U.S. Job Growth Surprisingly Strong in January

U.S. job growth accelerated sharply in January, amid efforts by the Federal Reserve to slow inflation with higher interest rates. Meanwhile, the U.S. unemployment rate dipped to a 54-year low. Employers’ steady demand for labor is keeping pressure on wage growth, and yet, pay increases aren’t keeping up with the high inflation rate.

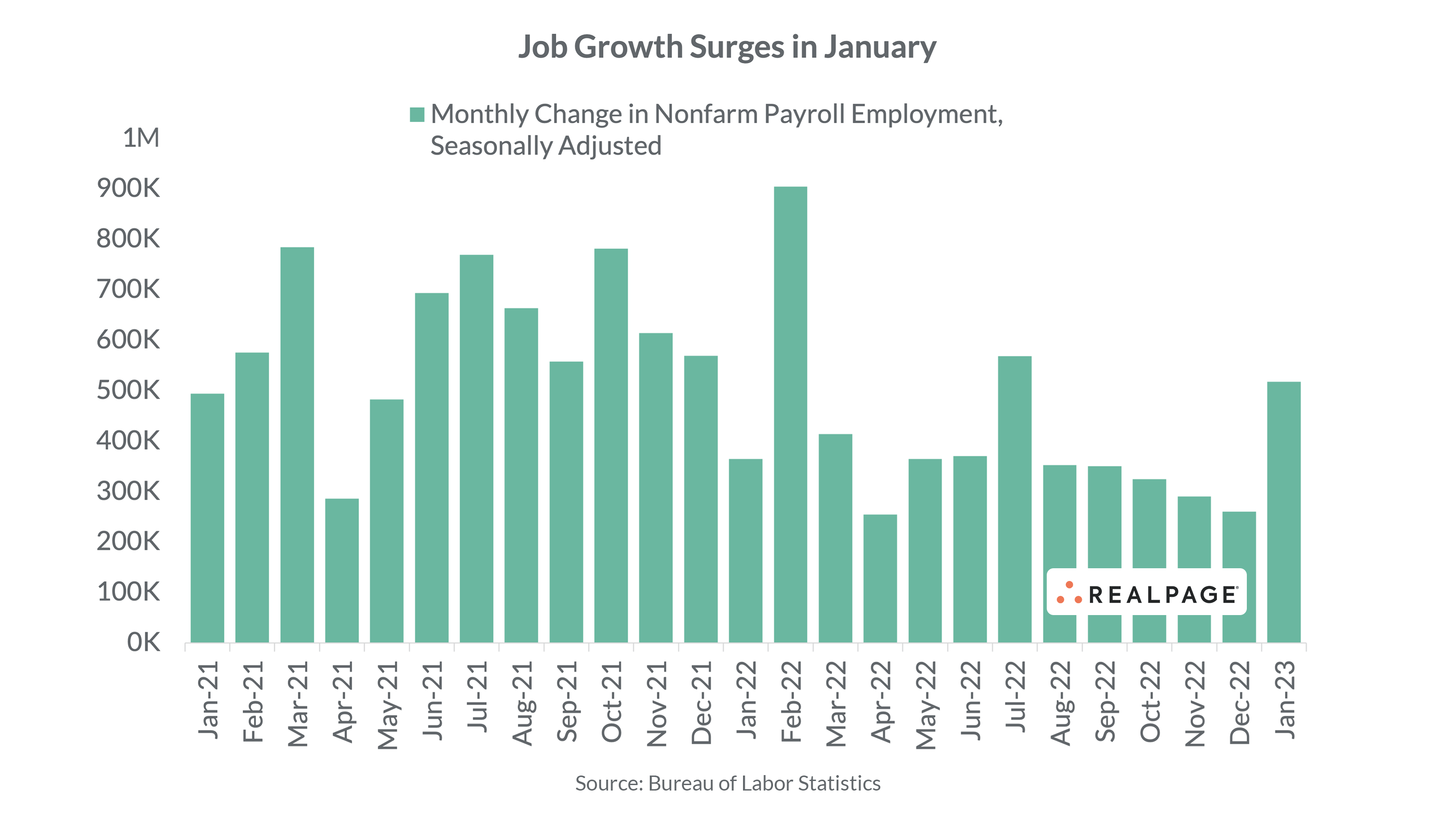

Roughly 517,000 employees were added to payrolls in January 2023, according to the Bureau of Labor Statistics (BLS). That was a far better result than the roughly 185,000 jobs economists projected for the month and well above December’s gain of 260,000 jobs. January’s jobs performance was the nation’s strongest monthly surge since July 2022. In addition, the recent job gains were above the monthly average of around 401,000 jobs added in 2022 and well above the average of roughly 190,000 jobs added each month from 2015 to 2019.

