Apartment Operators Cut Rents in San Antonio Amid Record Supply

Apartment demand remains near record levels in San Antonio, spurred by all-time highs in apartment supply. But operators here know how to hold onto renters and have been cutting rents to keep up with hefty completion volumes.

In the early 2020s, San Antonio saw a surge in multifamily construction, driven by strong population growth and pandemic-fueled migration favoring Sun Belt markets. Developers responded to strong demand enthusiastically, adding nearly 33,600 new units in the past five years, according to data from RealPage Market Analytics.

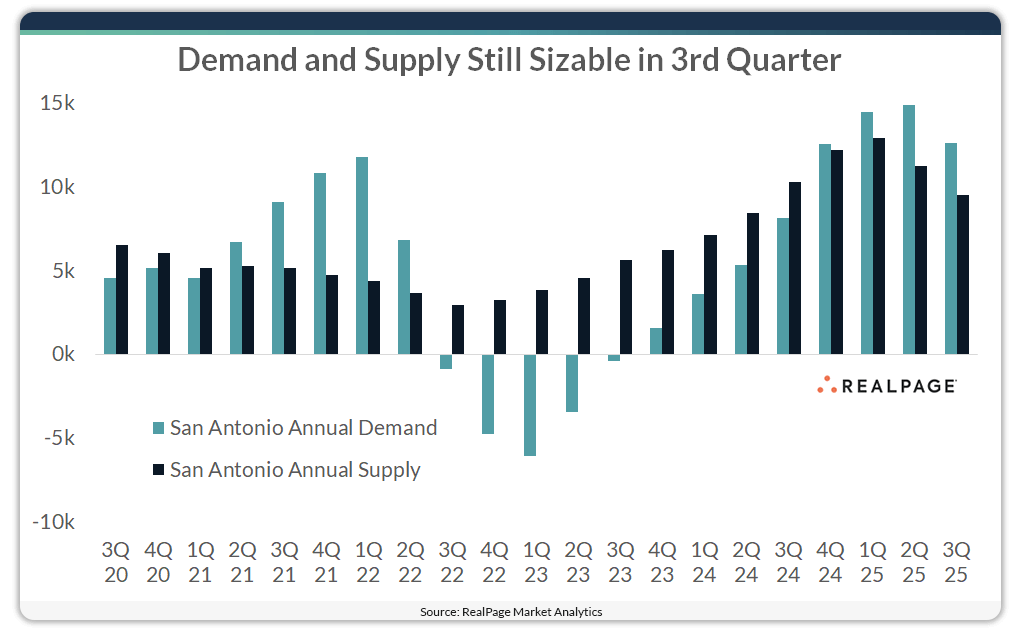

Annual supply volumes hit an all-time high in early 2025, when 12,900 units were delivered. Demand in San Antonio topped that mark and continued to gain momentum and peaked at more than 14,870 units in 2nd quarter 2025. In 3rd quarter, both supply and demand volumes dropped from those recent peaks but remained robust compared to historical norms.

