High Supply Apartment Markets with Less Severe Class A Rent Cuts

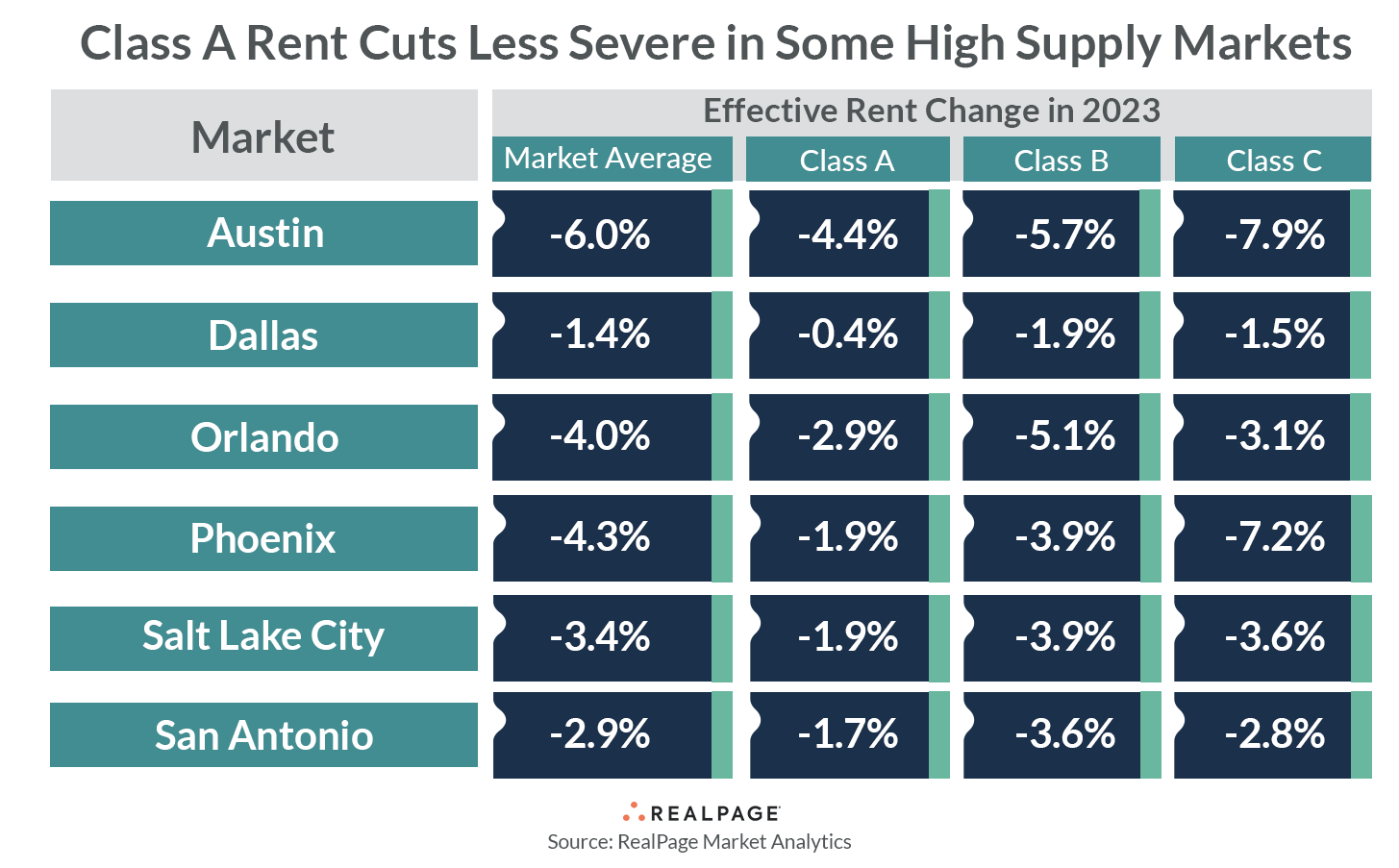

Among high supply apartment markets posting rent cuts in 2023, luxury Class A product is the relatively strong performer in some key places. In six of the nation’s major markets experiencing a supply boom, product delivering at the top of the price spectrum – that is, Class A units – reported the least severe rent cuts compared to Class B and C units within the same market.

To be clear, in these six high supply markets posting rent cuts – Austin, Phoenix, Dallas, Orlando, Salt Lake City and San Antonio – all asset classes posted rent cuts in 2023, but the degree of decline was less severe in the pricier Class A product, according to data from RealPage Market Analytics.

Austin was the national laggard for rent cuts in 2023, among the top 50 markets, with an annual decline of 6%. As such, all asset classes reported deepening rent cuts in every quarter of 2023 – with one mild exception. From 3rd quarter to 4th quarter 2023, Class A rent cuts maintained the same rate of annual rent cuts at 4.4%. That 4th quarter reading in Class A product was the mildest rent cut seen across the price spectrum. Operators in Class B (-5.7%) and Class C (-7.9%) units cut rents more harshly in Austin in 2023.

Phoenix experienced a similar breakdown in product class performance, compared to Austin. In 2023, operators in Phoenix cut rents 4.3%, also one of the worst performances among the nation’s top 50 markets. And while Class B units logged rent cuts slightly less than the market average at 3.9%, the real divergence was between Class A and Class C units. Operators in Phoenix’s Class A units cut rents a relatively mild 1.9% in 2023, compared to a much deeper cut of 7.2% in Class C units.

