Editor's note: This blog is part of a monthly series written by RealPage Senior Real Estate Economist Chuck Ehmann in which he examines multifamily and single-family starts and permits from the U.S. Census Bureau. Read previous blogs in this series here. According to Census numbers, May 2023 starts hit a 36-year high in May – an accolade RealPage Chief Economist Jay Parsons has called into question. Read his commentary discussing the validity of that number here.

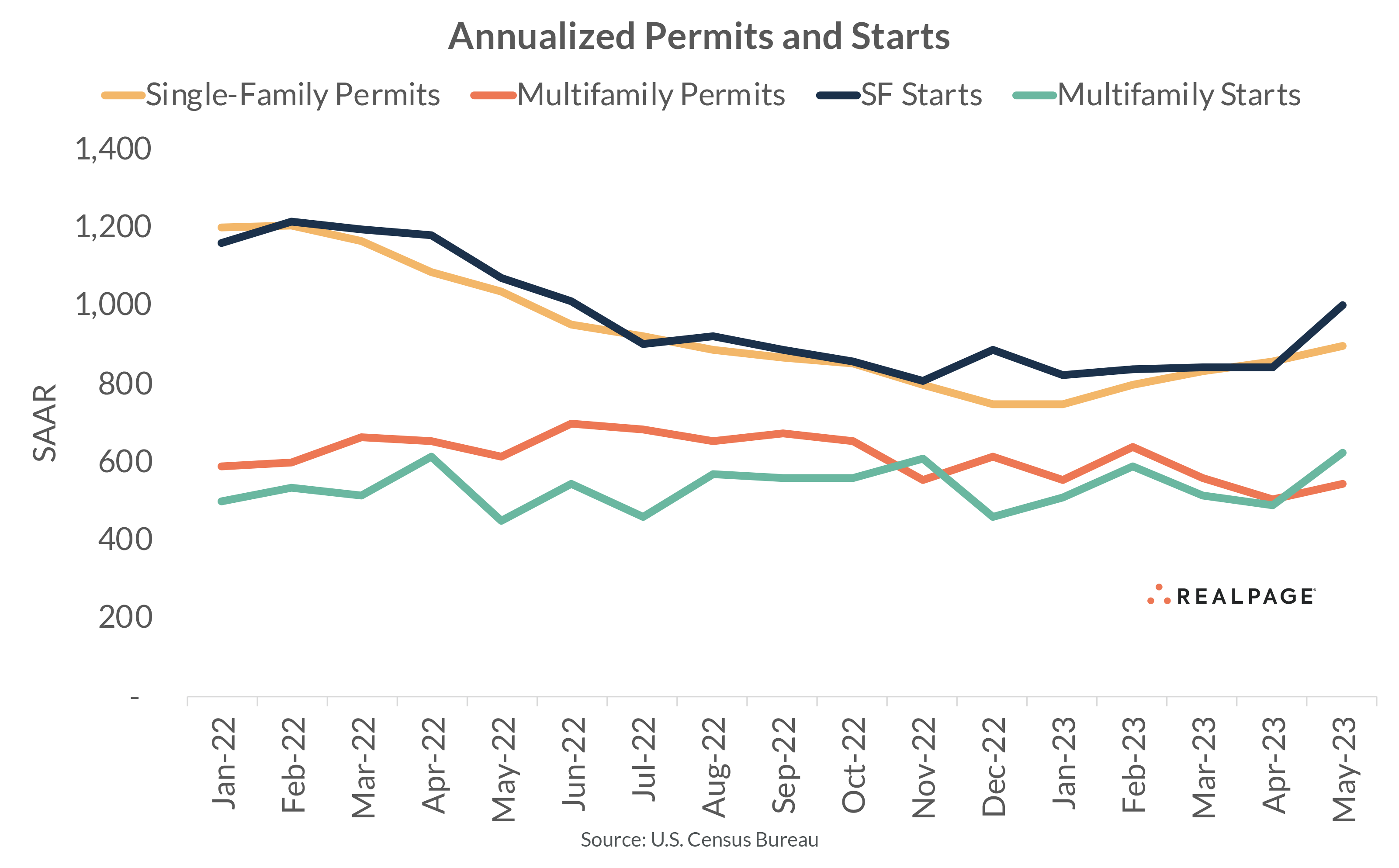

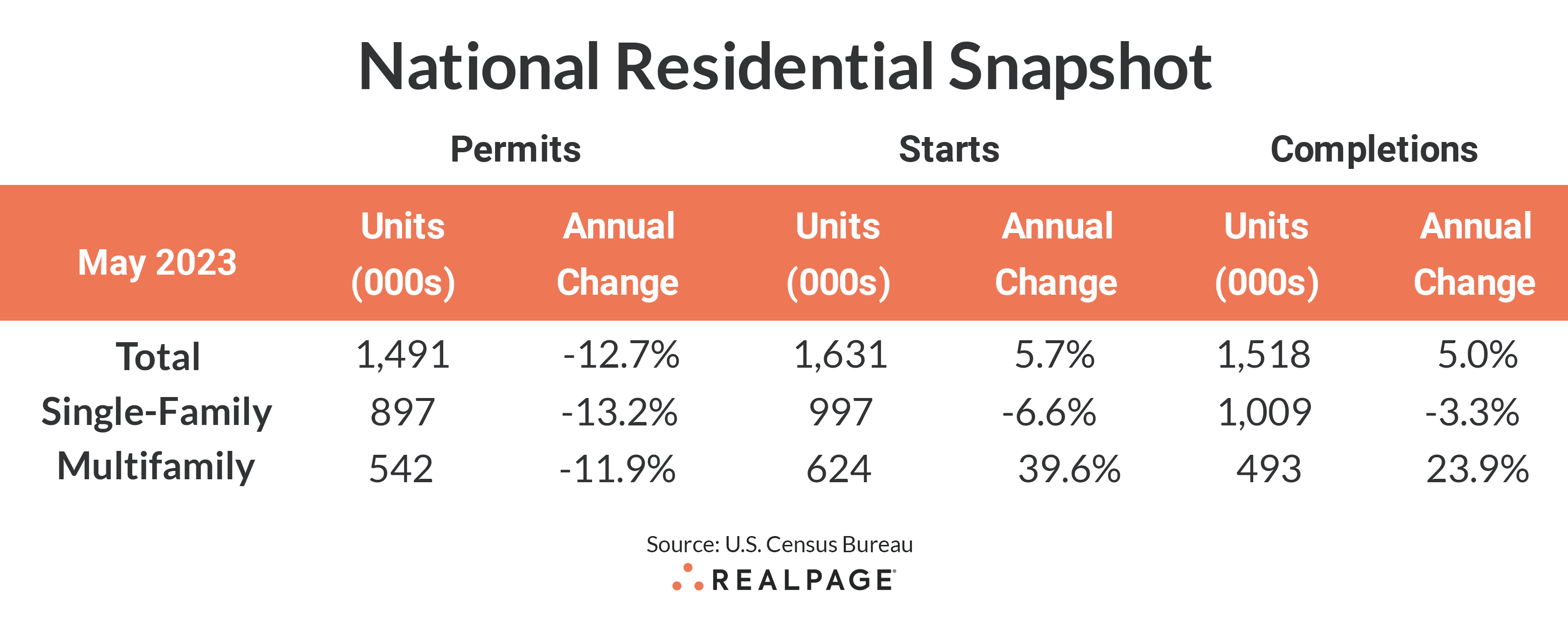

The seasonally adjusted annual rate for multifamily starts jumped 28.1% in May to 624,000 units. However, there are a few caveats. April’s rate for multifamily starts was adjusted down 11.3% from 542,000 units to 487,000 units, giving May’s increase a bigger percentage boost. Additionally, the average relative standard error for a 90-percentile confidence interval is about ±40%, meaning the rate for multifamily starts could range from 336,000 to 912,000 units.

That 624,000 units in multifamily starts for May is not an annual total but the annualized seasonally adjusted monthly start rate. Technically not a forecast or projection, it is simply the seasonally adjusted monthly value multiplied by 12. This allows for comparisons between months and years but can cause confusion if you think of it as the total starts in the past year.

The total for unadjusted multifamily starts in the year-ending May was 540,700 units, up 9.1% from the year before. The January to May increase is 4.6% compared to 2022. This gives some perspective on seasonally adjusted data versus not seasonally adjusted data.

Multifamily permitting is also seasonally adjusted, and May’s rate is 542,000 units, up 7.8% from last month but down 11.9% from last May. However, building permit data is collected from almost 20,000 permit issuing places as opposed to a survey sample of about 900 places for the Survey of Construction data (starts, completions, etc.), thus there are no confidence limits for seasonally adjusted permit data.

Single-family starts were at a seasonally adjusted rate of 997,000 units in May, up 18.5% from April but down 6.6% from last year. Even with an average relative standard error of more than 20%, increasing home starts is a believable trend as mortgage rates tick down slowly and builder confidence improves. Single-family permitting reached an annual rate of 897,000 units in May, up a modest 4.8% from April but still 13.2% below last year’s pace.

