How Far is Each Market Past Peak Apartment Construction?

New apartment supply has been one of the hottest apartment market talking points through the first half of 2023. New supply so far in 2023 has already put downward pressure on rent growth. And as our Chief Economist Jay Parsons explains, this is exactly what new supply is supposed to do. This is economics 101: the best way to satiate demand is by increasing supply.

Despite record construction volumes persisting, the development pipeline for U.S. market-rate multifamily units shows that things are already beginning to taper off. As of the end of 2nd quarter 2023, there were 1,037,904 market-rate multifamily apartment units under construction. This is down ever so slightly from the prior quarter, which boasted some 1,083,966 units in the pipeline.

On one hand, digesting 1M+ units in the coming quarters will be quite the task. Still, the pullback in construction is already showing up in the data.

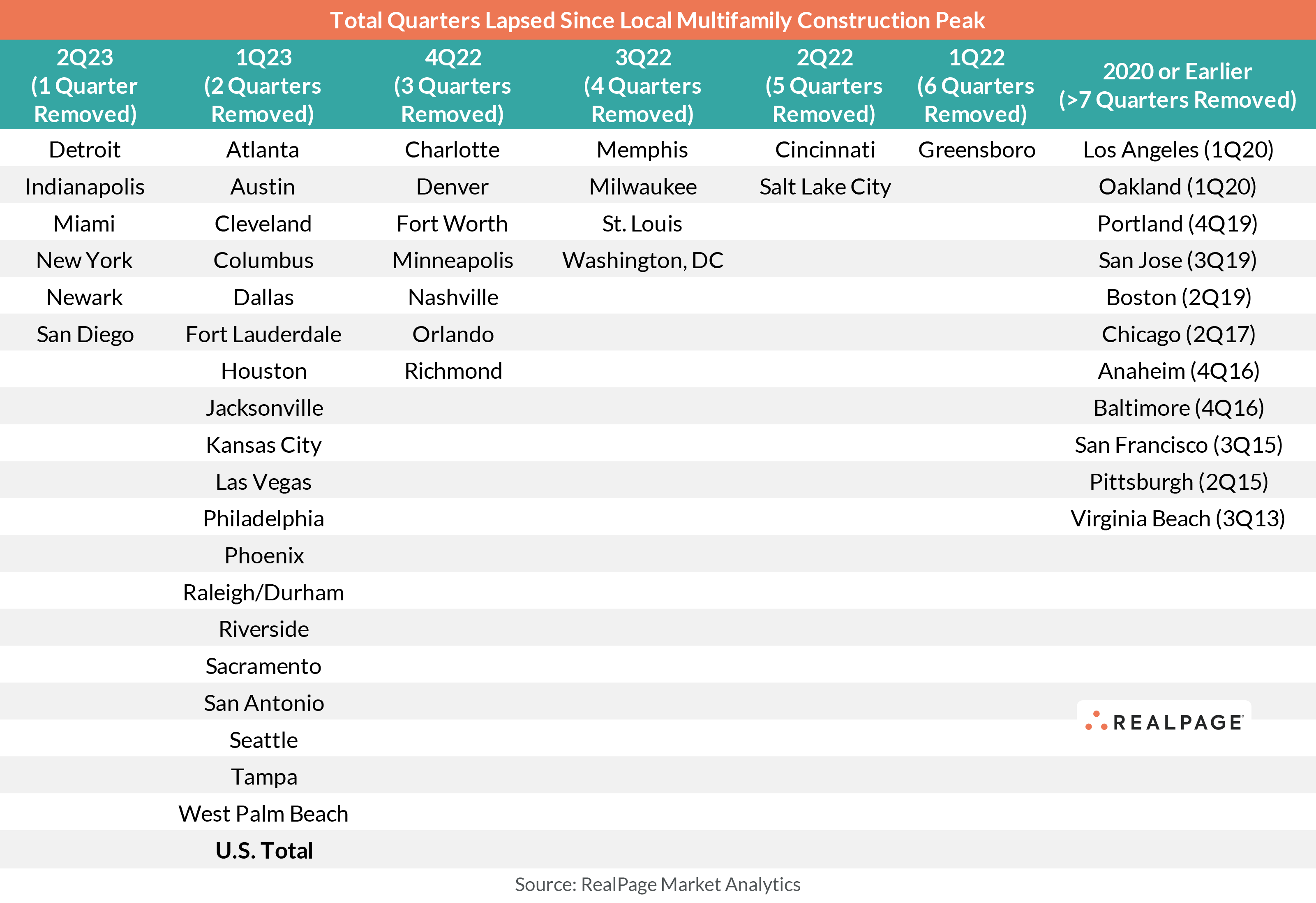

As of 2nd quarter 2023, six of the nation’s 50 largest apartment markets are currently at their peak construction volume.

