Using Year-to-Date Figures to Better Understand Today’s Apartment Fundamentals

Annual rent change is important, but it’s far from the only rent growth metric that holds value. One of the downsides of annualized calculation is that it is a lagging indicator of current fundamentals. It can also mask very recent (for instance, quarterly) history.

Year-to-date (YTD) rent growth, on the other hand, can provide some insight into recent performance momentum. Though far from a perfect metric, it can be telling at specific points of the year – particularly at the halfway point.

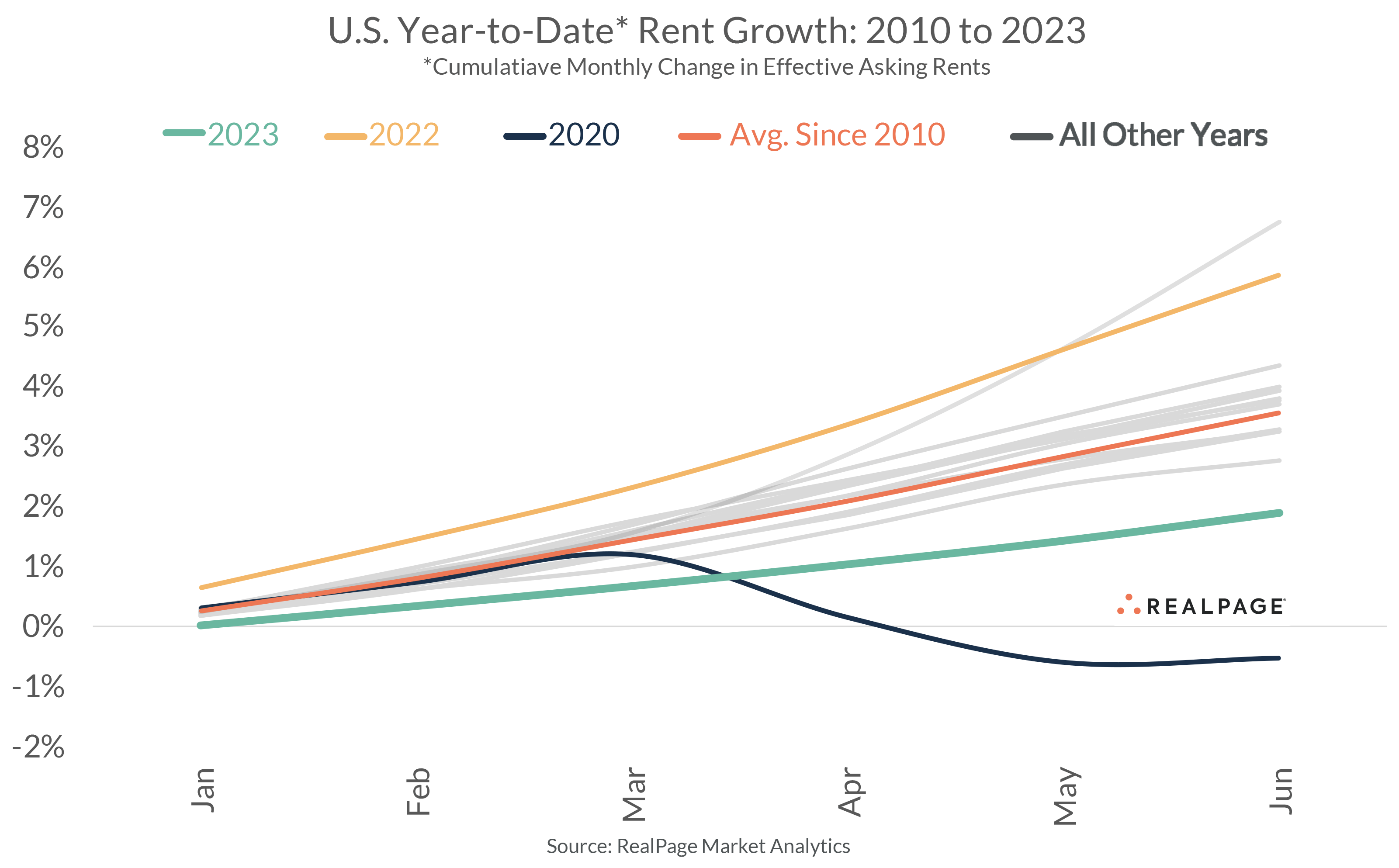

YTD rents have grown 1.9% across the U.S. (through June 2023), according to data from RealPage Market Analytics, which signals strong demand remains in the market. Similarly, occupancy has calmed somewhat in recent months and has only fluctuated 10 basis points (bps) since January to stand at 94.7% in June. This further signals the market is stabilizing after a challenging second half to the 2022 calendar year.

Still, YTD growth of 1.9% through June 2023 is modest-at-best within a historical context. In fact, that YTD figure comes in as the second weakest since 2010 (with lowest year being an outlier stemming from the COVID pandemic).

