Apartment Demand Slows, Leading to Uncommon 3rd Quarter Rent Cuts

The U.S. apartment market saw demand slow in 3rd quarter, ending the streak of rapid growth seen during much of the past two years.

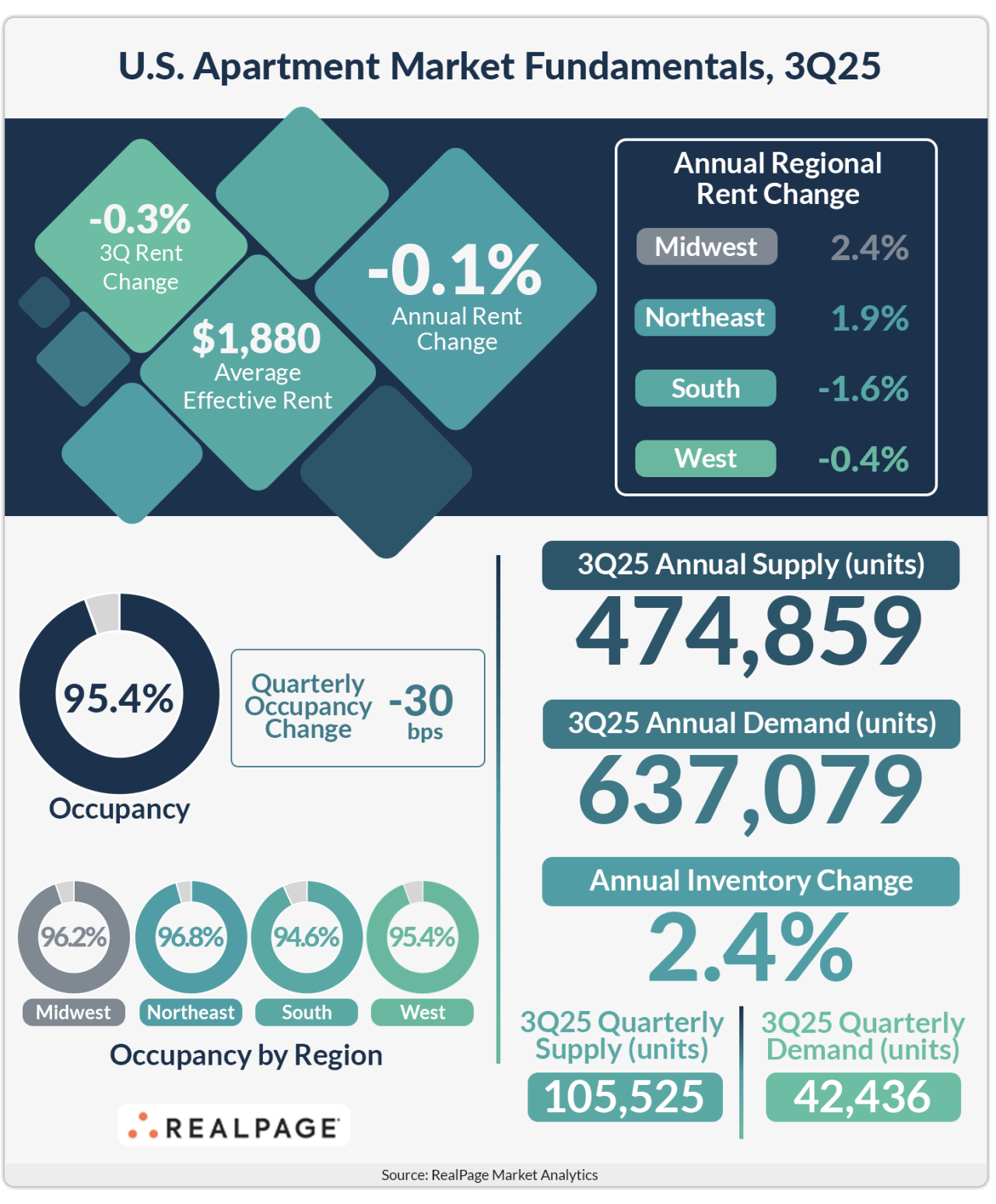

Roughly 637,100 market-rate units were absorbed in the year-ending 3rd quarter 2025. While still nearly double the volume of units absorbed annually on average during the past decade, this latest showing marked a turn in trend. The market's recent performance was down notably from the nearly 784,900 units absorbed in the year-ending 2nd quarter 2025, an historic peak the market reached after nine quarters of sustained growth.

“Sluggish new lease activity appears to be the primary driver behind a weaker-than-expected 3rd quarter,” RealPage Chief Economist Carl Whitaker said. “This sluggishness looks to be a reflection of broader macroeconomic headwinds as the nation has seen job growth quickly slow in the past few months.”

