The extreme volumes of apartment supply hitting Austin in recent years should have eroded market fundamentals. But just like traffic on IH-35, the constant jam of back-to-back deliveries couldn’t take the Texas capital down, as evidenced by increasing occupancy rates.

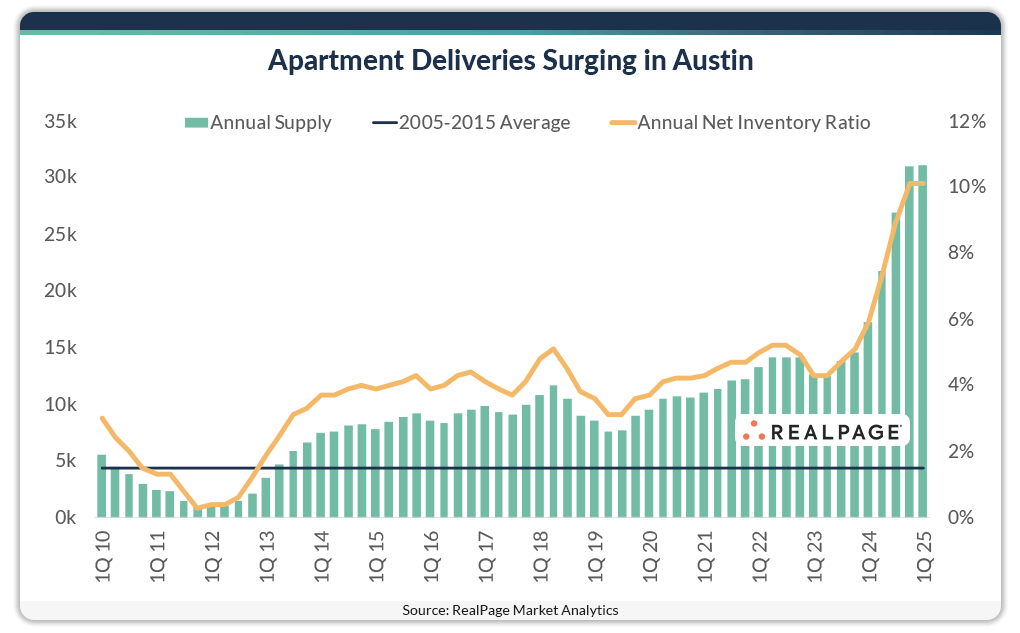

Supply volumes hit a record high in Ausitn recently, with over 31,000 new units delivered in the year-ending 1st quarter, according to data from RealPage Market Analytics. That was one of the biggest volumes nationwide (topped by only Dallas) and more than doubled Austin’s average annual completion volumes of roughly 13,000 units from the past decade (2015 to 2025). And the last decade’s completion pace in Austin was more than double the average annual volumes of 4,400 units in the decade before that (2005 to 2015).

Supply volumes of this magnitude could have caused fundamentals to soften for an extended period. But, so far, strong job growth, domestic in-migration and a young renter base have kept Austin’s occupancy afloat during a time when apartment market growth has exploded. Austin saw its population grow by 10.9% between 2020 and 2024, according to the latest estimates from the U.S. Census Bureau. That was the strongest showing among the nation’s largest markets.

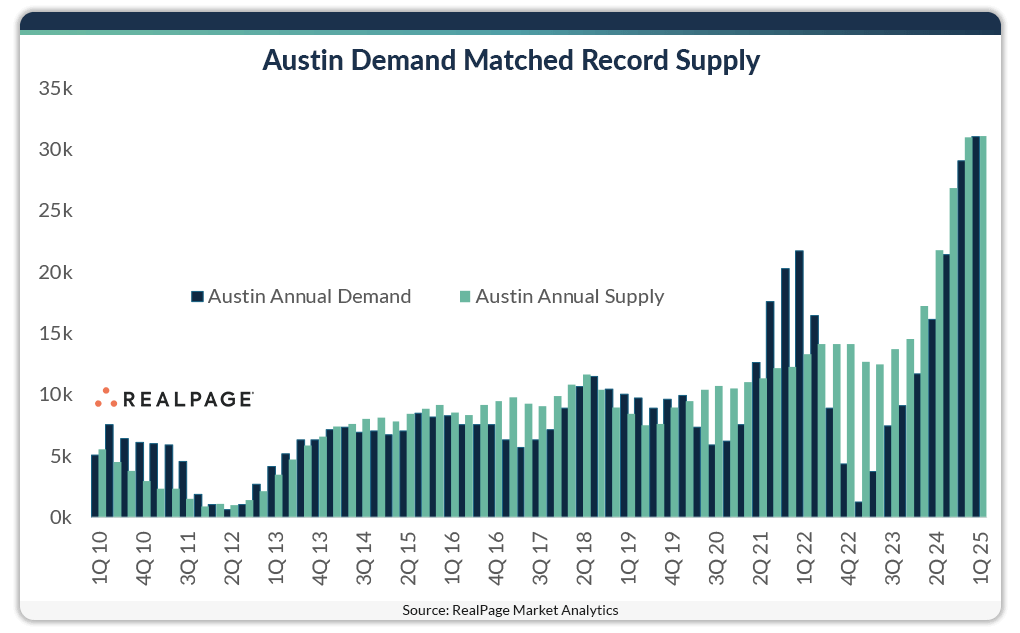

Demand isn’t typically a struggle for Austin. In fact, among the nation's 50 largest apartment markets, only Austin and Raleigh avoided net move-outs throughout both the Great Recession and the COVID-19 pandemic downturn.

