Apartment Transactions Continue to Rise in 2025’s 3rd Quarter

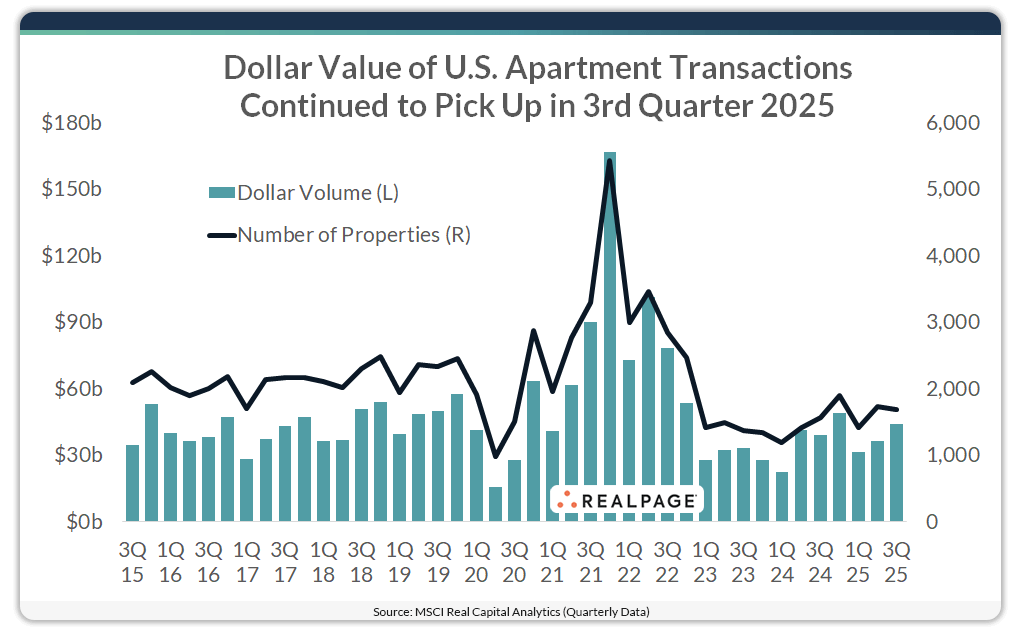

The dollar volume of U.S. apartment transactions continued to trend up during the July to September 2025 time frame, though the number of properties trading hands declined. On an annual basis, both the dollar volume and number of properties trading were up.