Interestingly, only one of those markets is in the South region (Miami), though a cumulative count of the South Florida trio (Miami, Fort Lauderdale and West Palm Beach) shows construction is down from 1st quarter 2023’s peak (from 46,328 units to 44,905 in 2nd quarter 2023). Arguably only Indianapolis (peaking about 800 units or 10% above its 1st quarter 2023 figure) boasts a noteworthy increase in the 2nd quarter figures.

Conversely, 15 major U.S. markets are one-plus year removed from their peak construction volume, about half of which are in the West region. San Francisco is nearly eight years beyond its 2015 peak while Anaheim about six and half years beyond its 2016 peak.

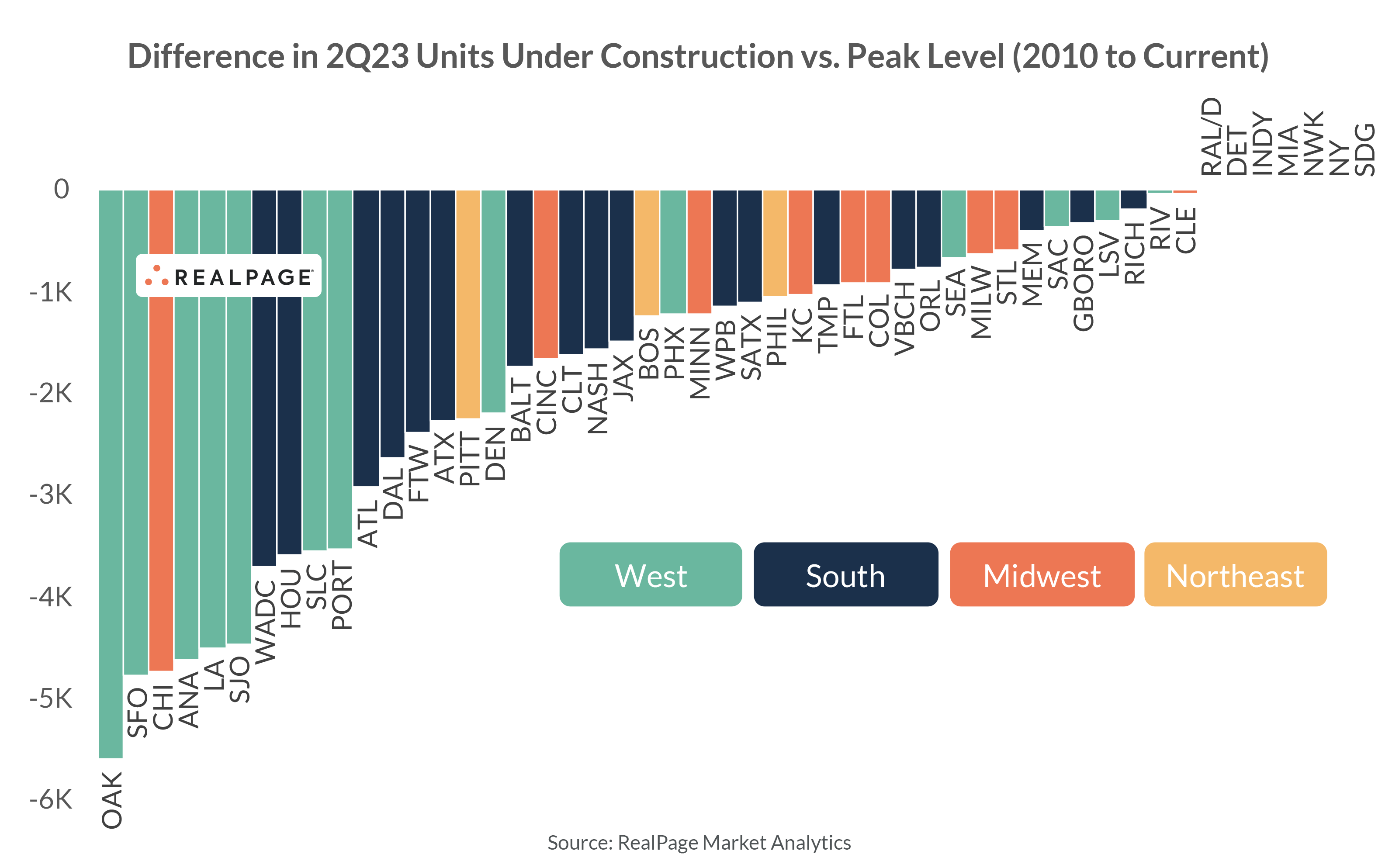

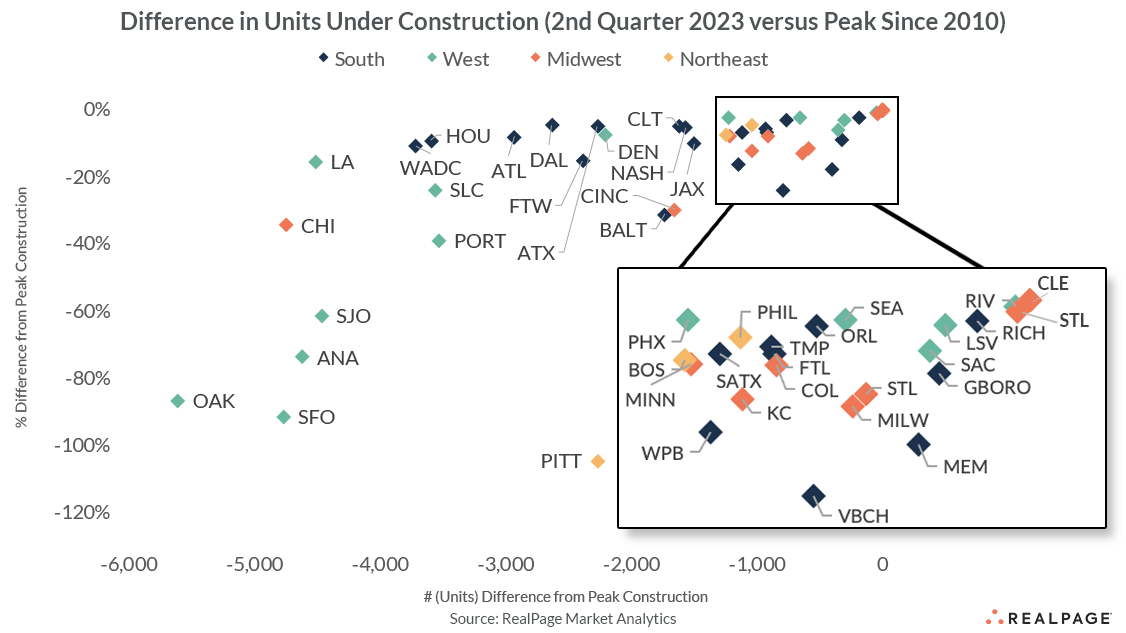

While timing is one way to view local construction peaks, it’s important to note where construction levels have fallen the most – both in nominal and in relative terms.

West region/West Coast markets generally show the largest departure from peak construction levels compared to their current level. Oakland represents the nation’s largest departure from peak construction with about 5,600 fewer units in the pipeline today than the market’s 1st quarter 2020 peak. Meanwhile, San Francisco, Anaheim, Los Angeles and San Jose all show strikingly similar departures in current construction.

In percent terms, again these West markets mark the starkest contrast from peak construction. In San Francisco, current construction is down 92% from its peak, followed by similar dips in Oakland (-87%), Anaheim (-73%) and San Jose (-61%). Only Pittsburgh (-105%) has a current construction volume less than half its peak from the past 13 years. Most major U.S. markets sit between 0% and 15% off peak construction levels.

