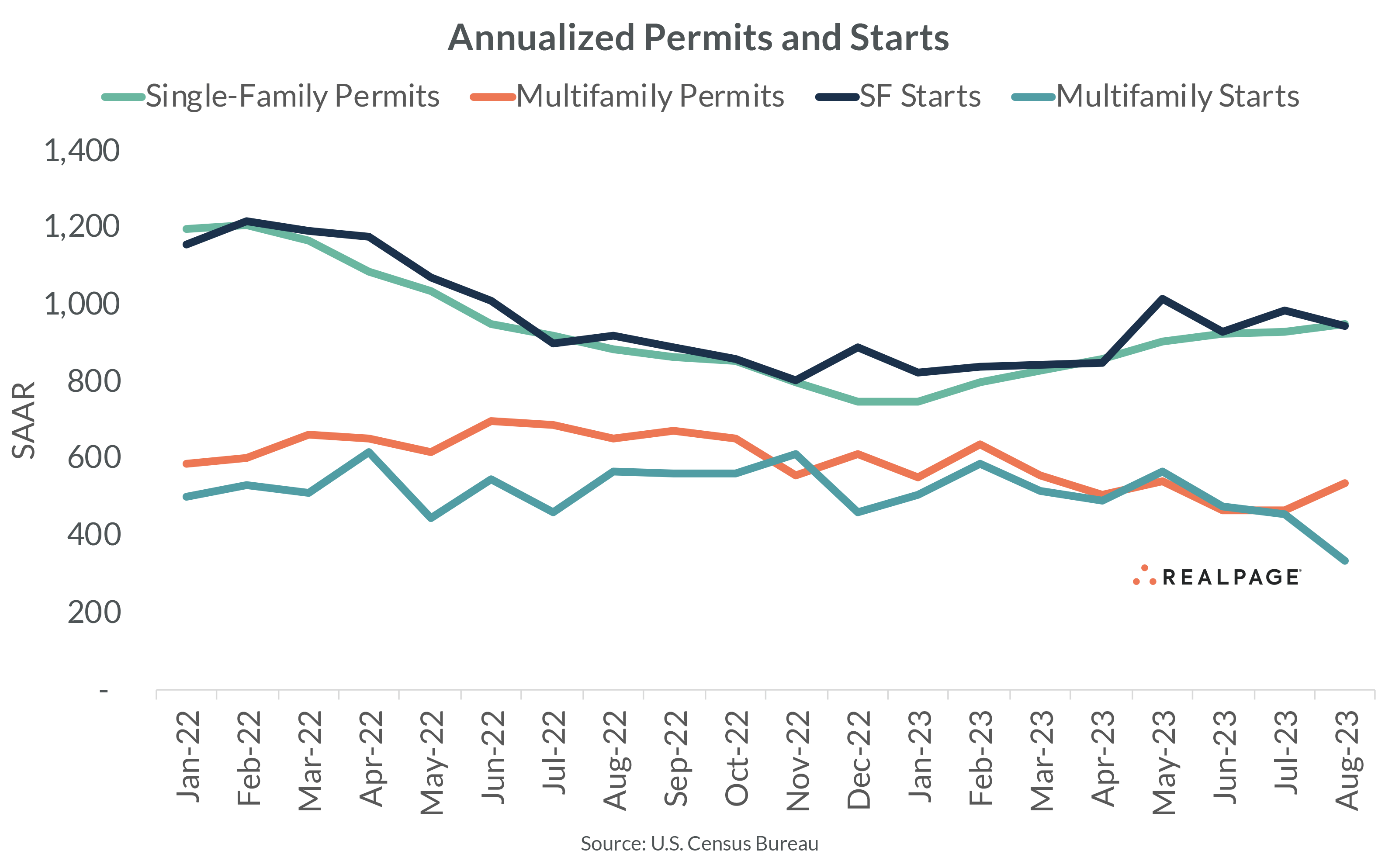

The annual rates for multifamily permits and starts had been running nearly coincidentally since the beginning of the year but diverged sharply in August, perhaps indicating funding and other issues may be delaying starts.