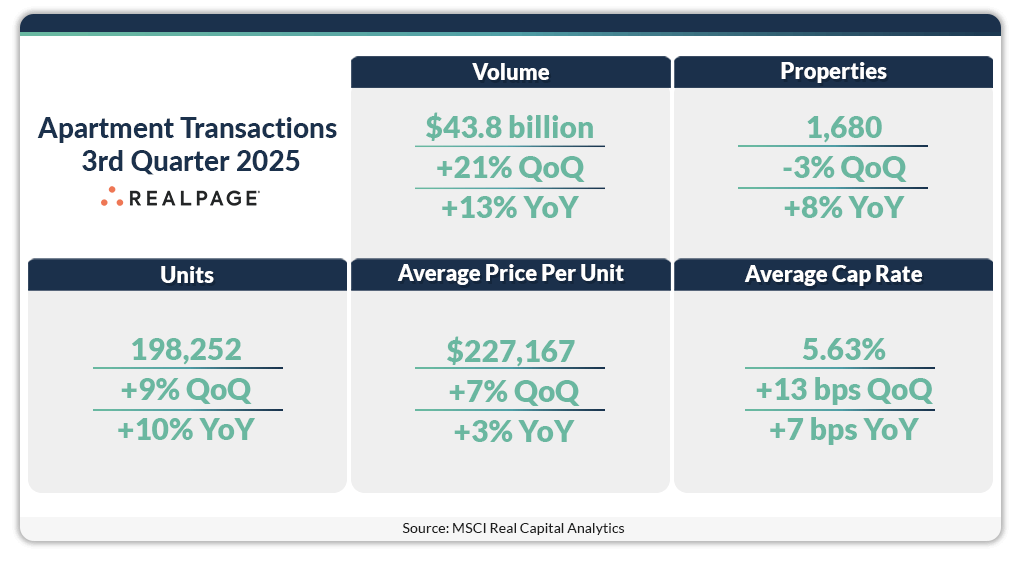

Roughly 1,680 apartment properties changed hands at a value of $43.8 billion during 3rd quarter 2025, according to MSCI Real Capital Analytics. Overall sales volumes were up 13% year-over-year and were 21% above the 2nd quarter 2025 level when around 1,728 properties changed hands for roughly $36.2 billion. Still, recent activity was well below the $55.6 billion quarterly average over the past five years.

The average price per unit remained high at $227,167 in 3rd quarter, registering above $200,000 for 15 of the past 17 consecutive quarters. Prior to 2021, the per unit pricing never exceeded that threshold and averaged roughly $151,000 from 2015 to 2019.

Meanwhile, cap rates for apartment transactions occurring in 3rd quarter 2025 averaged 5.63%, the highest cap rate in more than eight years and well above the pandemic-era low of 4.65% from 2nd quarter 2022. Though apartment cap rates have risen, they remain the lowest among major property types, keeping the asset class an attractive commercial real estate investment.

On an annual basis, transactions in the year-ending 3rd quarter 2025 totaled more than $159.9 billion with 6,717 properties trading hands. That total sales volume was up 23% from the previous 12-month period, while the number of properties sold was up 22%. Looking back over the past few years, sales dipped in calendar 2020 due to the pandemic, when about 7,300 apartment communities sold for $148.2 billion. That was well below the volume from 2019, when nearly 9,100 properties traded hands for $195.1 billion. In 2021, transactions jumped due to pent up demand following the onset of the pandemic, with roughly 13,500 properties trading hands at a value of roughly $359.4 billion, nearly double the 2020 level on both accounts.

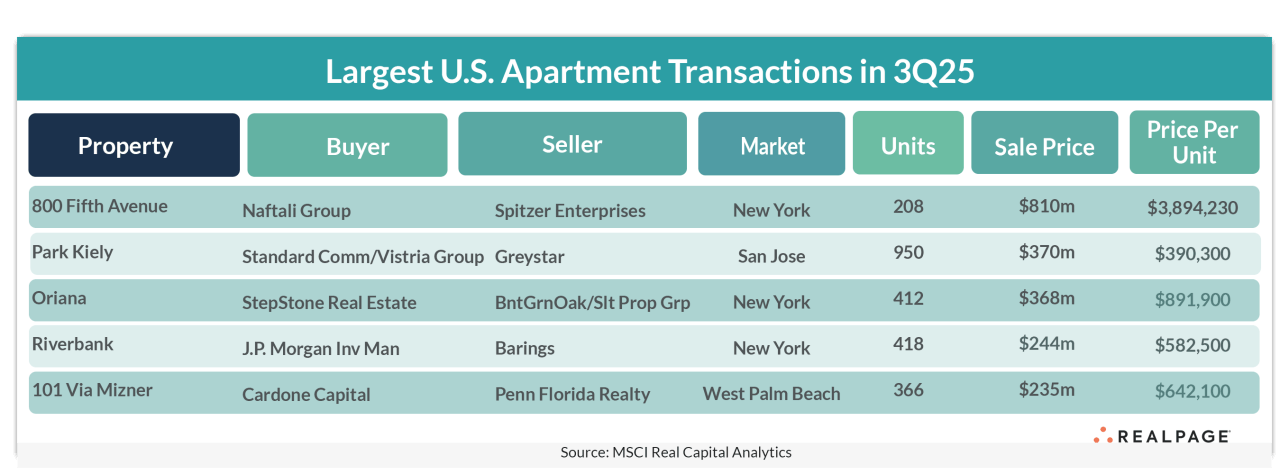

Among the five largest single-asset market-rate apartment transactions during 3rd quarter 2025, all sold for $235 million or more. Of those sales, three were in the Northeast region, with all three in New York City, while the South and West regions each had one transaction.