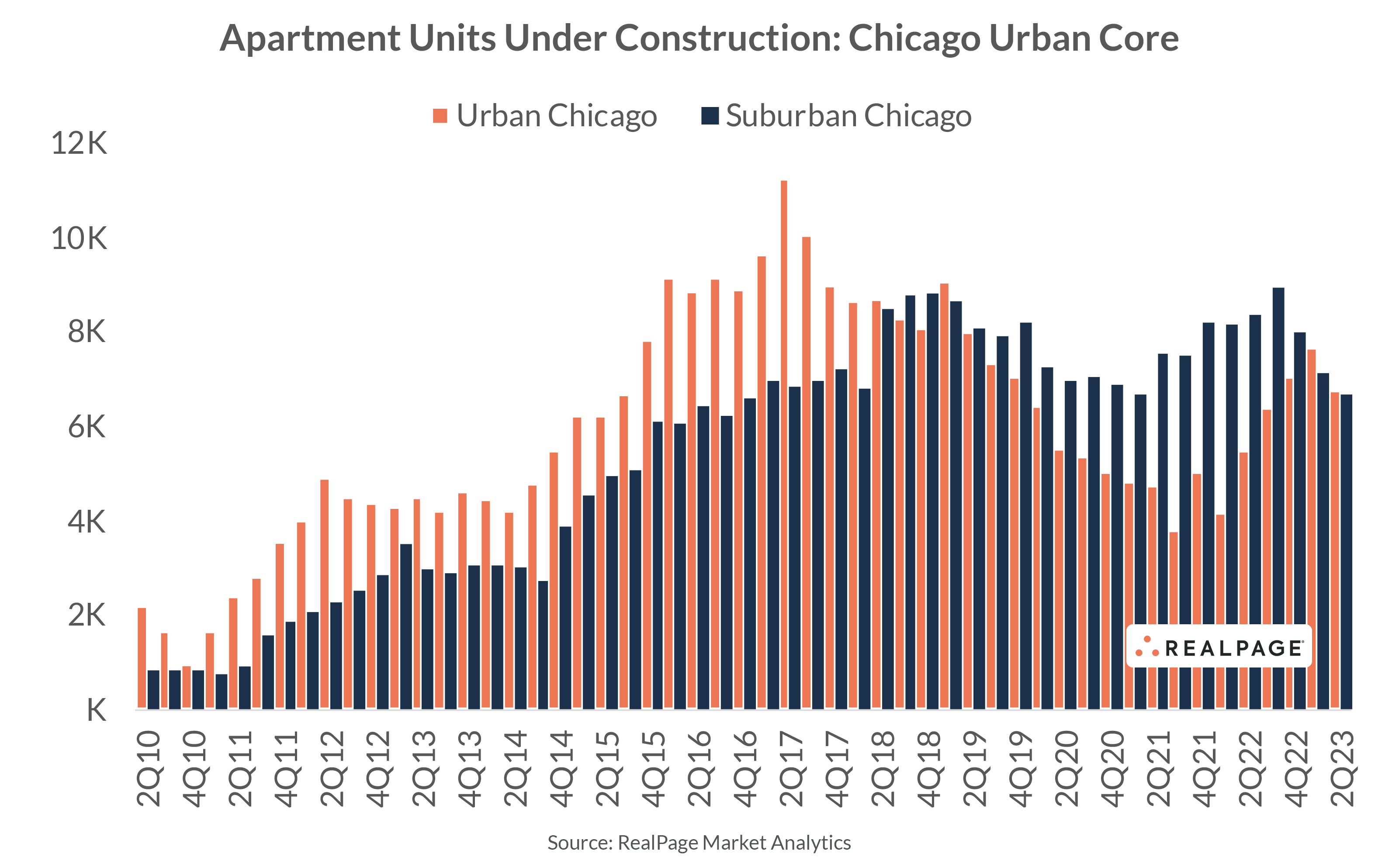

Chicago breaks the trend of West region markets with far less inventory underway today. In Chicago, however, the storyline is more of a reflection between urban and suburban dynamics. During Chicago’s peak construction (mid-2017), more than 60% of the market’s entire development pipeline was in the local urban core.

Today however, Chicago’s urban development pipeline has subsided to just 40% of its peak level. Meanwhile, construction in suburban Chicago has dropped off at a less pronounced rate and far more recently.

Submarket-level supply narratives will always be more influential on local performance readings. Still, market-level figures (and even national) are important to understand in today’s record high development environment.