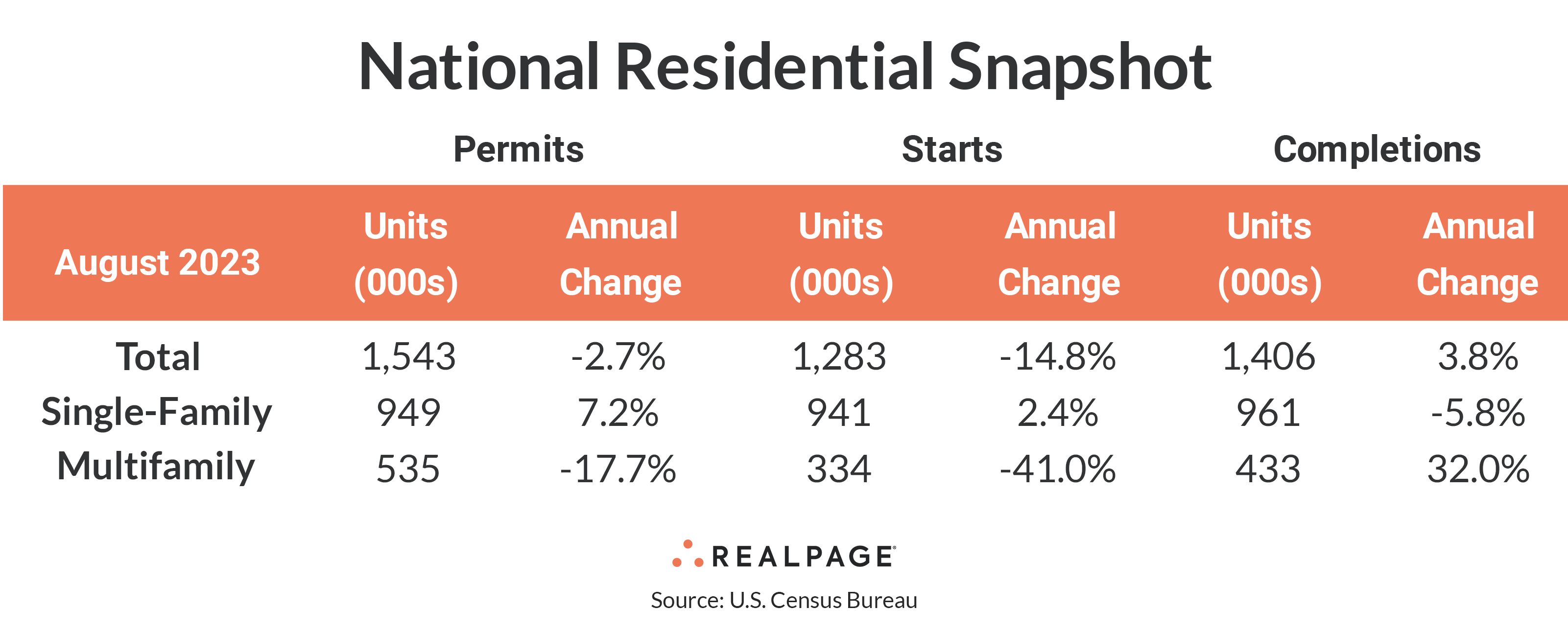

The seasonally adjusted annual rate (SAAR) for multifamily starts dropped 26.3% from July’s annual rate to 334,000 units and was down 41% from last year, according to the latest release from the Census Bureau. Meanwhile, completions of multifamily units increased 45.8% from July to 433,000 units, an increase of 32% from last August.

The forward-looking building permits rate increased 14.8% from July’s SAAR to 535,000 units but that annual rate was 17.7% below last August’s annual rate. The number of multifamily units currently under construction (995,000 units) was virtually unchanged from last month but up 13.5% from last year, as construction delays push some projects further back.

Single-family permitting continued edging up with the August pace increasing 2% from July and 7.2% from last year to 949,000 units. The annual rate for single-family starts dipped 4.3% in August to 941,000 units but was still 2.4% greater than a year ago.

The moderate monthly increase in multifamily permitting brought the rate of total residential permitting up 6.9% from July to 1.543 million units but the overall trend dropped the year-over-year rate by 2.7%. The stronger declines in multifamily starts brought total residential starts down 11.3% from last month and 14.8% from last year to 1.283 million units.

Despite increasing permitting and starts, single-family completions were down 6.6% for the month and 5.8% for the year to 961,000 units. The number of single-family units under construction was unchanged from July’s pace at 676,000 units but that was 16.3% less than one year ago.