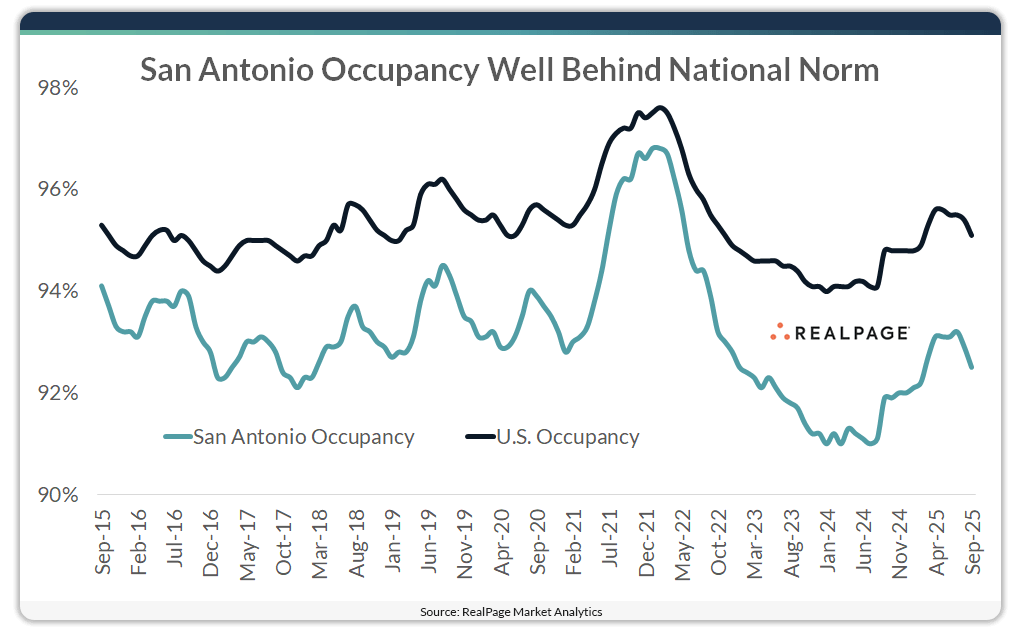

With such solid supply and demand performances, you’d expect occupancy to be in top shape in San Antonio. But occupancy here was at 92.5% in September, the lowest reading among the nation’s largest 50 apartment markets. Notably, neighboring Austin had the second-softest performance in September with occupancy at 93%.

While September occupancy in San Antonio was above the market’s recent low point of 91% in 2024, it was well below the market’s peak near 97% in 2022.

San Antonio operators have kept rents low in an effort to hold onto occupancy recently. In fact, this was the nation's most affordable large apartment market, with monthly rents averaging $1,172 as of September. San Antonio was the only market nationwide to see prices under $1,200 as of September.

Just five years ago, six other markets ranked below San Antonio for monthly prices. Most of those were Midwest markets, but two other South region markets – Greensboro and Memphis – were also more affordable than San Antonio.

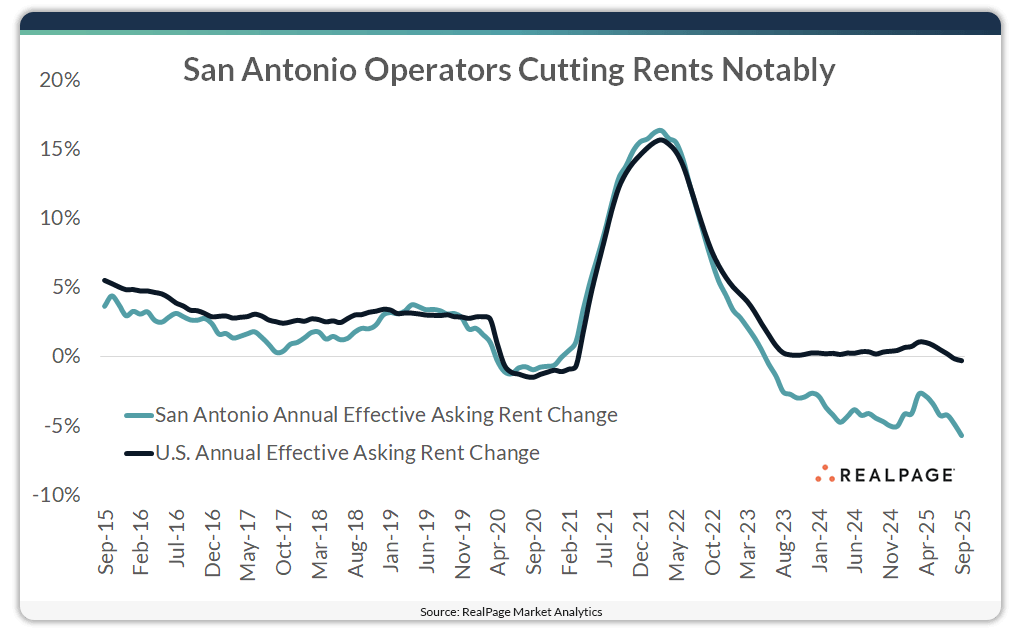

In the past five years, however, price positioning has been very reserved in San Antonio, with rents growing just $155 between September 2020 and September 2025. That was one of the smallest increases nationwide, tying with the growth in neighboring Austin. Denver had the nation’s third-smallest price increase during that time frame, with rent growth at nearly $100 more that San Antonio and Austin.

More recently, prices in San Antonio were cut 5.8% in the year-ending September. Only Austin and Denver saw a steeper decline. Annual price cuts have been the norm for San Antonio since June 2023.

The San Antonio apartment market has become increasingly competitive, with operators offering concessions to attract residents. Over 28% of conventional units were offering concessions in September. That was the biggest volume nationwide followed closely by Austin and Denver. The size of concessions, however, was only about 10%, which was about even with national trends. Austin and Denver, on the other hand, were offering concessions of 12% to 13%.