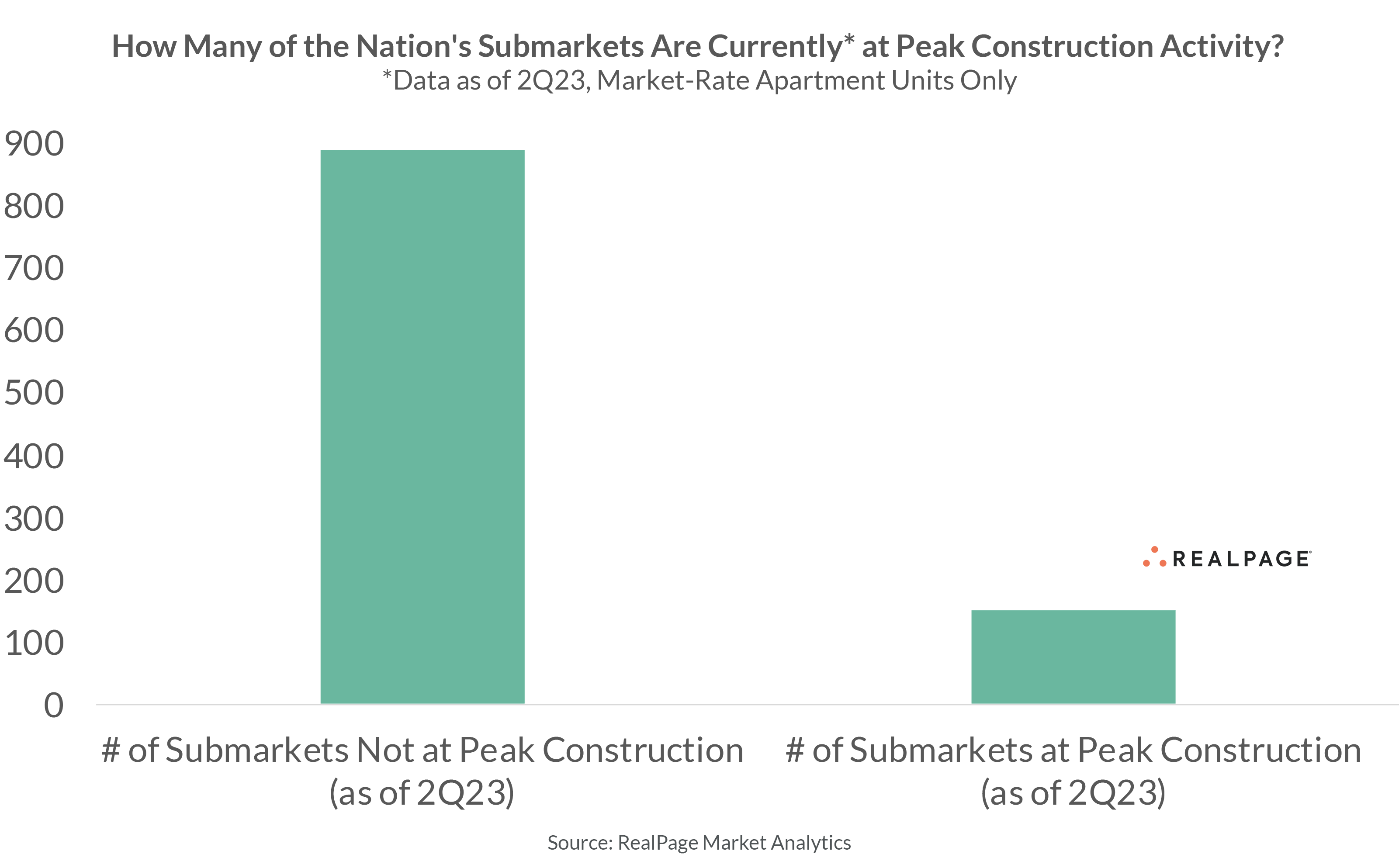

Considering that construction has peaked in nearly half of the nation’s top 50 metros in the first half of 2023, it may come as a surprise that the share of submarkets at peak construction is significantly smaller. In fact, just 150 of the nation’s 1,039 submarkets as classified by RealPage Market Analytics are currently at peak construction – less than 15%.

From that perspective, many submarkets could be in a position to rebound from the supply-driven performance slowdown in the coming few quarters. Conversely, there may be localized instances where supply pressure hangs over local performance well into 2024, and potentially into 2025 and 2026, depending on the degree of inventory underway in those areas.