Multifamily Operating Expenses Moderate Significantly, But Still Well Above Pre-Pandemic

Multifamily operating expenses moderated significantly in the last year, but cost per unit remains about two-fifth above the pre-pandemic rate nationwide.

The COVID pandemic set the stage for a high-demand and low-supply environment as the world saw significant disruption to manufacturing, logistics, and distribution. In the years following 2020, inflation surged across all sectors of the economy, impacting both private and commercial goods and services.

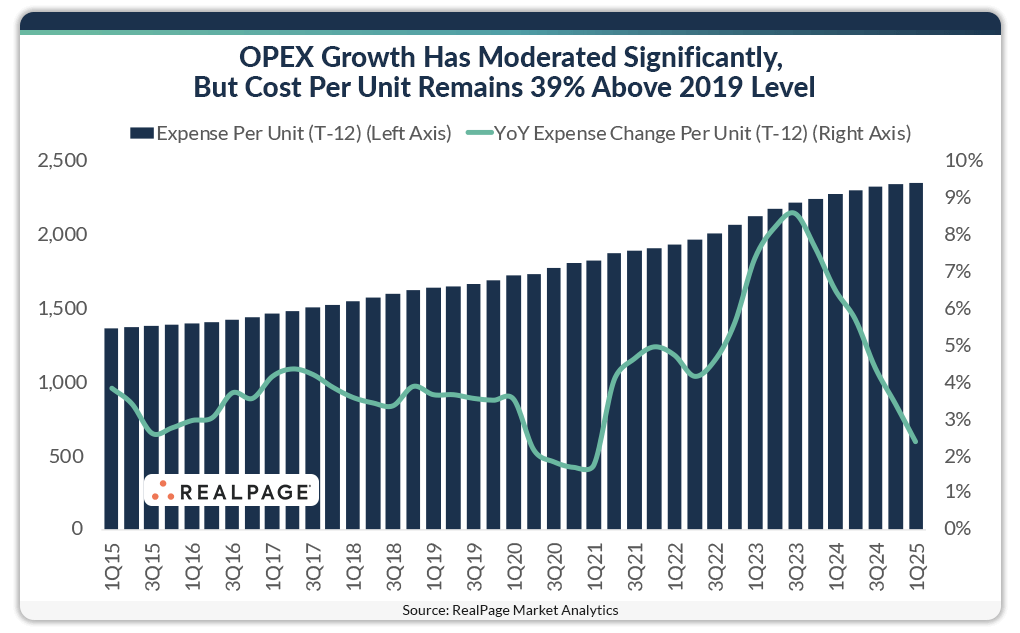

The multifamily industry was no exception, as owners and operators in the market-rate space saw operating expenses surge post-pandemic. Between 1st quarter 2021 and 1st quarter 2024, the average annualized expense cost per unit grew $445 or 24.4%. That increase compared to just under 18% cumulative growth in the three years leading up to 1st quarter 2020. If we look back over the last 10 years, that cumulative growth is not too surprising considering OPEX growth peaked in 2023 at 8.6% year-over-year – more than double the national norm between 2015 and 2019 of 3.5%.

