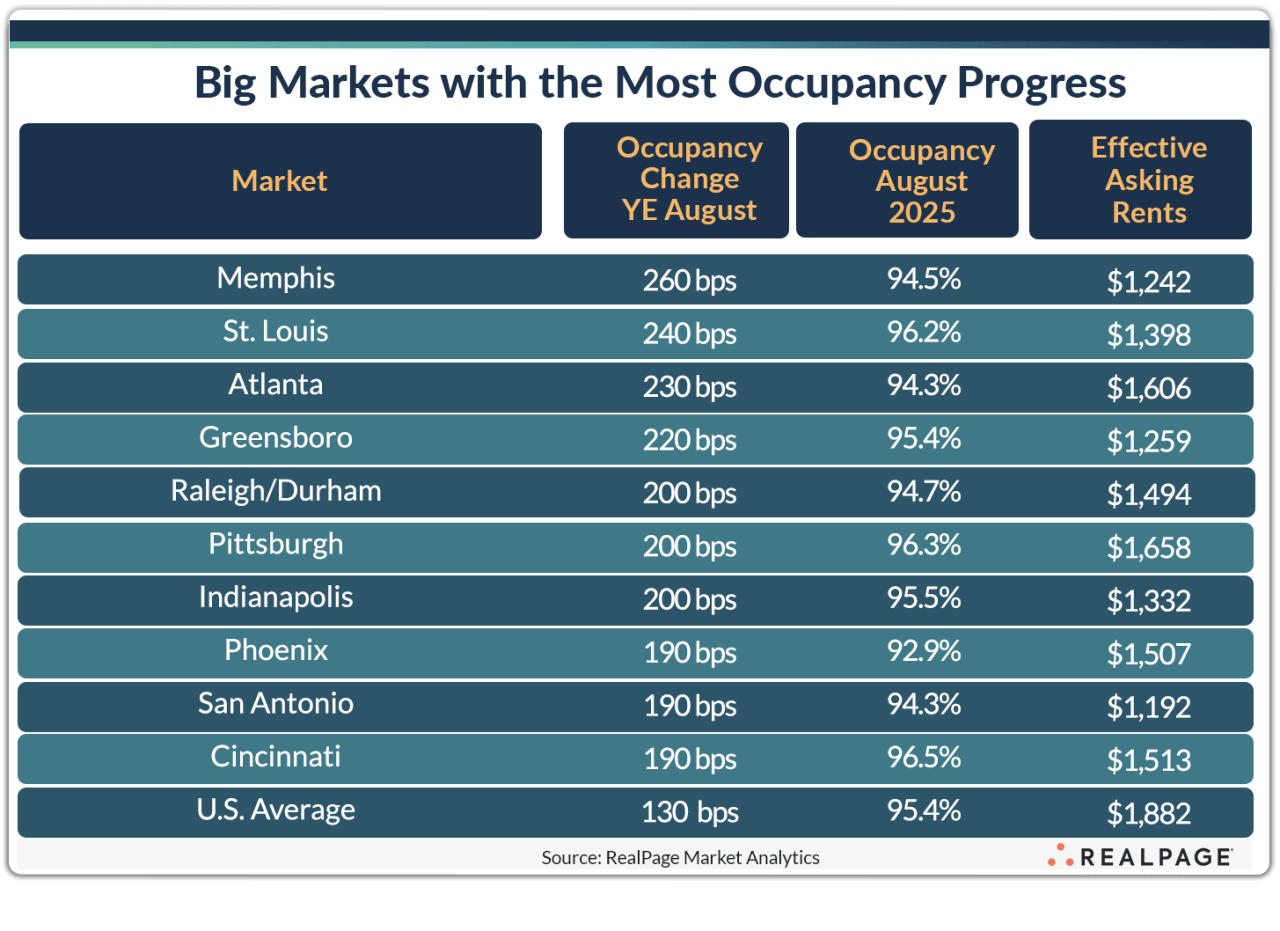

Some Affordable Apartment Markets Make Notable Occupancy Progress

While all major apartment markets nationwide made at least a little occupancy progress in the past year, a handful have seen especially notable upturns. Most of these markets with sizable occupancy increases were located in the South or Midwest regions of the U.S., with two exceptions (Pittsburgh and Phoenix). All were relatively affordable markets with monthly rents below the national average. Among the nation’s largest 50 apartment markets, Memphis was the national leader for occupancy progress, with growth of 260 basis points (bps) in the year-ending August, according to data from RealPage Market Analytics. Rents in Memphis were some of the most affordable nationwide at $1,242 as of August. The annual occupancy upturn in St. Louis was similar at 240 bps, while Atlanta and Greensboro also saw upturns in excess of 200 bps. The 190-bps upturn in Cincinnati took occupancy to 96.5% as of August, which was one of the strongest rates among the nation’s largest markets. In contrast, the 190-bps upturn in San Antonio wasn’t enough to make up for previous declines, taking occupancy to just 92.9%, the weakest rate among large markets. San Antonio also had the lowest monthly effective asking rents among large markets, with August prices of $1,192.