The number of multifamily units authorized but not started increased by 7.1% for the month to 135,000 units but was 8.8% lower than one year ago. The ratio of multifamily units not started to annualized permits dropped to 25.2% from almost 30% earlier in the year but is greater than the 22.8% ratio from last August. Single-family units authorized but not started increased 2.9% to 142,000 units from 138,000 units in July, down 2.1% from last year.

Compared to one year ago, the annual rate for multifamily permitting decreased in all four Census regions, with the largest decrease in the small Northeast region (down 27.8% to 49,000 units). The South region saw multifamily permitting slow by 21.7% to 252,000 units, while the West region’s permitting was down 10.2% to 158,000 units. The Midwest region saw a 9.6% decrease to 75,000 units in August. Compared to the previous month, permitting was up in all four regions.

Multifamily starts were unchanged in the Midwest region at 51,000 units, and down in the remaining three regions from last year, with the strongest decline in the small Northeast region (down 63.7% to 41,000 units. Starts were down by 44% in the South region to 153,000 units and by 31% in the West to 89,000 units. Compared to July’s SAAR, starts were down by about a third in the West and South and up modestly in the Northeast and Midwest.

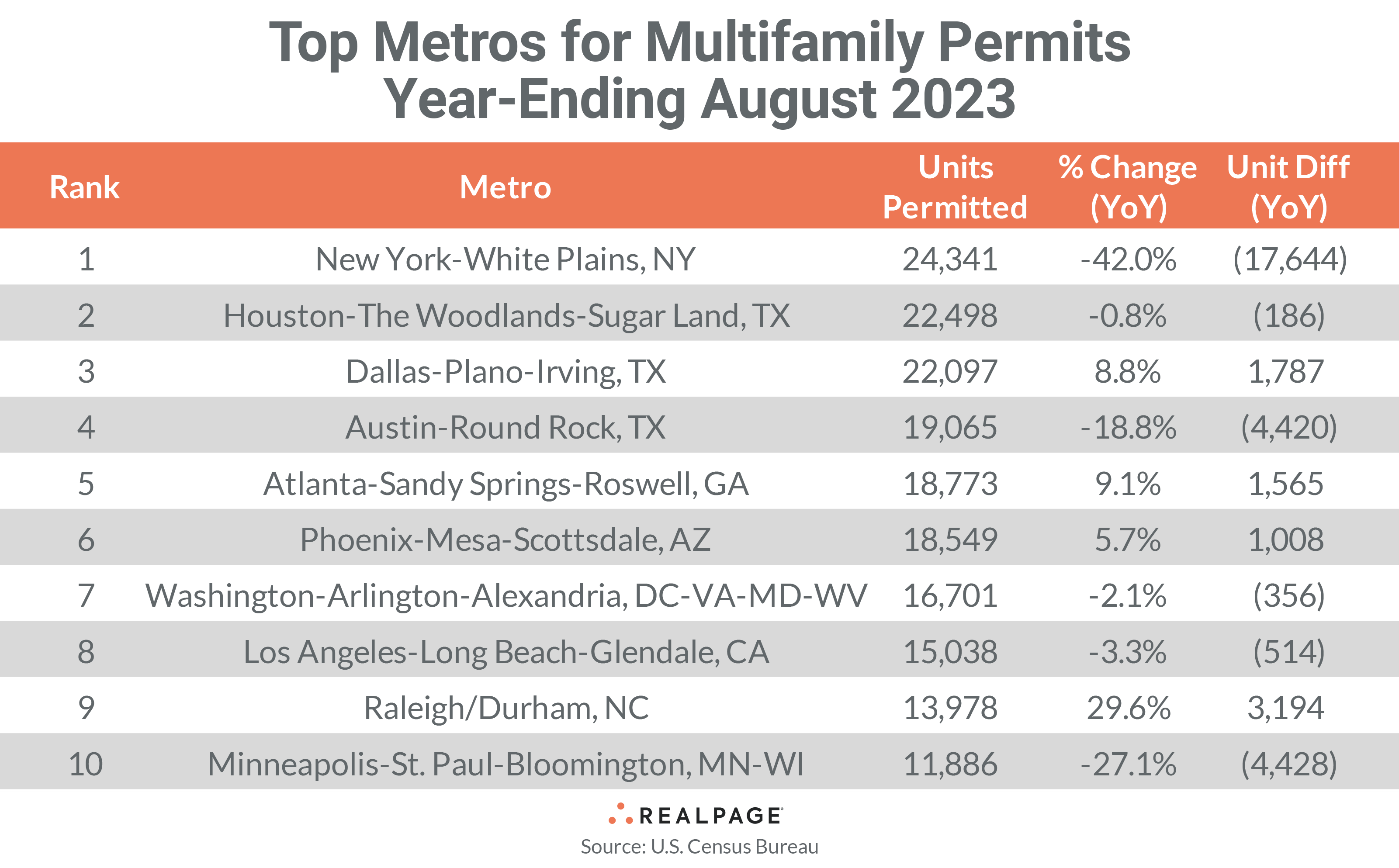

Metro-Level Multifamily Permitting

Nine the top 10 markets from July’s list returned in August with the first three remaining in order. New York again led the nation in multifamily permitting but continues to slow with a total of 24,341 units permitted in the 12-months-ending August, down by more than 17,600 units from last year and about 800 less than in July.

Houston returned at #2 with 22,498 units permitted, a decrease of just 186 units from last year but 827 units fewer than last month. Dallas retained the #3 spot with 22,097 units permitted in the past 12 months, 1,787 units greater than last year but down 467 units from July’s total.

Austin leapt three spots to land at #4 on the list with 19,065 units permitted for the year, down more than 4,400 units from 2022 but a jump of 2,109 units from July.

