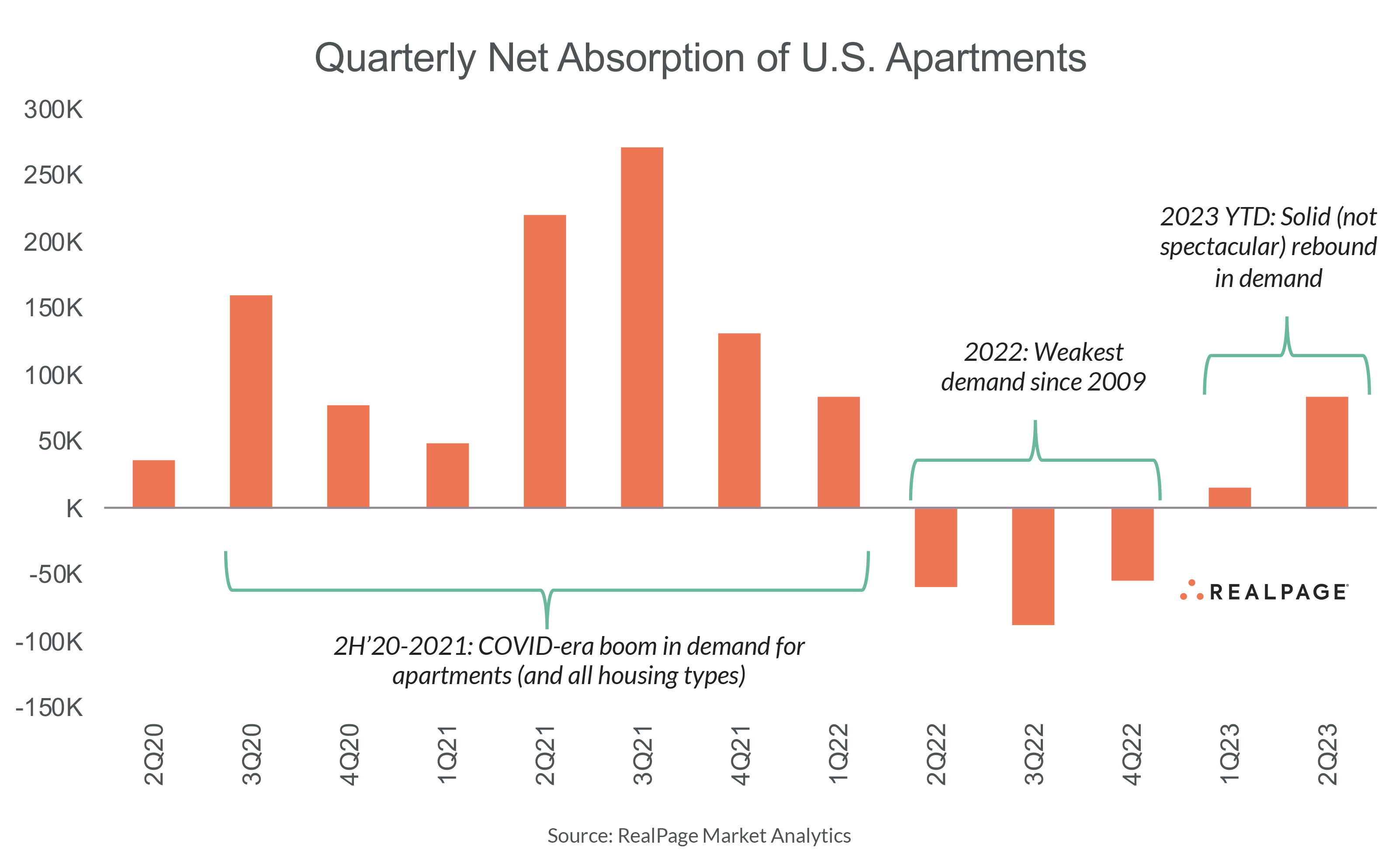

The U.S. apartment market has changed quite a bit in the past year, going from significant demand loss in 2022 to more normalized absorption in the first half of 2023.

After the extreme volatility in the pandemic, experts hoped to see the return of notable traffic translating into demand in 2023. As of 2nd quarter, that trend is starting to come to fruition.

While not spectacular, demand returned to the market in the first half of 2023. In 2nd quarter alone, roughly 84,000 units were absorbed. Though below long-term averages, that was a sizable amount of demand following 2nd quarter 2022, when deep loss was the prevailing trend.