Multifamily completions jumped 24.2% from April to 493,000 units and are up 23.9% from last May’s completion rate. Single-family completions were up 3.9% in May with the annual rate reaching 1.009 million units, down 3.3% for the year.

The number of multifamily units authorized but not started decreased 5.4% for the month to 140,000 units, up 3.7% from one year ago. The ratio of multifamily units not started to annualized permits moved to 25.6% from about 22% last May. Single-family units authorized but not started fell 1.4% to 138,000 units from a revised 140,000 units in April, down 5.5% from last year.

With moderating but still elevated permitting, the number of multifamily units under construction (978,000 units) continues to exceed that of single-family (695,000 units) and is up a modest 1.8% from last month.

Compared to one year ago, the annual rate for multifamily permitting decreased in three of the four Census regions, with the largest decrease in the Midwest region (down 22.1% to 67,000 units). The South region saw multifamily permitting slow by 18.8% to 264,000 units, while the West region’s permitting was down 4% to 143,000 units. The small Northeast region saw an increase of 23.6% to 68,000 units in May. Compared to the previous month, permitting was up sharply in the Northeast and Midwest but down slightly in the South and West.

Multifamily starts were down in only the Northeast region from last year, with a strong decline of -46% to 36,000 units. Starts surged by 86.4% in the West region to 151,000 units, and by 64.9% in the Midwest to 132,000 units. The South region increased by 38.8% to 307,000 units. Compared to April’s seasonally adjusted rate, starts were also down in the Northeast but up solidly in remaining regions.

