As supply volumes drop across the U.S., some individual apartment markets are logging pronounced declines.

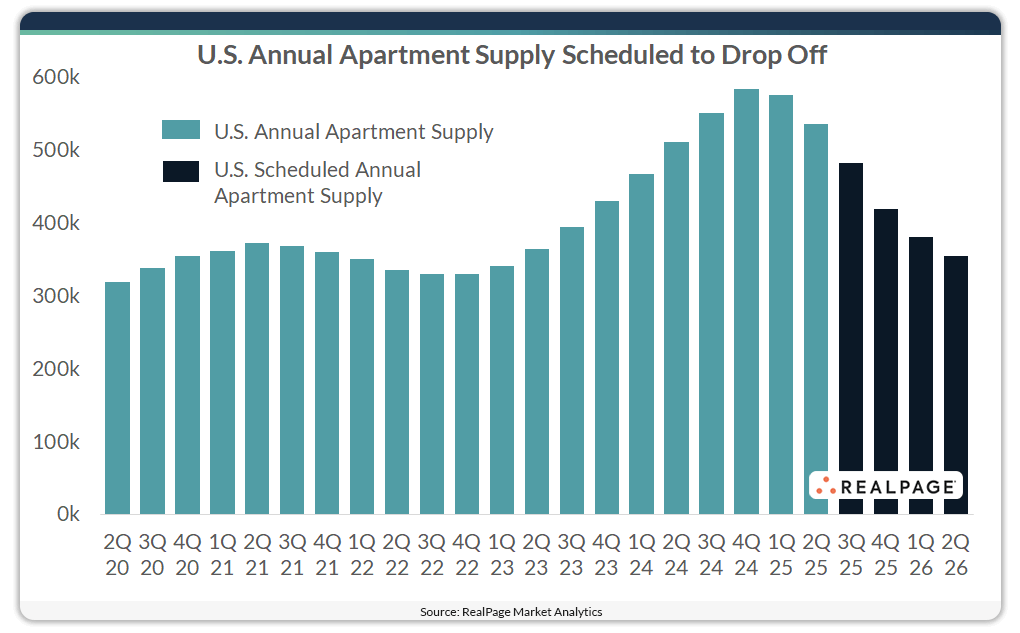

In the U.S. overall, just over 354,000 units were under construction at the end of 2nd quarter and scheduled for completion in the coming year. That is a 33.9% decline from the roughly 535,800 units completed in the year-ending 2nd quarter 2025, according to data from RealPage Market Analytics.

Next year’s scheduled supply in the U.S. marks a return to a more normal supply environment. In the past decade, supply volumes averaged roughly 360,000 units annually, elevated notably by the record volumes from the past few years.

