Urban Cores No Longer Grossly Underperforming Suburban Counterparts

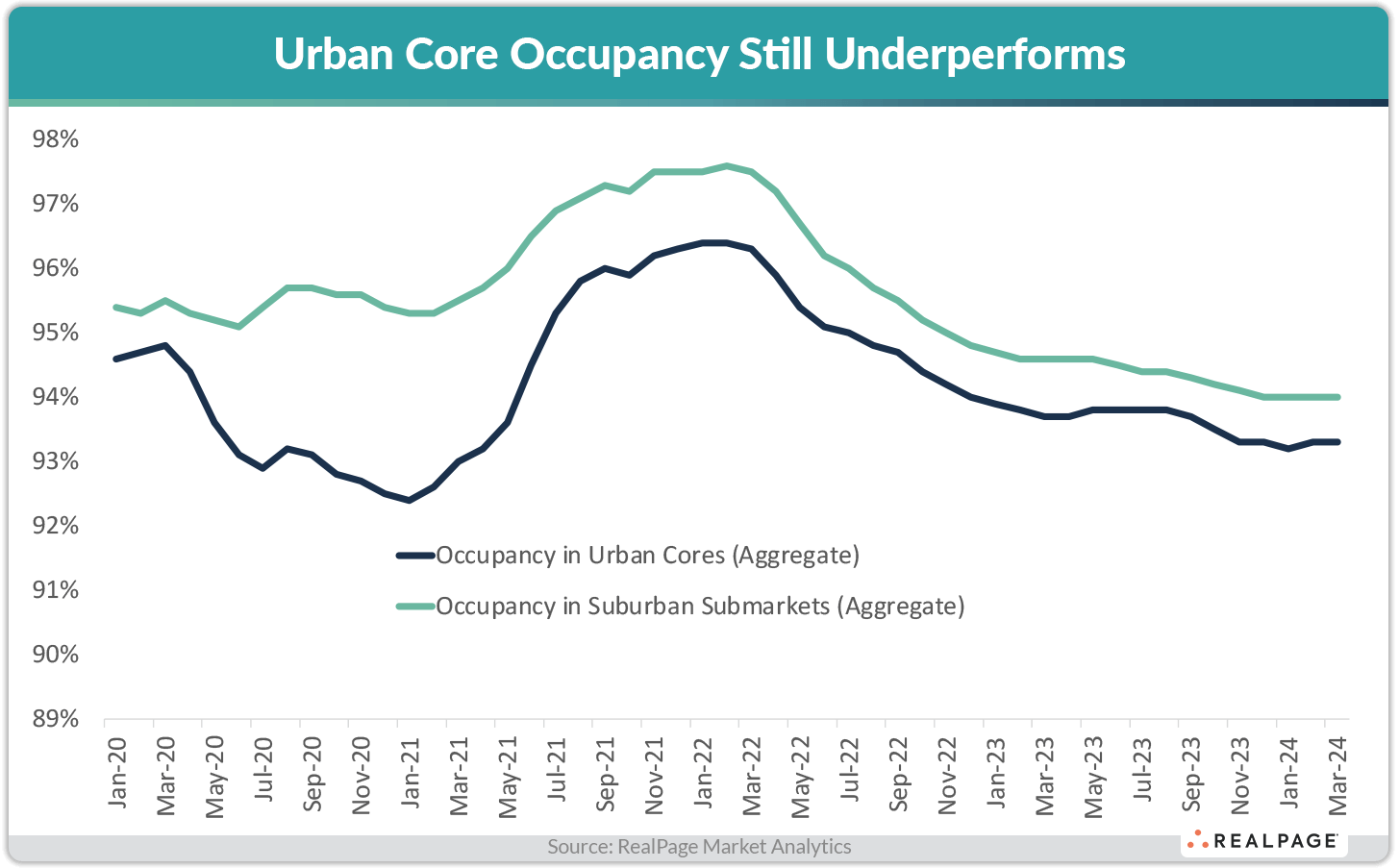

In a typical, pre-pandemic world, urban core submarkets generally underperformed their suburban counterparts by a small margin. Urban core occupancy typically fell less than 100 basis points (bps) below suburban occupancy. Likewise, annual effective rent change in urban cores underperformed suburban counterparts by about as much.

Then came the pandemic. Arguably no apartment niche was hit harder than downtowns, especially in gateway markets. Residents fled, taking up residence in cheaper, bigger, more suburban units where they could easily work from home. Most urban core operators had turned to rent cuts by 2nd quarter 2020 and continued cutting rents for at least another year.

Four years later, urban core submarkets are once again performing approximately in line with pre-pandemic patterns. That is, urban cores still underperform suburban counterparts – but about at the margin that was typical before early 2020.

Among the 50 largest apartment markets, RealPage tracks nearly 700 individual submarkets. Each of the top 50 markets has at least one urban core submarket, a proxy for that market’s downtown or central business district. A few markets have multiple urban submarkets (such as Washington, DC, San Francisco or Atlanta). Most markets’ submarkets tend to be overwhelmingly suburban, meaning that the suburban submarket aggregate is quite a bit more diverse and inclusive than the relatively narrow set of urban cores.