Metro-Level Multifamily Permitting

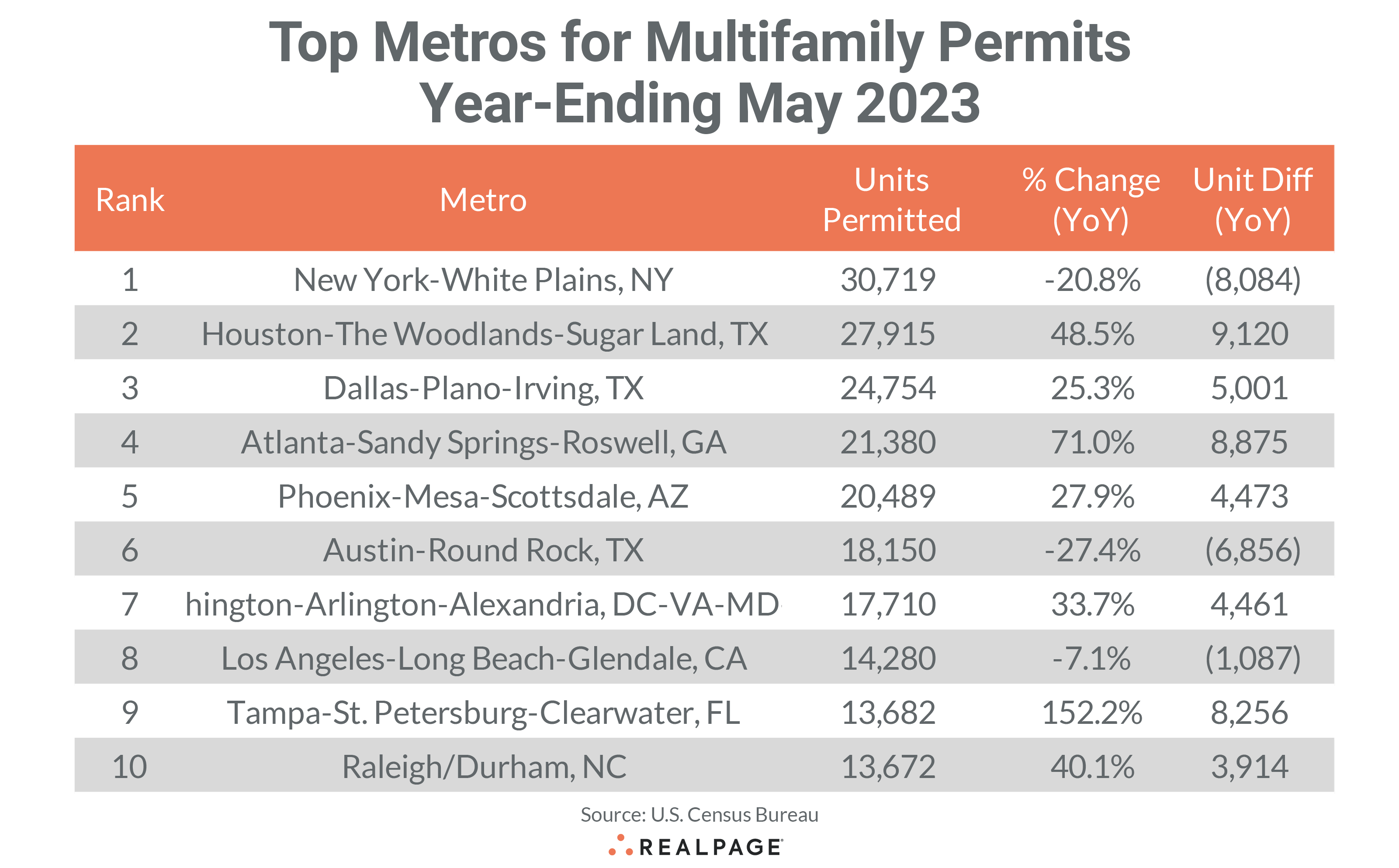

All the top 10 markets from April’s list returned in May with eight returning in order. New York continues to lead the nation in multifamily permitting, totaling 30,719 units through May, down by more than 8,000 units from last year but about the same as in April.

Houston returned at #2 with 27,915 units permitted, an increase of 9,120 units from last year and the highest annual increase of all markets. Dallas retained the #3 spot with 24,754 units permitted in the past 12 months, up 1,330 units from April’s total and 5,000 units greater than last year. Atlanta regained the #4 spot with 21,380 units permitted, pushing Phoenix down to #5, which decreased slightly to a total of 20,489 units in May.

The next five markets returned in order, with Austin at #6, permitting 18,150 units for the year, down more than 6,800 units or -28% from last May. Washington, DC permitted an annual total of 17,710 units in May to stay at #7, up almost 4,500 units from last year but 1,834 units less than in April.

Los Angeles retained the #8 spot with 14,280 units permitted, down 1,087 units from last May and about 900 fewer than last month. Tampa also returned to its #9 spot from April, permitting a total of 13,682 units, jumping 8,256 units from last year but 740 units fewer than last month.

Raleigh/Durham stayed in the #10 spot this month with a total of 13,672 units for the year-ending May, which is close to last month’s level but 3,914 units more than one year ago.

Seven of the top 10 multifamily permitting markets increased their annual totals from the year before and they were generally large increases, ranging from a low of 3,914 units in Raleigh/Durham to 9,120 additional units in Houston. Three of the top 10 markets increased multifamily permitting by at least 8,000 units over last year’s pace. Of the top 10 markets, only New York, Austin and Los Angeles had decreases from last year.

Other large markets outside of the top 10 that saw significant year-over-year increases in annual multifamily permitting in the year-ending May were San Antonio (+3,187 units), Portland, OR (+2,655 units), Riverside (+2,202 units), Anaheim (+1,550 units) and Baltimore (+1,432 units).

Smaller markets with big increases include the Florida markets of Crestview-Fort Walton Beach-Destin (+1,954 units), Cape Coral-Fort Myers (+1,929 units), Jacksonville (+1,375 units), Lakeland-Winter Haven (+1,297 units) and also Akron, OH (+1,231 units).

Significant slowing in annual multifamily permitting occurred in Philadelphia (-15,572 units), Seattle (-4,877 units), Nashville (-4,236 units), Orlando (-4,187 units), Minneapolis-St. Paul (-3,426 units), Salt Lake City (-2,793 units), Boston (-2,327 units) and Denver (-2,191 units).

The annual total of multifamily permits issued in the top 10 metros – 202,751 – was about 16% more than the 174,678 issued in the previous 12 months but down about 5% from last month. The total number of permits issued in the top 10 metros was almost equal to the number of permits issued for the #11 through #37 ranked metros.

