Charlotte is Set to Reach Peak Apartment Supply in 2nd Quarter 2025

Apartment construction across the U.S. appears to have peaked in 2024, but in some individual markets, the peak is yet to come. Charlotte is expected to reach an apex in new supply in 2025, and then pull into the naional lead for expansion, as the current leader – Austin – sees inventory growth wane.

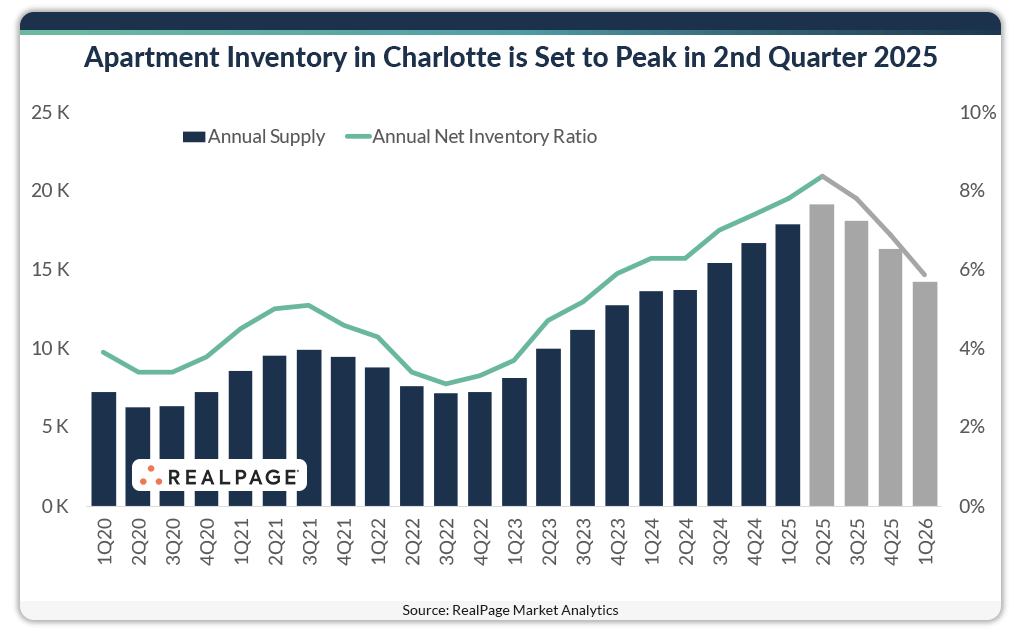

The Charlotte apartment market is expected to reach peak annual inventory growth in 2nd quarter 2025 when its stock is set to grow 8.4%, according to data from RealPage Market Analytics. That would be the market’s largest delivery load since RealPage began tracking the market in 1995 and the second-fastest growth among the nation’s 50 largest apartment markets, behind Austin (8.8%).