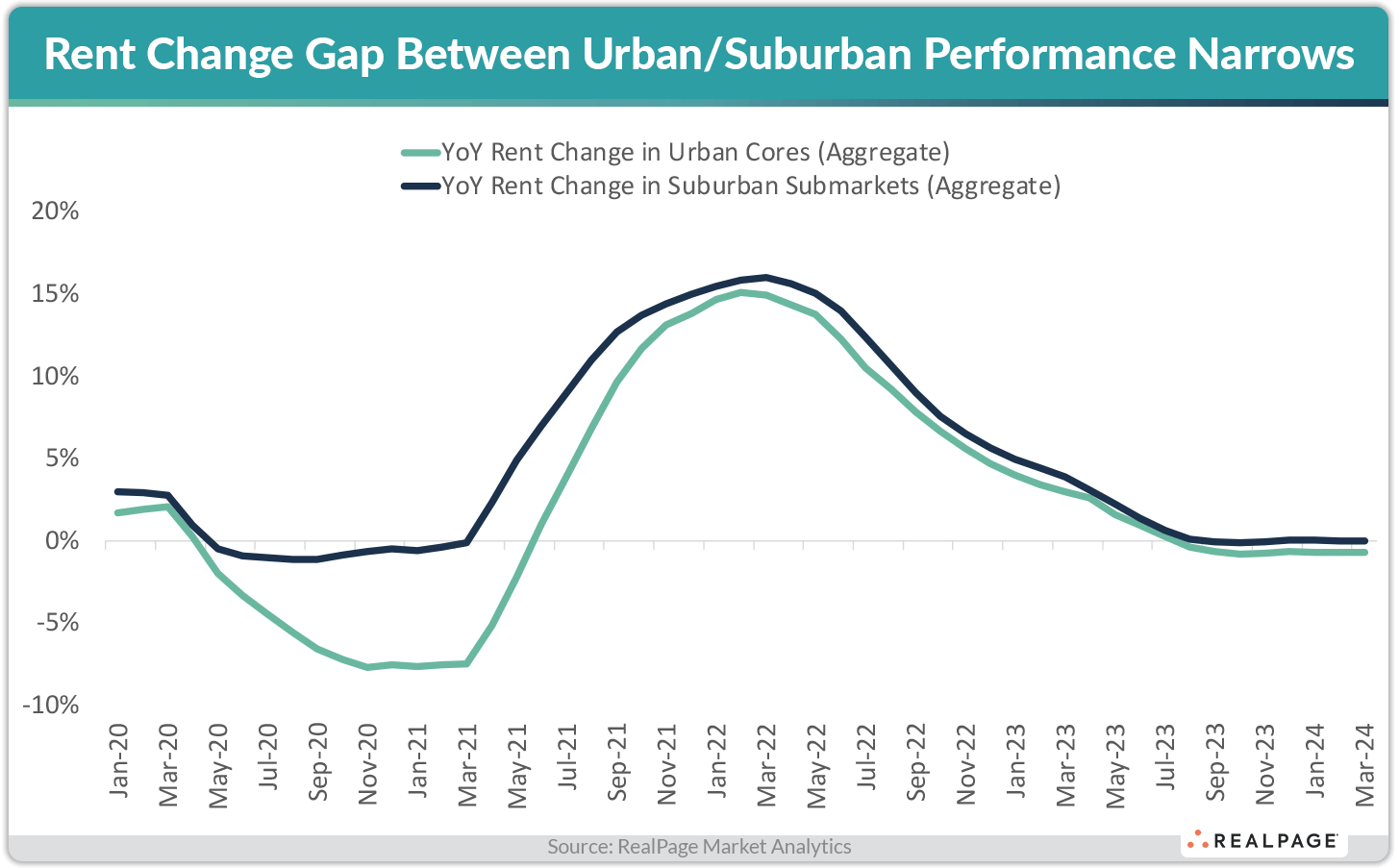

As of March, average annual rent change in urban cores clocked in at -0.7%. That marked an aggregate of over 50 urban cores within RealPage Market Analytics’ 50 largest apartment markets. Some select urban submarkets were growing rents at a strong pace in March, such as Milwaukee’s Downtown/Shorewood or Central Cleveland, but most were posting rent cuts, including the deepest declines in Downtown Atlanta and Central Nashville.

Suburban submarkets, meanwhile, posted no rent change (0.0%) on average as of March. Much like the nation at large, that reading for suburban submarkets has been near stagnant since August 2023. That 70-bps delta between urban and suburban performance marked a return to normal patterns after deepening as far as a 750-bps difference in mid-2021. At that time, apartment operators in urban cores were, on average, cutting rents deeper than 5% on an annual basis, while suburban submarkets were, on average, still posting rent growth of over 2%.

That time – early to mid-2021 – was also the same period that occupancy in urban cores underperformed by the widest margin, posting rates nearly 300 bps below suburban counterparts, on average.

Much like rent change, occupancy in urban areas generally underperforms that of suburban areas – and that delta grew into a chasm by late 2020 and through mid-2021. The gap closed more recently, as urban cores posted, on average, an occupancy rate of 93.3% in March, compared to a rate of 94% in suburban submarkets. Again, that roughly 70-bps difference has held steady for several months.