On an annual basis, the nation gained roughly 4.97 million jobs during the year-ending January 2023. Although down from the annual gains recorded throughout much of 2021 and 2022, it was well above the average of around 2.4 million jobs added annually from 2015 to 2019.

Upward revisions to November 2022 data showed 34,000 more jobs were added than previously reported, up to 290,000 jobs. The December 2022 job growth number was also revised up, with an additional 37,000 jobs, to a total of 260,000 jobs. With these revisions, employment gains in November and December combined were 71,000 higher than previously reported.

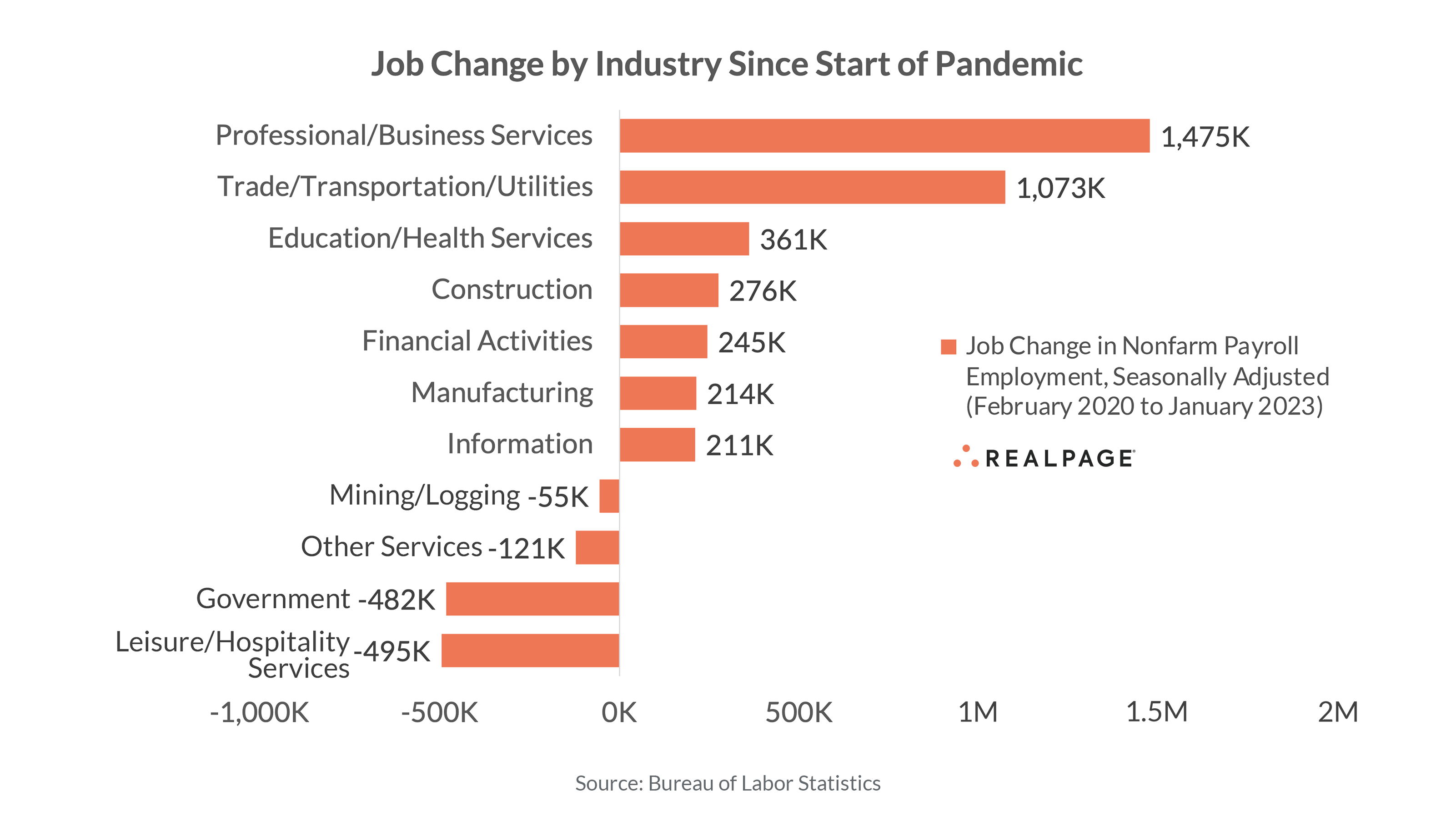

The U.S. economy has recovered all the net jobs lost during the COVID-19 pandemic. As of January, the nation had over 2.7 million more jobs (+1.8%) compared to the pre-pandemic employment level from February 2020.

