Miami is the tightest apartment market in South Florida, after recovering well from the pandemic-era occupancy decline.

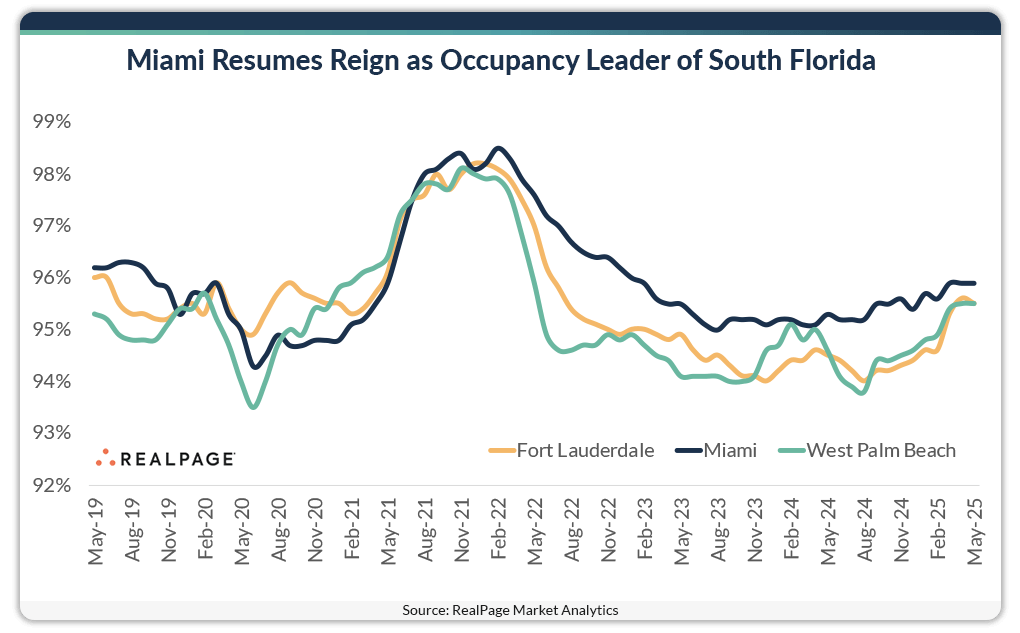

Before the COVID-19 pandemic, Miami tended to outshine the other two South Florida apartment markets in occupancy performance. In the five years leading up to the pandemic (2015 to 2019), Miami averaged occupancy at 96.1%, according to data from RealPage Market Analytics. Meanwhile, rates were lower at 95.1% in Fort Lauderdale and 94.4% in West Palm Beach.

In 2020, when occupancy rates took a hit across the county, all the South Florida markets lost some ground. Miami and West Palm Beach suffered more than Fort Lauderdale. When recovery started, Miami struggled more than the other two regional markets, as occupancy climbed slower here during the early months of 2021. Though the climb started slower, however, Miami recovery sped up by mid-year and this market hit rates above 98% in August 2021, one month before Fort Lauderdale and three months before West Palm Beach. Miami also held onto peak rates longer than its two neighbors, holding for eight straight months above the 98% mark.

As occupancy leveled out in the years since, Miami lost less ground than the other two South Florida markets and now this market has returned to its place as the region’s occupancy leader.

As of May 2025, Miami had occupancy of 95.9%, making it the only South Florida market with a rate ahead of the U.S. average. Occupancy was a bit lower at 95.5% in both Fort Lauderdale and West Palm Beach.

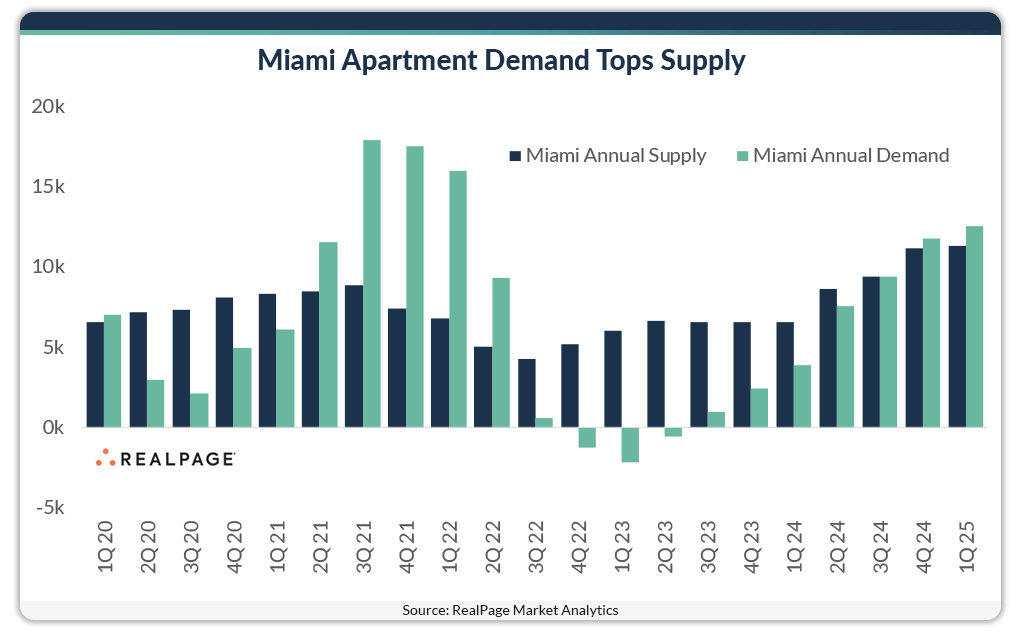

Helping boost apartment occupancy in Miami in recent years, demand has pushed ahead of high supply volumes. In the year-ending 1st quarter 2025, Miami absorbed over 12,500 units, pushing ahead of concurrent supply volumes by over 1,200 units.

In Fort Lauderdale, the difference between supply and demand was much smaller, as demand of roughly 6,400 units topped supply by about 800 units. West Palm Beach was the only South Florida market to see supply ahead of demand, as supply of 3,610 units topped demand by just 30 units.

Supporting hefty demand, Miami saw one of the nation’s biggest population increases recently. The resident base here grew by nearly 325,000 people between 2020 and 2024, according to the latest estimates from the U.S. Census Bureau. Miami ranked among the top 30 RealPage markets for total population in 2024, with more than 2.8 million residents. Fort Lauderdale saw an increase of roughly 94,000 people between 2020 and 2024, which grew its population to nearly 2.1 million people. Meanwhile, West Palm Beach grew by about 88,000 people to stand at a 2024 total of nearly 1.6 million residents.

As people continue to flock to Miami, this is the only South Florida market still logging rent growth. Prices increased 1.2% in the year-ending May, while rate cuts were still the norm in Fort Lauderdale (-1.1%) and West Palm Beach (-1.7%).

The South Florida apartment markets are some of the priciest nationwide. As of May 2025, monthly rents averaged $2,678 in Miami, ranking as the only South region market among the nation’s most expensive nationwide. Prices just missed a top 10 standing in West Palm Beach ($2,497) and Fort Lauderdale ($2,491).