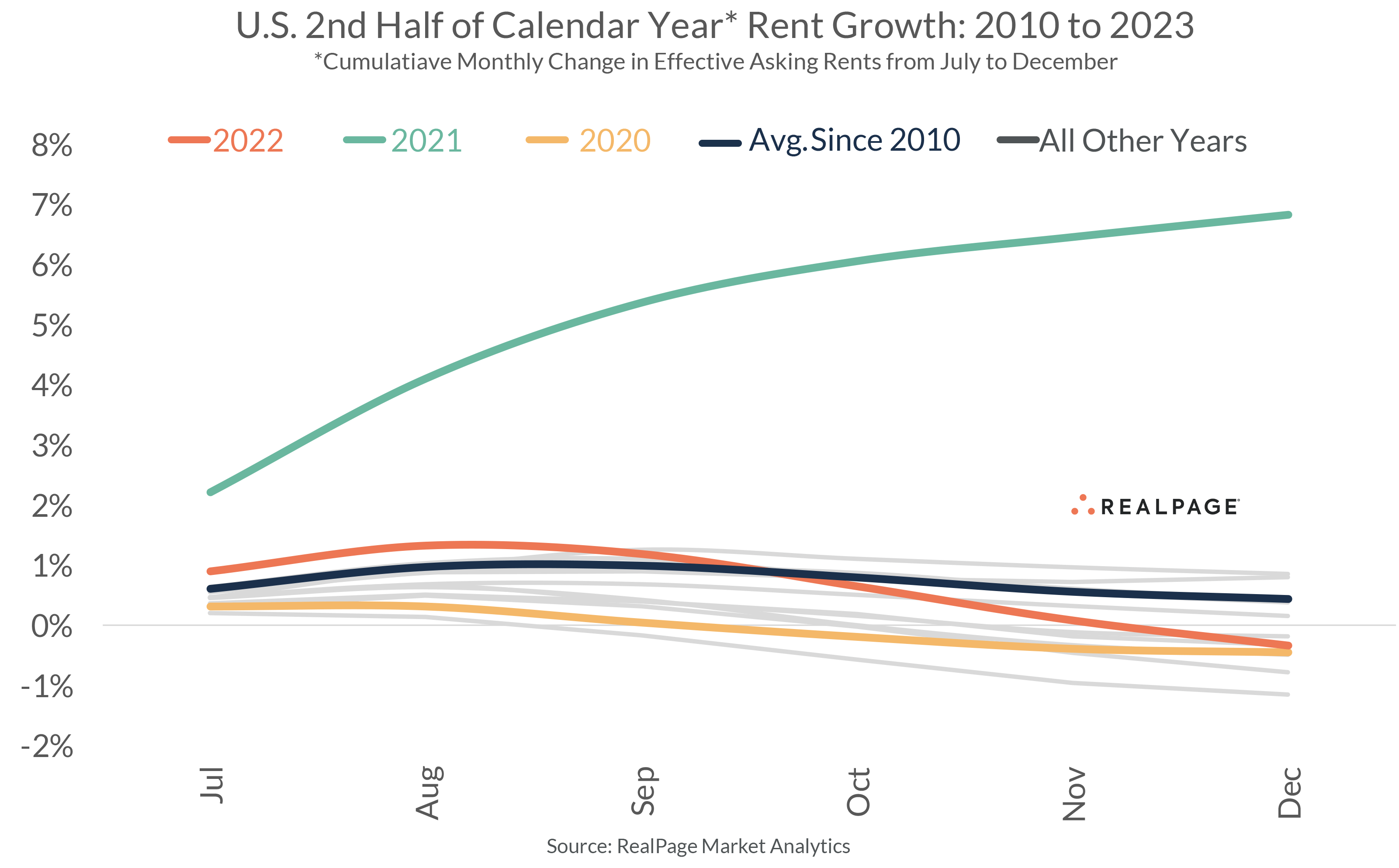

The lack of 2023 momentum might come as a surprise when comparing the two prior years (both of which were the strongest YTD growth rates since 2010). But isolating second half of the year rent growth (July to December) shows that the sluggish start to 2023 was actually beginning to emerge late last year.

Between July and December 2022, rents contracted by roughly 0.3%. That contraction clocks in larger than the average change in the second half of the year dating back to 2010 (+0.4% growth). It should be noted, though, that excluding the anomalous 2021 shows an average contraction of -0.1% during the second half of the year.

Stated differently, it’s common to see rent growth stall out (if not contract slightly) in the second half of the year as demand slows in line with seasonal norms. The real difference with 2022 was the exceptionally weak 4th quarter. Rents backtracked by more than 1% during 4th quarter 2022, the largest backwards step in 4th quarter rents since the Great Recession.

Thus, the sluggish start to 2023 isn’t quite as surprising, especially when considering the U.S. is on the precipice of a 50-year peak in apartment deliveries. In fact, new deliveries in the year-ending 2nd quarter 2023 (roughly 376,500 units) marks at least a 30-year high. Meanwhile, an additional 1,038,000 new market-rate units are currently under construction.