Jobs by Industry

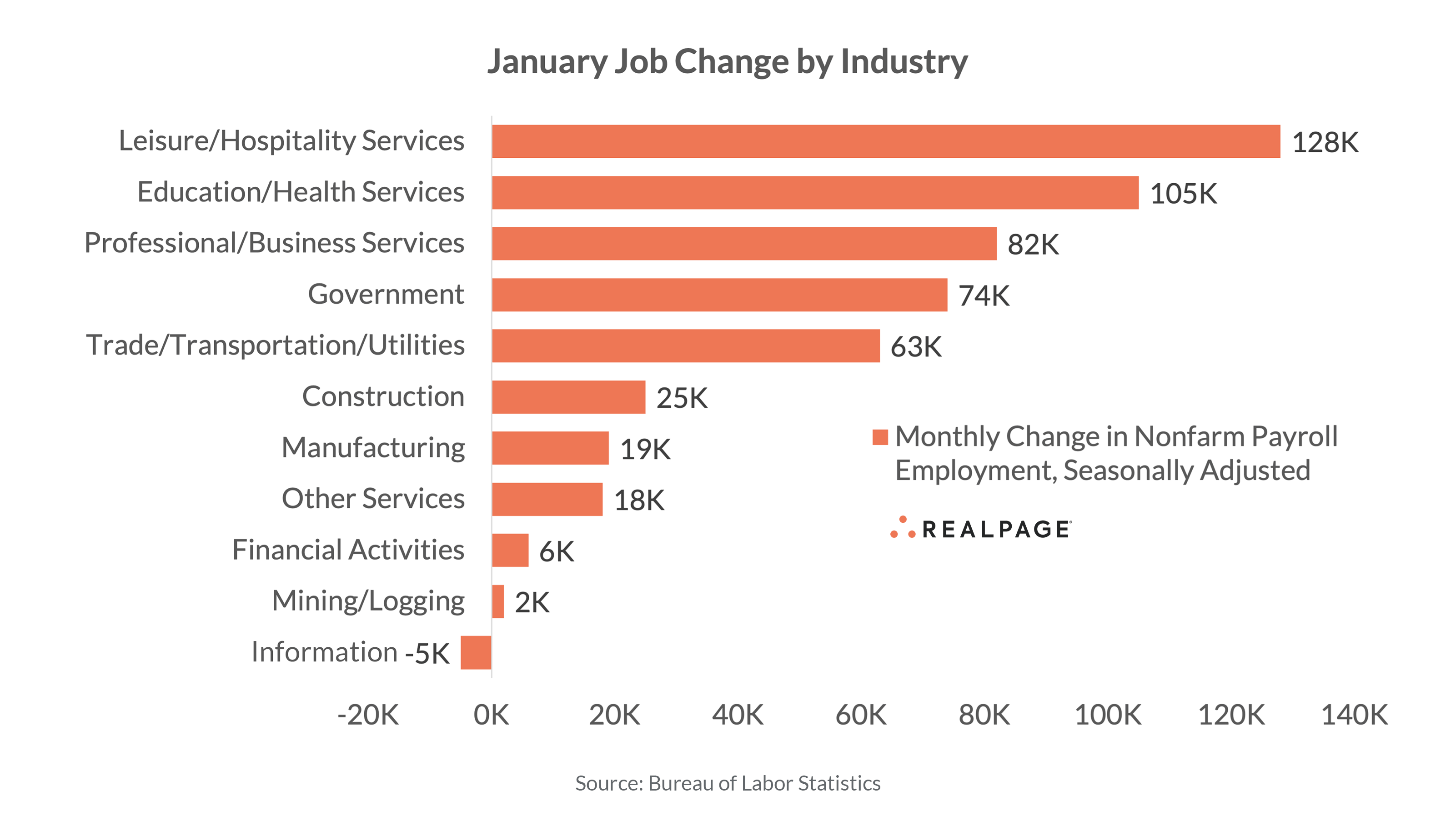

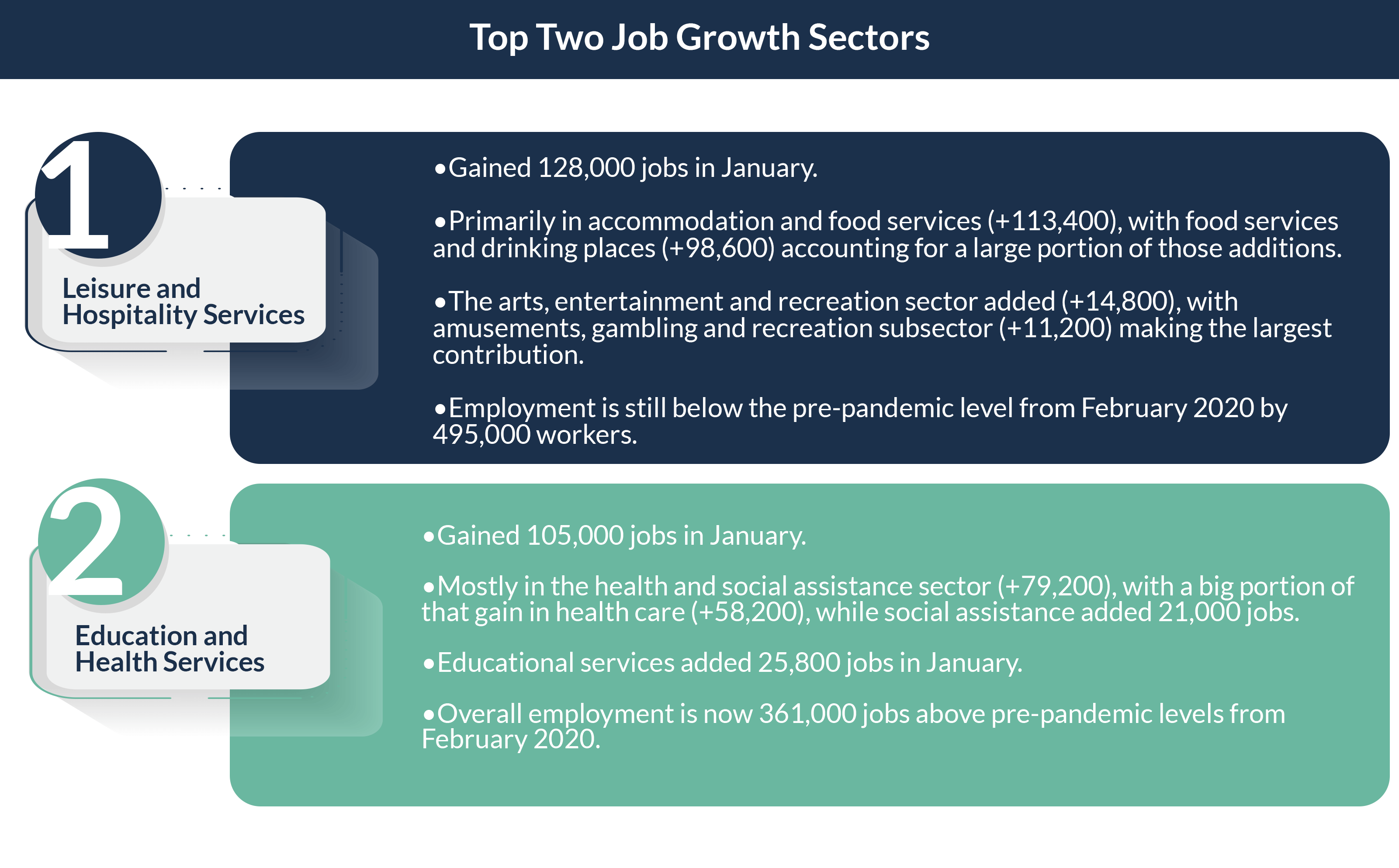

Job growth in January was widespread, with the biggest monthly job gains in Leisure and Hospitality Services, Education and Health Services and Professional and Business Services. The job additions in the Government sector partially reflected the return of university workers after a strike. Information was the only major industry to record a job loss during the month.

Most job sectors have recovered all the jobs lost during the COVID-19 pandemic downturn. Professional and Business Services has seen the best recovery, with today’s job count coming in nearly 1.5 million positions ahead of February 2020 numbers. Trade, Transportation and Utilities is also well ahead of pre-pandemic norms, with employment up by nearly 1.1 million jobs.

Alternatively, some of the harder-hit sectors remain below pre-pandemic job counts. Despite recent gains, employment in the Leisure and Hospitality Services sector is still well below its pre-pandemic employment count, by roughly 495,000 workers. The Government sector is about 482,000 jobs behind February 2020 levels. Other job sectors yet to recover all jobs lost during the COVID-19 downturn are Other Services (-121,000 jobs) and Mining and Logging (-55,000 jobs).