Atlanta, Phoenix and Washington, DC followed in the same order as last month, sliding one spot each, but while Atlanta and Phoenix permitted more than 18,500 units each (both up an average of about 1,300 units from 2022), the nation’s capital permitted 16,701 units, declining by 356 units from last year.

Los Angeles remained in the #8 spot with 15,038 units permitted, down 514 units from last August but 438 units more than last month’s total. Raleigh/Durham stayed in the #9 spot this month with a total of 13,978 units for the year-ending August, slightly lower than last month’s level but 3,194 units more than one year ago. Minneapolis-St. Paul displaced San Antonio at #10 with 11,886 units permitted for the year, up by 445 from last month but down 4,428 units from last August.

Only four of the top 10 multifamily permitting markets increased their annual totals from the year before but the size of the increases has remained significant with a range from 1,008 units in Phoenix to 3,194 additional units in Raleigh/Durham. In addition to New York’s large decrease from 2022, Austin and Minneapolis-St. Paul decreased by more than 4,400 units permitted each.

Other markets outside of the top 10 that saw significant year-over-year increases in annual multifamily permitting in the year-ending August were Riverside (+2,910 units), Crestview-Fort Walton Beach-Destin, FL (+2,414 units), Tampa (+2,153 units) and Cape Coral-Fort Myers, FL (+1,923 units).

In addition to New York, Minneapolis-St. Paul and Austin, significant slowing in annual multifamily permitting occurred in Philadelphia (-13,305 units), Seattle (-8,791 units), Denver (-4,150 units), Colorado Springs (-3,634 units), Fort Worth (-3,330 units) and Boston (-3,136 units).

The annual total of multifamily permits issued in the top 10 metros – 182,926 – was about 10% less than the 202,920 issued in the previous 12 months and down about 1% from last month. The total number of permits issued in the top 10 metros was almost equal to the number of permits issued for the #11 through #35 ranked metros.

