Multifamily Starts Plunge in March, Indicating When Supply Wave Could Taper

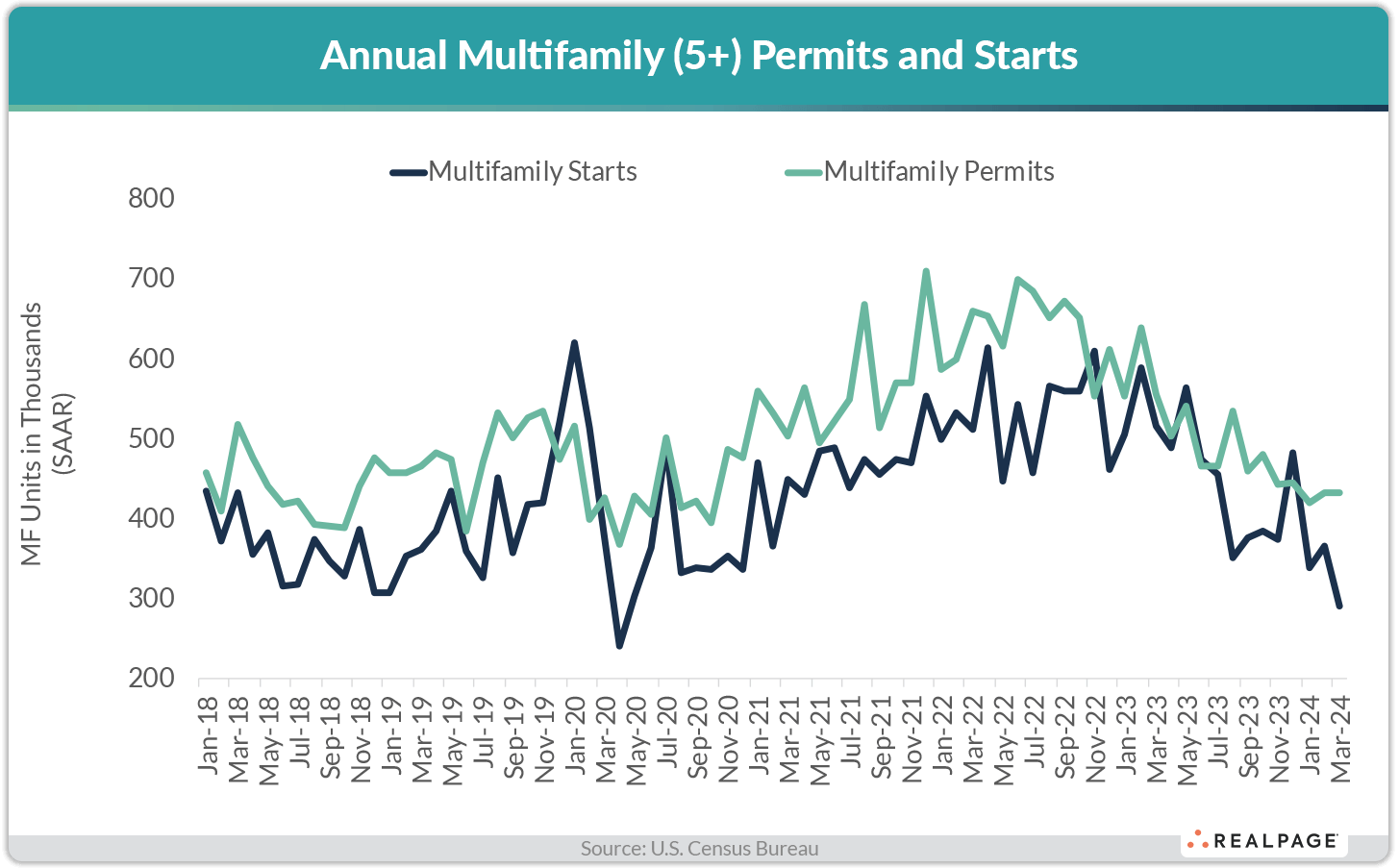

After jumping in February, multifamily starts dropped to the lowest level since the first month of the global pandemic.

The seasonally adjusted annual rate (SAAR) for multifamily starts plummeted 20.8% month-over-month, according to the latest data release from the U. S. Census Bureau.