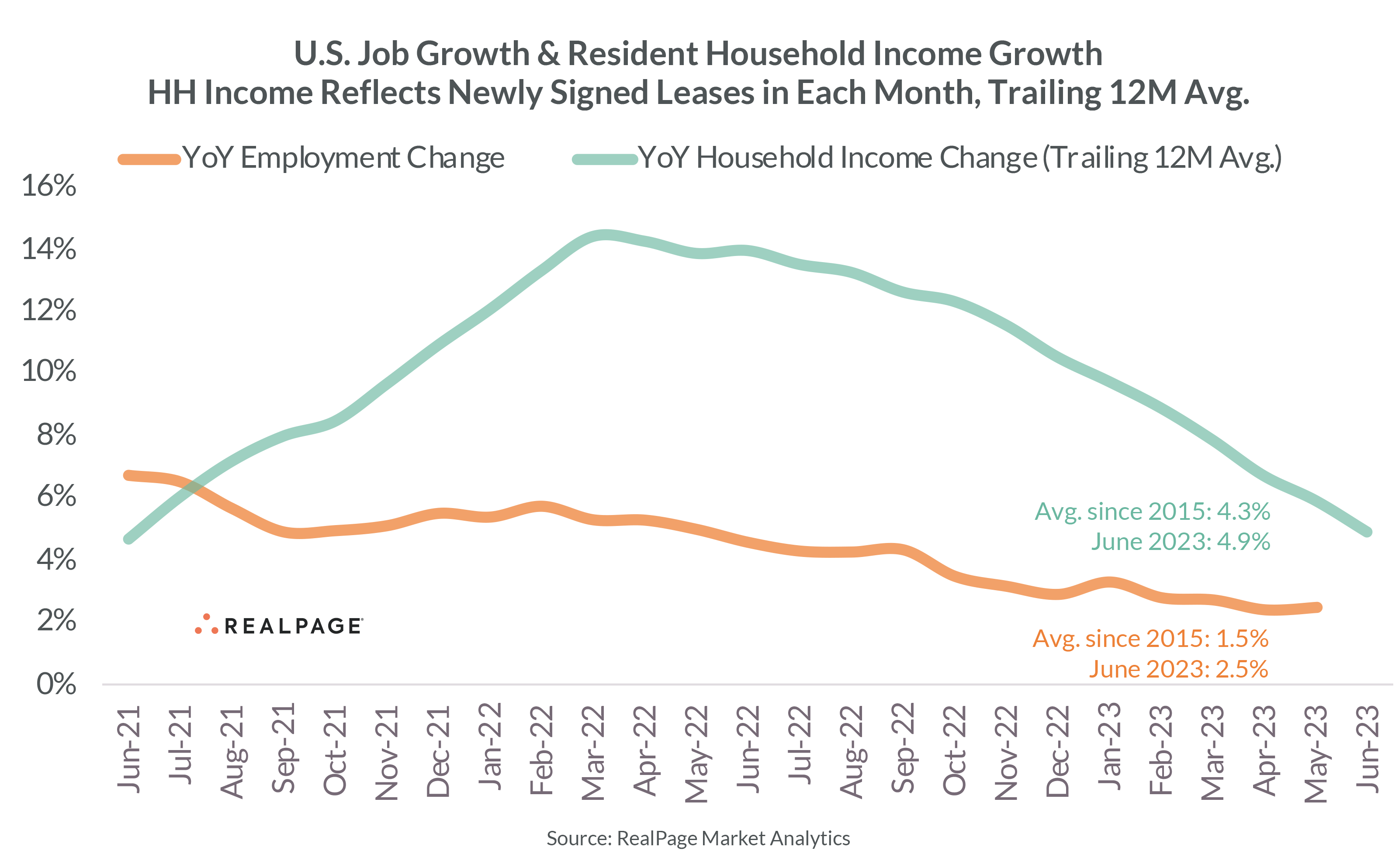

Until recently, there had been a disconnect between what job growth and income growth signaled should be happening in the market – and what was actually happening. Both job and income growth were strong throughout 2022, but those demand drivers did not align with weak apartment demand and consumer confidence.

In the first half of 2023, some of that pent-up apartment demand finally showed up, despite job and income growth easing from former highs.

Additionally, new lease traffic has been strong, indicating renters are shopping around as record volumes of supply have expanded their options. Thus, rent growth is faltering as supply does what it’s supposed to do – slow down intense price increases.