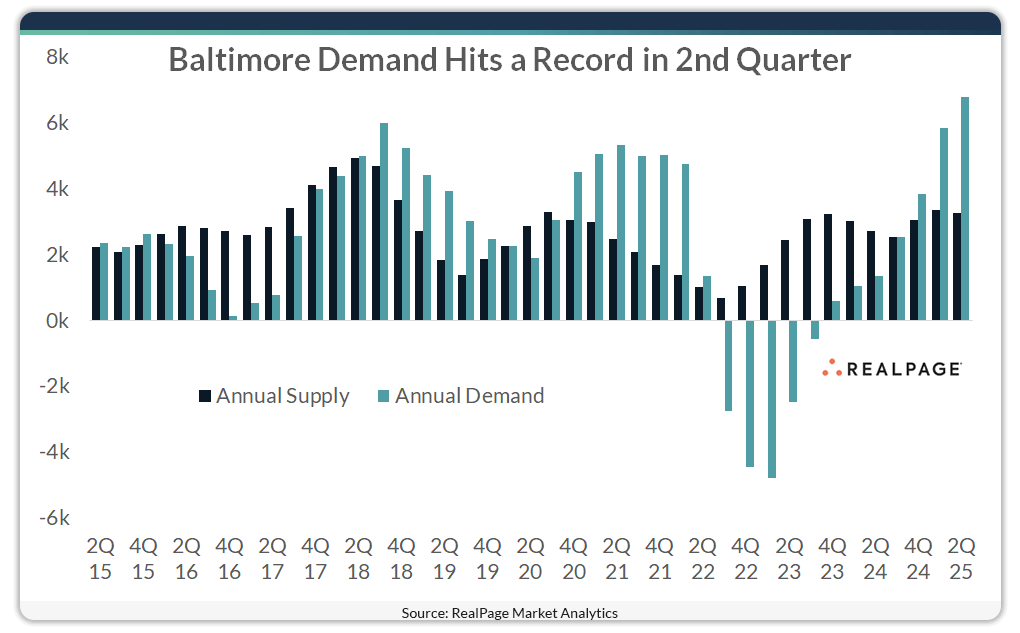

Apartment demand hit a record high in Baltimore in 2nd quarter, outpacing elevated construction activity, which is quite the turnaround for a market that was seeing net move-outs in the recent past.

Baltimore absorbed 6,769 units in the year-ending 2nd quarter, according to data from RealPage Market Analytics. That was nearly three times the market’s average annual absorption pace over the past 10 years, which was closer to 2,400 units.

Current demand volumes in Baltimore were remarkably strong after the performance from the last half of 2022 and the first half of 2023, when the market was losing demand at an average pace of more than 3,400 units annually.

Baltimore demand far outpaced concurrent supply volumes of 3,266 units in the past year. That supply pace was up from an average of about 2,700 units or so delivered annually in the past decade.