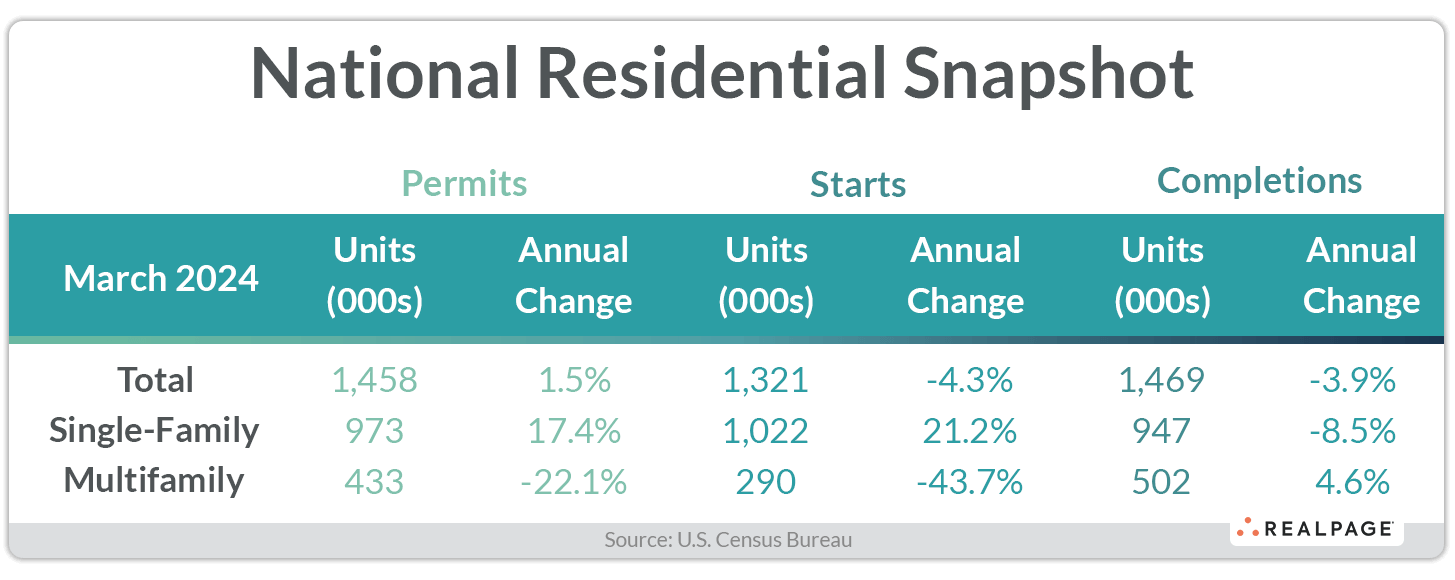

March’s annual rate of 290,000 units was down 20.8% from February’s revised rate of 366,000 units and 43.7% below the year-ago rate. Multifamily permitting was unchanged from last month but the SAAR of 433,000 units permitted was 22.1% less than last March.

Meanwhile, single-family starts were down 12.4% from last month to 1.022 million units, but that was 21.2% greater than the year before. The annualized rate for single-family permitting also declined for the month (-5.7%) but was 17.4% higher than last March.

Completions of multifamily units were down 19.9% from February to 502,000 units, which marked a 4.6% increase from last March. The number of multifamily units under construction dipped a minor 1.8% from February to stand at 940,000 units, a slight 1.6% decrease from last March. Additionally, the number of multifamily units authorized but not started was up just 0.8% to 127,000 units in March, a 17.5% decrease from one year ago.

Single-family completions were down 10.5% for the month and 8.5% for the year to 947,000 units. The number of single-family units under construction was virtually unchanged at 689,000 units (up 0.3%) but that was 2.7% less than one year ago. Single-family units authorized but not started was unchanged from February at 141,000 units, a 6% increase from last March.

Together with the small two-to-four-unit figures, total residential permitting fell 4.3% from last month but was up 1.5% for the year to 1.458 million units. March’s significant decreases in annual multifamily and single-family starts brought the SAAR of total residential starts down 14.7% from last month to 1.321 million units – down 4.3% from last year.

