U.S. Apartment Demand Fell Notably Short of Supply in 3rd Quarter

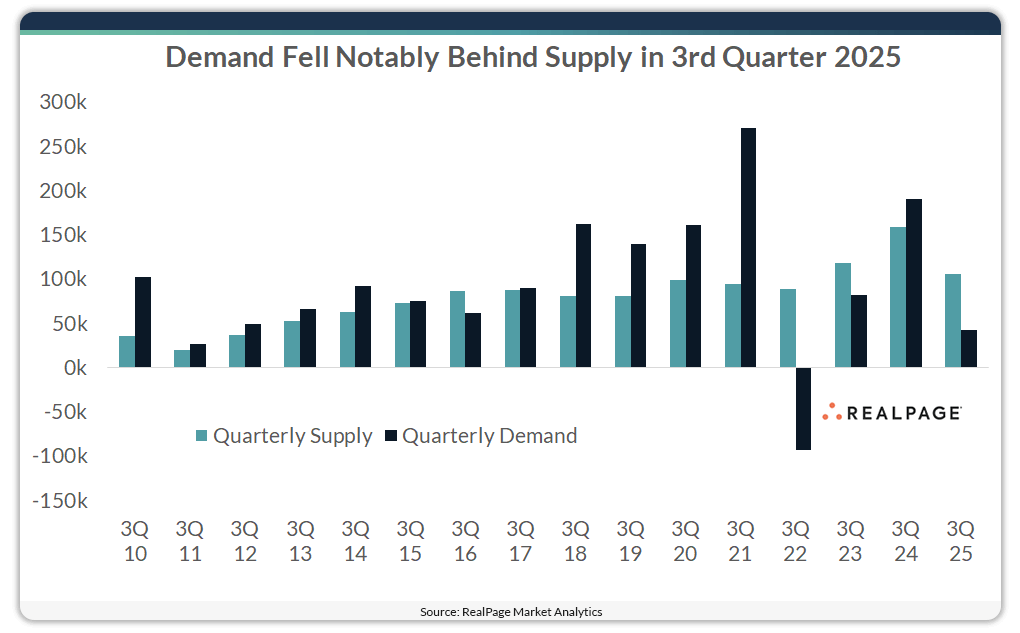

U.S. apartment demand slowed in 3rd quarter, coming in well behind concurrent supply volumes.

A little over 42,430 market-rate units were absorbed in the July to September time frame. This performance was about half the decade average for the market and quite a slowdown from what the U.S. has seen in much of the past two years. This pullback seems to be driven largely by softening employment numbers, gloomy consumer sentiment and general uncertainty in the economy.

Supply in 3rd quarter was also lower than what the market has seen in recent years, as the U.S. comes down from the delivery mountain that peaked in 2024. Still, at 105,525 units, supply for the quarter was still well ahead of concurrent demand.

Demand landed nearly 63,100 units short of concurrent supply in 2025’s 3rd quarter, marking one of the nation’s deepest 3rd quarter disparities in the RealPage database going back to 1993. Only 3rd quarter 2022 saw demand fall further behind supply, and that was the result of the deep net move-outs during the quarter.

Due to strong demand in the previous three quarters, nationwide absorption was still robust during the year-ending 3rd quarter 2025 at 637,079 units. And as supply continues to ease, demand disparity could rebalance in the near term.

For more information on the state of the U.S. apartment market, including forecasts, watch the webcast Market Intelligence: Q4 U.S. Multifamily Update.