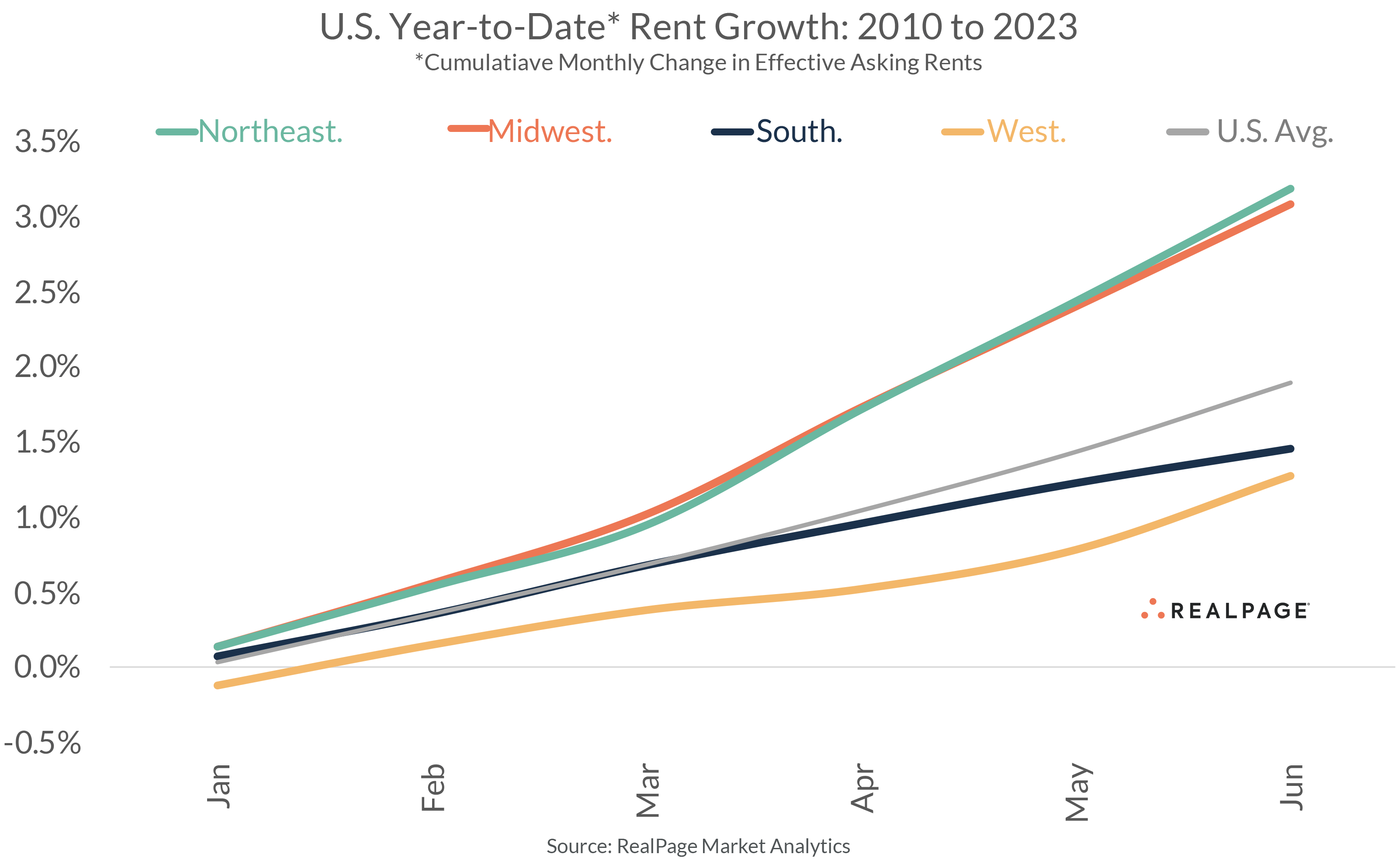

YTD regional variations are substantial – and are even larger within regions. By and large, the high-level regional takeaway serves as a microcosm for the national trend. In short, regions where supply is highest (primarily the South and West regions) are seeing less YTD rent growth momentum than the Midwest and Northeast regions.

The Midwest and Northeast regions are tracking remarkably close, posting YTD growth of 3.1% and 3.2%, respectively. Those two regions also have the fewest number of new units under construction (both with about 109,000 units) as of 2nd quarter 2023. About 50,000 units delivered in year-ending June 2023 in the Midwest region while 35,500 units delivered in the Northeast.

Momentum has been slower in the South region. Among those markets, YTD growth averages about 1.5%. Considering the sheer volume of construction in the region, however, this remains a testament to the strength of demand. An incredible 203,600 apartment units delivered in the year-ending June 2023. That accounts for 2.6% of all existing inventory.