Unemployment

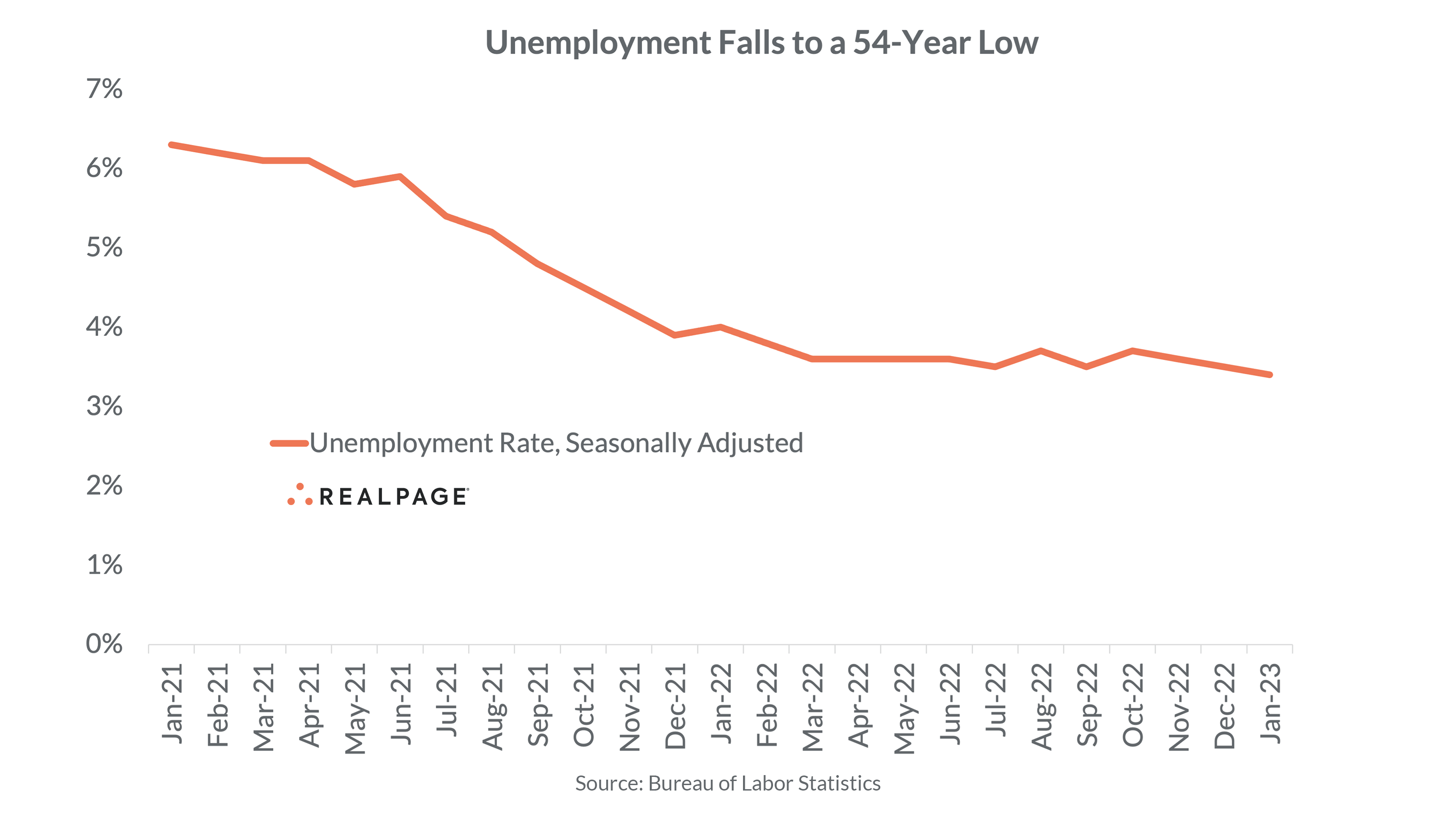

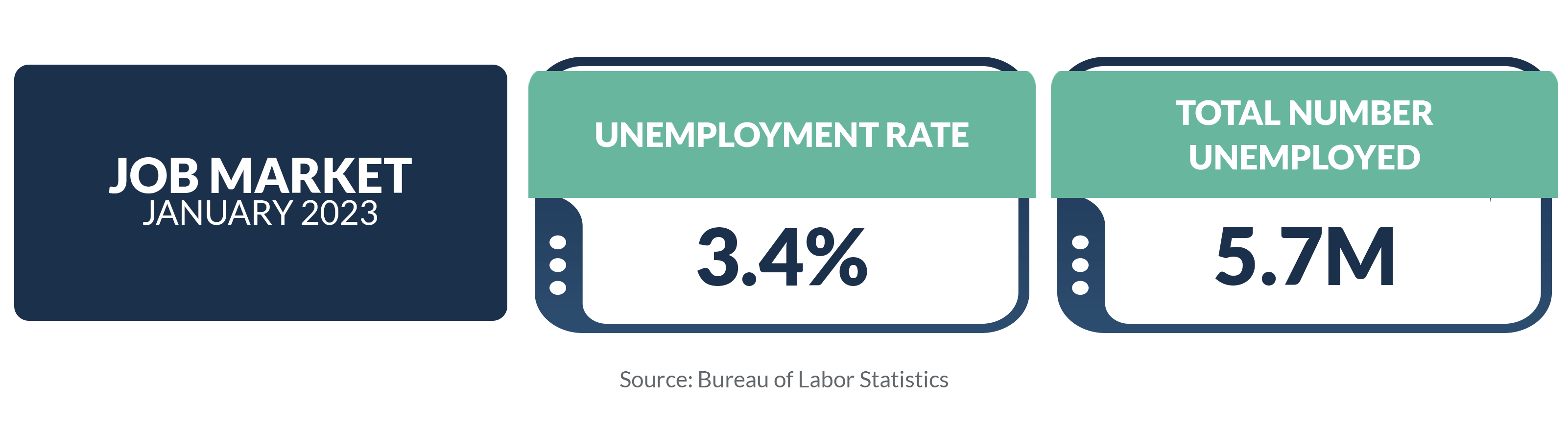

The unemployment rate (U3 or headline unemployment rate) edged down from 3.5% in December to 3.4% in January. That was the nation’s lowest unemployment rate since May 1969. The unemployment rate has been in a narrow range of 3.5% to 3.7% since March 2022. At the onset of the pandemic, the unemployment rate climbed to 14.7% in April 2020. Prior to the pandemic, the unemployment rate clocked in at 3.5% to 5.7% from 2015 to 2019, averaging 4.4% during that period.