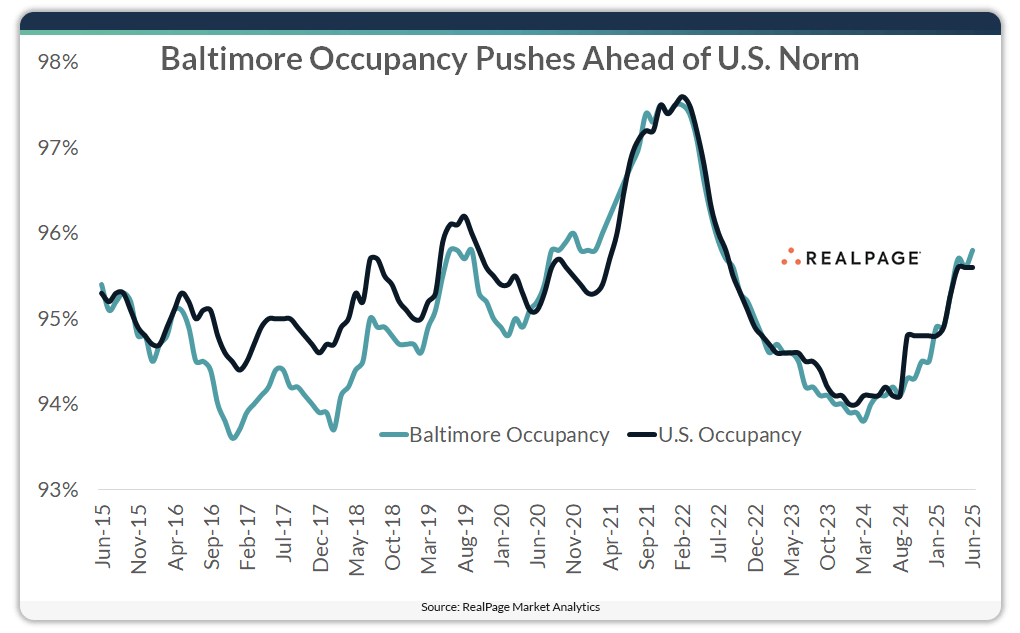

As a result of strong demand, Baltimore occupancy pushed ahead of the national average recently. As of June, occupancy was at 95.8%, up 170 basis points (bps) since June of last year, with most of that – 130 bps – happening in calendar 2025. Occupancy was a tad lower at 95.6% in the nation overall as of June, up 140 bps for the year. But when looking at the growth since the start of 2025, the U.S. climbed at about half the pace of Baltimore at 80 bps for the calendar year.

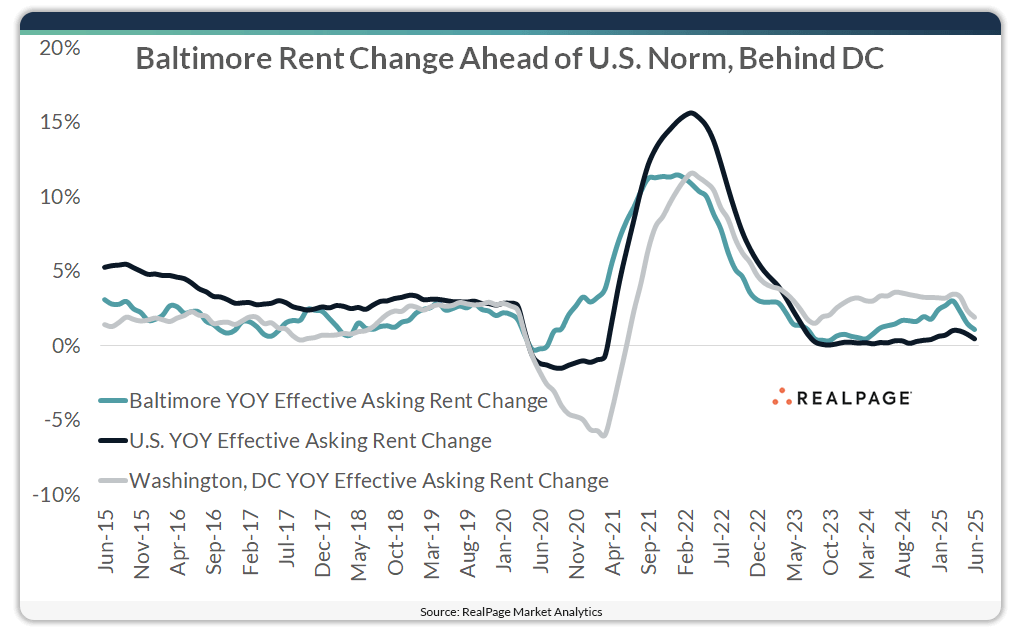

Solid demand and tightening occupancy in Baltimore have caused rent growth in recent months. Prices increased 1.1% in the market in the year-ending June. While that was behind the sizable rent growth Baltimore saw in 2022 and 2023, it was ahead of the national average of 0.5%. Rent growth in Baltimore, however, did come in shy of the Washington, DC average of 1.9% in the year-ending June.

Located just an hour drive from each other, the neighboring multifamily markets of Baltimore and Washington, DC are similar in demographic makeup but different in some other respects. One key difference is rent pricing. As of June, monthly effective asking rents averaged $1,774 in Baltimore. Meanwhile, Washington, DC rents are nearly $500 more expensive at $2,267. The U.S. average is somewhere in the middle at $1,887.

The large gap in pricing, and the short distance geographically between these two markets makes Baltimore a prime commuter market for the nation’s capital. Commuter markets gained a lot of traction in the COVID-19 pandemic, when employees across the nation started working from home. And though some workers have gone back into the office, those who got used to paying smaller rents are commuting.