Compared to one year ago, the annual rate for multifamily permitting increased only in the small Northeast Census region (up 13.8% to 91,000 units). Large declines in annualized multifamily permitting occurred in the Midwest region (down 40.9% to 52,000 units), the South region (down 26.9% to 185,000 units) and in the West region (down 22.9% to 105,000 units). Compared to the previous month, permitting was down in the Northeast and Midwest and up in the West and South regions.

Multifamily starts increased from last March in the Midwest (up 70.7% to 25,000 units) and West (up 13.1% to 115,000 units) and were down significantly in the small Northeast region (down 77.1% to 26,000 units) and South (down 56.5% to 125,000 units). Compared to February’s SAAR, starts were up only in the West region and down sharply in the three remaining Census regions.

Metro-Level Multifamily Permitting

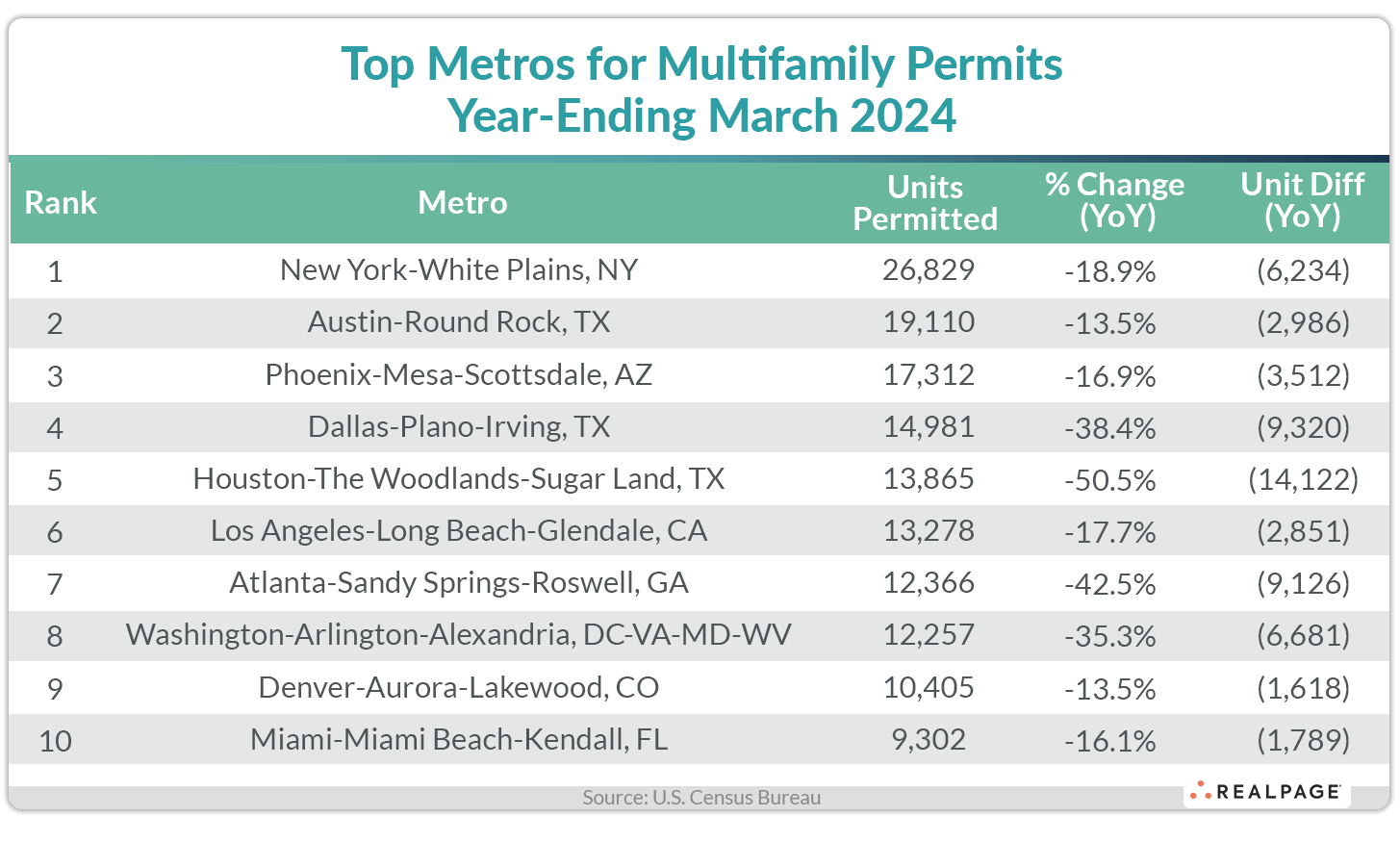

Nine the top 10 markets from February’s list returned in March with the first six remaining in order.