The total number of unemployed in the U.S. remained at roughly 5.7 million in January, with little movement from December.

The unemployment rate for adult men increased 10 bps from December to January, rising to 3.2%. The unemployment rate for adult women decreased 10 bps, falling to 3.1%. Meanwhile, the unemployment rate for teenagers decreased 10 bps from 10.4% in December to 10.3% in January.

Across 12 major industries, unadjusted unemployment rates declined in two from December to January. Decreases were recorded in Mining (down 160 bps to 0.3%) and Financial Activities (down 30 bps to 2.3%). The unemployment rate in Professional and Business Services was unchanged from December to January, at 3.5%. Conversely, the biggest increase in unemployment was recorded in the Construction industry, up 250 bps to 6.9%. Information and Wholesale and Retail Trade also recorded notable upturns, rising 150 bps from December to January, to 3.9% and 5.1%, respectively.

The highest industry unemployment rates (not seasonally adjusted) in January were in Construction (6.9%), Leisure and Hospitality Services (6.0%) and Wholesale and Retail Trade (5.1%). The lowest unemployment rates were in the Mining (0.3%) and Government (1.9%) sectors.

Average Hourly Earnings

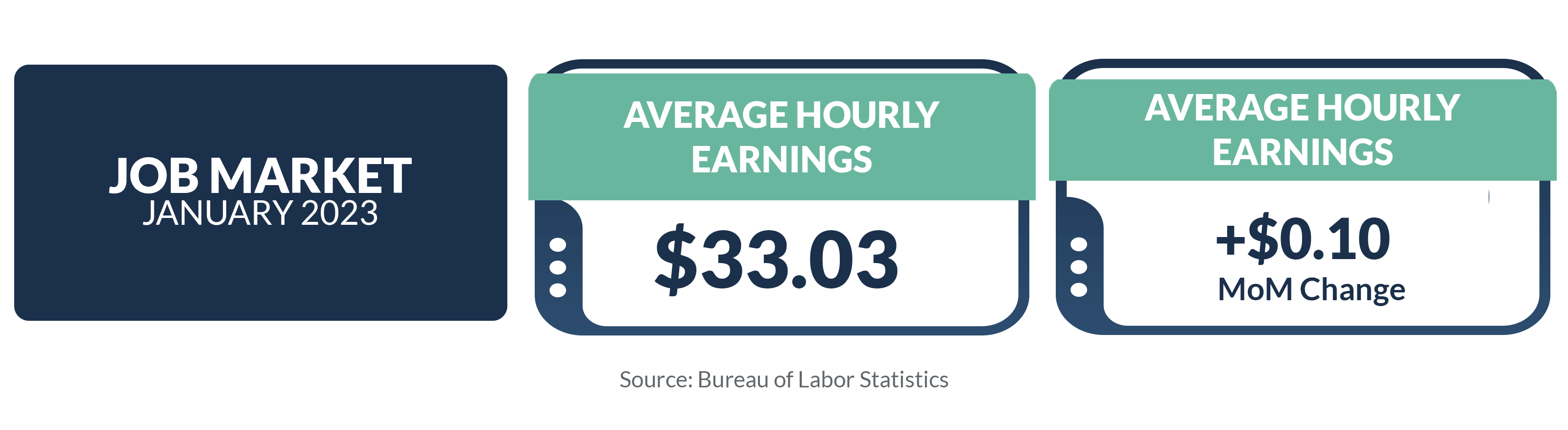

Average hourly earnings among employees on private nonfarm payrolls rose $0.10 (+0.3%) from December to January. That monthly increase took average hourly earnings to $33.03 in January. On an annual basis, average hourly earnings were up $1.40, a 4.4% increase year-over-year. However, wages were outstripped by inflation, as the Consumer Price Index (CPI) rose 6.5% in the year-ending December.

Wage growth over the past year varied by industry, ranging from a year-over-year increase in hourly wages of 3.2% among Manufacturing employees, to a jump of 7.0% among Leisure and Hospitality Services workers.