Meanwhile, apartment supply volumes continue to slow rapidly. Over 474,800 units wrapped up construction across the U.S. in the past year, including about 105,500 units in 3rd quarter alone. This marks a third consecutive quarter of decline after annual supply volumes peaked at 586,151 units in 4th quarter 2024. Still, like demand, the latest round of apartment deliveries is still ahead of decade norms.

Occupancy backtracked quarter-over-quarter as well, falling 30 basis points (bps) to land at 95.4% in 3rd quarter 2025. It’s common to see occupancy backtrack in 3rd quarter, but this decline also marks a new trend after five straight quarters of occupancy increases.

3rd Quarter Rent Cuts for the First Time in Over a Decade

Softening fundamentals in the U.S. apartment market resulted in effective asking rents falling 0.3% in 3rd quarter. This was the first time rents have been cut between July and September since 2009, at the end of the Great Financial Crisis. In the year-ending 3rd quarter, rents were down a mild 0.1%.

Nearly 22% of apartments were offering concessions as of 3rd quarter, and the average concession was 6.2%. As operators focus on filling units in the coming months, concession utilization could become even more prevalent, making true rent growth harder to realize until discounts burn off.

“Resident retention also remains substantial and is in fact increasing year-over-year. We tend to see less movement during periods of macro softening, as consumers tend to be more conservative and stay in place rather than moving around,” Whitaker said.

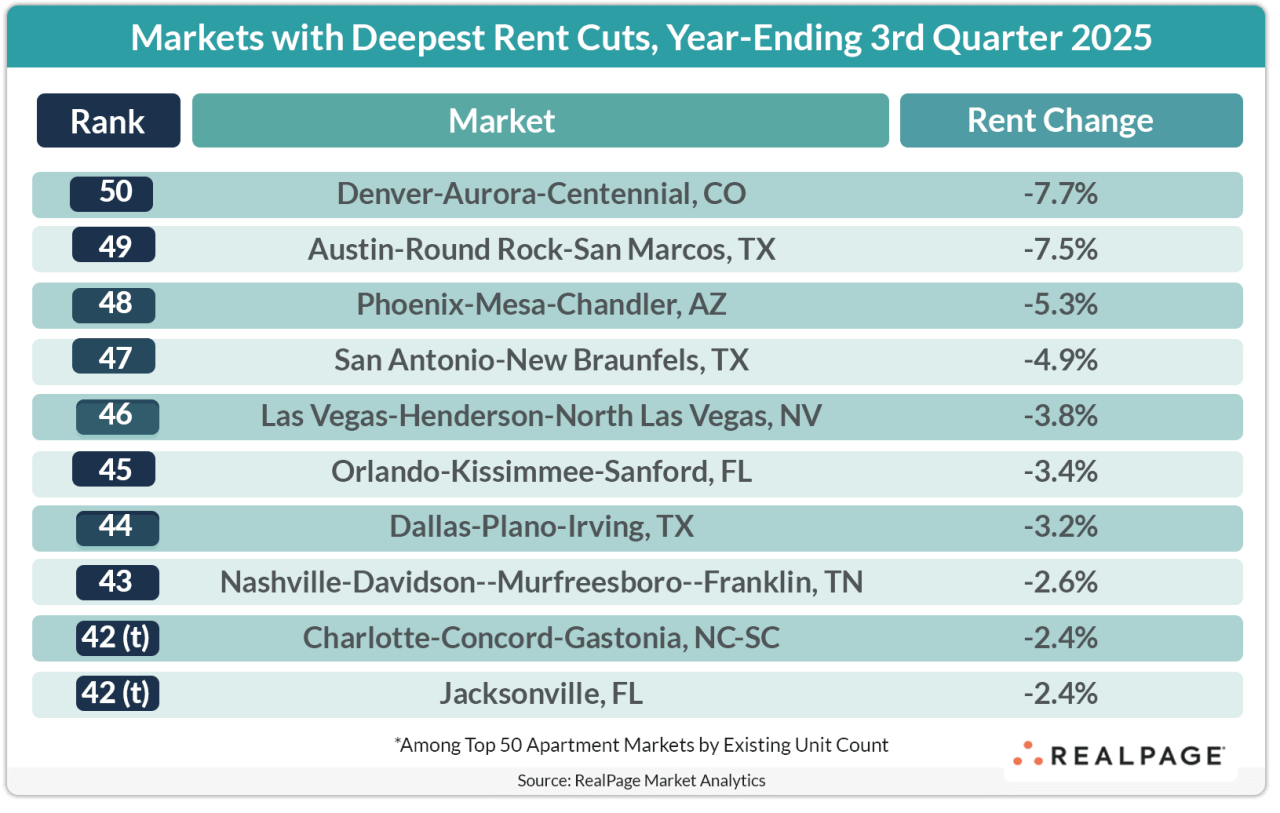

Rent Cuts Continue in Supply-Heavy Markets and Tourism Centers

While demand appears to be slowing, supply remains the key force suppressing rent growth. The supply-heavy regions of the U.S. – the South and the West – saw rent cuts in both 3rd quarter and the past year. On the other hand, the Midwest and Northeast regions – where supply additions have been milder – logged modest price increases.