Like Austin and Phoenix, Orlando also posted one of the most severe rent cuts among top 50 markets in 2023. Operators in Orlando cut effective asking rents 4% in 2023, with the most severe cut stemming from the middle-tier Class B product at 5.1%. Orlando’s Class C product saw rent cuts of 3.1% in 2023. Meanwhile, Class A rents posted the most mild annual decline among product classes at 2.9%.

Dallas reported rent cuts of 1.4% in 2023. And while all three asset classes reported cuts, Class B and C declines were deeper than the market average at 1.9% and 1.5%, respectively. Meanwhile, Class A rents were cut a more mild 0.4% in 2023.

Similarly in Salt Lake City, Class B and C rent cuts were deeper than the market average, whereas Class A rent cuts were more mild. Operators in Salt Lake City cut rents 3.4% in 2023, though Class B and C product reported slightly deeper cuts of 3.9% and 2.6%, respectively. In Salt Lake City’s Class A units, meanwhile, rents were cut 1.9% in 2023.

San Antonio operators cut rents 2.9% in 2023. Among product classes, Class C units posted rent declines approximately in line with the market average at 2.8%. San Antonio’s Class B units posted a 3.6% rent decline in 2023. Meanwhile, San Antonio’s luxury Class A units reported the least severe rent decline in 2023 at 1.7%.

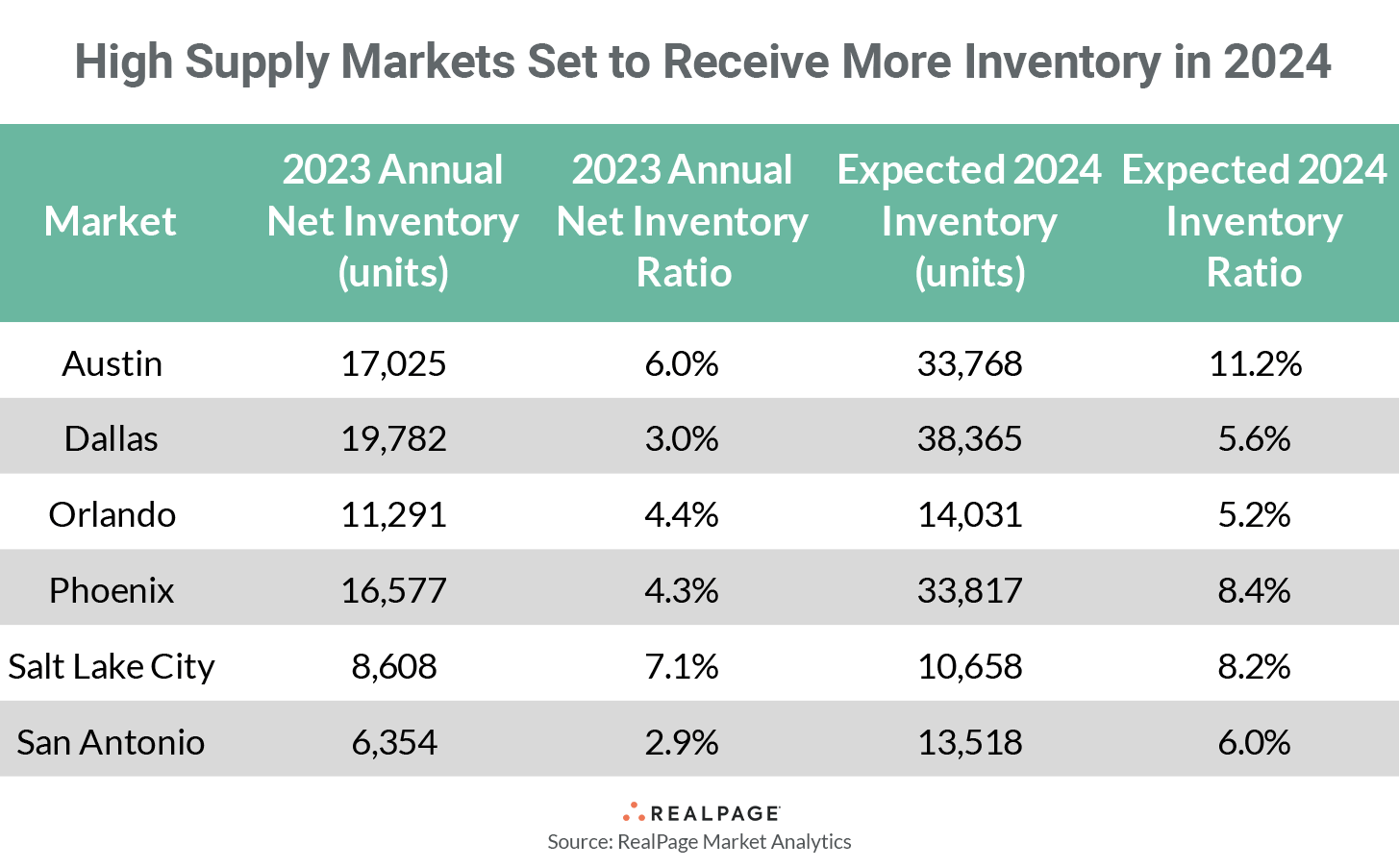

Meanwhile, all these markets added some serious new apartment supply in 2023, easily outpacing the national average for annual inventory growth of 2.3%. And all six markets will add even more new units in 2024 compared to 2023’s inventory jump.

In 2024, all six of these markets will grow total apartment inventory by at least 6%, such as in San Antonio. Neighboring Texas market Austin, meanwhile, will grow by over 11% in 2024 – the highest rate in the nation, among top 50 markets.