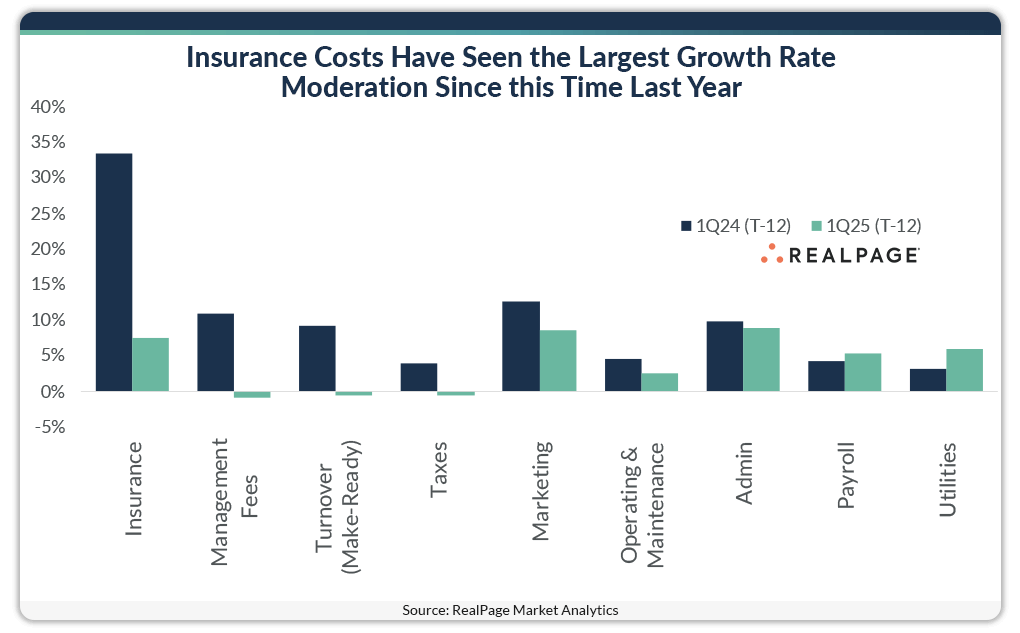

The good news: Though operational expenses in multifamily assets continue to grow and sit roughly 39% above where they were prior to the pandemic, the pace of increase has slowed to the lowest level since early 2021. Across nine operational expense categories tracked by RealPage Market Analytics, all but two – utilities and payroll – moderated over the last 12 months.

The most significant decline has been in insurance growth, which fell to just over 7% on an annualized basis in 1st quarter 2025. That compares to an incredible increase of 33.5% just one year prior. Taxes, another pain point for property owners as they account for roughly 30% of total OPEX costs, also registered a substantial drop. This time last year, taxes were growing by nearly 4% annually on average. But through the end of March 2025, the cost of taxes per unit on a national level have fallen 50 basis points (bps) year-over-year.

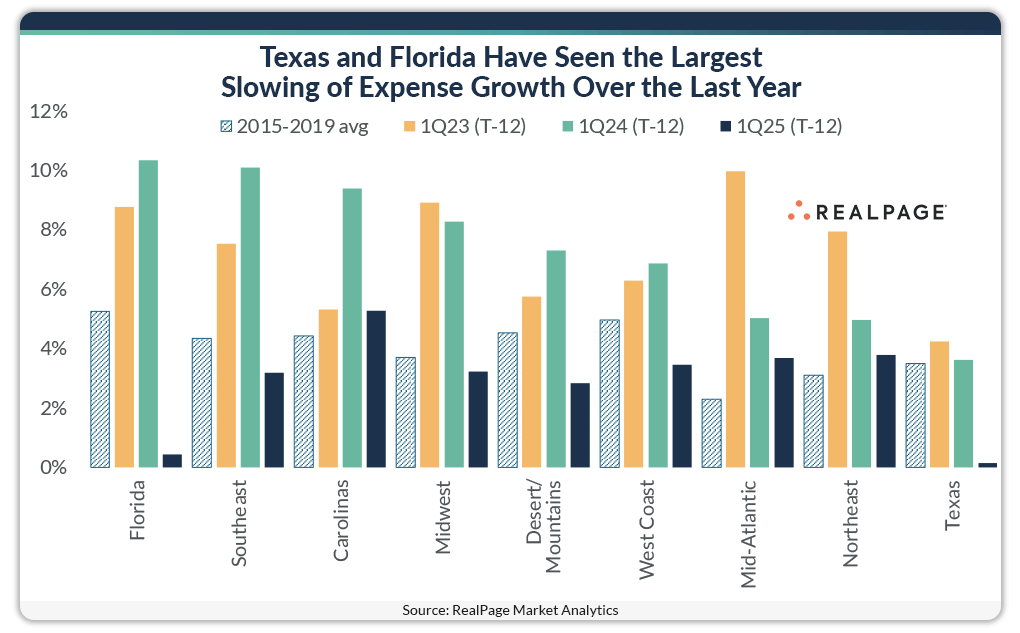

This theme of moderation has been seen across the country. All regions of the U.S. have seen expense growth fall below the change rates reported annually at the beginning of 2023 and 2024, albeit at varying levels. In total, two-thirds of regions registered an annual average expense growth in 1st quarter 2025 below their average growth in the five years ending 2019.

Texas has seen the smallest expense change over the last year, growing a meager 15 bps on average annually. Florida was not far behind the Lone Star State, ranking #2 nationally with an average of less than 1% annually. However, Florida easily outpaced all other regions when you consider that the 40 bps annual average growth rate today is 10 points below what the region registered just one year ago.

This trend of moderation in expense cost growth will likely offer a slight reprieve for operational budgets across the country this year. But with the recent uncertainty surrounding the U.S. economy and tariffs, the question remains: How long will the relief last?

For more information on economic impacts, watch the on-demand webcast Market Intelligence: The Impact of Tariffs on the Apartment Market.