800 Fifth Avenue

The largest single-asset market-rate apartment transaction in the nation during 2025’s 3rd quarter was in New York. New York-based Naftali Group purchased the 208-unit 800 Fifth Avenue residential tower on the Upper East Side for $810 million in August. The purchase price equated to nearly $3.9 million per unit. The seller was New York-based Spitzer Enterprises. The 33-story building is located at Fifth Avenue and East 61st Street near Central Park. The property is considered one of the most desirable sites in the city for luxury development. Naftali plans to demolish the 1979-built structure and replace it with a high-end condominium property, marking a major transformation from its legacy as a top-tier rental building. The site also includes 35,000 square feet of office space and 3,000 square feet of retail space.

Park Kiely

In August, Los Angeles-based Standard Communities in partnership with The Vistria Group purchased the Park Kiely apartment complex in San Jose for $370 million, the second-largest apartment transaction in the U.S. during 3rd quarter 2025. Greystar sold the 948-unit garden-style community for about $390,300 per unit. The apartment development on 32 acres at 355 Kiely Blvd. within the West San Jose/Campbell submarket was built in 1970 and renovated in 2008. Park Kiely features four swimming pools, a fitness room, movie theater room, soccer field, tennis courts, volleyball court, basketball court and a dog park. Standard and Vistria will restrict the units to households earning up to 80% of area median income, making it the largest market-to affordable conversion in the state of California. The new owners also plan to invest over $19 million in building improvements and renovations.

Oriana

The third-largest apartment transaction in the nation during 2025’s 3rd quarter, was the sale of Oriana in New York. In late July, New York-based StepStone Real Estate acquired the 38-story building at 420 E. 54th St. in the Midtown East submarket for $367.5 million. A joint venture between Miami-based BentallGreenOak and New York-based Slate Property Group sold the 412-unit building for roughly $891,900 per unit. The new owners plan to renovate the high-rise, which was built in 1982 and last renovated in 2016. Amenities include two outdoor rooftop areas, penthouse lounge, fitness center, play spaces for children, recreation room with climbing wall, vintage arcade room and pet spa.

Riverbank

In mid-July, New York-based J.P. Morgan Investment Management, a subsidiary of JPMorgan Chase & Co., acquired the 418-unit Riverbank apartment building in New York. Charlotte-based Barings, a global investment management firm owned by Massachusetts Mutual Life Insurance Company, sold the 44-story property for $243.5 million, or roughly $582,500 per unit, the nation’s fourth-largest apartment transaction during 2025’s 3rd quarter. Located at 560 W. 43rd St. in Manhattan’s Hell’s Kitchen, within the Midtown West submarket, the building was originally developed in 1987 as a condominium property. Amenities include several lobbies, coworking space, entertainment areas, indoor swimming pool, sauna, steam room, media lounge, fitness center, dining terrace with fire-pit, conference rooms and a game room equipped with poker table, billiards, ping pong and shuffleboard.

101 Via Mizner

Ranking as the fifth-largest apartment transaction in the nation during 3rd quarter was the sale of 101 Via Mizner in West Palm Beach. Aventura, FL-based Cardone Capital acquired the apartment community for $235 million in July. The 366-unit property on East Camino Real in Boca Raton traded for roughly $642,100 per unit. Cardone acquired the property from an affiliate of Penn Florida Realty (Via Mizner Owner I LLC) which filed for Chapter 11 bankruptcy in January. The new owner is looking into a potential condo conversion for the 14-story development which was built in 2018. Amenities include an on-site car wash, bicycle storage, concierge services, clubroom, cybercafé, resort-style pool and fitness center.

Every quarter, Real Estate Writer Charlotte Wheeler details the nation’s five largest multifamily rental transactions. Read the previous posts in the Apartment Transactions series.