The nation’s three deepest rent cuts were in supply-heavy markets that have dominated the price decline list of late. Rents were down nearly 8% in Denver and Austin, while prices were slashed by about 5% in Phoenix and San Antonio.

Meanwhile, markets that depend more on tourism, such as Las Vegas, Orlando, Nashville and San Diego continued to lose momentum in 3rd quarter. Softness in tourism-dependent markets can sometimes be the first sign of economic weakness as consumers tighten discretionary spending, such as on travel and vacations.

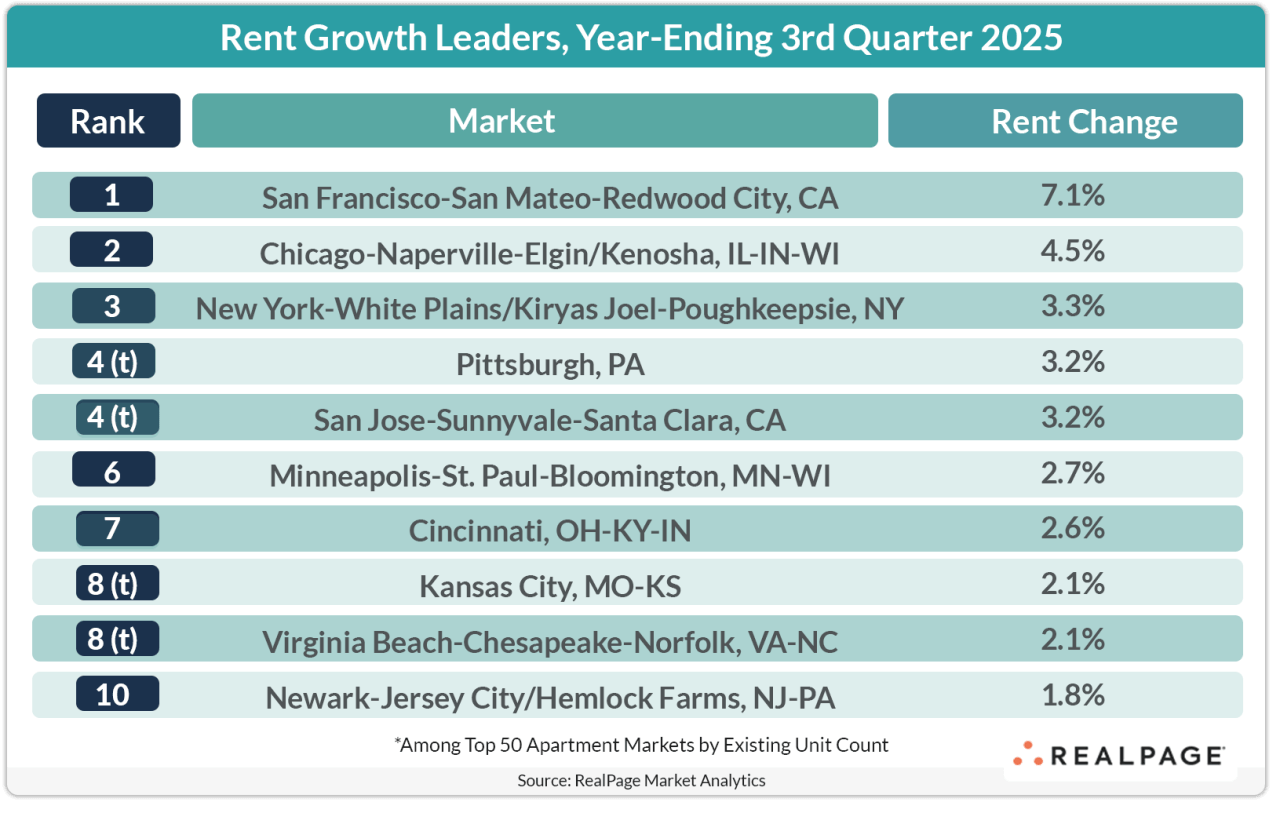

Tech-Heavy Coastal Markets Still Holding on to Rent Growth

Tech-heavy coastal markets like San Francisco, New York and San Jose continued to see rent growth in 3rd quarter, with strength perhaps linked to return-to-office mandates and waning supply volumes.

A handful of Midwest apartment markets with modest supply volumes were also still seeing rent growth in the past year.