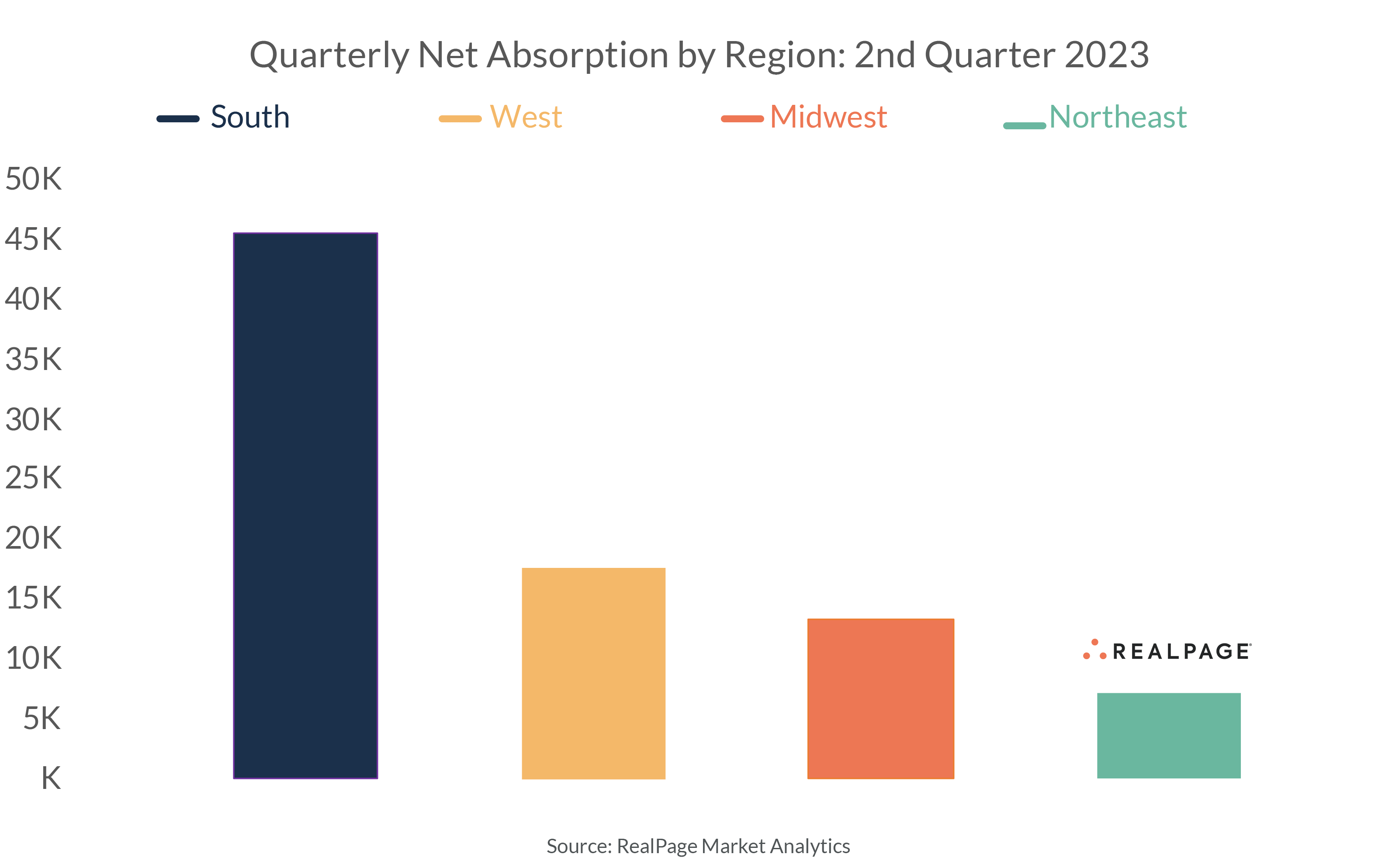

Still, the South is the only U.S. region to record positive absorption on an annual basis. And quarterly absorption (45,500 units) comes in about 20% greater than the total of the Midwest, Northeast and West regions combined.