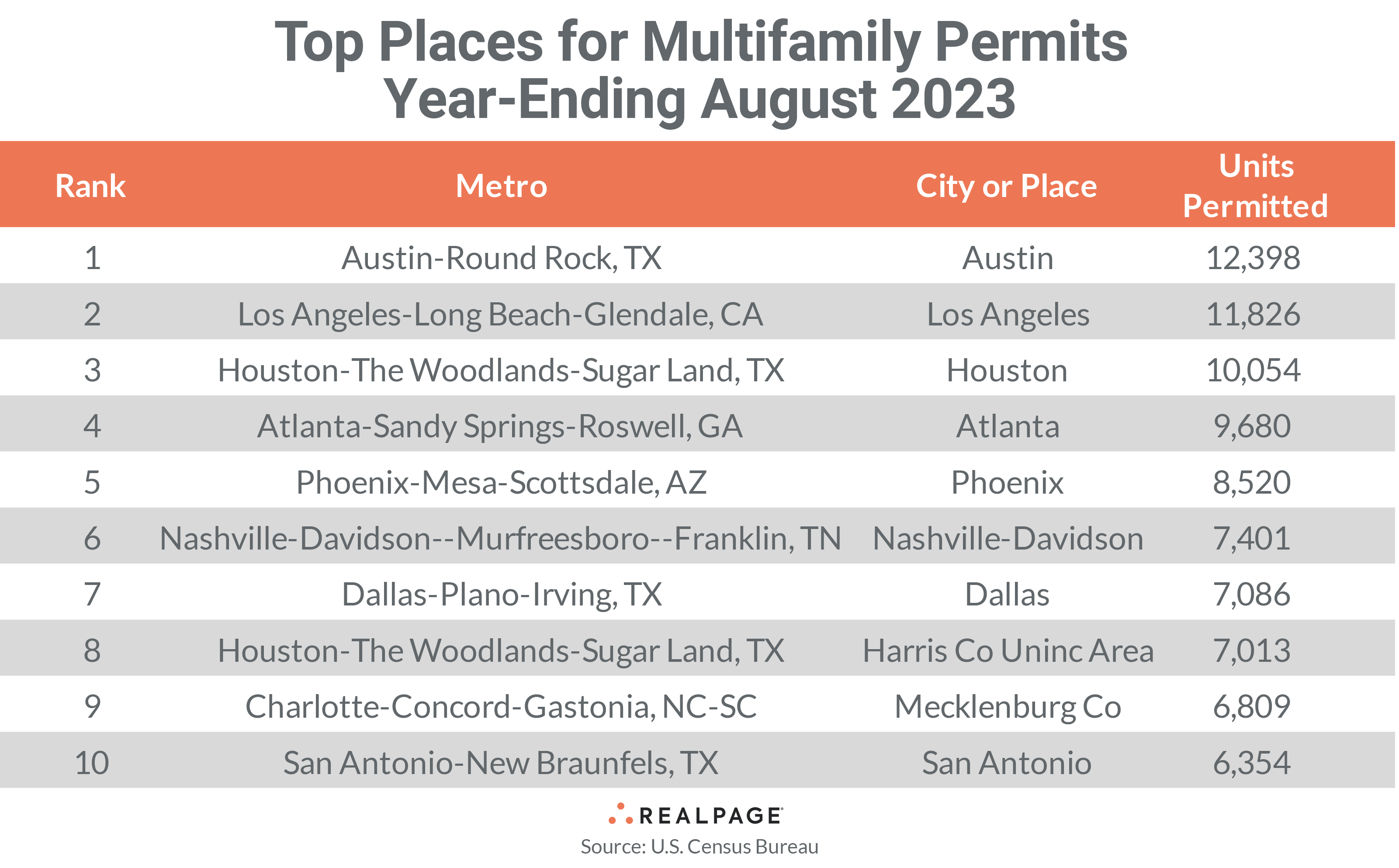

Below the metro level, nine of last month’s top 10 permit-issuing places returned to this month’s list with five remaining in the same place and the rest changing places. The list of top individual permitting places (cities, towns, boroughs and unincorporated counties) generally include the principal city of some of the most active metro areas.

In August, the city of Austin remained in the #1 position with 12,398 units permitted, 1,281 more units than in July. The city of Los Angeles also returned to its #2 spot with a total of 11,826 units permitted, up 738 units from last month. The cities of Houston and Atlanta switched places this month at the #3 and #4 spots with 10,054 units permitted in Houston and 9,680 units permitted in Atlanta, an increase of 431 units from last month in Houston but a decline of 594 units in Atlanta.

The city of Phoenix remained in the #5 spot in August with 8,520 units permitted, down just 375 units from July. All three were down from 313 to 976 units permitted from July’s annual totals. The city-county of Nashville-Davidson jumped onto the top 10 permitting place list at #6 with 7,401 units permitted through August, an increase of 2,483 units from July’s annual total.

The city of Dallas returned at #7 with 7,086 units permitted, only 140 more than last month, while Unincorporated Harris County (Houston) slipped two spots to #8 with a similar 7,018 units permitted (down 1,245 units from July).

Mecklenburg County (Charlotte) was virtually unchanged from last month with a total of 6,809 units permitted to remain at #9, while the city of San Antonio slipped two spots to #10 with 6,354 units permitted for the year, down 478 units from last month.

Five of the top 10 permitting places are in Texas (the Texas Triangle) but four of the next 10 places (#11-#20) are in Florida – including Jacksonville-Duval County, Hillsborough County Unincorporated Area (Tampa), the city of Miami and Orange County Unincorporated Area (Orlando).