on Yardly Town Center, a 511-home build-for-rent community rising in Anna, a suburb of Dallas. Developer plans for the community at West White Street and North Throckmorton Boulevard in the Allen/McKinney submarket call for units ranging from 717 square feet to 1,030 square feet. The one- and two-bedroom cottage-style community will offer residents private backyards and smart home technology. It is unclear where monthly rents may fall, however, conventional rents in the Allen/McKinney submarket average $1,661 per month or $1.769 per square foot. Occupancy in the Allen/McKinney submarket sat at 93.4% as of February 2023. The Allen/McKinney submarket is home to 30,751 conventional units.

Revere

Ohio-based Gross Residential is working on the 492-home Revere. Construction on the project located at 2135 Lebanon Rd. in Lebanon, within the Nashville market, started in February 2022. Construction is expected to complete by the beginning of 2025 on this BTR townhome and duplex community. Revere sits within the Hermitage/Mount Juliet/Lebanon submarket, about 40 minutes from downtown Nashville. As of February 2023, the average effective monthly rent in Hermitage/Mount Juliet/Lebanon for conventional properties averaged $1,540 per month or $1.497 per square foot. At the same time, occupancy in Hermitage/Mount Juliet/Lebanon stood at 94.5%. The Hermitage/Mount Juliet/Lebanon submarket is comprised of just over 14,200 conventional units.

Arroyo Verde

California-based American Homes 4 Rent broke ground on Arroyo Verde in November 2021. As previously reported, the 400-home Arroyo Verde is planned for Phoenix. Expected to deliver in the first half of 2024, Arroyo Verde will rise in the Avondale/Goodyear/West Glendale submarket around West Osbourn Road and North 199th Avenue. The developer offers traditional single-family home lot sizes with traditional backyards. With four other existing communities in the Phoenix market, American Homes 4 Rent typically offers units around 2,000 square feet in size with three to five bedrooms and two-car garages. Monthly rents average about $2,000, roughly $250 higher than average effective prices in conventional apartments for the Avondale/Goodyear/West Glendale submarket. Just over 20,500 conventional units make up the Avondale/Goodyear/West Glendale submarket.

Birdsong Sonoma Ranch

Under construction in Far Northwest San Antonio, the 400-home Birdsong Sonoma Ranch is expected to complete in August 2024. Locally based Fulton Development Group broke ground on the project rising on 34 acres northwest of the Hausman Road and Loop 1604 intersection in March 2022. Fulton describes its Birdsong rental communities of farmhouses and cottages as offering the spirit of country living to residents. Their communities offer shared green spaces along with multifamily amenities including a fitness center, fire pit, dedicated dog park and resort-style pool with private cabanas. The developer is also working on Birdsong at Leon Springs in San Antonio. Occupancy in Far Northwest San Antonio stood at roughly 93% at the end of February 2023. Average effective asking rents stood at $1,485 or $1.596 per square foot as of February.