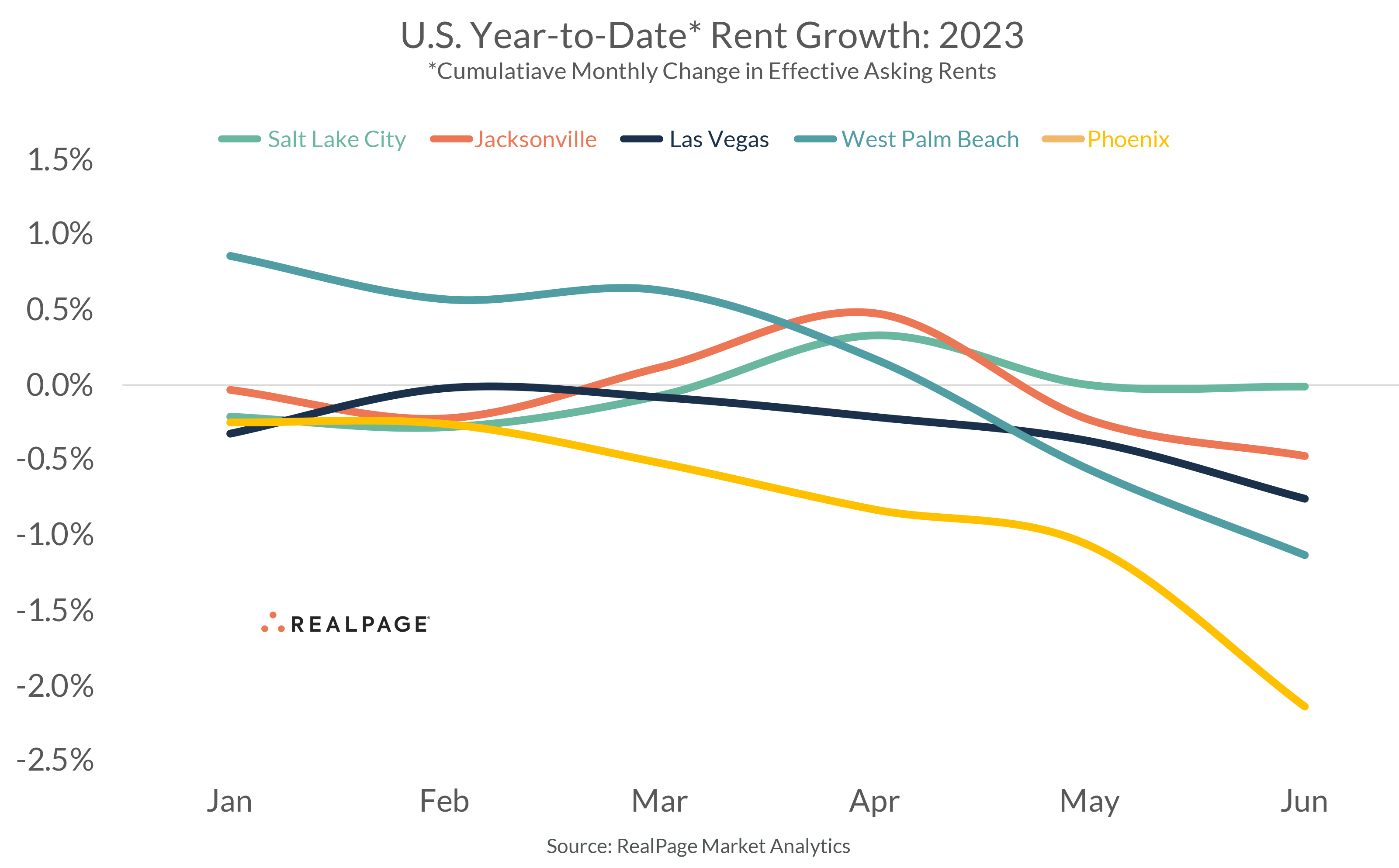

Clocking in with the weakest YTD rent growth is the West region. The West region – though not dealing with as much supply on aggregate as the South region – has some individual metro areas where the supply story is strong enough to cause weak (if any) rent growth. Three of the five weakest YTD growth rates belong to West region markets: Phoenix, Las Vegas and Salt Lake City.

Phoenix rents have fallen by 1.1% YTD in 2023, a signal of how rebalancing migration trends and a massive influx of new supply have impacted local performance. Las Vegas – though less supply driven and more demand driven – has seen rents fall by roughly 40 bps YTD. Salt Lake City meanwhile comes in at fifth-weakest in the country at 0.0% change. This market is one with a favorable long-term demand outlook. But a local record of 10% of all existing inventory scheduled to complete in the coming 12 months has resulted in a pause of rent growth.

It’s likely that more than a few markets will see year-over-year rent growth dip negative between August and October 2023, due to the nature of annualized calculations. Recall that it wasn’t until the late summer and early fall of 2022 in which monthly rent change started to stall. And now that the bigger growth months from early 2022 will be falling outside of the 12-month calculation window – and, in turn, be replaced by some of the weakest winter months on record – it wouldn’t be surprising to see rent cuts permeate many markets nationwide.

The good news is that demand appears to have turned a corner from the bearish 2022 figures. Though it’s reasonable to assume that supply outpaces demand in the highest supply markets, it can still be seen as positive sign that renter demand remains robust.