Property Managers Prioritize Occupancy Over Rent to Start 2nd Quarter

The U.S. apartment market kicked off 2nd quarter 2025 with solid occupancy gains, reinforcing momentum heading into the peak leasing season. National occupancy increased 0.4% in April to register at 95.7%, according to RealPage Market Analytics. This noticeable jump from last April’s 0.1% increase signals that renters have remained active despite broader economic uncertainties.

While absorption patterns are strong, the pace of leasing suggests some demand may be pulled forward from later in the year, as renters and property managers weigh inflationary risks and tariff pressures.

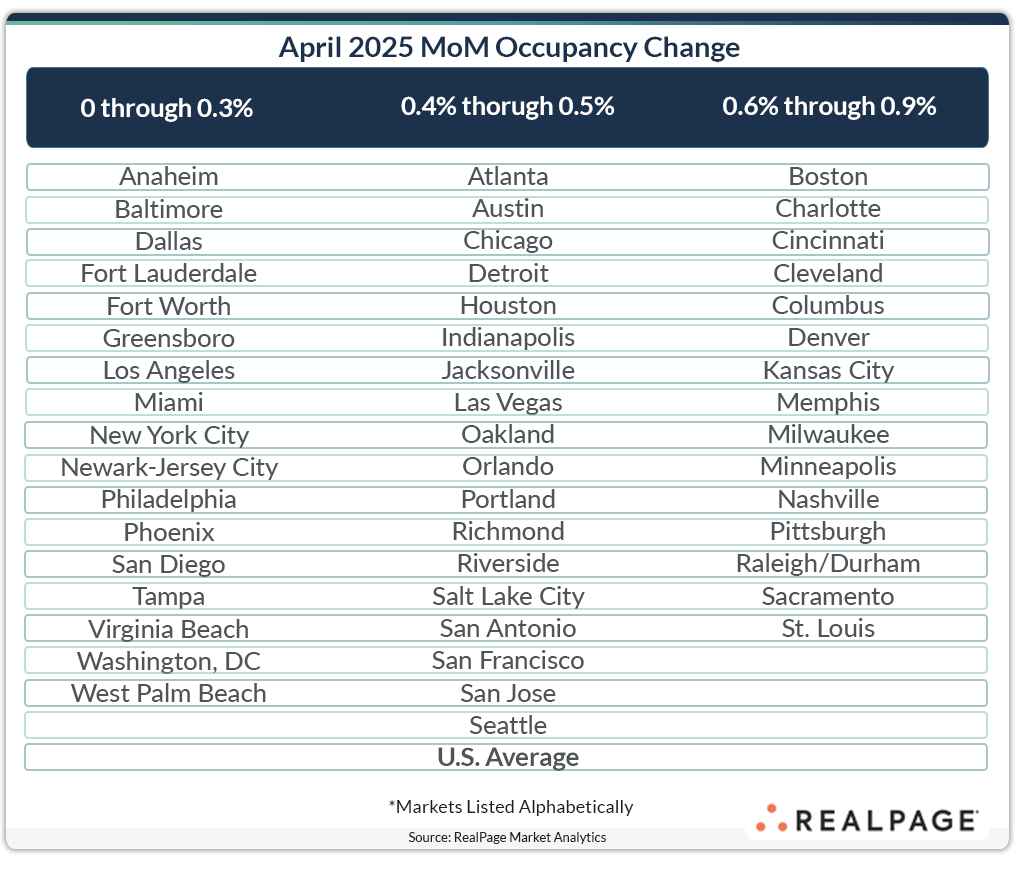

Occupancy Strengthened Across All Regions and Markets

Across major regions, the Midwest led the way for monthly occupancy gains, climbing 0.6% in April, followed by the South, West and Northeast, each posting 0.4% gains. The Midwest’s above-average improvement underscores steady demand in metros benefiting from stable economic conditions and relatively affordable rents. Meanwhile, the South continues adjusting to aggressive inventory growth. The West is showing signs of stabilization. Large Northeast markets continue to post solid leasing strength.

One of the most notable trends in April was broad-based leasing strength, with all 50 of the largest markets posting occupancy gains. Among those, certain markets stood out. Charlotte, Denver, Raleigh, Nashville, San Antonio, Austin and Salt Lake City each posted a jump of 0.5% or more, reinforcing the idea that high supply metros are seeing strong absorption rates amid elevated supply volumes.