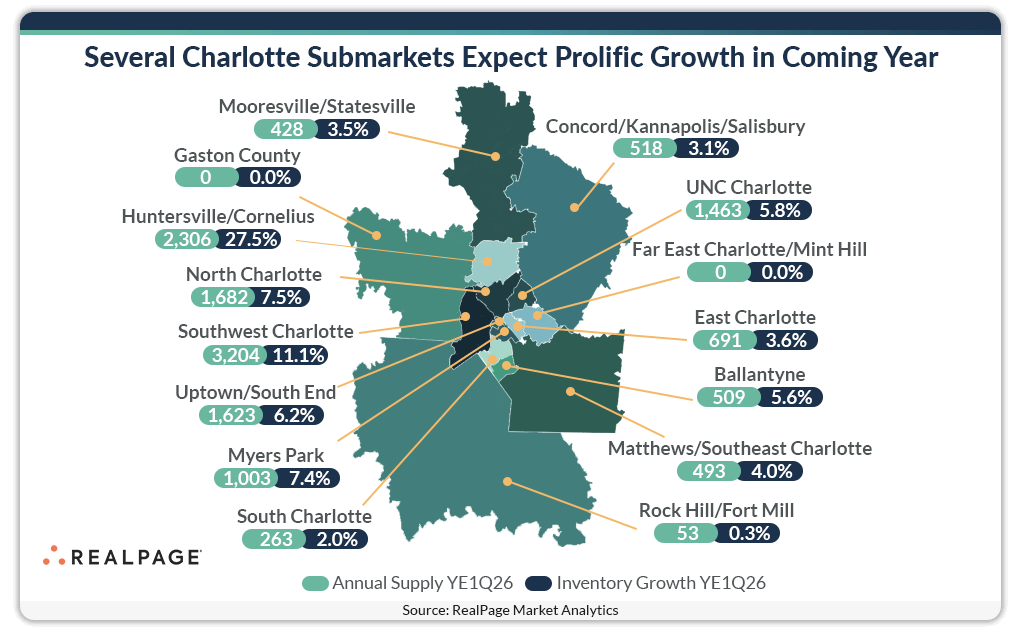

Most recently, Charlotte delivered 17,914 units in the year-ending 1st quarter 2025, growing total inventory 7.8%, which also marked the second-highest inventory boost among the nation’s largest markets, again after only Austin which reached its peak of 10.1% growth. The largest share of Charlotte’s new supply in the past year (roughly 57%) was concentrated in just three of the market’s 15 submarkets – Southwest Charlotte (3,813 units), Uptown/South End (3,576 units) and North Charlotte (2,724 units).

Charlotte’s supply wave is expected to trend down in the second half of 2025 and into early 2026, though the rate of growth will still be impressive. The Charlotte apartment market is expected to deliver 14,236 units in the year-ending 1st quarter 2026, growing total inventory 5.9%. Autin inventory growth rates are expected to fall off notably by that time, leaving Charlotte to lead the nation’s largest 50 markets, followed closely by Phoenix (5.8%).

Five of Charlotte’s 15 submarkets are set to receive nearly three-fourths of the market’s completions in the coming year. Southwest Charlotte (3,204 units) is expected to lead again for new supply, followed by Huntersville/Cornelius (2,306 units), North Charlotte (1,692 units), Uptown/South End (1,623 units) and UNC Charlotte (1,463 units).

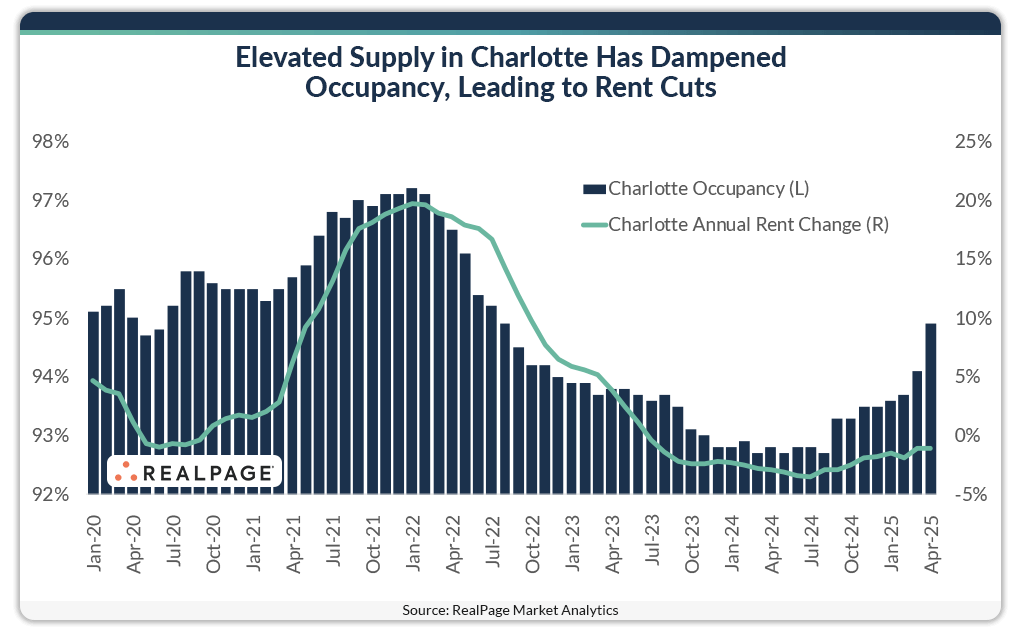

Elevated completions have taken a toll on occupancy in the Charlotte apartment market. Since reaching a high of 97.2% in January 2022, occupancy has fallen below 94% for much of the past two years. However, in April 2025, occupancy increased to 94.9%.

Less active submarkets for new supply such as Gaston County (96.5%) and Rock Hill/Fort Mill (96.2%) had the highest occupancy rates among Charlotte’s submarkets in April, while Myers Park (93.8%) and UNC Charlotte (93.9%) had the lowest rates.

In an effort to preserve occupancy, operators in the Charlotte apartment market have resorted to rent cuts. Rents have declined on a year-over-year basis each month since July 2023. In the year-ending April 2025, prices were down 1.1%. However, while rents continued to fall over the past year, the downturn was one of the smallest since August 2023.

Ten of Charlotte’s 15 submarkets logged rent cuts during the year-ending April 2025, with the steepest declines in Uptown/South End (-4.5%) and Myers Park (-4.4%). The largest rent gains were in Ballantyne (2.2%) and Rock Hill/Fort Mill (1.6%).