New York remained the top multifamily permitting market in the year-ending March with 26,829 units permitted, down almost 19% from last year and about 4% from February. Austin returned at #2 with 19,110 units permitted, down 5.4% for the month and down 13.5% for the year.

Phoenix remained in the #3 spot, permitting a total of 17,312 units for the year, about 9% fewer units than last month’s total and about 3,500 units less than last March. Dallas continued to slow its blistering annual multifamily permitting pace with 14,981 units permitted to remain in the #4 spot, 9,320 units less than last year.

Houston also slowed permitting activity sharply, dropping 14,122 units from its 12-month total last year to 13,865 units this year. Los Angeles rounded out the first six markets returning in order with 13,278 units permitted, up modestly from last month but 2,851 units less than a year ago.

Atlanta changed places with Washington, DC again at the #7 and #8 spots with 12,366 units permitted for the year, more than 9,100 less than last March but about the same as last month. Washington, DC increased permitting 2.1% from its February total to 12,257 units – over a third below last year.

Denver jumped on to the top 10 list at #9 with 10,405 units permitted for the year, displacing Miami to the #10 spot with 9,302 units permitted, both markets were down about 1,700 units from last March.

All of the top 10 multifamily permitting markets decreased their annual totals from the year before and some were pretty significant declines. Houston had the largest decrease in annual multifamily permitting of the top 10 (-14,122 units), followed by Dallas (-9,320 units), Atlanta (-9,126 units), Washington, DC (-6,681 units) and New York (-6,234 units). Phoenix, Austin and Los Angeles had significant declines in multifamily permitting as well.

Other major non-top 10 markets with significant declines in annual permitting include San Antonio (-6,886 units), Tampa (-5,712 units), Raleigh/Durham (-5,471 units), Seattle (-5,243 units), Minneapolis/St. Paul (-5,108 units), Jacksonville (-4,017 units), Portland (-3,691 units) and Orlando (-3,526 units).

Major markets with significant year-over-year increases in annual multifamily permitting in the year-ending March were Nashville (+4,096 units), Greensboro/Winston-Salem (+3,630 units), San Diego (+3,317 units), Pittsburgh (+1,512 units), Riverside (+1,322 units) and Knoxville, TN (+1,116 units).

The annual total of multifamily permits issued in the top 10 metros – 149,705 units – was about 28% less than the 207,944 issued in the previous 12 months and down about 2% from last month. The total number of permits issued in the top 10 metros was almost equal to the number of permits issued for the #11 through #33 ranked metros.