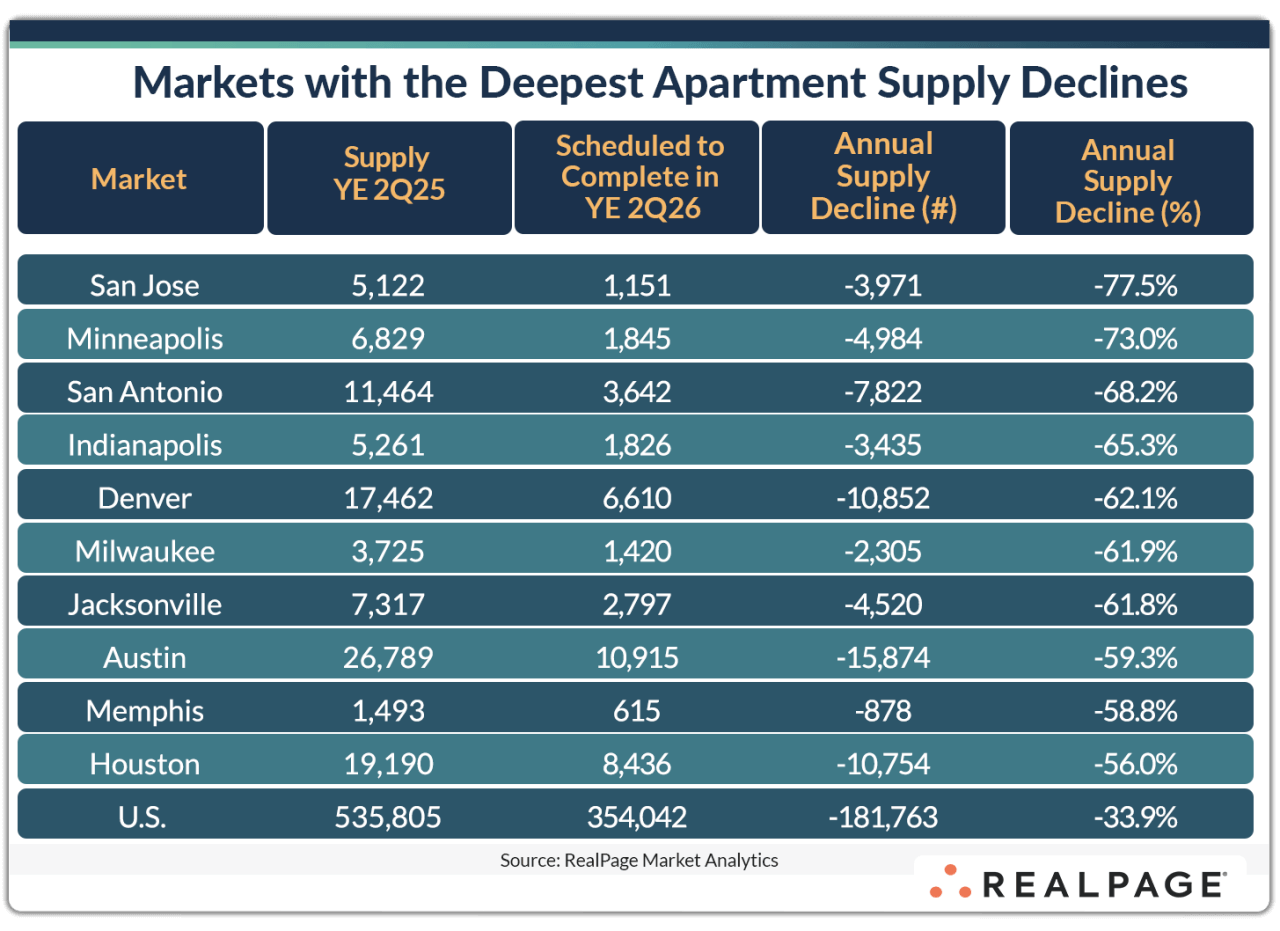

Across the nation, most big and small apartment markets alike are set to see declining supply volumes in the coming 12 months. Among the nation’s 50 largest apartment markets, seven are scheduled to see delivery volumes fall by roughly twice the national pace – about 60% or more – in the coming year.

The sharpest decline in apartment supply in the coming year is set for San Jose. New apartment completions in San Jose hit a record pace of 5,122 units delivered in the year-ending 2nd quarter 2025. At the end of the quarter, there were 2,008 units under construction in San Jose, with 1,151 of those units scheduled to complete in the coming year. That’s a 77.5% decline from last year’s pace and hits well behind the market’s decade average of 3,092 units delivered annually.

The only other West region market on this list is Denver, which was one of the nation’s biggest centers for apartment deliveries in the year-ending 2nd quarter 2025 with the completion of 17,462 units. Just over 6,600 units are slated to wrap up construction in the next 12 months in Denver, which represents a decline of 62.1%.

Three Midwest region markets are scheduled to see drastic supply declines in the coming year. Minneapolis, Indianapolis and Milwaukee are all slated to see their supply volumes come down by roughly 60% to 70% by the end of 2nd quarter 2026.

San Antonio is seeing the South region’s deepest relative decline in apartment supply in the coming year. Roughly 3,600 units are under construction and scheduled to complete by the end of 2nd quarter 2026, which is 68.2% less than completed last year.

Just missing the 60% decline mark were South region markets Austin, Memphis and Houston, where supply volumes are scheduled to come down by 56% to 59%. Austin is the market with the nation’s deepest volume decline in the coming year, with deliveries dropping by 15,874 units. It’s worth mentioning, fellow Texas market Dallas is also seeing supply come down by about 15,000 units in the coming year, representing a relative decline of 44.4%.

In contrast, read about the handful of markets scheduled to see supply increase next year.