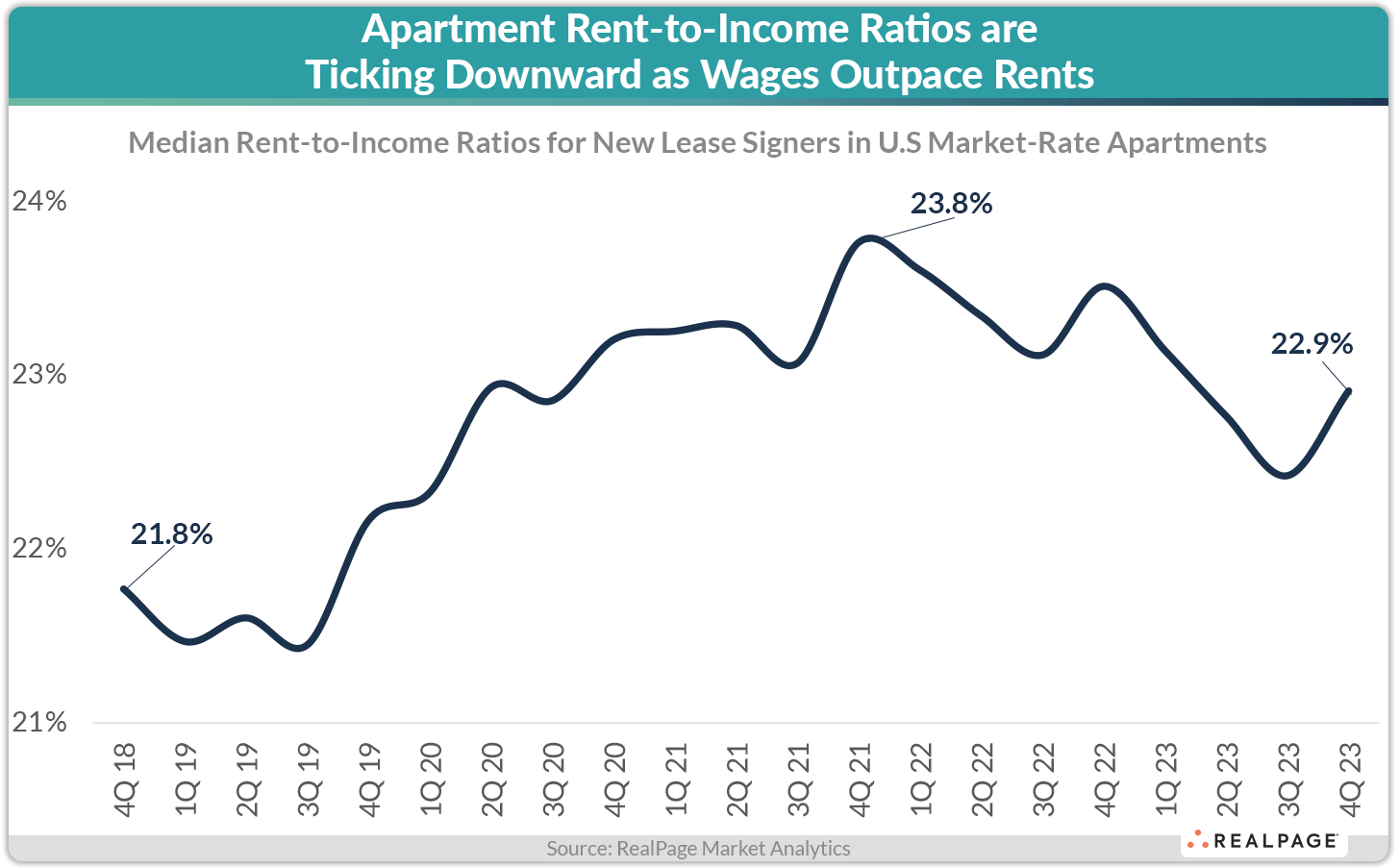

Here's some good news: Apartment rent-to-income ratios declined in 2023 as incomes grew faster than rents. The median U.S. household signing a new lease for a market-rate apartment came in with a rent-to-income ratio of 22.9% in 4th quarter 2023, down 90 basis points (bps) from the peak and down 60 bps year-over-year, according to data from RealPage Market Analytics.

In fairness, rent-to-income ratios remain slightly above the pre-COVID norms of around 22%, given that rents outpaced wages during the peak inflationary period.

But market-rate apartment affordability is steadily improving thanks to the onslaught of new supply cooling off rent growth, even as wages keep rising. This is good news for renters AND operators.

When wages outpace rents, it widens the demand funnel for rentals at all price points. This trend should almost certainly continue through 2024 with more supply on the way and rent growth likely to remain minimal.

Whenever I share this data, I get questions on methodology so let's talk about that. This approach mirrors how most REITs report on affordability (and indeed, all of them are in the low- to mid-20% range similar to this data). We take the household income (with roommates) reported on the lease application along with the executed rent, then calculate each household's rent-to-income ratio. We then take the median ratio. (Note this does not include renewals since renters typically do not report incomes at renewal.)

Other measures routinely inflate rent-to-income ratios due to poor methodologies. You can't just mash together incomes and rents from different datasets, as most researchers do. Particularly when you do this with public datasets on income, it's apples and oranges.

This is because there are (unfortunately) millions of households who cannot afford market-rate rentals. If you include them in the calculation, it inflates the ratio. It's totally valid to point out unaffordability among low-income households, but it's NOT an accurate representation of who actually lives in these rentals and the rents they're actually paying.

On that note, the sad reality is that the households spending 30%+ of income on rent are often those in subsidized affordable housing or using vouchers, as many government programs require those renters spend the 30%. This is why we need a lot more affordable and attainable housing in the U.S. – and a lot more public and private support for it.

But in most professionally managed, market-rate rentals, operators typically will not lease to renters with rent-to-income ratios of 30%+. And yet there's been enormous demand in recent years for market-rate rentals among renter households spending 22-23% of income toward rent.

Among market-rate renters, there are certainly some facing financial challenges. I don't want to downplay that because those needs are real and must be addressed.

But broadly speaking, affordability is not the massive headwind it's often portrayed to be... and furthermore, it's now trending in the right direction.