Austin hasn’t seen annual net move-outs since the Dot-com crash of the early 2000s. And when record apartment supply volumes loomed over the market in recent years, demand rose up to match them. In the year-ending 1st quarter, Austin apartment demand hit a record high of nearly 31,000 units, running right in line with record completion volumes.

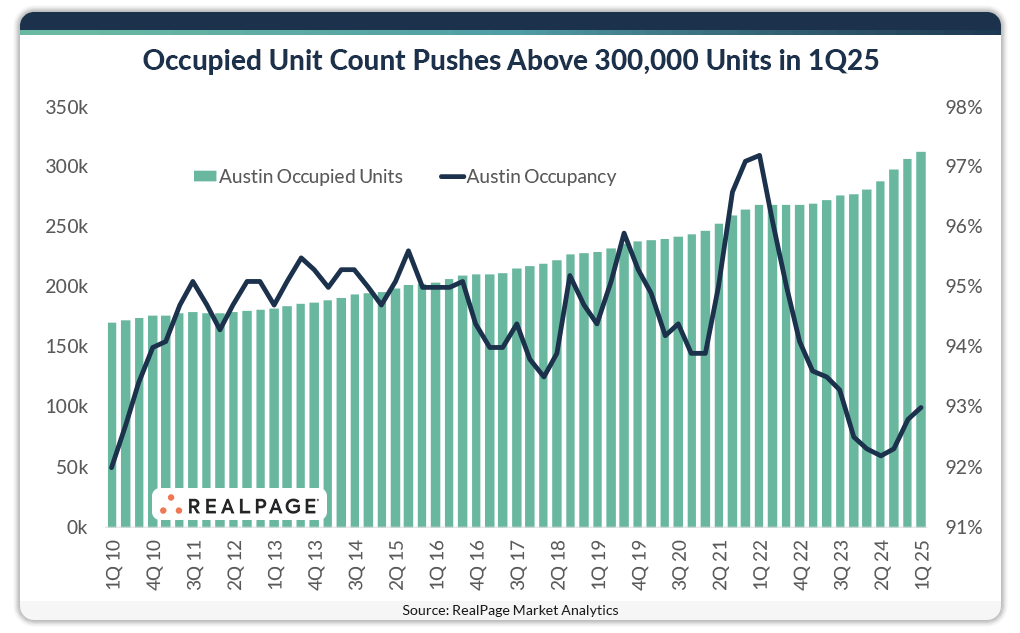

As a result of strong apartment demand, Austin occupancy clocked in at 93.8% in May. While that’s down from the elevated levels of 2022, it’s not too far behind Austin’s decade average of 94.3%. And, in fact, Austin has seen occupancy gain some ground in the past year, with the May 2025 reading rising 170 basis points (bps) ahead of the year-ago figure.

With demand and supply both hitting record highs, the volume of occupied units in Austin increased nearly 117,000 units in the past decade. Back in 1st quarter 2015, there were nearly 207,000 existing units in Austin. Roughly 95% of those were occupied, meaning there were nearly 196,000 filled units in the market. Ten years later, the existing unit count in Austin has swelled to more than 336,000 units. With an average of about 93% occupied in 1st quarter 2025 (just a bit lower than the monthly average), there are now over 312,000 occupied apartments in the Austin market.

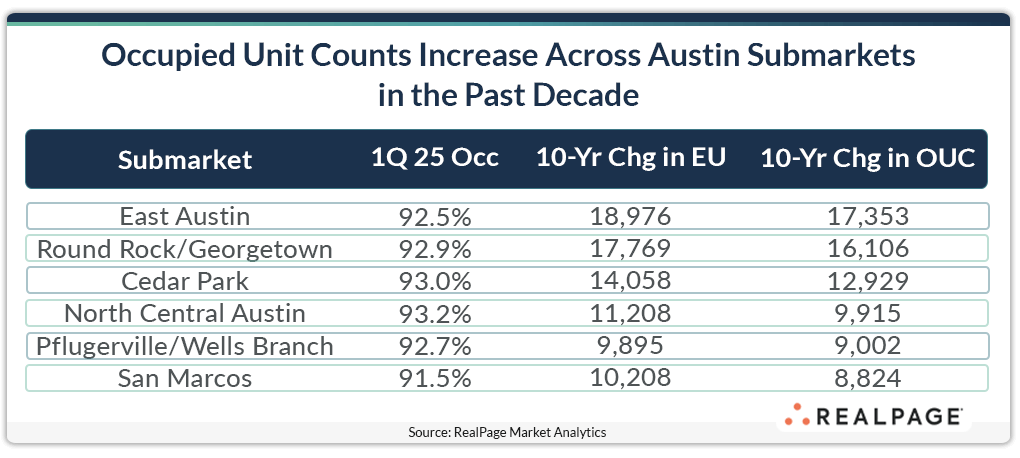

The submarket that saw the biggest growth in occupied units over the past decade was East Austin. This area just east of downtown saw its existing base expand nearly 19,000 units since early 2015. The growth in occupied units was similar at 17,353 units.

Northern suburban submarkets Round Rock/Georgetown and Cedar Park also saw incredible growth in occupied units. Round Rock/Georgetown saw its occupied unit count growth by over 16,000 units in the past decade, while Cedar Park growth was around 13,000 units.

Monthly rents in Austin are still on the downslope, but prices are still well ahead of pre-pandemic norms. As of May, effective asking rents were cut by 8% from last year’s prices. That was the steepest rate cut nationwide. However, rents of $1,456 as of May 2025 were still about $150 ahead of where they were before the pandemic.

Austin’s historic apartment supply volumes are set to fade in the near term. Assuming apartment demand continues to hold up, the local apartment market could see occupancy continue to grow and rents stabilize as supply volumes start to fall from recent peaks.