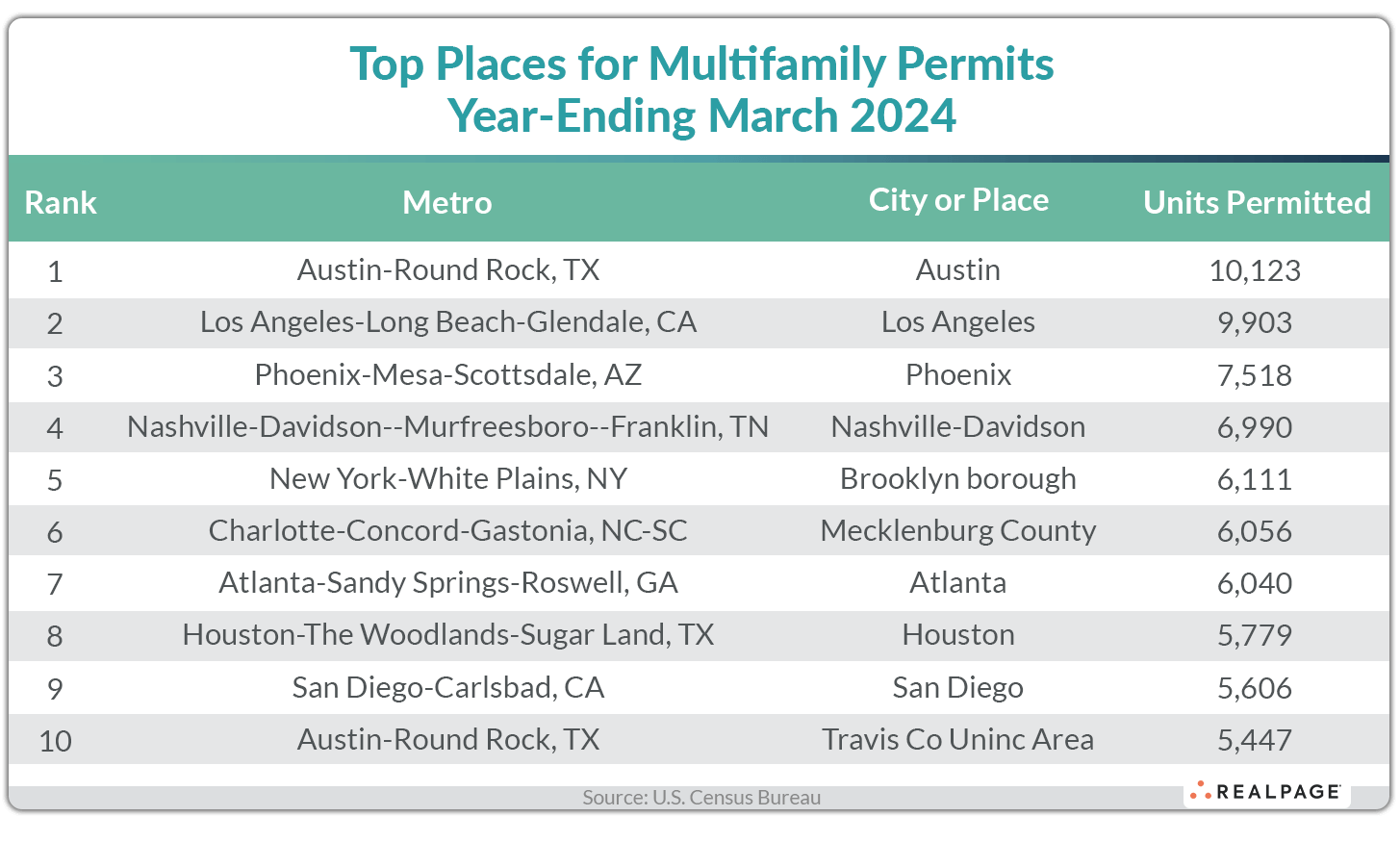

Below the metro level, nine of last month’s top 10 permit-issuing places returned to this month’s list, with only five remaining in the same place and the rest changing places. The list of top individual permitting places (cities, towns, boroughs, and unincorporated counties) generally include the principal city of some of the most active metro areas.

In March, the city of Austin remained in the #1 position with 10,123 units permitted, about 1,000 units less than in February. The city of Los Angeles returned to the #2 spot in March with 9,903 units permitted, 534 more than last month. The city of Phoenix stayed in the #3 spot with 7,518 units permitted, 1,179 units less than last month, while the city-county of Nashville-Davidson remained at the #4 spot, permitting 6,990 units.

The borough of Brooklyn moved up two spots this month to #5 on the list with 6,111 units permitted for the year and Mecklenburg County (Charlotte) permitted 6,056 units for the year to fall to #6. The city of Atlanta moved up one spot to #7 with 6,040 units permitted. The city of Houston fell two spots to #8 with 5,779 permitted units.

The city of San Diego joined the top 10 list at #9 with 5,606 units permitted in the past 12 months, up almost 600 units from February. Unincorporated Travis County (Austin) returned to the #10 spot with 5,447 units permitted, exactly the same amount as last month.

Three of the next 10 permit-issuing places by total units permitted are Texas markets that had been top 10 leaders in the past such as the cities of Dallas and Fort Worth and unincorporated Harris County (Houston). Other cities with slowing multifamily permitting include Columbus, OH, Miami and Raleigh.