Meanwhile, Florida’s positioning remains a key story as well. Of the markets with the lowest occupancy gains in April, four were in the Sunshine State, suggesting that recent supply volumes continue to pose a challenge for Florida operators. Tampa (+0.3%) and Fort Lauderdale (+0.3%) maintained resilience, but Miami (+0.1%) and West Palm Beach (+0.1%) posted more muted occupancy gains, reflecting that adjustments in renter demand continue to evolve.

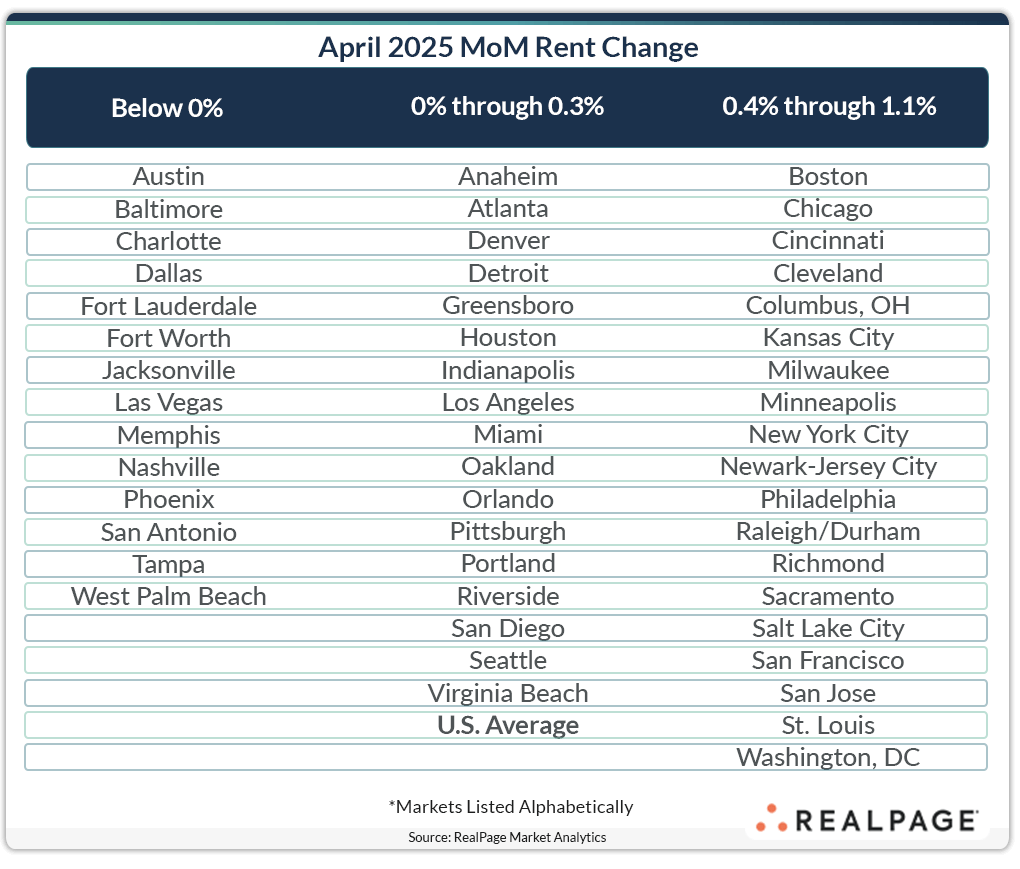

Rent Growth Remains Mostly Flat

While occupancy has increased nationwide, rent performance has varied widely, reinforcing regional differences in leasing conditions.

Nationally, rents grew 0.2% in April, but the regional breakdown highlights clear disparities. The Midwest led rent gains, climbing 0.6% month-over-month, followed by the Northeast at 0.5%. Meanwhile, the West posted a slight increase (+0.1%), while the South remained flat (0.0%), reflecting inventory-heavy conditions.

At the market level, rent trends continue to diverge. In high-cost urban markets, adjustments have been modest but steady, as demand holds firm in Boston, Washington DC and Los Angeles. However, certain Sun Belt metros like Austin and Phoenix are recalibrating, with rent trends responding more to supply conditions.

Looking ahead, the trajectory for rent performance will depend on the interplay between absorption and inflationary pressures. If occupancy momentum holds, rent stabilization could persist. But if demand slows, pricing adjustments may follow. The coming months will determine whether rent trends align with the broader leasing strength or diverge due to regional supply dynamics.

What Comes Next?

With leasing activity holding strong, the big question is whether these gains represent lasting momentum or an early pull-forward of demand. Will property managers continue to prioritize occupancy and stability, or will rent adjustments take center stage as economic conditions evolve?

These shifts will define absorption trends heading into the peak leasing season, shaping pricing strategies and market expectations for the rest of 2025.