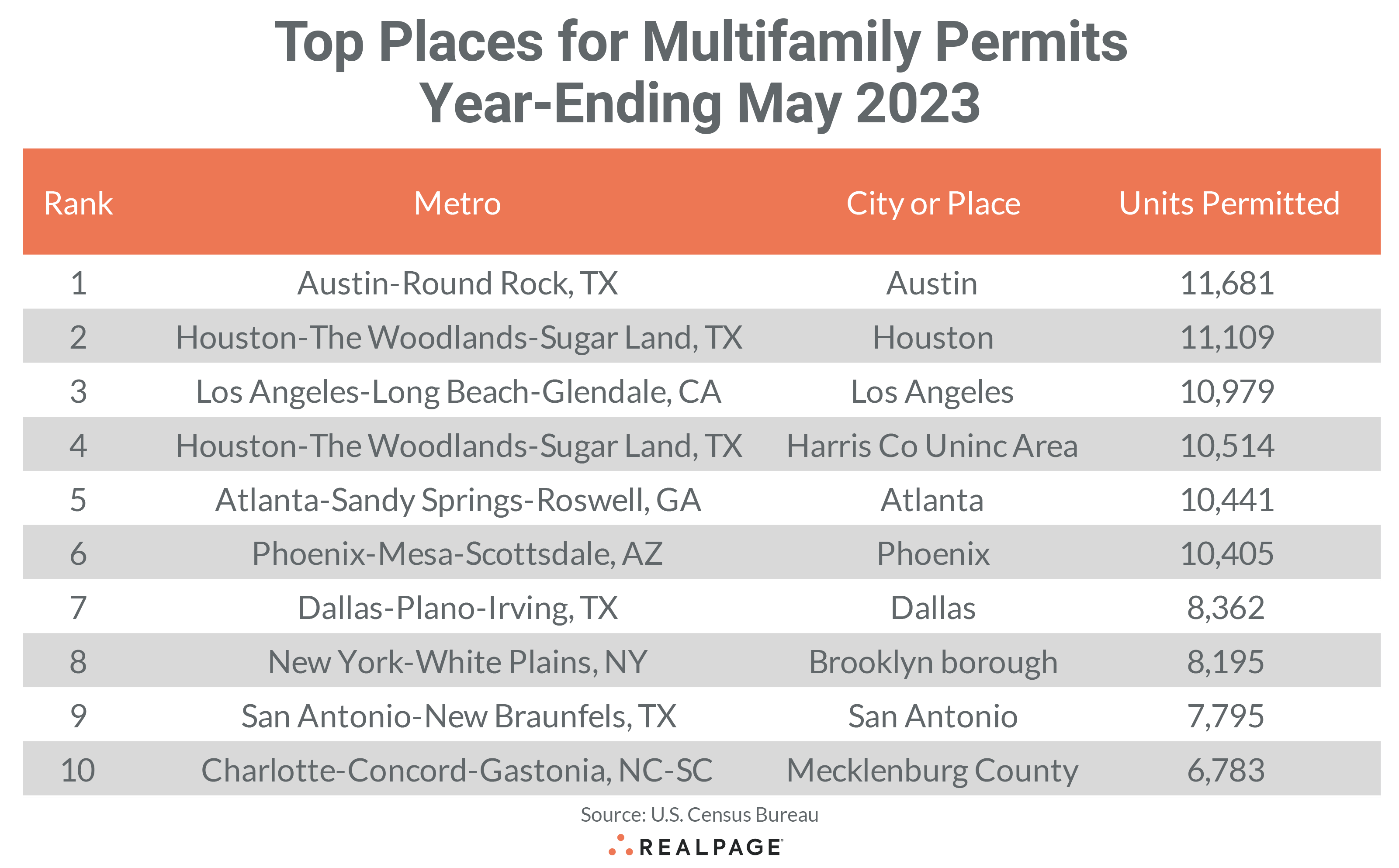

Below the metro level, nine of last month’s top 10 permit-issuing places returned to this month’s list with only four remaining in the same place and several others changing places. The list of top individual permitting places (cities, towns, boroughs, and unincorporated counties) generally include the principal city of some of the most active metro areas.

The city of Austin remained in the top spot with a permitting total of 11,681 units, about 1,700 units less than in April. The city of Houston moved up one spot to #2 with 11,109 units permitted, almost 400 units more than April’s total. The city of Los Angeles slipped to the #3 spot from last month with 10,979 units permitted, down 483 units from last month. The unincorporated portion of Houston’s Harris County moved up one spot to #4 with 10,514 units permitted, only a slight 69-unit increase from last month.

The city of Atlanta also moved up one spot to #5 with an annual total of 10,441 units permitted, up 96 units from April, while the city of Phoenix slipped two spots to the #6 spot, permitting a similar 10,405 units for the year. The city of Dallas filled the #7 spot again this month with an annual total of 8,362 units permitted, down 353 units for the month.

The borough of Brooklyn and the city of San Antonio remained in the #8 and #9 spots, permitting 8195 and 7,795 units, respectively. Mecklenburg County (Charlotte) displaced the unincorporated portion of Hillsborough County (Tampa) for the #10 spot with 6,783 units permitted, down 247 units from April’s total.

The cities of Houston and Atlanta and Unincorporated Harris County were the only top 10 permitting places on May’s list to see an increase in permitting from April’s annual total. The cities of Austin, Los Angeles, San Antonio and Dallas decreased their annual permitting by at least 300 units from last month’s annual total.